To read a PDF version of this report, click here.

As House Republicans rush to “repeal and replace” the Affordable Care Act (ACA), it has become clearer how much their proposal would harm New Jersey. The non-partisan Congressional Budget Office analysis of the American Health Care Act projects a major increase in the number of uninsured Americans, deep cuts to Medicaid, higher insurance premiums and tax cuts for the wealthy and corporations.

The best way to understand the American Health Care Act is to see it as a vehicle to shift income from working and poor families to the wealthy and as part of the plan to shift federal spending from a broad range of domestic services to the military budget.

In fact, the proposed cuts in the Medicaid expansion and the marketplace alone would reduce or eliminate health coverage for millions, including half a million New Jerseyans in just the next three years. Meanwhile, 250 New Jersey millionaires would see their federal taxes reduced by an average of $57,000 a year – a $14 million break, all told – while thousands of low- and middle-income New Jerseyans would face 30 percent tax hikes as support for their health care premiums would shrink or disappear.

Republicans are doing more than replacing the ACA with this legislation: Their plan is to enact a radical agenda that will dramatically change how Medicaid is funded, with the eventual result of big cuts to medical assistance for seniors, people with disabilities, working parents and children.

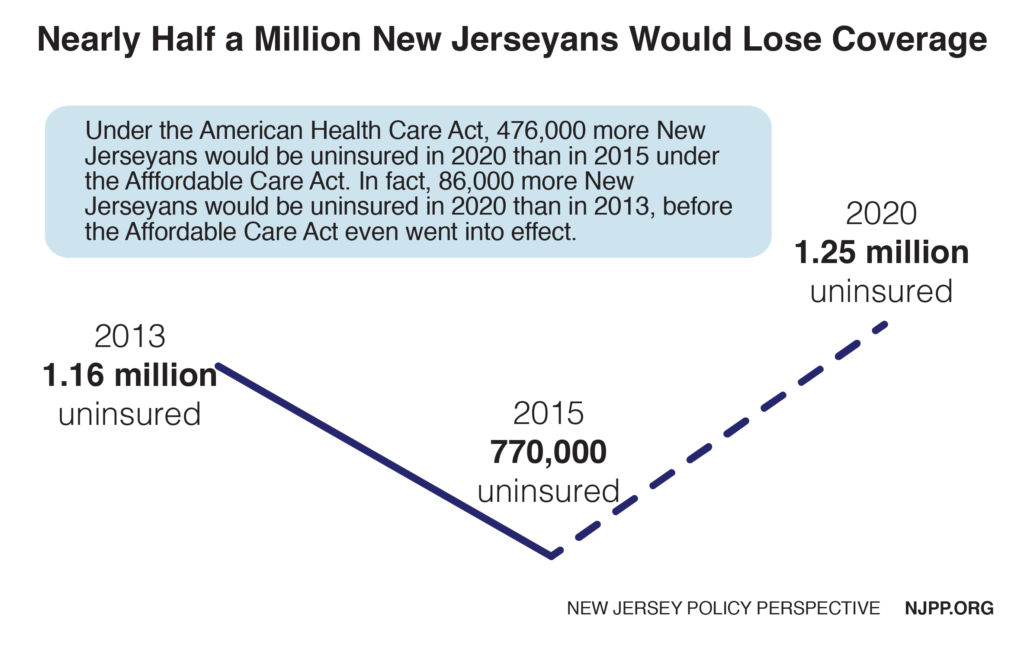

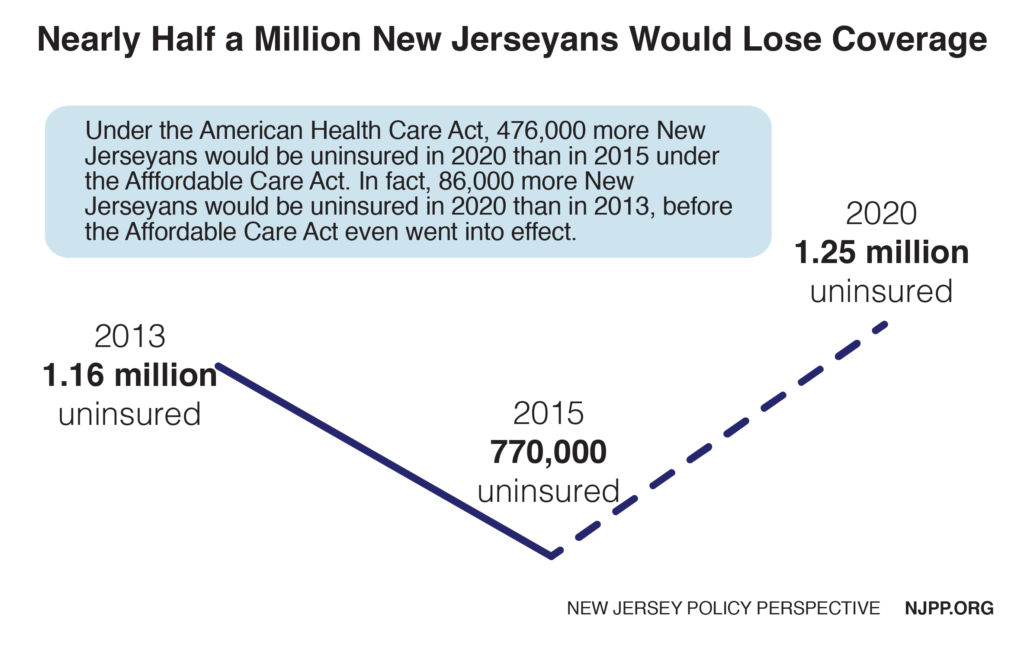

Nearly Half a Million New Jerseyans Would Lose Health Coverage

By 2020 under the American Health Care Act, about 476,000 fewer New Jerseyans would have health insurance than in 2015, due to the almost-certain end of the Medicaid expansion and other changes in the insurance marketplace, like a one-third reduction in premium tax credits for low-income New Jerseyans. (2015 has the latest and most reliable data for the uninsured, as supplied by the U.S. Census.) If anything, using that year underestimates the numbers of uninsured by 2020 since marketplace and Medicaid expansion enrollment increased in 2016 and 2017.

The result would be more New Jerseyans lacking insurance in 2020 than in 2013, before the ACA began insuring more residents – because there are 172,000 New Jerseyans who were on Medicaid before the ACA but would no longer be eligible since the state is in no financial condition to replace federal funding for Medicaid expansion with state dollars.

Number of Uninsured Would Spike in All Congressional Districts

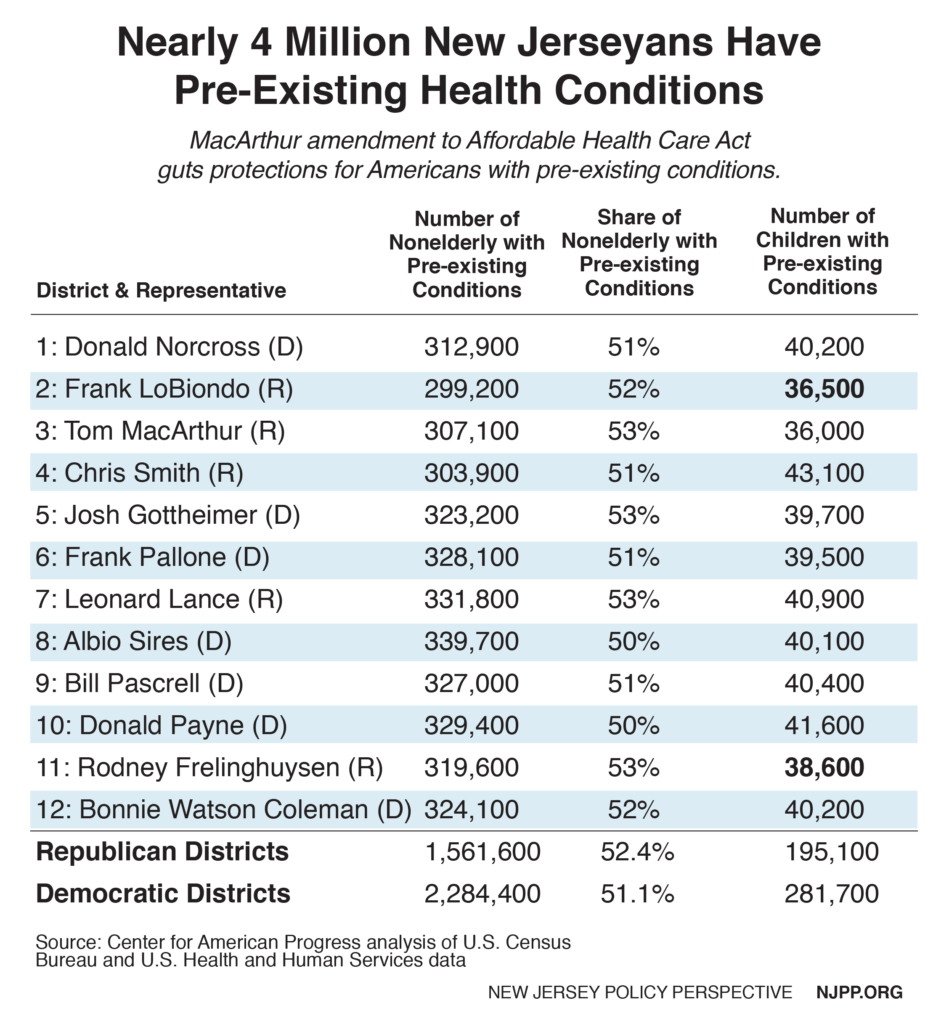

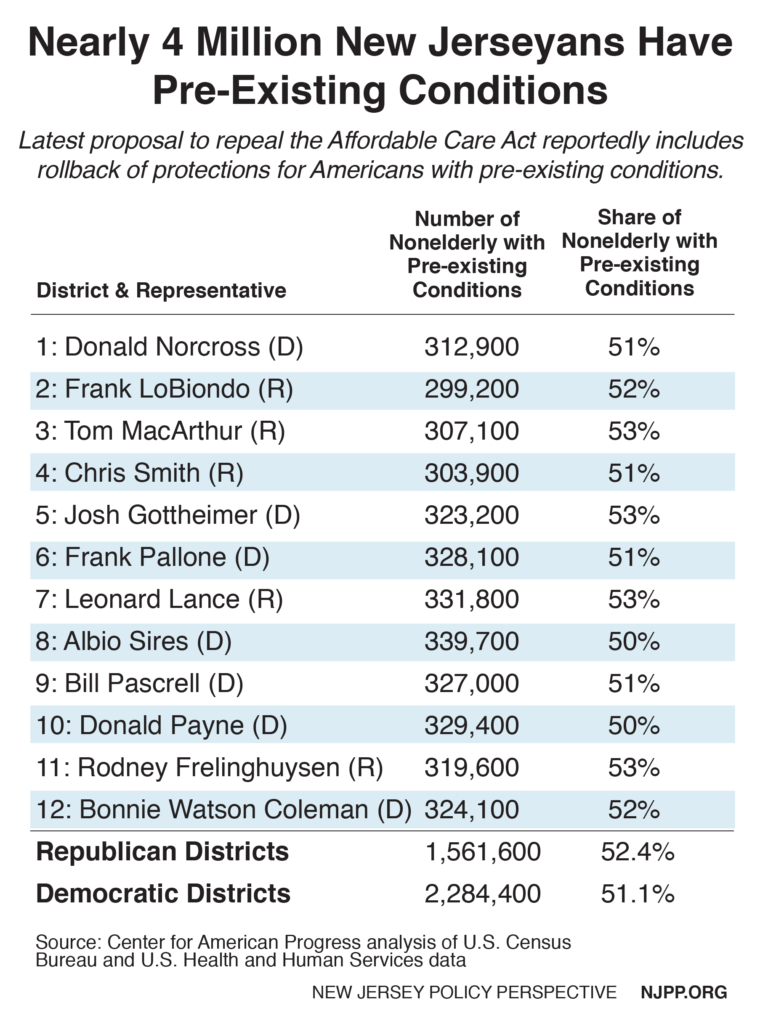

All New Jersey Congressional districts would see major increases in the number of uninsured residents under the American Health Care Act. But the largest percentage increases would be in districts currently represented by Republican Congressmen (New Jersey has no Republican Congresswomen).

All New Jersey Congressional districts would see major increases in the number of uninsured residents under the American Health Care Act. But the largest percentage increases would be in districts currently represented by Republican Congressmen (New Jersey has no Republican Congresswomen).

Taken together, the number of uninsured constituents by 2020 would increase by 74 percent in New Jersey’s five districts with Republican Representatives, a significantly higher jump than the increase of 58 percent in the state’s seven districts with Democratic Representatives.

The largest percentage increase in the number of uninsured would be in District 3, where their ranks would almost double (94 percent increase). In that district, 34,350 additional residents would become uninsured by 2020 on top of the 36,539 residents uninsured in 2015. The smallest increase was in District 8.

The main reasons for this difference are:

- Democratic districts tend to have more residents who live below the federal poverty line who were already covered by Medicaid prior to the expansion

- The marketplace includes more residents who work and have modest incomes who are disproportionately in Republican districts

- Republican districts have lower uninsurance rates than in Democratic districts, so they see a bigger percentage increase when their residents are dropped from Medicaid and the marketplace

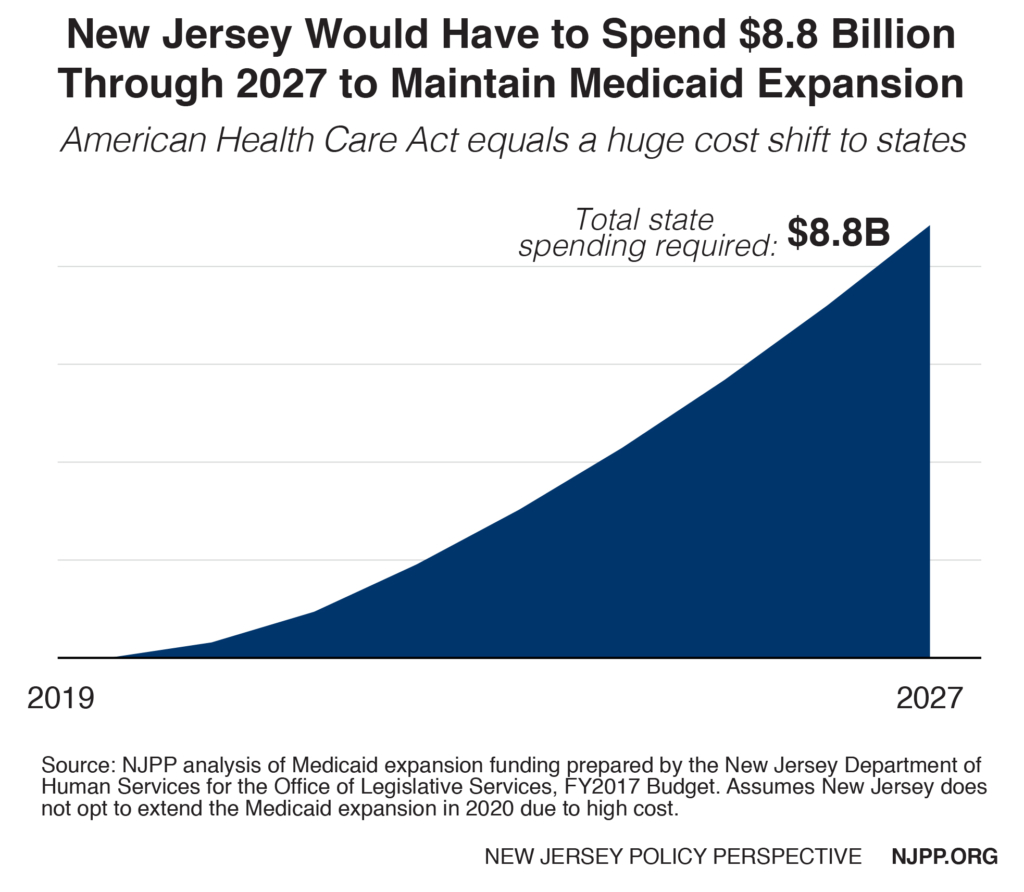

New Jersey’s Successful Medicaid Expansion Would Be Jeopardized

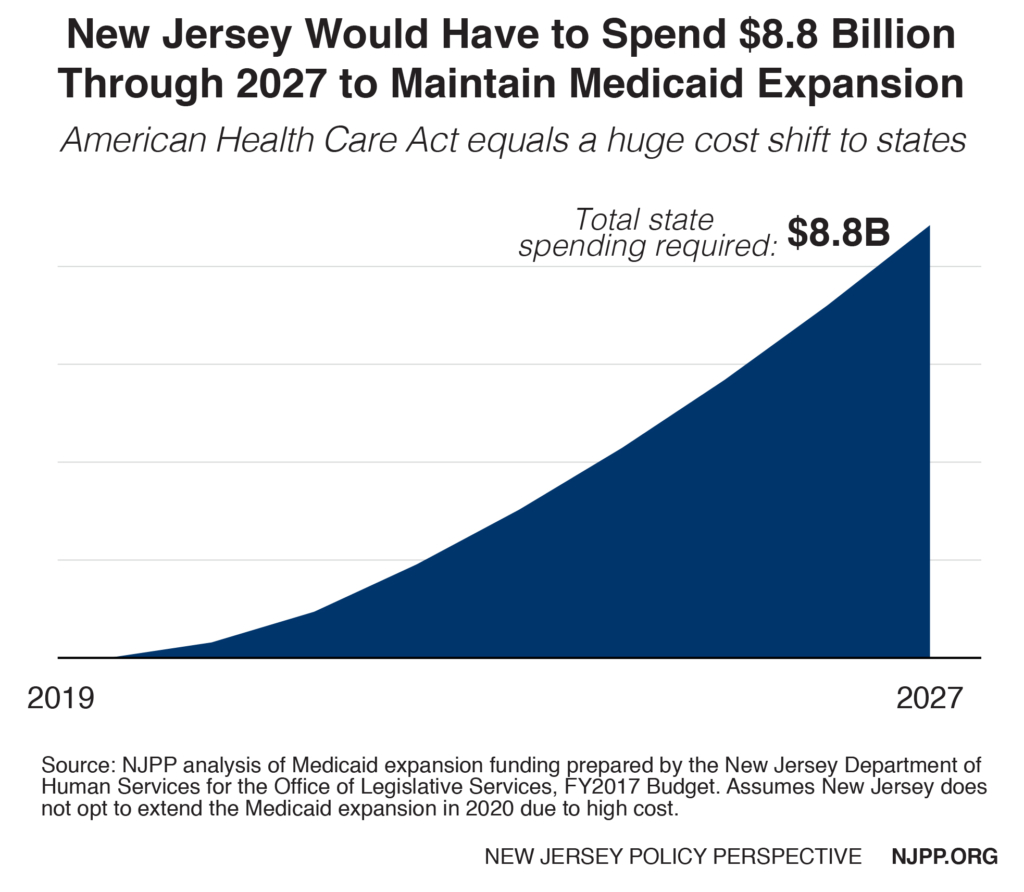

The latest House Republican plan to replace the ACA includes drastic cuts in federal funding for the Medicaid expansion. This cut would likely result in many New Jerseyans losing their health coverage. If New Jersey’s economy and financial condition were stronger, the state could continue the expansion starting in 2020. However, if it were to maintain it at current eligibility levels, New Jersey would be on the hook for an additional $8.8 billion over the next decade. By 2027, New Jersey’s annual match would be five times higher ($2.1 billion instead of $461 million) than it would if the Affordable Care Act were continued. And these estimates are conservative since they assume no increase in enrollment over that time, such as would occur with the onset of another recession (inflated health care costs are factored in).

Radical Restructuring of Medicaid Funding Would Harm New Jersey

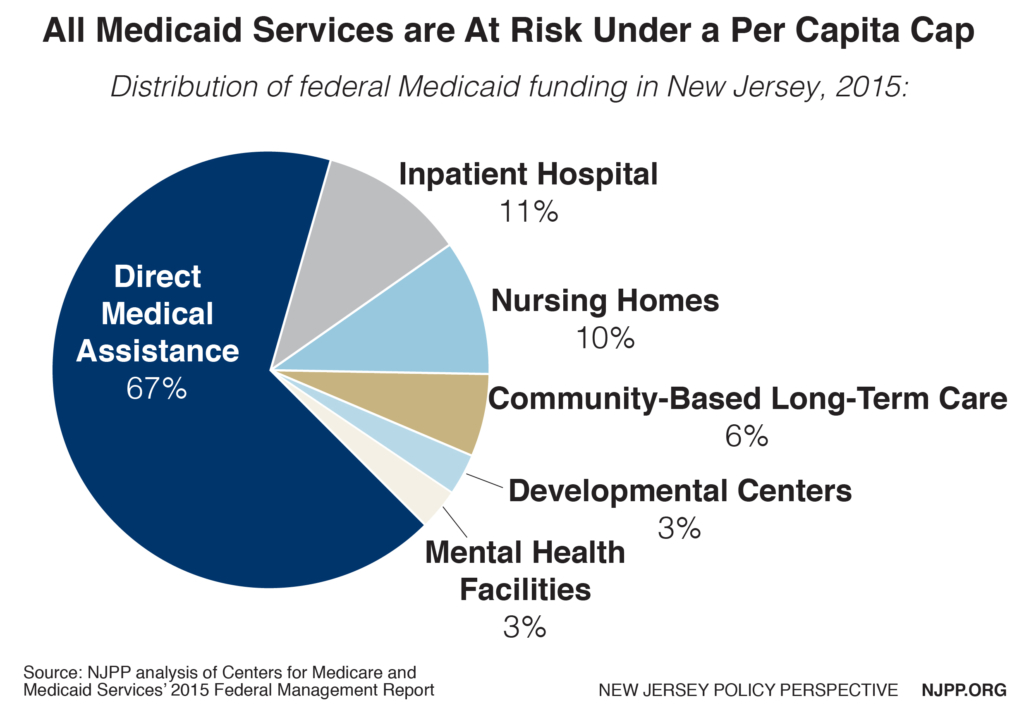

New Jersey would also lose additional federal funding under the proposed Medicaid per capita cap. The bill would establish a dollar-amount cap on each person enrolled in Medicaid. The cap would be different for different types of enrollees (aged, disabled, children, and adults in the Medicaid expansion in 2016) and it would be adjusted annually by the federal index for health services prices (CPI-Medical).

The index’s increases will likely fall below what high-cost states like New Jersey need, helping to generate the federal savings needed to offset revenues lost by tax cuts to the wealthy and corporations. Most states will likely fall below the index in some years and above it in others. The Congressional Budget Office projects that the index for health costs will increase on average by 3.7 percent annually from 2017 to 2026, compared to a 4.4 percent increase for Medicaid costs – or a 19 percent higher rate. From 2000-2011, average per capita increases in New Jersey exceeded the CPI-M level for adults (7 percent) and children (5.1 percent). Using national averages almost always puts high-cost New Jersey at a disadvantage.

Since this is a national price index, it would not respond to state-specific health crises and patterns, like an infectious disease outbreak like Zika, a medical breakthrough or an opioid addiction crisis. In addition, while federal funding under a per capita cap would increase when additional residents were served – such as during a recession – the rate of federal reimbursement would be lower than a state would receive today. In other words, if more residents needed services during a recession it would still cost the state more - at the very same time when federal payments to states would be reduced.

Since states will not know their level of federal funding until the year before, long range planning will be very difficult, if not impossible. The federal government could also decrease the caps at any time. With federal Medicaid funding uncertain, states would likely spend less to stay within the caps, or cut services and/or reimbursement rates when the caps are exceeded. Because the caps are based on 2016 federal Medicaid expenditures, states would likely curtail Medicaid expenditures as soon as the bill is signed into law to avoid exceeding the caps in 2020 when they take effect. For example, if the state continues to expand services to opioid addicts, it runs the risk of increasing the average per capita cost for adults covered by the Medicaid expansion. Thus, by 2021 the state might easily exceed its cap with the state on the hook for all additional costs.

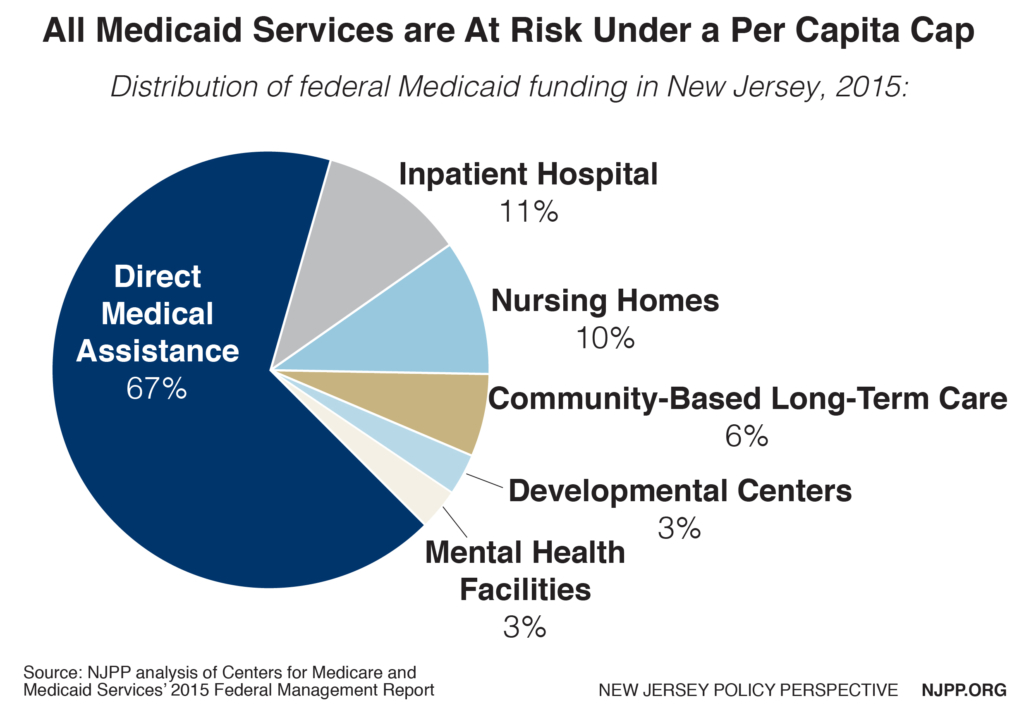

Currently there are more federal optional services (28) than required services (15). New Jersey has very comprehensive benefits and has opted for nearly all the services that are permitted. Some of these optional services that could be eliminated to reduce per capita costs include:

- Prescription drugs

- Home and community based services

- Private duty nursing

- Dental

- Case management

- Physical therapy

- Hospice

- Institutional services for the developmentally disabled and children

Reduced access to services

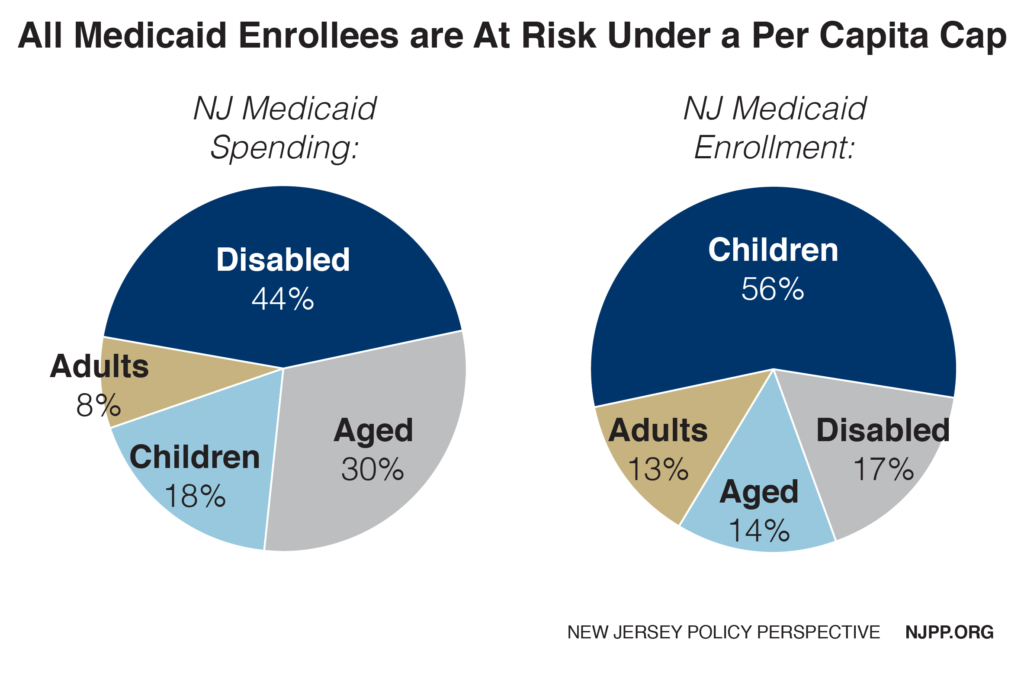

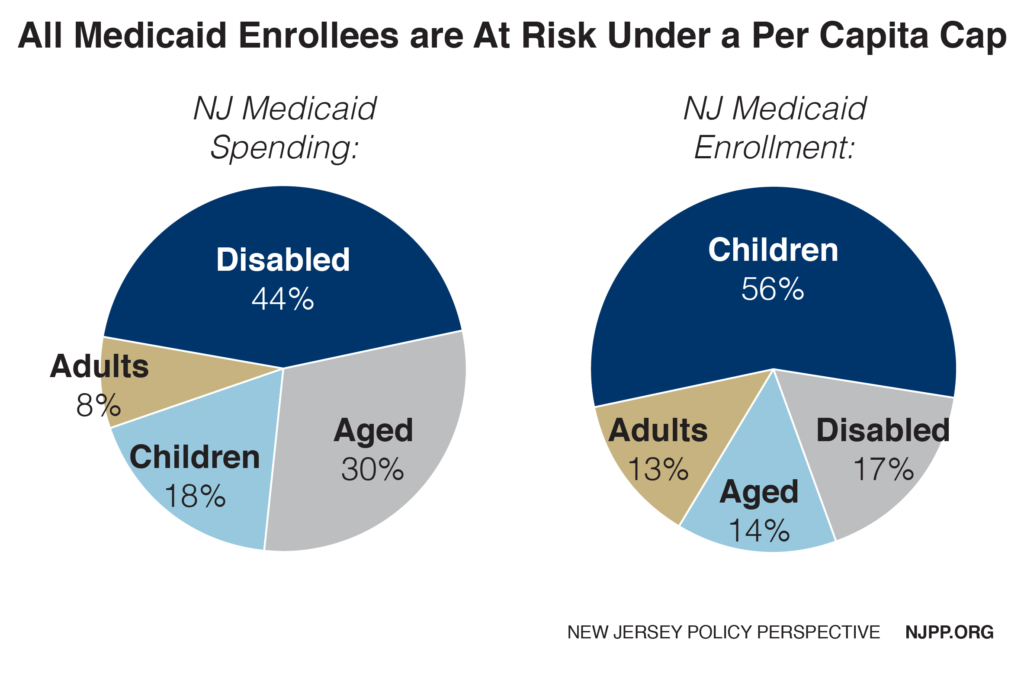

If a state decides to make up for steadily declining federal grants, it may focus its cuts on the most costly enrollment groups, thus putting New Jersey’s seniors and the disabled in the crosshairs since these two groups generate about three-quarters of all the state’s Medicaid spending. On the other hand, if the state decides to make the cuts based on the largest enrollment groups, children would be put at disproportionate risk, as they comprise over half of total enrollment.

Instead of viewing Medicaid as an investment, the state would view it as threat to the budget and other priorities. Since total Medicaid funding would in effect become a shrinking pie, different groups in Medicaid would have to compete with each other for diminishing resources.

In addition to eliminating services, the state could also reduce reimbursement rates for services, some of which are already some of the lowest in the nation despite New Jersey’s health costs being among the nation’s highest (it should come as no surprise that just 38.7 percent of New Jersey doctors accept Medicaid patients, the lowest rate in the nation).

New Jersey would be penalized for its efficiencies in Medicaid

Proponents of capping federal Medicaid funding claim that states would have more flexibility to initiate efficiencies that would absorb any loss in federal funds. However, any additional flexibility in Medicaid in New Jersey would probably not help, because the state already implemented the most promising efficiencies under the flexibility of the current Medicaid program. Unfortunately, the federal dollars New Jersey has saved will be subtracted from the 2016 base year that will be used to calculate the state’s Medicaid funding in the future. In other words, the state would permanently lose those funds because it tried to make Medicaid more efficient and effective.

The following are some of the efficiencies that have been implemented—many with waivers approved by the federal government– which might not be available to New Jersey to absorb any future loss in federal dollars due to Medicaid caps:

- New Jersey saved $2 billion in federal funding over five years under a comprehensive waiver that, among other things, placed the elderly in communities rather than nursing homes.

- New Jersey is ranked sixth highest nationally in the percent of it Medicaid population in managed care (95 percent).

- New Jersey operates three Accountable Care Organizations that focus on patient-centered quality and cost of care for Medicaid participants, one of the highest numbers in the country.

- New Jersey is ranked 49th lowest nationally in fees to providers (mostly primary care physicians).

- New Jersey is ranked ninth nationally in medical home participants.

- New Jersey spends only about seven percent of its Medicaid dollars for administration, far lower than in the private insurance sector.

Methodology

Increase in the uninsured

The estimated number of uninsured in New Jersey in 2013 and 2015 is from the American Community Survey. The 2020 estimate assumes that the state would not opt for the Medicaid expansion because of the high cost to the state and that, therefore, all of the 550,000 New Jerseyans currently enrolled in the expansion would lose their Medicaid.

The estimate that 172,000 of those New Jerseyans were participating in New Jersey Family Care prior to the Affordable Care Act is based on the New Jersey Department of Human Services’ response to the Office of Legislative Services for the 2017 budget. It is assumed that they would all become uninsured if made ineligible for Medicaid.

For the remaining individuals in the expansion it was estimated that 51 percent of them would not find alternative health coverage and therefore would become uninsured consistent with a 2015 RAND study (Trends in Health Insurance, 2013-2015) which estimated the number of individuals in the Medicaid expansion who did not have insurance prior to the Affordable Care Act.

To determine the number of the uninsured resulting from proposed changes in the insurance marketplace, New Jersey’s share of the national marketplace is applied to the Congressional Budget Office (CBO) national estimate for the number of individuals who will lose their coverage in the marketplace in 2019 and 2020. That number was reduced on the assumption that half of them would be able to find coverage elsewhere. The CBO national estimates of the number of uninsured from the marketplace decreases by 2027 which would also lower the number of the uninsured in New Jersey in that year. The projected increase in uninsured New Jerseyans is conservative because it does not take into account the likely decrease in employer-based coverage and other changes in the House Republican plan.

Congressional district impact

The share of adults enrolled in Medicaid in each district was calculated based on enrollment data for public insurance in the American Community Survey, which was applied to the number of persons statewide that would become uninsured as a result of the House Republican plan as described above. The share of adults in the marketplace in each district was calculated based on data provided by the Kaiser Family Foundation, Interactive Maps: Estimates of Enrollment in ACA Marketplaces and Medicaid Expansion, February 28, 2017 which was applied towards the statewide total of uninsured due to changes in the marketplace caused by the House Republican plan as explained above.

State cost for new Medicaid expansion

To determine the cost to New Jersey of maintaining Medicaid expansion should it elect to maintain coverage for those enrolled via Medicaid expansion, the total cost of the Medicaid expansion as estimated by the New Jersey Department Human Services for state fiscal year 2018 was increased by 4.4 percent annually as projected nationally through 2027 by the Congressional Budget Office cost estimates, American Health Care Act, March 13, 2017. Federal funds were calculated based on the 90 percent matching rate under current law. To determine federal funds under the House Republican plan, the federal funds were reduced to take into account the attrition rate for all individuals that were grandfathered in the expansion based on the attrition rate estimated by the Center and Budget and Policy Priorities. The remaining federal funds were calculated based on the 50 percent federal matching rate. The state matching rate under current law and the proposed House Republican plan were compared to calculate the additional state cost.

As written, the American Health Care Act appears to require that if New Jersey wants to continue receiving a higher federal match for individuals in the Medicaid expansion as of 2020, the state must also accept all newly eligible individuals at the lower match of 50 percent. Our cost estimates assume that scenario. However, if the state decides that it cannot afford the lower match it could also decide not to elect the Medicaid expansion in which case everyone would become ineligible in 2020 and the state would lose about $3 billion annually it currently receives in federal funds.

However, the current interpretation is that the intent of this legislation is to allow the state more flexibility in this option and allow it to 1) not accept any new enrollees and let the grandfathered cases remain in Medicaid at the 90 percent federal match until they leave; or 2) accept a narrower category of new enrollees. For example, New Jersey could make eligible the 172,000 parents and childless adults who were eligible for Medicaid prior the ACA. However even with this more liberal interpretation, it would cost the state hundreds of millions of dollars depending on how they define this new eligible category.