To read a PDF of this Fast Facts, click here.

The outlook for New Jersey’s economic future went from bad to worse this week, as legislators hastily pushed forward a tax-cut plan that would cost the state about $17 billion over the next 10 years as the price for finally enacting a gas tax increase for essential transportation capital funding over the next 8 years.[1] At a time when the state already cannot meet its current and future obligations, invest in the assets that grow a strong state economy or provide a strong safety net for its neediest residents, blowing a hole of this magnitude in the state’s budget is reckless, short-sighted and – indeed – unfair.

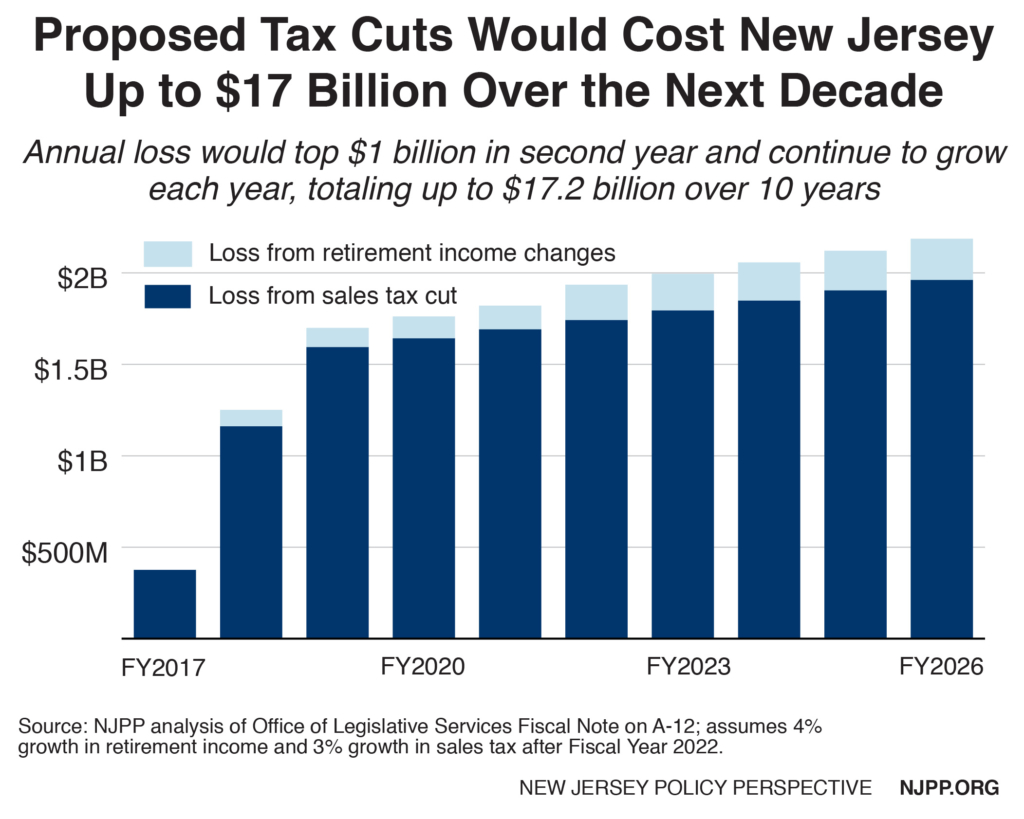

The largest piece of the plan is a cut in New Jersey’s sales tax, to 6 percent from 7 percent, which will go into effect over two years. This would be paired with a 400 percent increase – phased in over 4 years – in the threshold at which retirement income is subject to personal income tax. The annual loss from these tax cuts would top $1 billion in Fiscal Year 2018, hitting $1.8 billion by the time both are fully phased in and grow up to $2.2 billion by Fiscal Year 2026, assuming relatively conservative rates of growth.

This projected revenue loss does not include the invisible cost that will likely emerge quickly if these tax cuts are enacted in the form of another credit downgrade for New Jersey bond issues, which could come with higher interest rates and tens of millions of dollars in new costs.

These tax cuts would deprive New Jersey of the resources it needs to thrive as a state, from helping to make college affordable to protecting our environment to ensuring that the least fortunate among us have adequate assistance to get by.

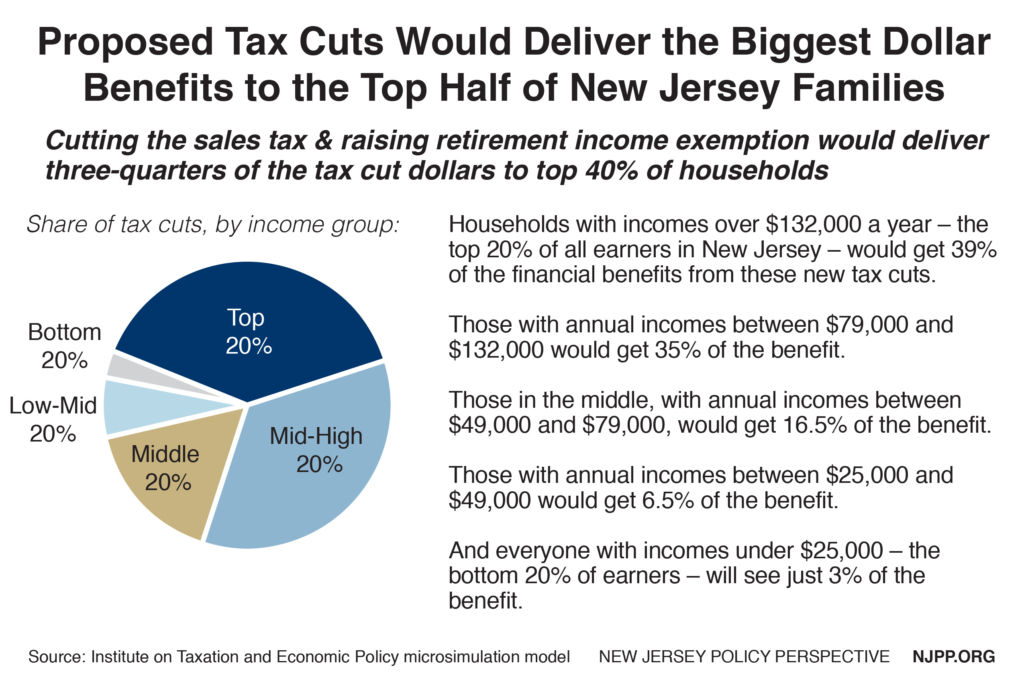

It would also deliver a big tax cut to many well-off families who need it least, unlike targeted tax credits designed to help low- and moderate-income working families, like the Earned Income Tax Credit (EITC).

The two tax cuts would give an average annual cut of nearly $2,000 a year to the top 1 percent – those with annual household incomes over $808,000 – and an average cut of $84 to those in the bottom 20 percent earning less than $25,000. Those in the middle 20 percent (household incomes between $49,000 and $79,000) would get an average tax cut of $253 a year.[2]

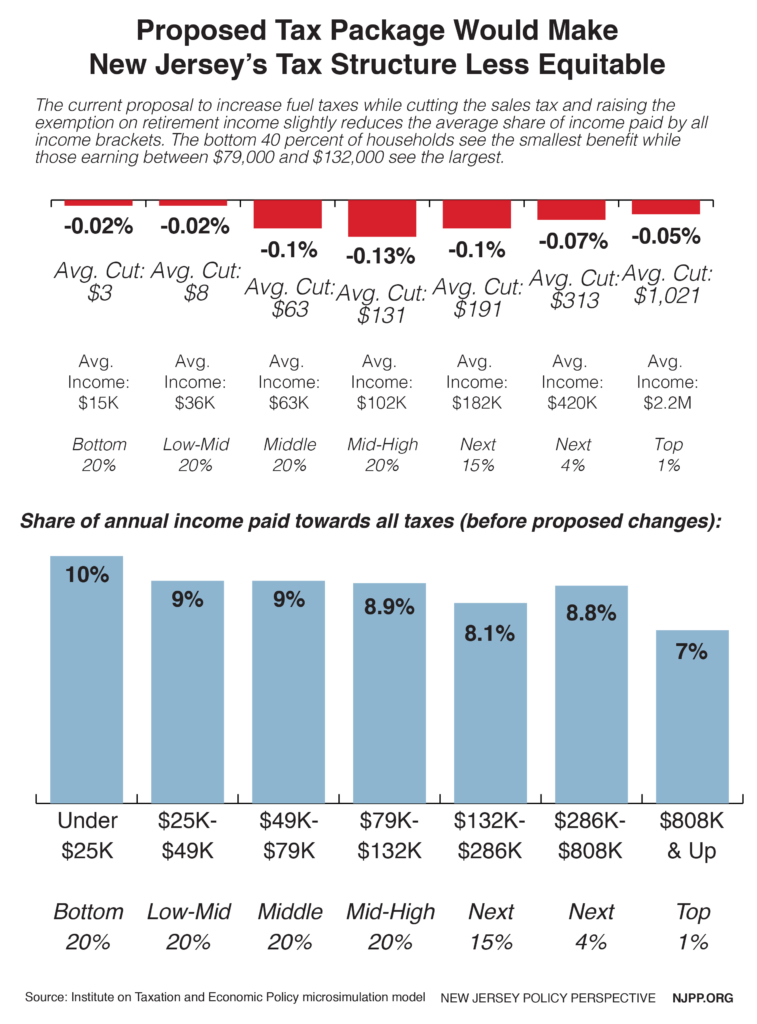

After accounting for both the tax cuts and the fuel tax increases, the top 1 percent would receive an average annual tax cut of $1,021, the bottom 20 percent would receive an average cut of $3 – or a nickel a week – and the middle 20 percent would receive an average cut of $63.

Of course, lower- and middle-income families also have – by definition – less income, so it’s also instructive to look at the impact of any tax change as a share of income. This package would make the state’s tax structure slightly less equitable by offering the smallest – nearly invisible, in fact – reduction of the average share of state and local taxes paid to the income groups that already pay the highest share – those earning less than $49,000.

Endnotes

[1] NJPP estimates based on currently unpublished Office of Legislative Services (OLS) fiscal note on bill A-12. NJPP used figures directly from OLS for the first 6 fiscal years’ impact, and then projected the increases over the next 4 years based on OLS’s estimated rates of growth. The range for 10-year budget impact is between $16.7 and $17.2 billion, from Fiscal Years 2017-2026. The low of the range represents annual FY 2023-2026 growth of 3 percent on the retirement income exemption; the high of the range represents annual FY 2023-2026 growth of 4 percent on the retirement income exemption.

[2] Analysis using Institute on Taxation and Economic Policy microsimulation, using 2016 incomes. The analysis is targeted to tax impacts for New Jersey residents only using an estimate that non-residents pay 20 percent of New Jersey sales taxes and 28 percent of fuel taxes.