On Friday, Congressman Norcross touted new federal statistics “on Camden’s nation-topping employment figures,” while Gov. Christie asserted that “Camden had the nation’s highest percent employment increases [sic] over the past year.”

“Today is another good day for the residents of Camden,” the congressman said. “In the past, Camden was portrayed as crime-ridden, but now it’s job-ridden.”

But a closer look reveals that the facts don’t match the rhetoric tying the job growth to the city of Camden or to New Jersey’s surge in tax breaks in the city: jobs and economic opportunities are still too scarce for Camden city residents.

The job growth being touted was for the Camden metropolitan area that encompasses Burlington, Gloucester and Camden counties, which – at 3.7 percent growth from February 2016 to February 2017 – tied with the Dallas-Plano-Irving metro in Texas for the strongest year-over-year job growth. In all, the Camden metro area added 18,900 jobs during that time and currently has an unemployment rate of 4.8 percent.

Gov. Christie was quick to use the news to highlight the “economic investment and action to promote job creation in Camden” that has been occurring under the state’s runaway corporate tax break program, Grow New Jersey – trying to connect the state’s heavily taxpayer-subsidized and short-sighted economic development strategies to the good employment news.

Any economic growth for New Jersey is news worth celebrating, but it’s also worth noting that the employment situation in the city of Camden is not as promising as in the metro area – and that this surge in tax breaks is overly generous to corporations, bares little teeth when it comes to helping the local economy or growing jobs for Camden city residents, and comes with heavy risk to all New Jersey taxpayers.

In fact, the city of Camden added just 502 jobs during the same 12 months, an increase of 2.1 percent. It’s unemployment rate sits at 9.6 percent, certainly lower than it was when it neared 20 percent during the depths of the recession, but almost identical to the 9.7 percent rate when the recession began in December 2007.

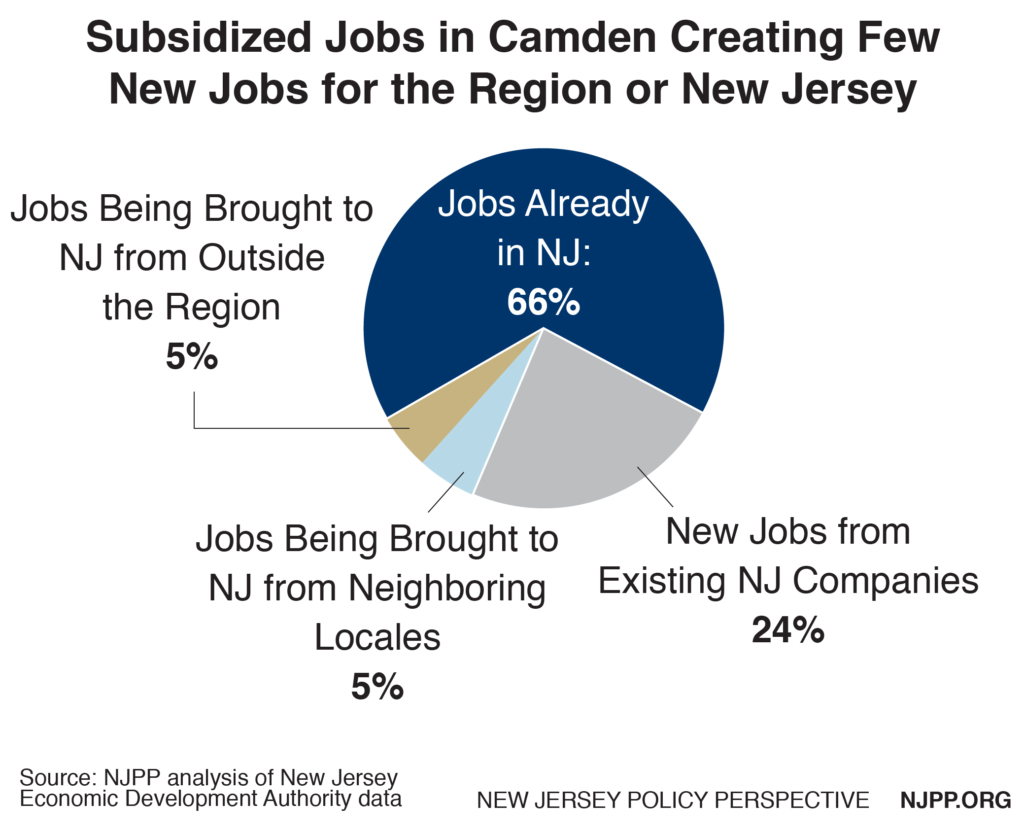

It’s no surprise that the surge in Camden tax breaks – $1.5 billion to 26 companies since December 2013 – has not noticeably improved the job prospects for city residents. First, there’s a natural lag between granting the tax breaks and the time when subsidized projects are completed (the lion’s share have yet to come online). But far more importantly, these projects – by and large – will merely shift jobs that already exist in New Jersey into the city from the surrounding suburbs. Not only will that have a limited impact on Camden’s employment numbers, it’s a seriously flawed approach to economic development.

After all, tax breaks can only do so much to help a distressed city if they aren’t accompanied by public investment in a city’s basic physical, social and economic infrastructure, or by enforceable requirements for corporations to take part in rebuilding a local economy and employing local residents. And the magnitude of the tax breaks to these mostly well-connected corporations clearly puts all New Jersey taxpayers at risk – which, of course, includes the residents and business owners of Camden.