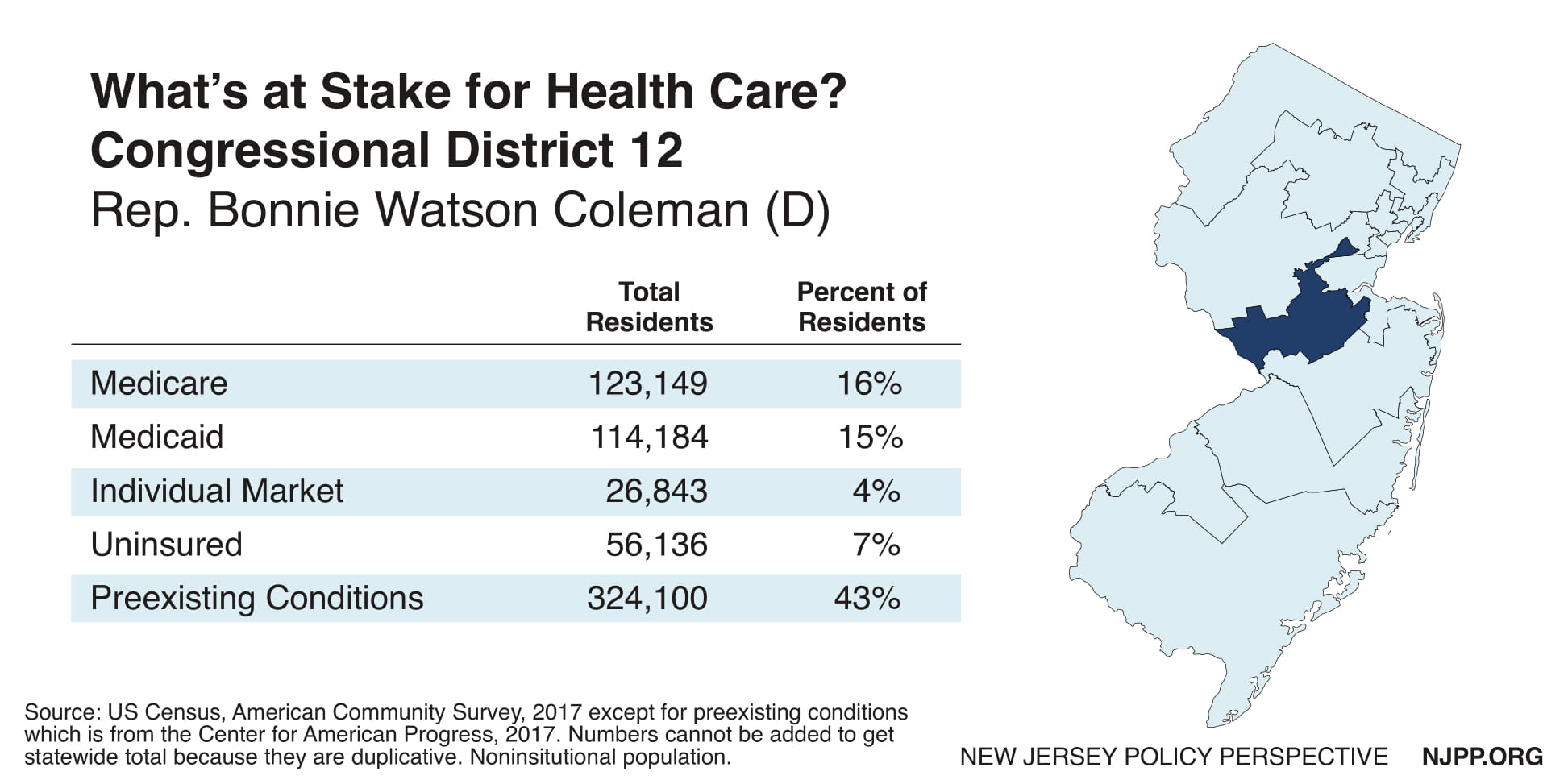

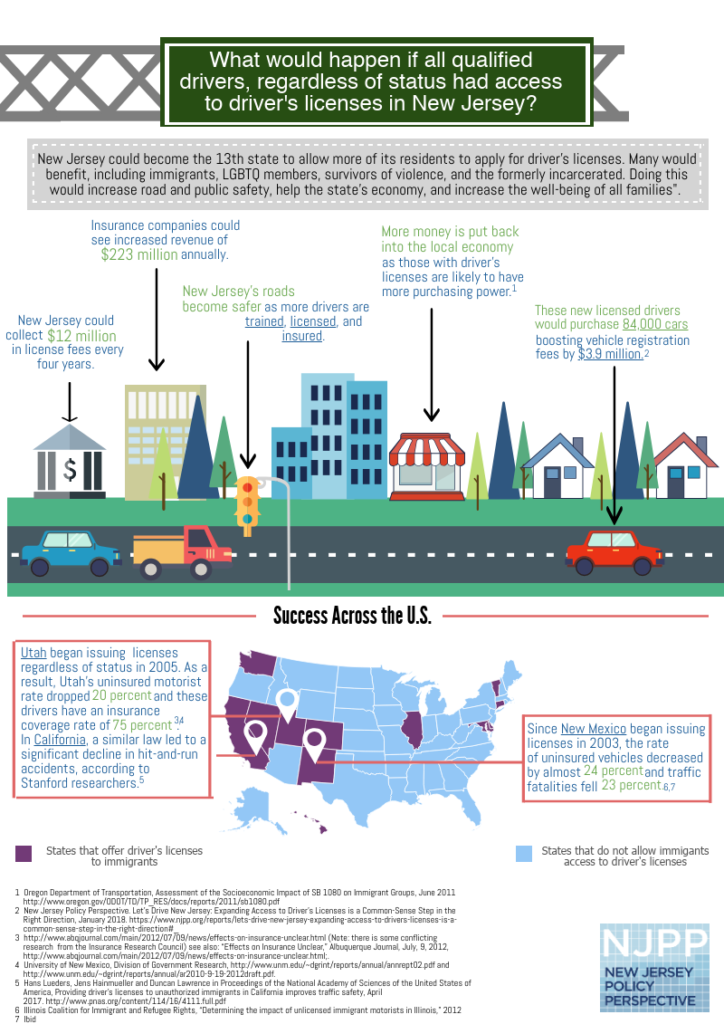

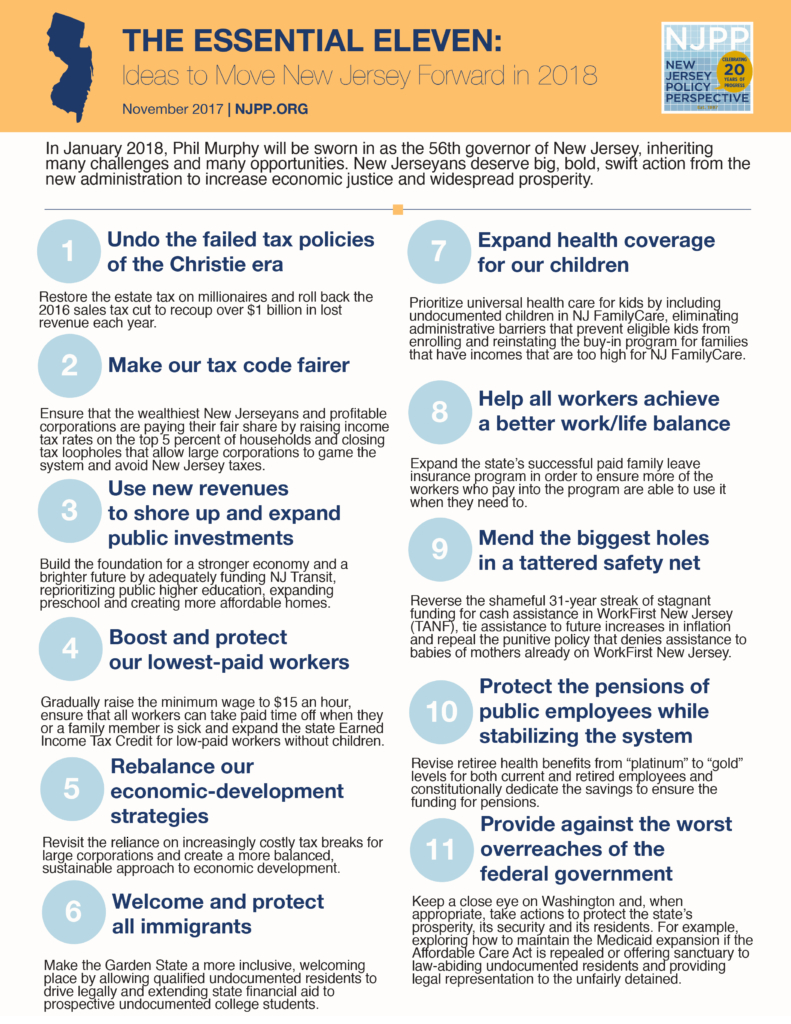

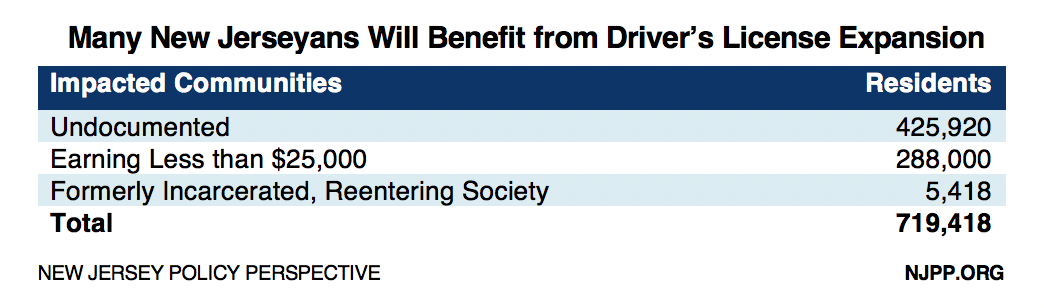

As New Jersey welcomes 2019 with the passage of a $15 minimum wage and paid family leave expansion, it’s time to shift focus to another policy issue that’s critical to the economic security of working families: making New Jersey the 13th state in the nation to allow all its residents to apply for driver’s licenses, regardless of their immigration status. There is a proposal in the Legislature — A4743 — that would lower the barriers to getting a driver’s license, impacting 719,000 New Jersey residents and benefitting not only undocumented immigrants, but those who earn less than $25,000 a year as well as those reentering society from the criminal justice system. This policy will increase public safety, empower workers and families in every corner of the state, boost the state’s economy, and contribute over $9 million in revenue to the state in the form of registration and licensing fees.

In New Jersey, having a car is essential to fully participating in the economy. No matter where you live in the Garden State — with very few exceptions — driving is necessary to get to work, pick kids up from school and take them to the doctor, shop for groceries and complete all the other errands that fill up the day. The ability to drive legally and safely is central to a vibrant New Jersey economy where everyone can work, get around and provide for themselves and their families.

Based on the experiences of other states that have implemented driver’s license expansion, NJPP estimates that 338,000 New Jersey residents will apply for a license during the first three years of implementation.

Restricting who is allowed to legally drive also has a chilling effect on the families and children of those who do not have the documents necessary to receive a driver’s license. In New Jersey, 168,000 children have undocumented parents who cannot drive them to and from school, their doctors appointments, sports games and practices, and other activities and errands parents make with their children. Instead, they are left relying on underfunded transit systems and spending money on taxis or Uber/Lyft drivers when that money could be going toward their children and spent in their local communities.

The proposed legislation, A4743, would create two categories of driver’s licenses and identification cards:

- REAL-ID: a REAL ID Act-compliant driver’s license and identification card that residents can use to travel domestically on an airplane and enter federal buildings.

- Standard License: a non-REAL ID basic license and identification card that would not be valid to board an airplane or to be used for certain official federal purposes. However, the non-REAL ID license would be valid for driving purposes and a form of identification.

What is REAL ID?

In 2005, the Congress passed and then-President George W. Bush signed the REAL-ID Act, legislation requiring driver’s licenses and identification cards to meet certain requirements set by the federal government to control who could board an airplane and hence make the country “more secure.” Specifically, the Real-ID Act calls for proof of legal presence in the United States and identity, a social security number, and state residency. The law also requires that applicants’ personal data and documents be entered into a state government database that is accessible to the federal government. These requirements are similar to the six-point system New Jersey currently has with the exception of the requirement to retain or scan documents into a DMV database. Despite there being no data that suggests the provisions in this law actually make driver’s licenses and identification cards more secure, the federal government is set to fully implement and enforce the REAL ID Act over the next two years.

States are not required to have their driver’s licenses and identification cards comply with the REAL ID Act, as there is no legal or financial punishment, but non-compliance will create a burden for residents of those states as they will need additional documentation, such as a passport, to fly domestically or enter federal buildings. The federal government will start enforcing the provisions of the REAL ID Act in New Jersey on October 10, 2020.

Is New Jersey REAL ID Compliant?

No, New Jersey’s licenses and identification cards are not compliant with the REAL ID Act, but state officials have signaled that they hope to change that in 2019. As of February 2019, 38 states are compliant, as well as Washington DC, Puerto Rico, and Guam. New Jersey is one of twelve states that is not compliant, and all twelve have received enforcement extensions into 2019 and 2020.

Who will benefit from A4743?

If New Jersey becomes REAL ID compliant without creating a standard license as an alternative option, many residents will be impacted by this change. The federal REAL ID Act’s requirements will make driver’s licenses out of reach for many, including undocumented immigrants, individuals earning less than $25,000 a year, and people reentering society from prison.

To ensure these residents, who may not have the funds and necessary documentation for a REAL ID, are able to legally drive and fully participate in society, New Jersey must create an alternative license. This is the only way to ensure that all New Jersey residents can continue to have access to a driver’s license and be able to protect their privacy.

Sponsored by Assemblywoman Annette Quijuano, A4737 would ensure New Jersey is compliant with the REAL ID Act while also creating an alternative standard license.

Creating an alternative standard license would benefit the following people:

- Citizens who do not want their information stored in a federal data system

- Those who do not need a license to travel domestically

- Certain senior citizens

- Survivors of domestic violence who are unable to retrieve all their documents

- Formerly incarcerated individuals

- Low-income individuals and families

- Transgender people whose documents may not accurately match their gender identity

- Immigrants, including undocumented immigrants

- Both citizens and noncitizens who have lost essential documents and have not yet obtained replacements because of cost or administrative delay

New Jersey has an opportunity to be REAL ID compliant and allow other qualified New Jersey residents the opportunity to be trained, licensed, and insured. It is a common sense policy that would make the Garden State’s road safer, allow children to arrive safely to school, help local economies to prosper, and establish a modeled system for the nation to follow.

Methodology

- Estimating how many people who are undocumented would be impacted

To estimate the number of people who would get licenses if New jersey allows undocumented immigrants to apply, we start with the number of unauthorized immigrants who are 18 years and older. We use the experience of other states to predict the “take-up rate” for New Jersey—the share of unauthorized immigrants who would get licenses if the policy was changed.

The number of unauthorized immigrants is drawn from the Center for Migration Studies (CMS), PEW Hispanic Center, and Migration Policy Institute Estimates of the Unauthorized Population; we take the average of the three estimates which is 484,000 and multiply that by the percentage of undocumented population that is 18 years and older,88 percent to give us the estimated number of folks who would benefit, 425,920.

The share of age-eligible unauthorized immigrants who get a license within three years of implementation of the policy ranges from about a quarter (25 percent in Nevada) to about a half (47 percent in Illinois), according to the Fiscal Institute Policy. In New Jersey, we assume that the policy would be implemented well, and that the take-up rate would be at the top of this range. Our estimate is that (47 percent) of age-eligible unauthorized immigrants would get a license.

- Calculating how many people earn less than $25,000

According to the IPUMS American Community Survey 2017, 1-year sample, an estimated 2.4 million U.S. citizens adults including naturalized citizens in New Jersey reported earning less than $24,999 and based on a study at least 12 percent of voting-age American citizens earning less than $25,000 per year do not have a readily available U.S. passport, naturalization document, or birth certificate. Hence, we multiple 2.4 million times 12 percent.

- Calculating how many people reenter from the criminal justice system

According to the latest outcome report, “State of New Jersey Department of Corrections

State Parole Board Juvenile Justice Commission (2016), 10,835 inmates were released in 2011. Based on the Motor Vehicles Affordability and Fairness and Task Force Final Report (https://www.state.nj.us/mvc/pdf/about/AFTF_final_02.pdf) studies show that at least 50 percent of those released out prison do not have access to identification. Thus, we multiplied 10,835 times 50 percent.

- Calculating license revenue:

Under A4743, the cost of obtaining a “standard basic license” is $18 and an initial permit is $10 for a license, totaling $28. Under the first outcome, the three potential groups total is multiple by the 47 percent “take-up rate” (see number 1 for more). The second outcome only includes the undocumented population times the 47 percent “take-up rate” times the price of license plus permit. The recurring revenue calculates only the revenue for renewing the license.