This Q&A with the editorial page editors of Gannett’s New Jersey newspapers appeared in the Sunday, June 26, 2016 editions of the Asbury Park Press, Courier-News, Home News Tribune and other Gannett papers.

We keep hearing that millionaires are moving out of the state in droves to escape high taxes. But there is plenty of evidence to the contrary, correct?

The facts flat out debunk the myth of millionaire flight. We aren’t running out of wealthy New Jerseyans. In fact, we have the fourth highest share of millionaires of all states, and their numbers increased by 11 percent in the last decade. In addition, the number of families with taxable incomes over half a million dollars nearly doubled between 2003 and 2013 – a time in which income taxes were raised on these folks not once, but twice. Lastly, revenues from the estate tax itself are at an all-time high, and are projected to grow by over 40 percent in just the next five years.

So who keeps driving that myth? Is it too simple to blame stodgy Republicans for trying to protect their rich benefactors?

The myth’s been broadcast for three decades nationally and is repeated frequently by some of the state’s loudest voices in the public debate, from our governor to leading legislators to powerful business lobbyists.

There are a few other reasons:

Every New Jerseyan seems to know someone who left the state because they felt they couldn’t afford to live here anymore. In reality, that decision is driven primarily by housing costs and property taxes, which can create serious financial strains for middle-class families and recent retirees. That storyline is frequently simplified to, “They left due to high taxes.” And well-funded lobbies seeking to eliminate taxes on wealthy New Jerseyans are more than happy to step in and insert “estate” or “income” into that sentence. It’s a scare tactic that attracts attention.

There’s also a psychological aspect: lots of people who think they’ll be affected by the estate tax don’t end up owing any. In fact, while between 10-12 percent of heirs to deceased New Jerseyans file paperwork for the estate tax in any year, less than half actually end up owing the estate tax.

Supporters of eliminating the estate tax say that would help keep more of our precious millionaires in the state. But they also insist New Jersey’s estate tax affects the middle class as well as the wealthy because we have the lowest exemption threshold in the nation — $675,000. To what degree – if any – is that true?

It’s disingenuous to claim this tax affects the “middle class” when it’s actually only paid by the largest 4-5 percent of estates left behind by everyone who dies in New Jersey in any given year. This tax clearly is concentrated at the very top of the wealth scale.

Also missing from public conversation is the fact that these heirs still get a pretty good deal. If you inherit taxable assets of $675,000, you would pay less than $20,000 in taxes – netting over $650,000 in new wealth.

Would you be more comfortable raising the threshold to soften that supposed middle-class impact without completely eliminating the tax? Or would you prefer to leave the law as it is?

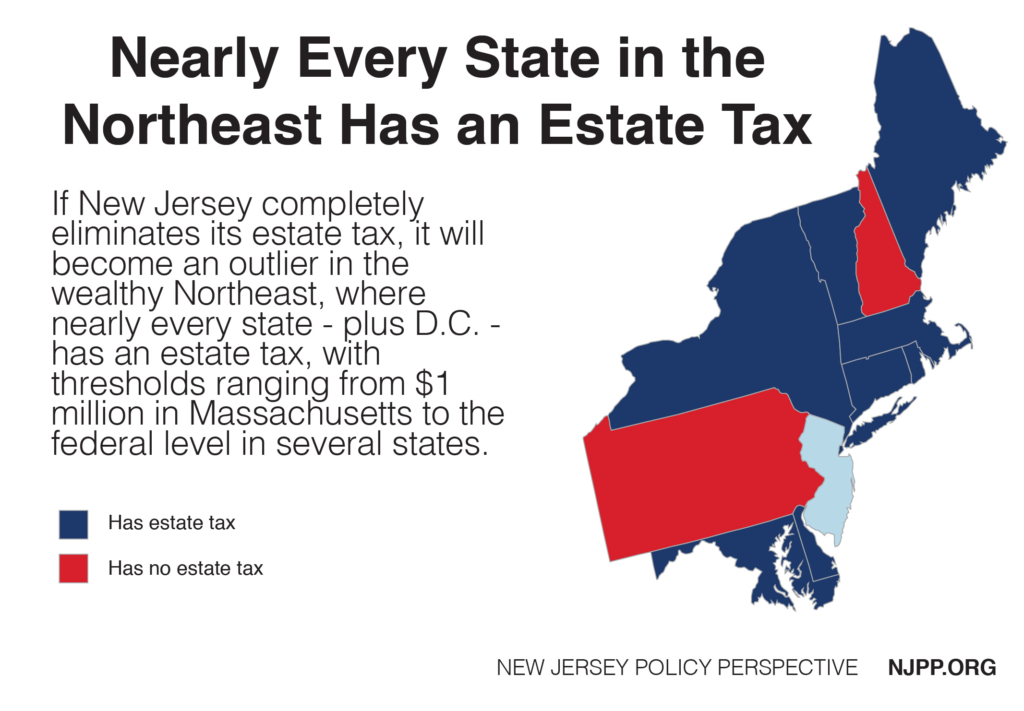

Raising the threshold to $1 million is a reasonable alternative; it would eliminate the tax for about 2 of every 5 payers, and preserve nearly all the revenue. It would also bring us in line with several other states, removing our “outlier” status on the threshold level. That said, the estate tax serves a crucial purpose. It provides revenue that helps communities thrive. The financial and economic benefits to the common good from maintaining this tax far outweigh any benefits from cutting it or, certainly, from eliminating it.

It does seem to be a fair point that New Jersey’s “death taxes” are particularly onerous, not only because of that low threshold but because the state is one of only two to have both an estate and inheritance tax. Why is New Jersey on the extreme side of death taxes?

It’s really the result of a coordinated decades-long campaign to eliminate taxes on inherited wealth. The dismantling of the federal estate tax under George W. Bush, in particular, led a number of states to follow suit. Thankfully, New Jersey hasn’t yet joined that race to the bottom.

Wouldn’t the absence of an estate tax exacerbate the growing wealth gap between haves and have nots? Or do you buy the trickle-down notion that more contented rich people will produce a more contented middle class?

It absolutely would widen the wealth gap. New Jersey’s estate tax, in fact, was created 82 years ago in response to the concentrated wealth and inequality of the 1920s. Today, inequality is as high in New Jersey as it was back then. So there’s a very strong need to maintain taxes on the largest amounts of inherited wealth.

The idea of eliminating the estate tax is gaining traction as a “tax fairness” tradeoff for a likely gas-tax hike to fund transportation. But we’re guessing you wouldn’t call it “fair” at all, would you?

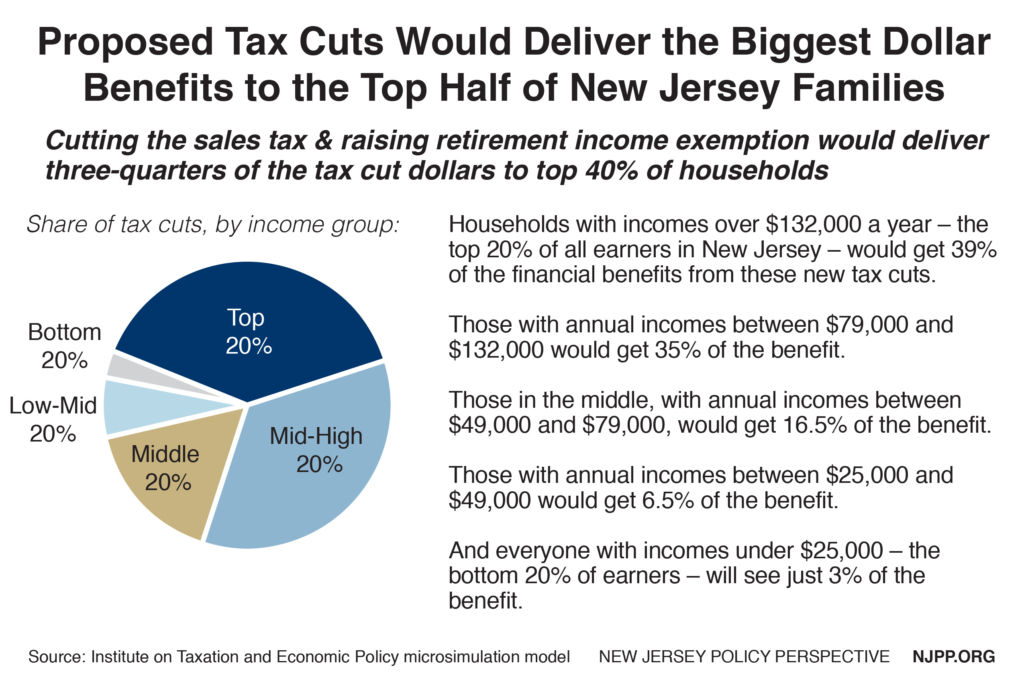

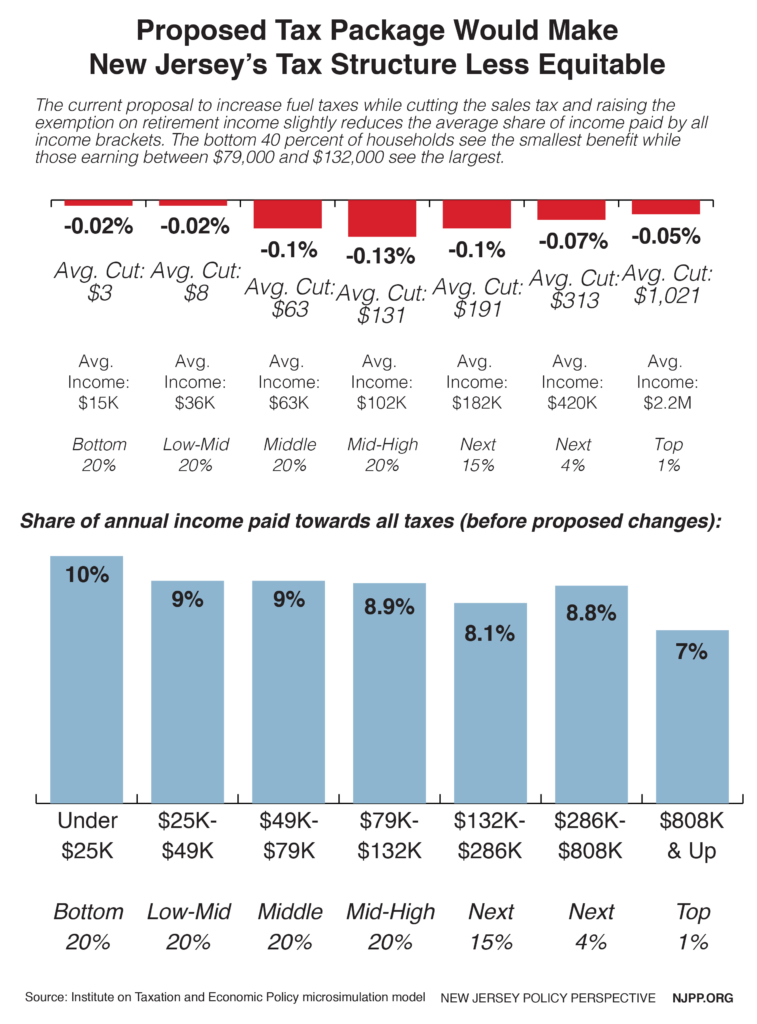

Pairing a tax increase that will be most felt by working-class and low-income New Jerseyans with a major tax cut that will deliver all of its benefit to the state’s wealthiest heirs isn’t tax fairness at all. It’s tax injustice.

So if you had to come up with a tax reduction to offset an increase in gas taxes, what would you suggest?

There should be help for New Jerseyans making under $45,000 a year. We’re grateful that lawmakers heeded that call by including an increase in the Earned Income Tax Credit, which would help even out the impact of higher gas prices for most working New Jerseyans – but given the overall package, it’s clear that a few thousand of the richest families would benefit far more from the currently proposed deal, at the expense of the other 9 million New Jerseyans.