Despite making “billions of dollars in incentive commitments in recent years,” New Jersey “has not adopted a plan for regular evaluation of tax incentives,” Pew Charitable Trusts finds in a new national report. The report identifies the Garden State as “trailing” when it comes to the evaluation of its tax subsidy (or incentive) programs.

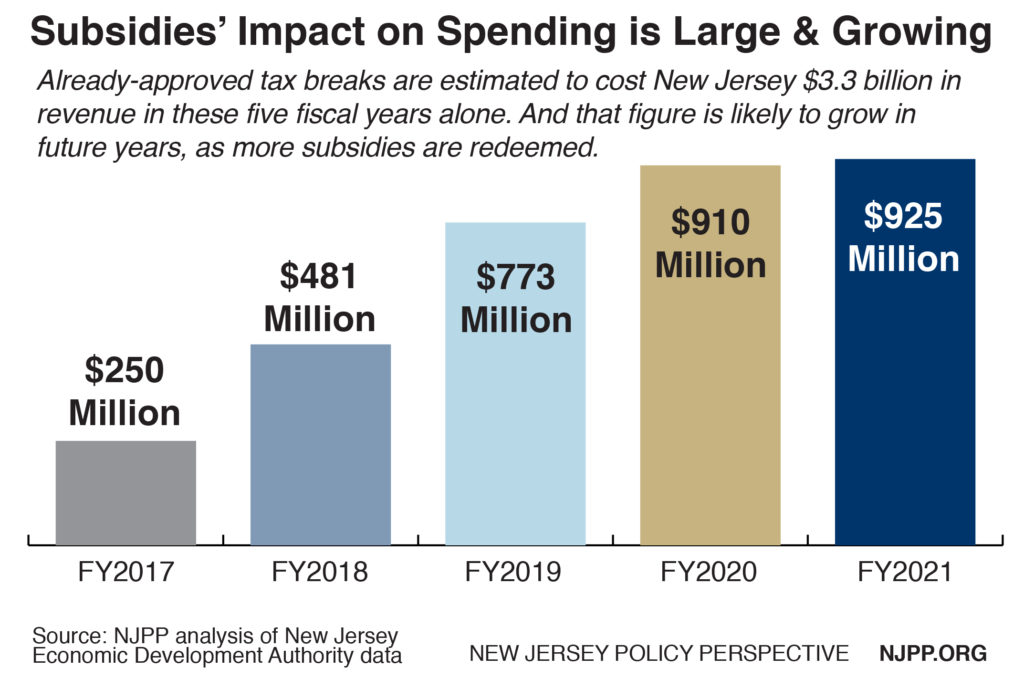

Pew’s findings echo our own work that has detailed the shortcomings of New Jersey’s tax break laws and oversight processes. And they came the same day that the Economic Development Authority shed new light on the short-term budget hit this surge in subsidies is expected to cause – a cost of $3.3 billion in this and the next four fiscal years.

It’s no surprise that national researchers have found New Jersey’s runaway tax subsidy programs wanting when it comes to evaluation and oversight. New Jersey’s tax breaks for big corporations have gone from bad to worse in recent years, with lawmakers mortgaging the state’s future to the hilt all in order to put more ribbon cuttings on the political calendar.

After years of reckless subsidy policy that has enriched already profitable corporations at the expense of New Jersey’s taxpayers, it’s time for some common-sense reforms. Restoring some semblance of fiscal sanity to these programs, mandating better reporting and evaluation and pulling back on the rewards for merely shifting jobs around the state would be great places to start.

New Jersey’s Subsidy Surge, at a Glance: (all figures are up-to-date through the EDA’s April meeting)

$7.9 billion: Amount of tax breaks approved since January 2010 (a monthly rate of $89 million)

$5.3 billion: Amount of the $7.9 billion that’s come since December 2013, when the “Economic Opportunity Act of 2013” went into effect (a monthly rate of $128 million)