In a year of unprecedented surplus and abundance, the new state budget signed into law by Governor Murphy had the opportunity to transform government and build an economy that works for everyone. With rising prices on everyday needs — and many New Jerseyans still struggling to get back on their feet from the COVID-19 recession — this was a chance to make the state affordable for all. But instead of providing transformational direct relief to low-paid working families who have been historically left behind in the policy-making process, lawmakers used a bulk of the state’s record-setting $10.7 billion surplus on tax rebates for upper-middle class homeowners, tax credits for corporations, and a gimmicky sales tax holiday for everyone else.

Some important, positive changes were enacted in the spending plan, namely a new state-level Child Tax Credit, but it’s hard to see the budget as anything but a missed opportunity to help those who have the least and to start dismantling persistent economic and racial disparities. Given the opaque and rushed process, with a $50.6 billion spending package crafted behind closed doors and immediately voted out of committee before anyone had a chance to read the bill, it’s easy to see how lawmakers left out important proposals that would have benefited low-paid workers and their families.

From the onset, “affordability” was the major theme of this year’s budget season, but many of the policy proposals that emphasized “affordability” would have primarily benefited the already wealthy and big businesses. This is why essential workers and advocates repeatedly posed the question, “affordable for who?” — and for good reason. While other states used their unexpected windfall of state dollars to dramatically expand the social safety net, tax credits for working families, pandemic relief for immigrants, and hazard pay for essential workers, New Jersey lawmakers left these policy proposals on the cutting room floor. And, unlike years past, there is no shortfall of dollars to explain inaction on policies to help those fighting the hardest to get by, only a shortfall of political will.

Federal Funds

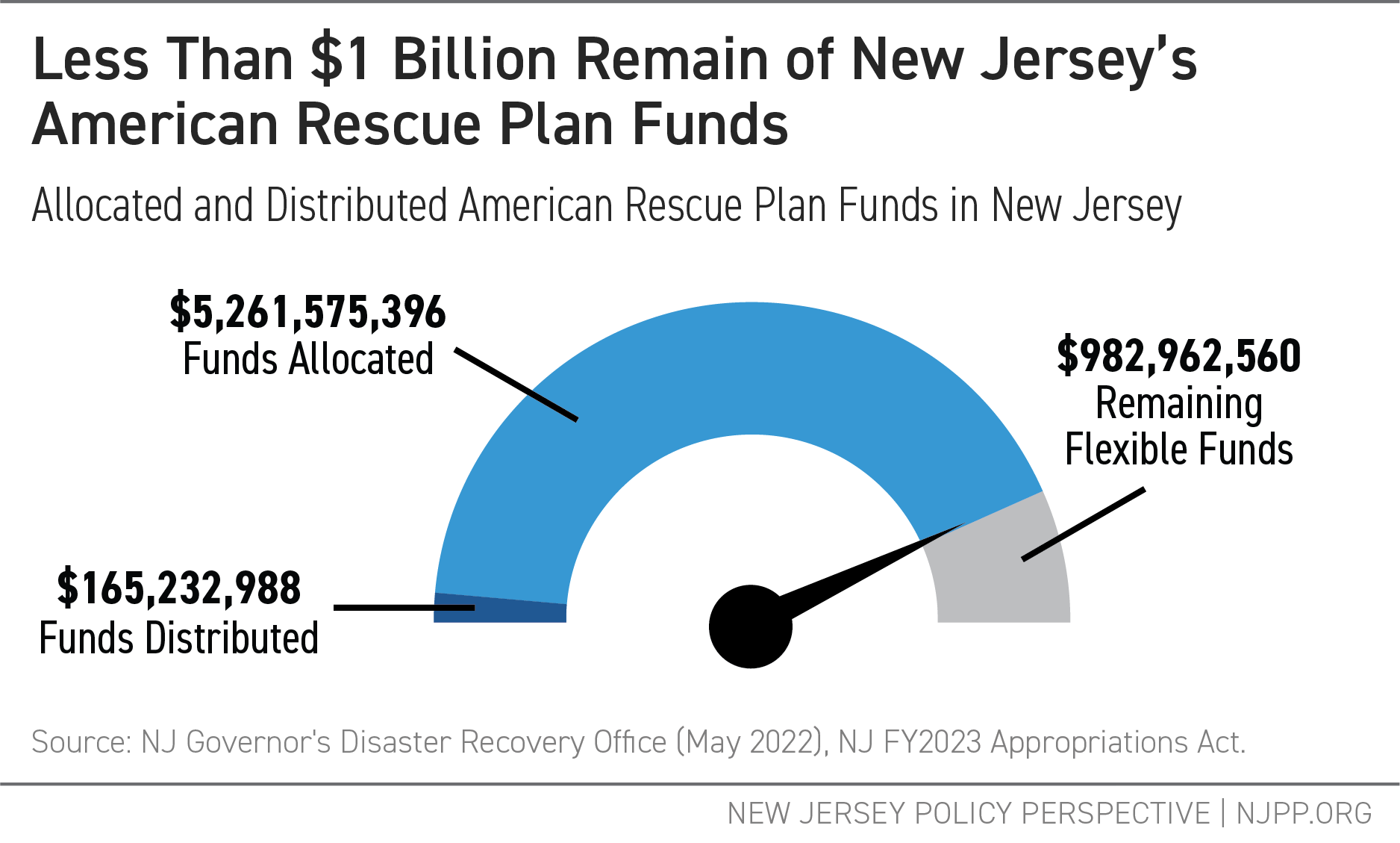

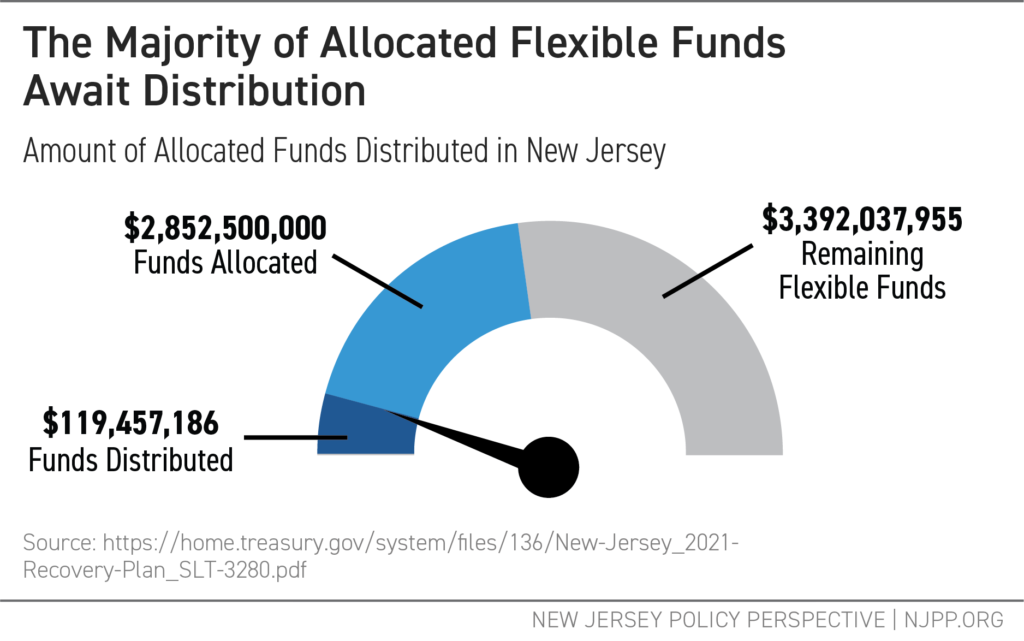

A combination of strong revenue collections and federal pandemic relief presented the state with an unprecedented surplus and $3 billion in remaining American Rescue Plan (ARP) funds. These federal dollars were specifically intended to help the state begin reversing the harms of the pandemic and promote an equitable economic recovery, especially for low-income residents and working-class families.

Roughly $2 billion in ARP funds were allocated as a part of the new spending plan, meaning these funds were similarly negotiated behind closed doors without an opportunity for public input. New investments funded by ARP dollars that will help working families and historically disinvested communities include:

- $300 million for water infrastructure

- $170 million for home lead paint remediation

- $120 million for universal preschool facilities

- $48 million for subsidized child care payments

But almost none of these federal dollars went directly to residents harmed by the pandemic or essential workers who risked their health and well-being so others could safely social distance at home. Hazard pay for essential workers, continued rental assistance, and replenishment of the Excluded New Jerseyans Fund were all left out in favor of blank checks to capital improvement projects. Granted, a large segment of these projects involve health care facilities and services, including mental health and emergency departments. But hundreds of millions of dollars in federal aid went to projects outside the scope of how the Biden administration recommended using the funds. Alarmingly, some ARP funds went towards programs that should be funded by state dollars, calling into question whether lawmakers have a plan on how best to sustain these investments once federal funds dry up.

Investments

Fiscal Health

Pension

For the second year in a row, state lawmakers committed to making a full payment into the state’s pension fund, shoring up the retirement security of roughly 800,000 current and retired state workers. This is the first time in two decades that the state has made back-to-back payments in their entirety, helping correct decades of skipped or shorted payments into the fund. That winning streak is also a sign of fiscal responsibility to credit rating agencies, which should help improve New Jersey’s credit rating and bring down future borrowing costs.

Rainy Day Fund

The final spending plan includes a $6.78 billion surplus, representing a whopping 20 percent of the state’s general fund. This surplus is three times the size of what it was originally estimated to be. Yet, lawmakers opted against using any of this robust buffer to replenish the state’s empty rainy day fund, making this the third year in a row without a deposit. A healthy rainy day fund enables the state to meet increased demand for essential state services during tough economic times or unexpected events like a severe storm or public health emergency. When the state was faced with drastic shortfalls at the start of the pandemic, the rainy day fund, though small, helped the state avoid harmful cuts. New Jersey already went through a shameful period when the fund was left empty for 11 straight years and simply cannot afford to repeat mistakes of the past. A deposit of $500 million, for example, would be enough to protect vital support and services in unforeseen circumstances while still leaving billions of dollars in leftover surplus.

Economic Security

ANCHOR

Touted as the largest tax relief program in New Jersey history, Governor Murphy’s ANCHOR program will send $2 billion worth of property tax rebates to homeowners and renters alike. The program, which is twice the size of the original proposal, will provide renters with much-needed $450 tax credits to meet skyrocketing rents. The bulk of the tax credits will go to homeowners, however, including nearly $300 million worth of $1,000 payments going to high-earning homeowners.

Child Tax Credit

For the first time, New Jersey will have a state-level Child Tax Credit to help families meet the high cost of raising kids. Modeled on the widely successful federal Child Tax Credit expansion, the program will provide a $500 tax credit to families with kids under age 6. These credits, available to households earning $80,000 or less, are fully refundable and will benefit 374,000 New Jersey children, according to the Office of Legislative Services. This is a big win for working families, providing them with a critical lifeline for basic needs like food, housing, child care, and more.

Expanded School Meals

No child should go hungry in school, and a new expansion of free school meals to all children under 200% of the federal poverty level will help bring the state closer to that reality. With the federal extension of school meal waivers in jeopardy, this state-level change protects New Jersey’s children and their development.

Health Care

Reproductive Health Care

With the recent Supreme Court decision overturning the right to abortion established through Roe v. Wade, more state action is vital to both protect and expand access to reproductive health care. The new state budget takes important steps in this direction with a significant boost in funding for family planning services and new funding for family planning facility upgrades. Lawmakers also approved funding to train new abortion providers and grants to beef up security against anti-abortion extremists, high-priority measures to prepare the state for a post-Roe reality.

Universal Newborn Home Nurse Visitation

For people who recently gave birth, consistent, easy-to-access health care support is essential to a healthy recovery. As part of the Nurture NJ campaign to address disparities in maternal and infant mortality rates, the budget allocates $17 million to a new Universal Newborn Home Nurse Visitation Program to make sure everyone has access to this care. ARP funds cover $6 million of the program’s funding, however, raising concern that this funding provides only a temporary level of support.

Cover All Kids

All New Jersey children, regardless of income, race, or immigration status, deserve access to affordable, high-quality health care. This budget continues the state’s investment in the Cover All Kids initiative, aimed at making sure all children in the state have health insurance, by including $11 million to implement Phase II of the initiative. Specifically, this funding will expand NJ FamilyCare options to all income-eligible children, regardless of immigration status.

Increased Marketplace Subsidies and Plans for Medicaid Disenrollment

During the COVID-19 pandemic, increased federal subsidies for plans on GetCovered NJ and a pause on Medicaid disenrollment from Medicaid have helped to get and keep more New Jerseyans insured. The new budget anticipates the end of the federal public health emergency by increasing the funding available in the Health Insurance Affordability Fund to $168 million. These funds will be used for continued state subsidies on GetCovered NJ and for helping people who are moved off of Medicaid plans to afford plans on the state marketplace.

Harm Reduction Services

Harm reduction services play a vital role in serving people who use drugs and providing them with the private and dignified health care they deserve. This budget continues the state’s improving commitment to harm reduction services, with $4.5 million — a small increase over last year’s budget — committed to helping expand services. With a new state law in effect, allowing centers to open without municipal approval, these funds will go a long way towards bringing harm reduction services to residents who previously lacked access to this life-saving care.

Criminal and Legal Systems

Violence Interruption Programs

Community-based violence interruption programs promote public safety and improve community trust. Like last year, this budget invests $10 million in community-based services which, with inflation, is essentially a cut in funding. The continued support for these programs is essential to building stronger, more resilient communities. Larger investments in these programs and other alternatives that do not center policing will be required to keep communities safe.

Reentry Services

People returning from incarceration should be met with support, understanding, and all the tools they will need to thrive. With newly allocated funds, the Department of Community Affairs will spend a total of $30.7 million on reentry services, which is more or less flat funding from the year before. Given high inflation rates right now, this translates into a spending cut. Funding for reentry services in New Jersey has been historically inadequate, and all communities benefit when previously incarcerated people return home with the resources they need.

Mental Health Crisis Hotline

Moving away from police-centered crisis response is a vital step toward safer communities, especially for calls that police are not trained to deal with. The budget sets aside $16 million for the implementation of the federal 9-8-8 hotline to serve as an alternative to 9-1-1 in the event of a mental health crisis.

Transit and Environment

Liberty State Park

Liberty State Park is a crown jewel of the state park system, providing public access to green space in one of the state’s densest cities and sanctuary to endangered shorebirds and other species. The new budget authorized $50 million in federal funds for park improvements, which are sorely needed. The legislation, however, failed to protect the park from large-scale commercialization and private development. By ceding the decision to preserve Caven Point to the Department of Environmental Protection, lawmakers chose to gloss over this public good. The Legislature did, however, amend the bill to increase public participation in deciding how the improvement funds will be spent, and removed a mandate for the park improvements to generate revenue.

NJ Transit

Safe and reliable public transportation is essential to making New Jersey more equitable and meeting the state’s clean energy goals, and yet this budget once again punts on identifying a dedicated funding source for the state’s mass transit system. NJ Transit’s budget includes up to $746 million from the New Jersey Turnpike Authority and $82.1 million from the Clean Energy Fund, a fund that is meant to offer financial incentives, programs, and services to help families and businesses alike save energy, money, and the environment. While the budget includes language that directs revenue from the Clean Energy Fund for clean energy and bus electrification, there is no guarantee it will be. In the short term, the state can only rely on federal relief funds and federal infrastructure dollars that will run out within the next few years.

What’s Missing

Hazard Pay

Hundreds of thousands of low-paid essential workers put their lives — and the lives of their families — at risk during the height of the pandemic. Despite public praise and many promises of support, the state has yet to dedicate hazard pay dollars for those who risked their health so others could stay home and socially distance. With billions of federal dollars at its disposal for hazard pay for its dedicated essential workers, the state has turned a blind eye to their contributions once again.

Excluded New Jerseyans Fund

The Excluded New Jerseyans Fund, which has distributed more than $30 million to about 13,000 residents excluded from federal pandemic relief, has been a lifeline to many immigrant households. However, many immigrant families have received little to no pandemic aid, despite an abundance of data showing that immigrant communities suffered disproportionately from COVID-19. Expanding the fund would have helped correct pandemic-exacerbated inequities. A planned one-time $53 million payment to immigrant taxpayers is not enough to offset the over $1 billion these households have been denied.

Earned Income Tax Credit (EITC) Expansion

Immigrants contribute hundreds of millions of dollars in state tax collections every year, but they are ineligible for many of the programs they help pay for, including the Earned Income Tax Credit (EITC). The EITC rewards hard-working, low-paid taxpayers by giving them money back to supplement their wages. While other states like Colorado, Maryland, and Washington have expanded EITC eligibility to all taxpayers, regardless of their immigration status, New Jersey chose not to include immigrant workers in this powerful anti-poverty program.

WorkFirst New Jersey Reforms

Somehow, in a year focused on affordability, lawmakers managed to ignore the most important program for very-low-income New Jerseyans: WorkFirst New Jersey. A proposed benefit increase and other eligibility reforms would have helped families in poverty keep a roof over their heads and food on the table, but state lawmakers once again left families living in deep poverty behind. New Jersey will never be affordable for all if those with the lowest incomes — those who struggle with affordability the most — are not prioritized in the state budget.