Today New Jersey’s surge in subsidies topped $7 billion as the state approved $174 million in new tax breaks for corporations.

New Jersey has now OK’ed over $7.1 billion in these special tax breaks since January 2010, and more than $4.5 billion since December 2013 alone under the misleadingly-named “Economic Opportunity Act.”

The financial largesse that continues to greet very few large corporations is creating a ticking time bomb for New Jersey. For a state already so deep in a hole, it’s astonishing how eager policymakers are to keep digging the hole even deeper.

This surge in subsidies is creating a long-term and growing economic drag that policymakers will have to grapple with for at least the next 15 years as the backlog of tax credits is paid out. In fact, these tax breaks will cost New Jersey an estimated $2.8 billion through fiscal year 2020, or an average of $550 million a year. That’s a substantial amount of revenue that could be put to much better use by investing in the assets that, unlike tax breaks, are proven to grow New Jersey’s economy, like higher education or transportation, or providing a stronger safety net for the growing numbers of working New Jersey families and children who are living in poverty.

And the negative impact on New Jersey’s finances is only going to grow after 2020, as more of the corporations who’ve been approved for tax breaks in recent years cash in. Of the $4.1 billion in tax credits approved between December 2013 and April 2016, for example, only $12.9 million – or 0.3% – has been redeemed to date, according to the Economic Development Authority.

What’s more, this over-reliance on tax breaks to try to boost the state’s economy has done little to move the economic needle or grow good jobs. As of May 2016, New Jersey, with among the most lucrative corporate subsidy offerings in the country, is one of just 9 states that hasn’t yet recovered all the jobs it has lost since the Great Recession’s official start in December 2007.

UP TO DATE DATA ON NEW JERSEY & CORPORATE TAX SUBSIDIES:

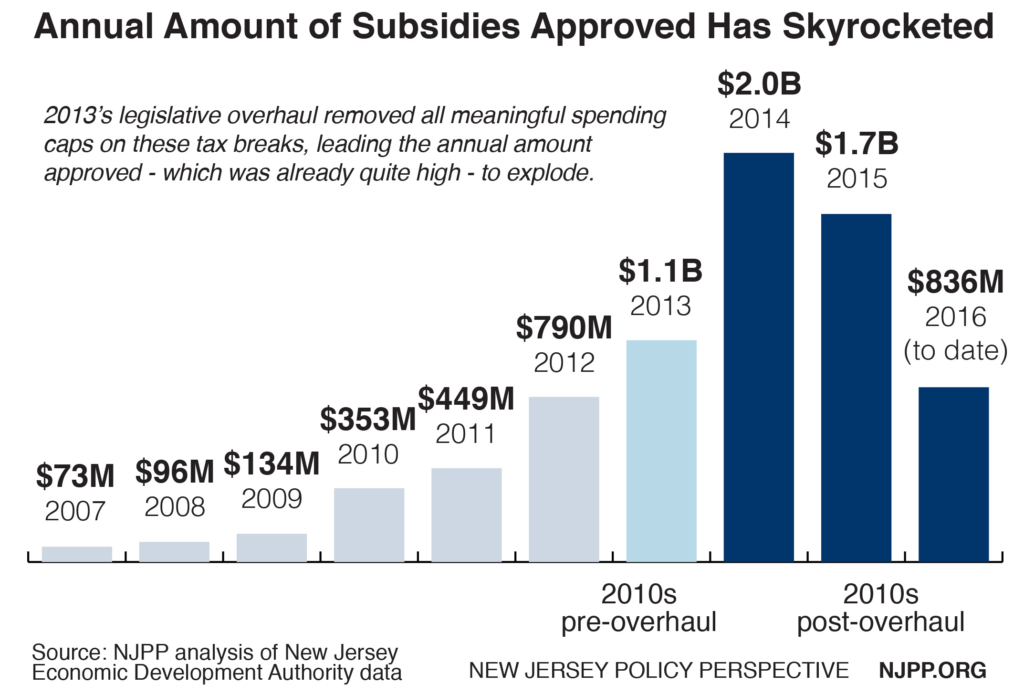

The 2010s Have Seen a Subsidy Surge

- $7.1 billion: The dollar amount of total business tax breaks approved by New Jersey since January 2010. This is up from $1.2 billion the entire previous decade.

- $90 million: The monthly rate of business tax breaks awarded since January 2010. This is up from $10.1 million in the 2000s.

- $59,900: The cost per job of these subsidies since January 2010. This is up from $16,400 in the 2000s.

2013 Legislative Overhaul Opened the Floodgates Even Wider

- $4.5 billion: The dollar amount of total business tax breaks approved by New Jersey since December 2013, when the 2013 legislative changes went into effect.

- $141 million: The monthly rate of business tax breaks awarded since December 2013.

- $80,400: The cost per job of these subsidies since December 2013.