Earlier this summer, Gov. Christie dashed the hopes of thousands of New Jersey’s poorest children by refusing to at least partially restore lost TANF assistance, which has not been increased in 29 years. As a result, eligibility and amounts of assistance in New Jersey will continue to erode due to inflation. Currently over 80 percent of all children living in poverty are not receiving any assistance, and those that do, receive TANF assistance that is only 25 percent of the federal poverty level, all but assuring that they will continue to live in deep poverty.

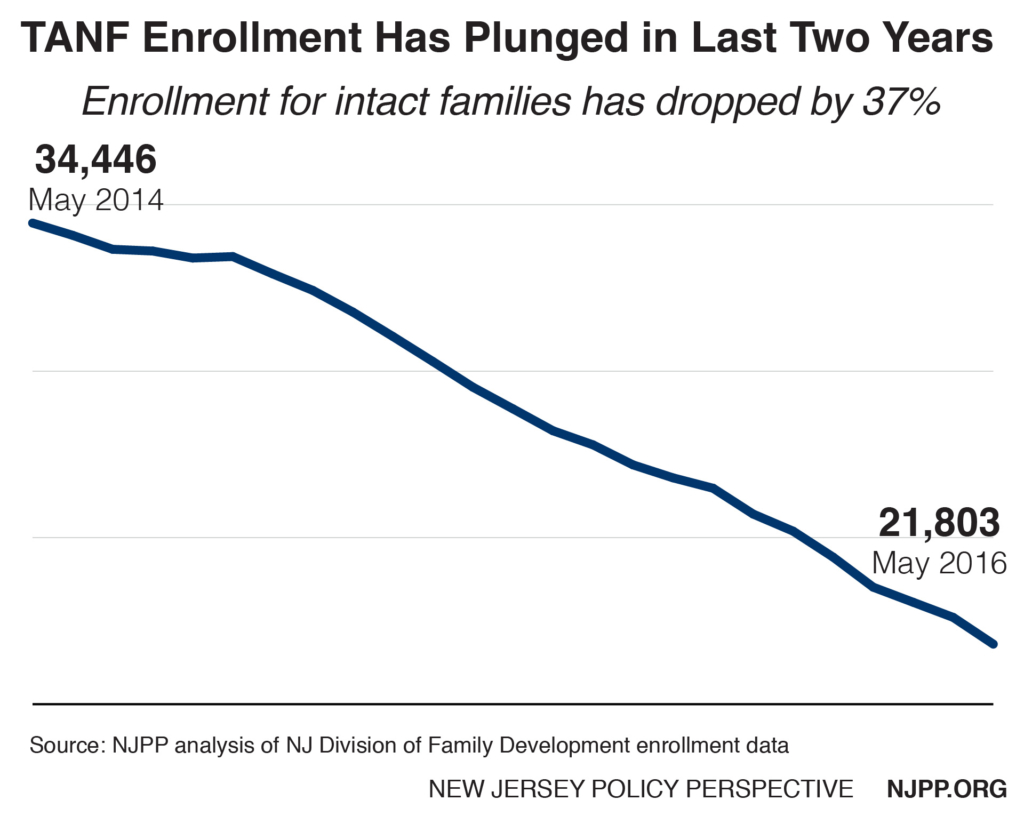

Today we are releasing new data that shows in the last two years alone, TANF enrollment of intact families with children has decreased by an incredible 37 percent. At this rate, we estimate that the only basic safety net for families in New Jersey could cease to exist within a decade.

New Jersey’s TANF assistance is the lowest in the northeast and, when you consider the cost of housing, it is the 40th lowest in the country, below states like Kentucky and Oklahoma. According to the state’s own standard, it takes $2800 a month for a three-person household to live in a decent and healthy environment in New Jersey compared to the $424 a month they get in TANF.

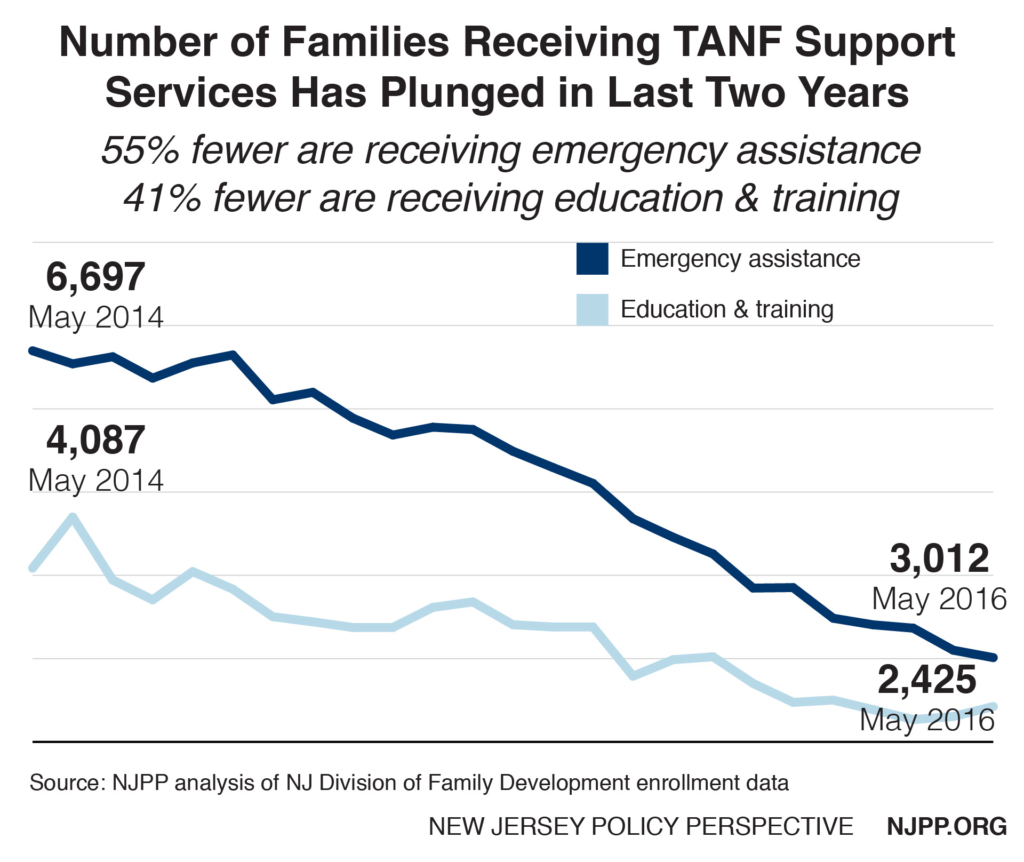

The biggest problem facing these families is their inability to pay for their housing costs, which have doubled since 1987 and are now averaging about $1400 a month. That is the same amount as New York, which has a TANF benefit that is almost double New Jersey’s. As a result, these families need more emergency assistance – but even that has decreased by over half (55 percent) in the last two years.

This is not only about the kids in very poor families, but their parents too. Most New Jersey parents living in poverty are also not eligible for TANF, which can provide essential education, training, and other work experiences that they need to get out of poverty permanently. In the last two years the number of parents receiving education and training dropped by a stunning 41 percent.

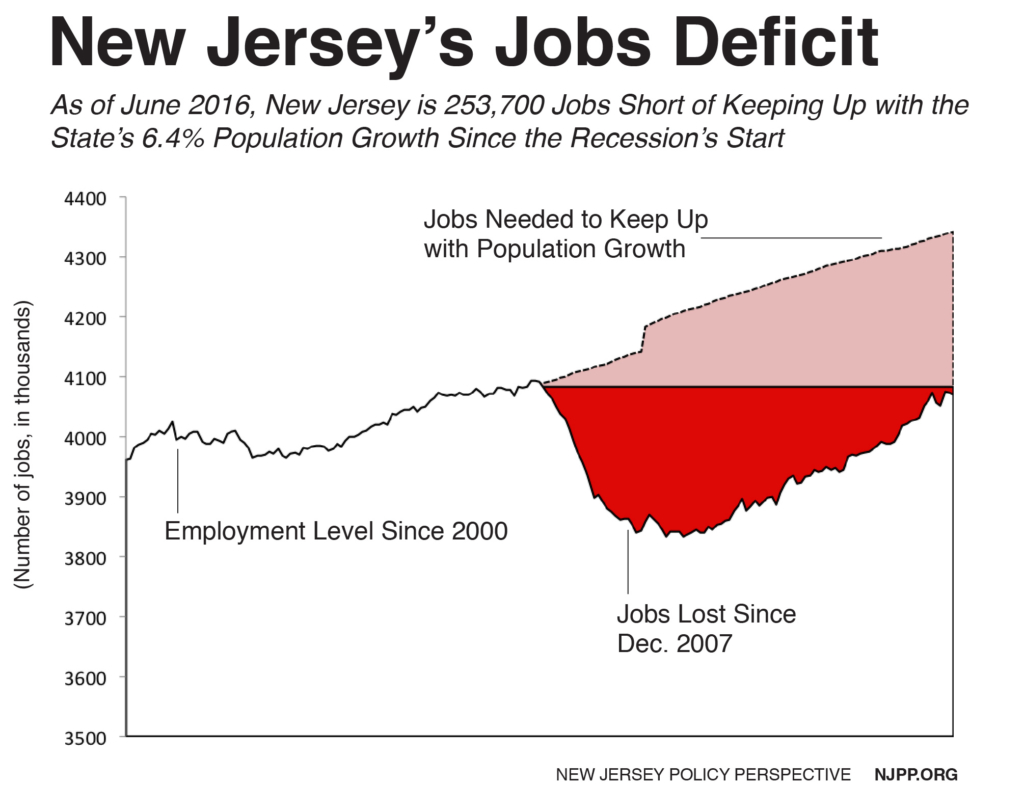

In other words, everyone loses – even the taxpayers because we know that child poverty costs the state $13 billion a year in higher health and criminal costs as well as lost productivity when these kids become adults.

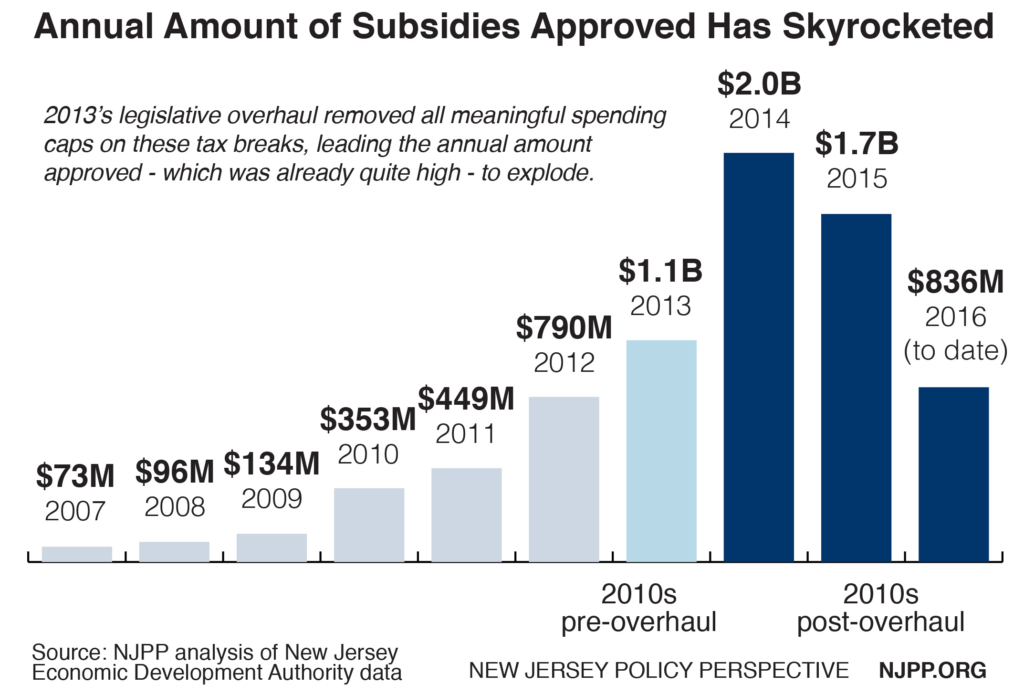

The governor’s vetoes are not only about denying equal opportunities for children, they represent an assault on struggling families that is both immoral and economically foolish.