This op-ed appeared in the May 26, 2016 edition of the Bergen Record.

For the fourth time in six years, New Jersey is facing a budget gap with just a few months to close it. Last week we learned that the revenues expected over the next 14 months are short by at least $1 billion, mostly due to less than stellar personal income tax collections in April.

For the fourth time in six years, New Jersey is facing a budget gap with just a few months to close it. Last week we learned that the revenues expected over the next 14 months are short by at least $1 billion, mostly due to less than stellar personal income tax collections in April.

But while the personal income tax shortfall got the most attention, corporate income tax collections are also a problem, and were also downgraded by nonpartisan legislative analysts, falling short by $206 million. The Christie administration, though, expects corporate income taxes to remain flat – thanks to a little old-fashioned can-kicking.

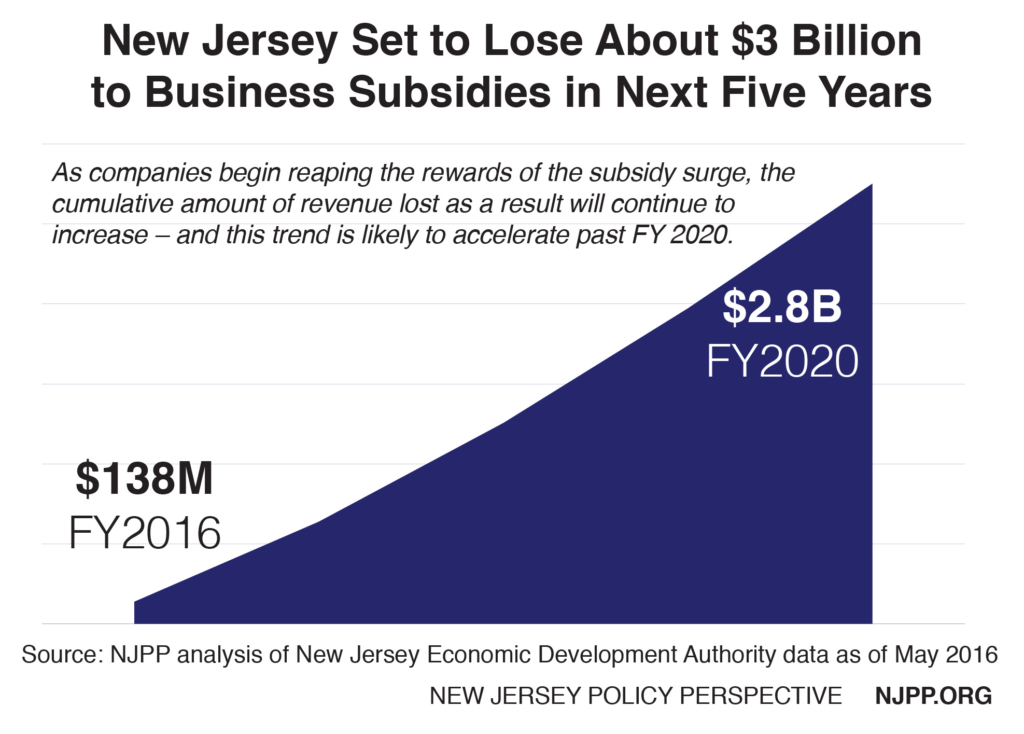

To keep corporate collections from going into the red in 2017, the administration recommends again delaying payments of business tax subsidies to corporations that have now been waiting for years. This gimmick, which comes on top of an earlier conversion of these subsidy rebates into tax credits, is expected to save the state $135 million. Pro tip: If you’re trying to attract business to New Jersey with a huge surge in these subsidies, you might want to be prepared to pay for them when the bills come due.

Here’s another pro tip: There is a much better way to boost corporate tax collections while leveling the playing field for small, local businesses. It’s called “combined reporting,” and it’s a common-sense tax policy now employed by 25 states plus the District of Columbia. By updating the corporate tax code and closing a variety of remaining corporate tax loopholes, policymakers could ensure that all New Jersey businesses are paying their fair share – and raise up to $290 million a year in new revenue doing it.

As it stands, local businesses are more likely to have to pay taxes on all their profits, because, unlike multistate firms, they have nowhere to shift them. Without combined reporting, large multistate corporations end up paying income tax at a lower effective tax rate than small businesses. Recent legislation introduced by Senators Lesniak, Sarlo and Greenstein and Assembly members Holley, Eustace and McKnight would change that by expanding combined reporting, which treats the parent company and subsidiaries of multistate corporations as one entity for state corporate income tax purposes. A diverse group of 37 leading New Jersey organizations – from advocacy to labor to environmental to faith – have asked the legislature to implement this policy, and to do it soon.

Some major multistate corporations and business lobbyists oppose combined reporting, claiming it leads to costly tax compliance burdens. These corporate interests also threaten that combined reporting could lead to job losses if major employers leave the state or reject it for future investments. However, these stale concerns ring hollow because most of New Jersey’s largest employers – 92 of 98 – already operate in combined reporting states and, in some cases, have been doing so for decades.

While kicking the can down the road might help the Christie administration plug leaky corporate tax collections in the short term, it is not sustainable. Corporate taxes will continue to be a sticky spot in the budget for years to come, thanks to the record levels of lucrative tax subsidies awarded by the state over the past few years. Ignoring this no-brainer corporate tax reform sends a lopsided message to New Jersey businesses that have consistently played by the rules. It’s time to realign the corporate tax code in the name of genuine tax fairness.