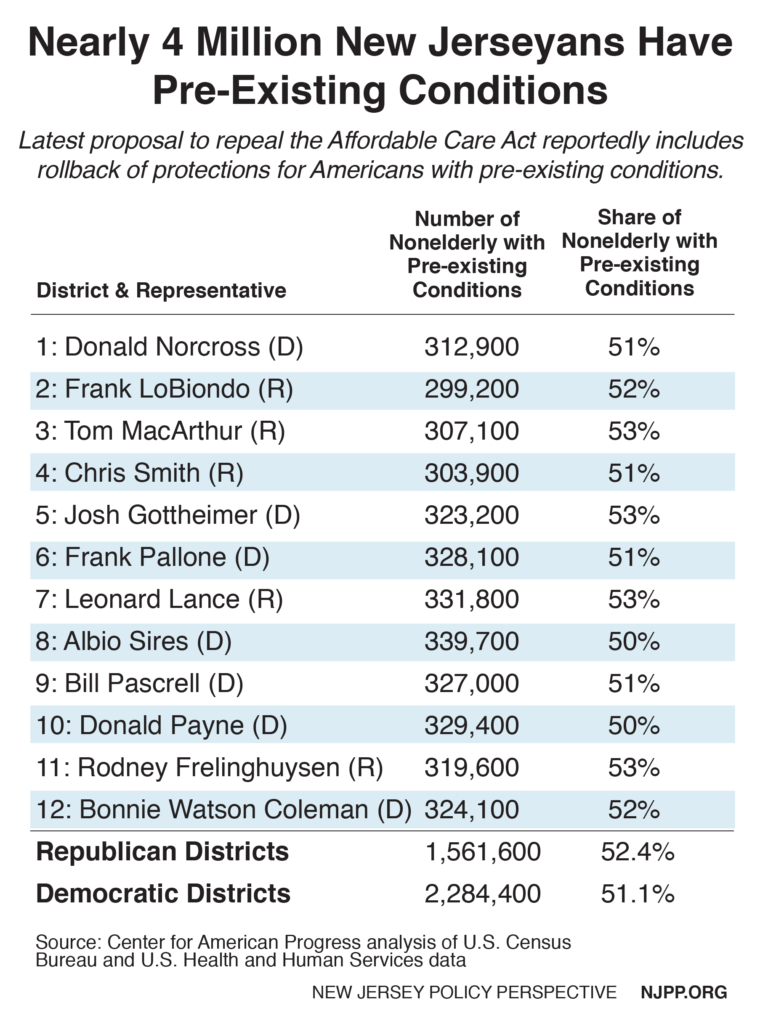

Today Congressmen Frelinghuysen and MacArthur put their political party ahead of the health care of tens of thousands of their own constituents by voting to repeal the Affordable Care Act and replace it with a wholly inadequate substitute that will eviscerate Medicaid, drive up insurance premiums and gut consumer protections for people with pre-existing conditions. Thankfully, they were the lone New Jersey Representatives to do so, with the other 10 members – including fellow Republican Congressmen Lance, LoBiondo and Smith – rightly seeing this legislation for what it is: An attack on the health, well-being and economic security of hundreds of thousands of New Jerseyans.

Despite the doublespeak down in D.C., none of the amendments and last-minute additions – including Rep. MacArthur’s own – made this bill substantively better. And they are all built on a faulty foundation of a proposal that strips health care from 24 million Americans, drives up premiums and shifts costs to the states – all in order to deliver massive tax cuts for the wealthiest families.

What This Means for New Jersey

- The Upton Amendment is Not a Solution:

Adding $8 billion over 5 years to help protect Americans with pre-existing conditions comes nowhere close to filling the likely gap created by the MacArthur Amendment.

In fact, it would take up to $790 million each year to assist the New Jerseyans with preexisting conditions who would apply for health coverage (and this is a very conservative estimate). Even if the funds from the Upton amendment are added in, the bill would only allocate about $353 million on average – leaving a $437 million gap in New Jersey, the eleventh highest in the nation.

In total, the nationwide gap is estimated to be $20 billion a year – or $100 billion over the five years that Rep. Upton’s amendment would pledge an additional $8 billion. In other words, the Upton amendment fills just 8 percent of the gap.

Background: https://www.njpp.org/blog/new-jerseyans-with-pre-existing-conditions-remain-at-risk and https://www.americanprogress.org/issues/healthcare/news/2017/05/02/431698/house-health-care-plan-not-enough-keep-high-risk-pools-afloat/ and http://www.cbpp.org/research/health/8-billion-comes-nowhere-close-to-meeting-republican-commitments-to-people-with-pre

- The MacArthur Amendment Poses an Even Greater Threat to New Jersey Than Original Repeal Bill:

Rep. MacArthur’s amendment retains all the worst elements of the original plan to repeal, and on top of that eliminates key protections for people with pre-existing health conditions and marks a return to the highly-flawed, discriminatory pre-ACA individual insurance market.

In practice, the amendment means that up to 3.3 million New Jerseyans with preexisting conditions would no longer be guaranteed affordable health coverage if they lose their insurance, women would likely be charged more than men for insurance, and plans for up to 3.6 million New Jerseyans could once again come with annual and lifetime limits on coverage – violating promises President Trump and many Republican legislators have repeatedly made to maintain these protections.

Background: https://www.njpp.org/healthcare/macarthur-amendment-to-american-health-care-act-would-cause-even-more-harm-to-new-jersey and http://www.cbpp.org/research/health/fact-checking-claims-about-the-macarthur-amendment

- The American Health Care Act is a Horrible Deal for New Jersey:

The original proposal to repeal the Affordable Care Act would be extremely harmful to New Jersey.

- Up to a half million New Jerseyans would lose their health insurance

- The Medicaid expansion would be phased out, eliminating coverage for 562,000 residents and sharply reduce federal funds for the state’s budget

- Permanent structural changes to Medicaid would reduce funding to New Jersey by 20 percent, the largest reduction in the nation, putting health care for up to 1.8 million New Jersey seniors, people with disabilities and children at grave risk.

- Approximately 250,000 New Jerseyans who purchase insurance through the Marketplace would see an average increase in out-of-pocket health are costs of $2,740 a year, making insurance unaffordable for many of them.

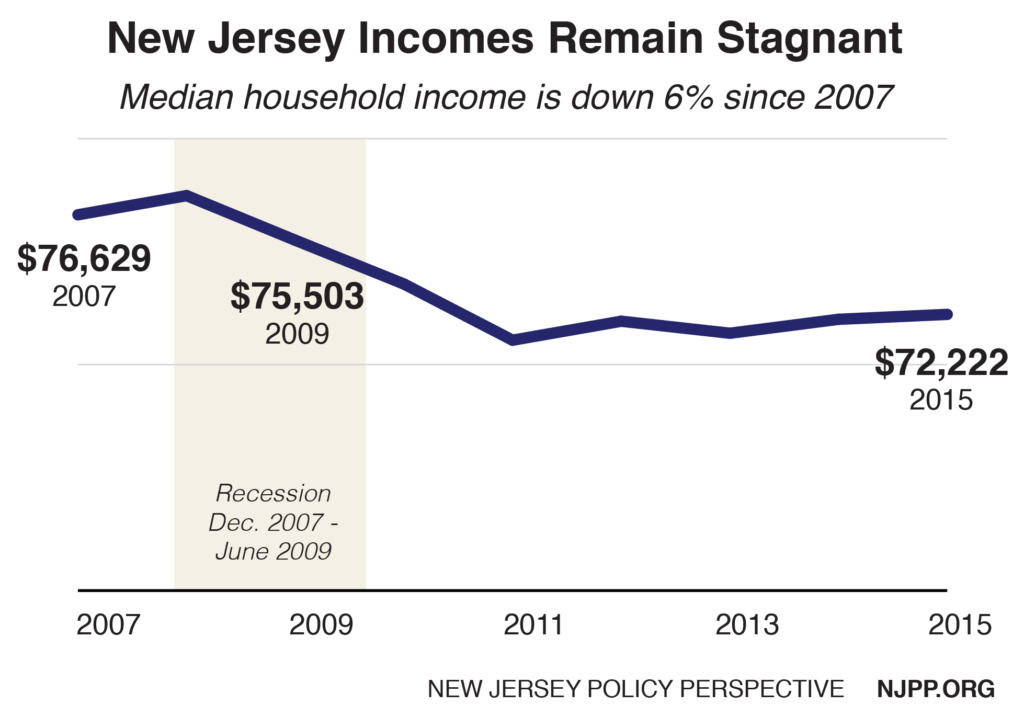

- The state’s alarming gap between the wealthiest and the rest of us would increase, thanks to big tax cuts for the top 5 percent of New Jersey households. The wealthiest 1 percent of households would get an average tax cut of $23,000 a year.

- The loss of over $30 billion in federal funds over the next decade due to the Medicaid cap alone would lead to the loss of tens of thousands of jobs.

Background: https://www.njpp.org/healthcare/the-american-health-care-act-would-cause-nearly-half-a-million-new-jerseyans-to-lose-health-coverage and http://www.cbpp.org/sites/default/files/atoms/files/4-13-17health-factsheets-nj.pdf