Governor Murphy delivered the first budget address of his second term with New Jersey flush with cash, thanks to stronger than expected revenue collections. Along with targeted federal aid, higher wages, and new, sustainable sources of revenue, this kind of economic growth proves that progressive tax policy is fiscally responsible tax policy. These resources provide the state a big opportunity to invest in communities – with an emphasis on policies that are proven to build the economy from the bottom up and the middle out. The Governor’s $48.9 billion spending plan takes advantage of this windfall by attending to such long-standing obligations as a full pension payment for a second year in a row, another big increase in school aid, as well as no fare hikes for NJ Transit commuters and a property tax relief program to replace the Homestead credit.

With “affordability” the buzz word in Trenton — the Governor mentioned it more than 20 times in the speech — some of the new proposals raise the question: who does this budget make New Jersey more affordable for? The economic fallout of the pandemic continues to wreak havoc in thousands, if not millions, of households across the state, especially among those lacking the financial resources to weather tough times. Many workers who risked their lives on the job as COVID-19 swept through New Jersey have received no assistance. Families with young children still face school closures and a low availability of child care.[1] The state’s poverty rate remains quite high at the same time the highest earners nationally have seen their wealth grow even further.[2] Housing advocates warn of a spike in evictions without additional help. It’s important for policymakers to understand that these devastating effects of the pandemic will not disappear on their own.

A more balanced and equitable approach to crafting the next state budget is essential – one that centers people and communities with the greatest need to ensure an equitable recovery. Proven policies like cash assistance, tax credits for hard-working families, affordable health care, child care, and reliable and cleaner public transit are needed now more than ever to make New Jersey affordable for all.

Healthy State Finances Could Support More Investment

New Jersey’s financial picture is the brightest it has been since before the pandemic, with overall tax collections up 21.7 percent compared to this time last year.[3] Thanks in large part to a strong stock market, wage growth, and an uptick in consumer spending, the state has a $4.5 billion surplus.[4] This comes on the heels of enormous federal support sent to New Jersey state and local governments overwhelmed by the health and economic damage wrought by the pandemic.[5] These resources provide a once-in-a-generation opportunity to target immediate relief and make long-overdue investments in New Jersey’s underserved communities, rebuild emergency savings, and put our state on a path to a more equitable economy.

Absent from the budget are major improvements to a state tax code that still has inequitable features and does not bring in as much revenue as it could for important public investments that help communities thrive. While the state appears to be in good fiscal shape in the short term, additional resources will be critical to sustain investments in such areas as public education, the public employee pension system, and property tax relief once federal pandemic relief funds are exhausted and amid an uncertain global landscape.

Pensions

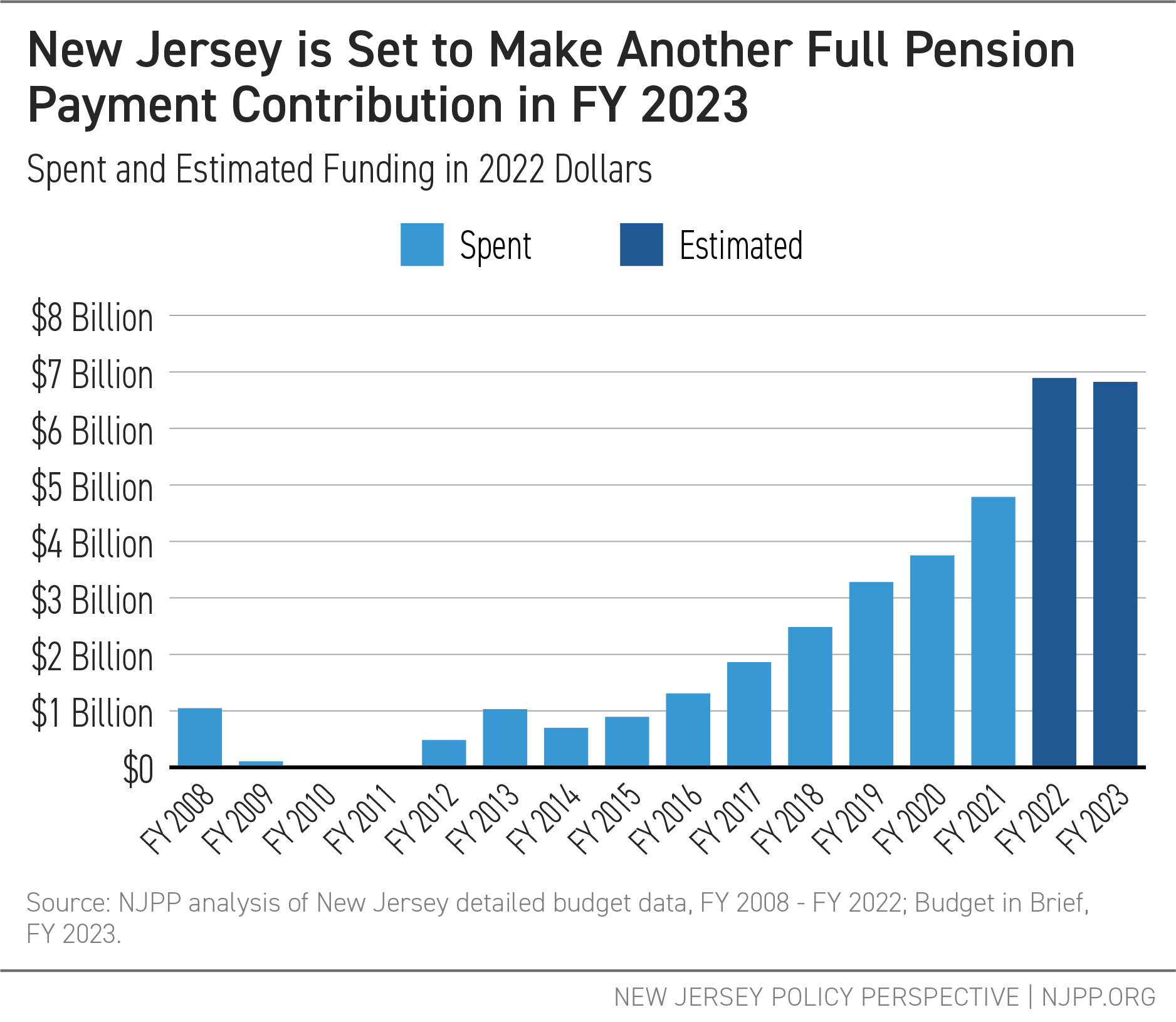

The FY 2023 budget includes another full pension fund contribution — which would be the second in as many years — to bolster the retirement security of more than 800,000 public workers and retirees. A full payment is a necessary step in the pension fund’s long road back to solvency after more than two decades of skipped or incomplete payments. The proposed $6.82 billion payment is possible due to another year of healthy tax collections and New Jersey Lottery receipts, plus freed-up resources thanks to federal COVID-19 relief funds.[6]

If the pension fund’s annual returns cool off in tandem with financial markets, it is expected that resources from other state-funded support and services will have to be siphoned to make the required payments.

Rainy Day Fund

New Jersey’s surplus is expected to total more than 10 percent of the state’s general fund — nearly double what it was in FY 2021. Despite such a robust buffer, the Governor’s proposal does not include replenishing the state’s rainy day fund.

New Jersey has a rocky history when it comes to keeping its emergency savings account ready to cover costs incurred from such unexpected events as a hurricane or a deep recession. A healthy rainy day fund enables the state to meet increased demand for essential state services instead of resorting to deep, harmful budget cuts at a time when families and communities need help the most. New Jersey was left with no choice but to do exactly that when faced with drastic shortfalls at the start of the pandemic. The rainy day fund would have been more robust had it not been left empty for 11 years. Budget experts recommend having enough socked away to run state operations for at least two months.[7]

With an expected $4.6 billion surplus, New Jersey could easily make a deposit of, say, $1.5 billion now and still have billions in surplus to shore up any mid-year shortfalls next year.[8]

Federal Pandemic Relief

New Jersey’s economy works best when it works for all of us. An inclusive recovery is one where those hit hardest by the pandemic — workers of color, and Black and brown women in particular — reach full employment and have the resources they need to make ends meet. That’s why it’s so important for New Jersey to its spend Fiscal Recovery Funds (FRF) in ways that reflect the principles set by the Biden administration: to directly address the public health crisis, help the people who need it most, and reduce racial and economic inequities exposed and worsened by the ongoing pandemic.

With $3.5 billion in federal relief funds from the American Rescue Plan Act still unallocated, the state should immediately act to stabilize residents facing hardship and keep their children safe from the short- and long-term effects of poverty. Based on past economic crises, it’s clear that some New Jersey residents will continue to experience hardship even after the effects of the pandemic begin to subside.

The most straightforward way to boost household income of families living paycheck to paycheck is to provide direct cash payments with no strings attached and regardless of immigration status. This proposed budget would use $53 million of federal funds for $500 direct payments to individual, low-paid ITIN holders — an alternative to the now-expired Excluded New Jerseyans Fund. Another approach to FRF-funded cash assistance should be to compensate low-paid workers for the risks taken during the shutdown and as COVID-19 variant surges swept through the state.

Relief funds could also be used to spearhead a robust overhaul of departmental IT platforms, as well as an outreach campaign and application assistance for all social assistance and support services, not just those funded by federal relief dollars. This campaign could target communities that face systemic barriers to learning about and accessing support programs, including immigrants and people of color with low incomes, and should be tailored to families living in poverty who are less likely to owe and file taxes and, as result, may miss out on tax credits for low-paid workers and their families.

Bringing More Relief to Working Families

Every family in New Jersey deserves to live the American Dream and raise their children with the basics they need to thrive. But New Jersey’s high cost of living means that families often need support to pay for rent, bills, unexpected health care costs, and food. The state has a variety of programs to put money into families’ pockets. The proposed budget would increase funding for some helpful programs, but more remains to be done to remove barriers to economic security for working families who do not get paid enough or receive enough hours to pay for everyday expenses.

Tax Credits for Working Families

Since 2000, the New Jersey Earned Income Tax Credit (EITC) has provided a critical lifeline to workers and their families.[9] With this tax credit, the state pays back low- and moderate-wage workers for a percentage of their earned income, lowering their taxes or, for those owing little or no taxes because of low incomes, providing cash.

The EITC is a powerful poverty-reduction tool. It helps to reduce racial income inequality while raising low-income households’ bank balances. In FY 2019, over 530,000 households claimed the credit, averaging about $850 per credit. Beginning in tax year 2021, adults ages 18-21 and adults 65 and over without dependents became eligible to apply for the credit, closing key gaps left by the preexisting credit and making 90,000 more taxpayers eligible.[10] The FY 2023 budget continues strong support for the EITC with $114 million in additional funding.[11]

But the EITC could be improved further by eliminating barriers that keep some workers excluded from the credit, such as immigrants who file taxes with an (ITIN). New Jersey should also build on the credit’s anti-poverty effects and raise the credit amount to 50 percent of the federal credit.

Property Tax Relief

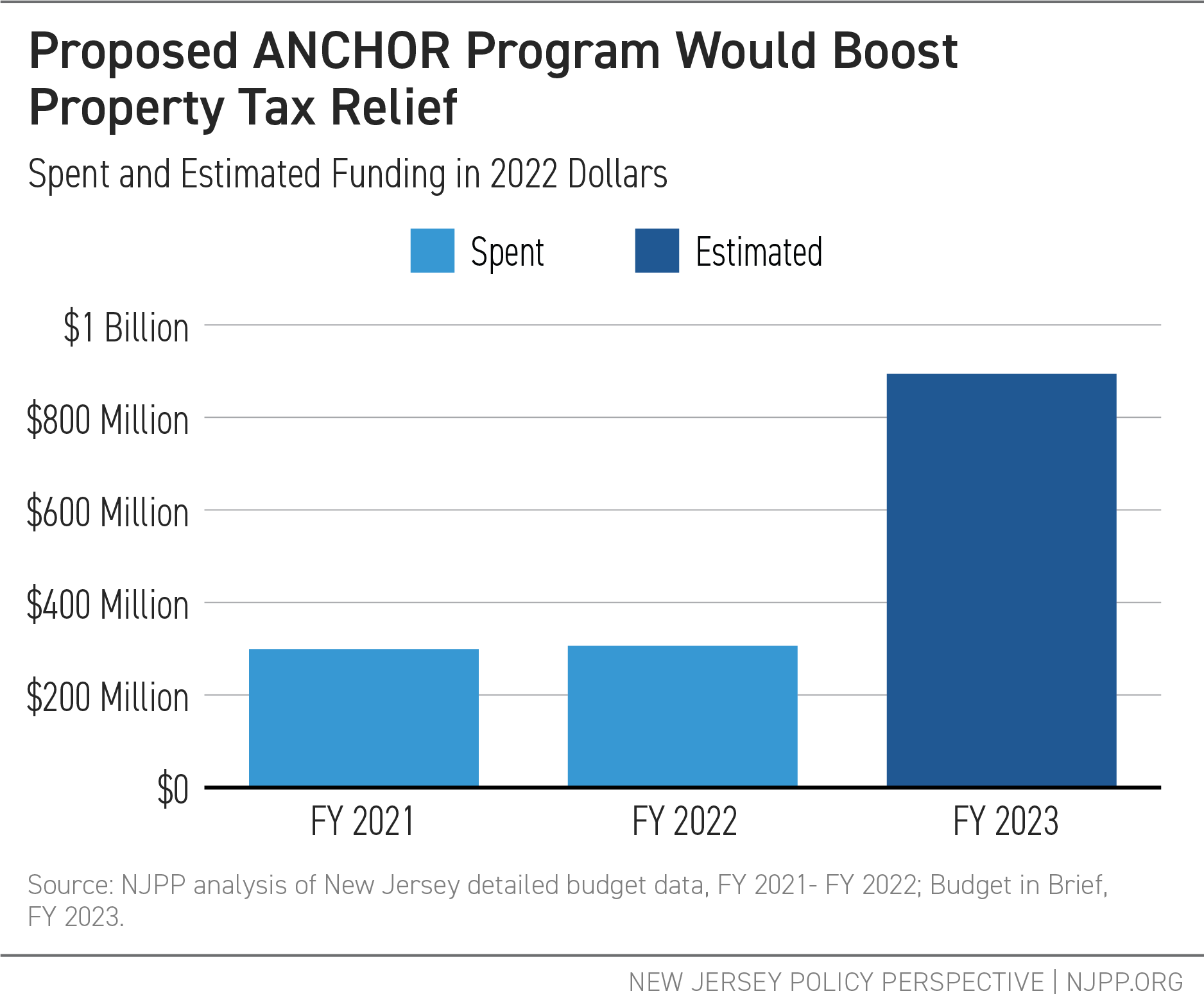

Property taxes are a perennial source of concern among New Jersey residents and, fittingly, were a big theme of Governor Murphy’s budget address. The Governor’s ANCHOR proposal would revamp the state’s flagship property tax relief program, the Homestead rebate, by increasing overall taxpayer benefits, eligibility, and funding by more than $570 million. Expanded property tax relief under the proposed ANCHOR would be phased in over three years.

The ANCHOR program would provide relief to homeowners with up to $250,000 in annual income and renters making up to $100,000. Renters, who tend to have lower incomes than homeowners, were previously not eligible for Homestead rebates.

The ANCHOR proposal would expand property tax relief to households earning up to $250,000, well into the top 20 percent of New Jersey households.[12] As proposed, it would provide more funding ($158 million) to households earning $150,000 or more than it would to all renters ($101 million).[13]

Temporary Assistance for Needy Families

During the pandemic, millions of individuals and households needed increased assistance. Yet, enrollment in WorkFirst NJ — the state’s Temporary Assistance for Needy Families (TANF) program — has dropped below pre-pandemic levels.[14] This decrease is the direct result of the outdated changes in “welfare” during the 1990s that supporters said would assist very low-income families with cash assistance, child care, and job placement.

But the strict eligibility requirements these changes imposed are a barrier to more residents qualifying for WorkFirst NJ and have kept the program’s maximum benefit levels for cash assistance far too low to lift families out of poverty. TANF benefits max out at 30 percent of the Federal Poverty Level — a mere $559 per month for a single-parent family of three.[15] That inadequate level of support is slated to remain the same, based on the Governor’s proposal for FY 2023.[16]

To meet its goals of helping families and individuals rise from poverty, the WorkFirst NJ program should be reformed in next year’s budget, with higher benefit levels to better reflect the state’s cost of living and new rules so families are no longer punished for saving money and children are no longer cut off from resources.

Bringing Equity to Education Funding

New Jersey’s public schools consistently rank among the best in the nation, thanks to robust state funding. Schools with adequate funding can provide students with a high-quality education, as well as better health, counseling, and other services to those having difficulty reacclimating after an abrupt and prolonged pivot to online learning. Adequate funding also helps school districts recruit and retain well-qualified teachers[17] and helps keep school buildings in good repair and safe in the face of the ongoing pandemic.[18]

K-12 School Funding

School funding is one of the biggest investments New Jersey makes in any year. Yet, state lawmakers have never fully funded New Jersey’s school funding formula as mandated in the School Funding Reform Act, or SFRA.This formula defines how much each school district needs to provide an “adequate” education. While many affluent districts spend above this amount, many districts spend well below it.[19] Ensuring that all schools have adequate funding must be the top educational priority of the Legislature and the Governor in the current budget cycle and beyond.

In FY 2021, New Jersey schools received $2.4 billion less than the adequacy level set by SFRA. A substantial portion of this adequacy gap was due to districts not contributing their “local fair share,” but the state’s contribution was still well below what it should have been under the law.[20] Many of the students suffering from this chronic underfunding are Black and Hispanic/Latinx children whose districts cannot raise adequate revenues due to systemically racist housing practices.[21]

For FY 2023, the Governor proposed increasing K-12 formula aid by $578 million. This additional aid, as well the redistribution of aid to underfunded districts, will help close the adequacy gap. Still, a large number of students will be enrolled in underfunded schools. As previously reported, funding targets set by SFRA are likely inadequate.[22] This proposed increase is a step toward providing New Jersey’s schools with what they need to properly educate the state’s children. But more work remains to correct the course toward equity.[23]

Pre-Kindergarten

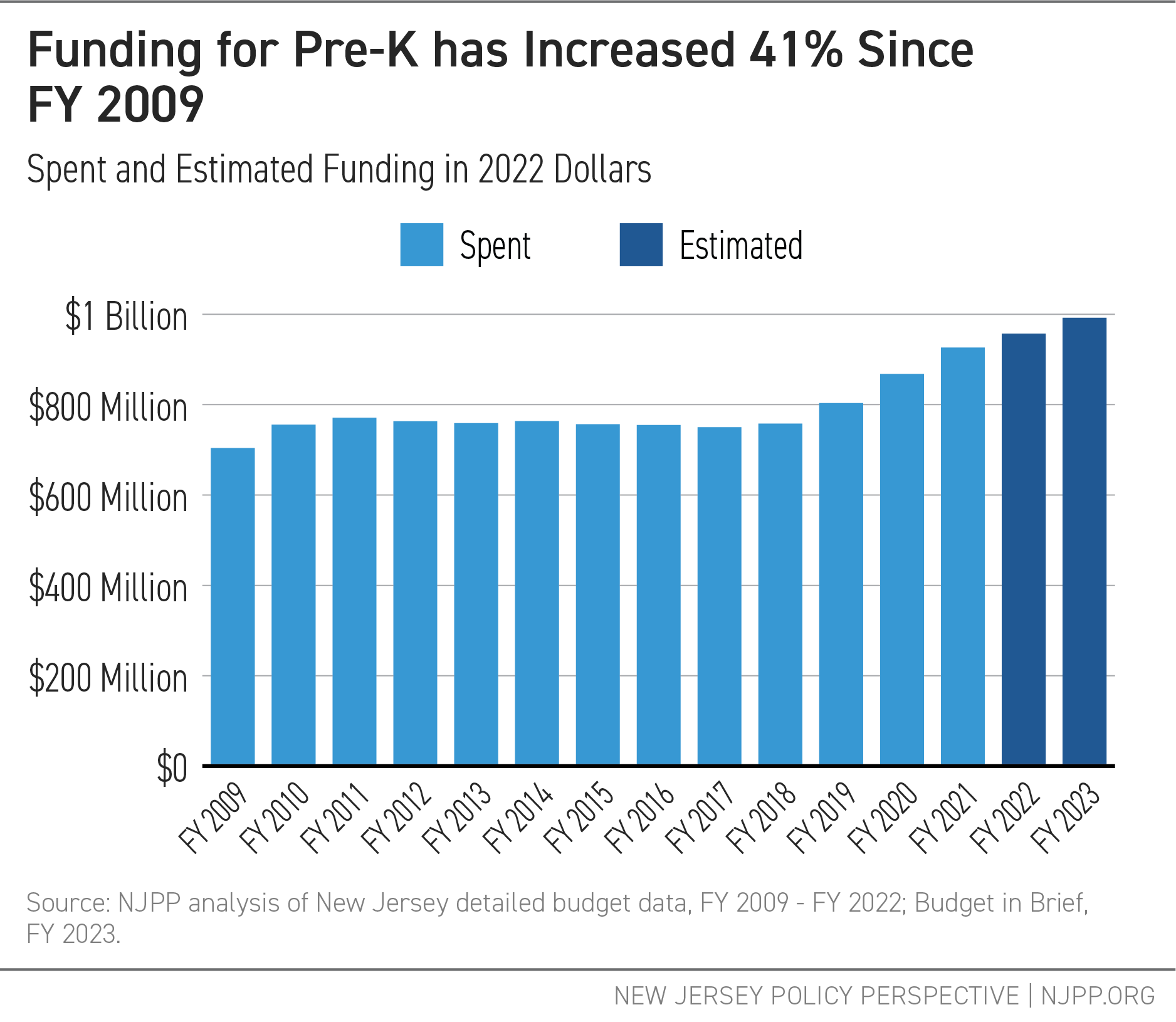

For younger students, New Jersey’s investment in pre-kindergarten education continues to grow steadily. Governor Murphy’s budget proposes $991.9 million toward existing and new Pre-K programs — a 41 percent increase since FY 2009. Of the proposed $70 million increase for FY 2023, $40 million will support 3,000 new seats in 40 school districts.[24]

Greater Investments Needed for Health

COVID-19 Response

As essential workers, working families, and communities continue to face immediate and long-term harm from the COVID-19 pandemic, investments in public health, mental health services, and the broader health care system continue to be essential for an equitable recovery.

Federal dollars through the American Rescue Plan and increased Medicaid and hospital funding support many of these services. In response to a spike in the need for mental health services, the Governor has proposed a $12.8 million allocation to establish a new federally mandated 988 suicide and crisis helpline, as well as allocating American Rescue Plan funds toward student mental health initiatives.[25]

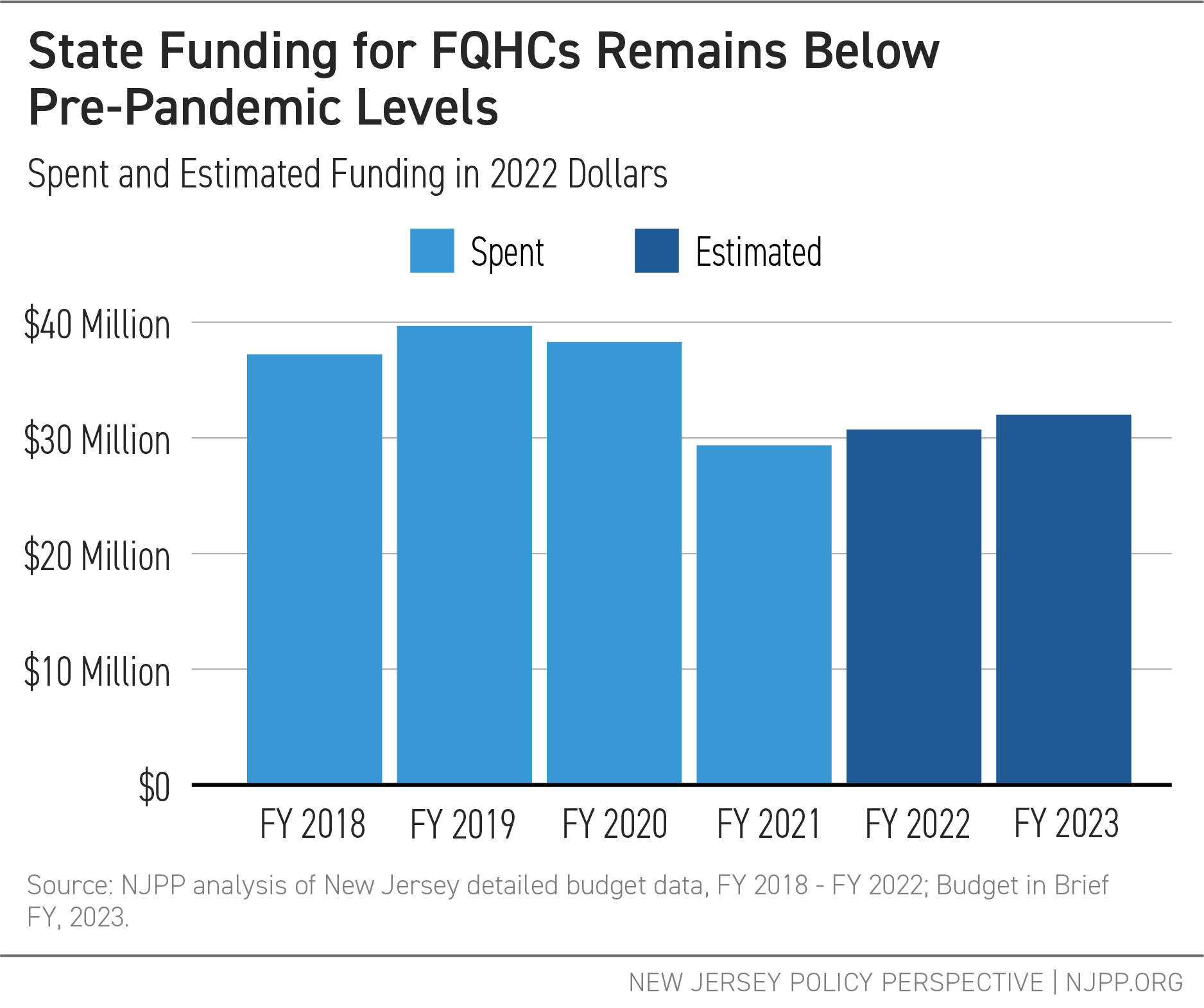

But more is needed. Funding for federally-qualified health centers (FQHCs), for instance, remains below pre-pandemic levels. These nonprofit, community-based organizations offer comprehensive primary care services and are a key safety net provider for historically underserved people.

Finally, state dollars toward reimbursing charity care continue to grow despite great strides in health insurance expansion. Charity care is the system under which hospitals provide services without charge to patients who cannot afford to pay and are reimbursed by the state. After a recent change in the funding formula for charity care, the Governor’s budget proposes $339 million in funding for FY 2023, an increase of 17.4 percent over pre-pandemic levels.[26] As the state continues to expand coverage for more residents, these costs should decrease in the future.

Harm Reduction

Health care for people who use drugs should meet people where they are, focusing on reducing harm rather than punitive treatments. This helps people who use drugs find their paths to long-term health. Last year saw an increase in state spending to support syringe-access programs, continuing a trend of greater investment since FY 2020.[27] However, this funding was not fully allocated due to restrictions on establishing new syringe access programs beyond the current seven.

This year, state policymakers expanded their commitment to overcoming these obstacles, as Governor Murphy signed two pieces of legislation to decriminalize syringe possession and remove restrictions to expanding syringe-access programs across the state.[28] Funding for the program in the proposed budget reflects this commitment to establishing more harm reduction centers, with an additional $500,000 – a 10 percent increase over the current fiscal year[29]

Reproductive Health Care

Every New Jersey resident, regardless of gender, income, or immigration status, deserves access to the reproductive health care that meets their needs. Legislation signed by Governor Murphy at the beginning of the year codifies abortion rights, yet necessary access and equity improvements remain unaddressed.

Funding in the FY 2023 budget reflects the Murphy administration’s continued commitment to maternal and infant health services in response to New Jersey’s wide racial disparities. This includes an additional state appropriation of $8.5 million to the new Universal Home Visiting program, which entitles all parents with newborn infants to at least one free postpartum home visit.[30] New Jersey is only the second state to implement such a policy.[31] However, the initial proposed budget provides no information on whether covered contraceptive and prenatal services would be expanded to include abortion care.

Cover All Kids Implementation

All kids deserve quality, affordable health care, and New Jersey has taken significant steps toward that goal. After passing Cover All Kids legislation in June 2021, the state eliminated waiting periods and premiums in NJ FamilyCare, the state’s publicly-funded health insurance program, and expanded outreach to improve enrollment of eligible children.[32] Now, the Governor has proposed taking the next important step toward universal access for children by expanding eligibility for NJ FamilyCare to all children, regardless of immigration status. To fund the expansion, $11 million has been set aside in the proposed FY 2023 budget.[33]

State Subsidies on Marketplace

For many New Jersey residents, health insurance continues to be unaffordable, even with financial assistance that lowers premiums for those with plans in GetCoveredNJ, the state-run health insurance marketplace. To address this, the state introduced additional state subsidies that reach more residents on GetCoveredNJ in 2021.[34]

More than 324,000 residents enrolled during open enrollment for 2022, an increase of 54,000 over 2021.[35] To meet the growing need, funding for these subsidies would increase by roughly 10 percent in FY 2023 to $168 million.[36]

More Pandemic Relief Needed for Immigrants

Excluded New Jerseyans Fund

No one should have to live in fear that getting sick or other circumstances beyond their control will cost them their home or the ability to put food on the table. To ensure this basic protection during the health and economic crises of the past two years, unemployment insurance benefits and federal relief checks were sent to families and individuals. But undocumented New Jerseyans, who are disproportionately represented in service sector jobs, were ineligible forthese programs.

To address this gap, the Murphy administration created the Excluded New Jerseyans Fund, a $40 million state program to support workers ineligible for federal pandemic relief. Using funds from the federal Coronavirus Aid, Relief, and Economic Security (CARES) Act, the relief program got off to a rough start. An onerous application process dictated by federal rules kept the majority of eligible residents from receiving assistance. When the fund expired at the end of 2021, the administration replenished the program using American Rescue Plan relief funds instead, which allowed for a much simpler application process. When this version of the program ended in February, the Excluded New Jerseyans Fund received over 35,000 applications, making clear that the $40 million total fell far short of the needs of New Jersey’s immigrant communities.[37]

Now, the Governor proposes a one-time, $53 million relief fund for Individual Taxpayer Identification Number (ITIN) holders who have not received federal stimulus aid. This new program will build upon the Excluded New Jerseyans Fund and provide a $500 benefit to over 100,000 ITIN holders.[38] This investment is key to an inclusive recovery but, as outlined above, does not quite match the need. Individual ITIN holders deserve a $2,000 benefit, matching what the majority of working families in New Jersey received during the peak of the pandemic.

Criminal Justice: More Support Needed for Community Programs

Community-Based Violence Interruption Programs

All New Jerseyans deserve to feel safe in their communities but, often, police responses to issues of public safety cause more harm than good, especially for people who face a legacy of racism, classism, and misogyny. Community-based violence interruption programs that do not involve a law-enforcement response are effective, preventive tools that help keep people safe and out of the criminal justice system.

To combat violent crime, especially shootings, the Governor’s proposal maintains a $10 million investment to support the state’s existing violence intervention programs, which includes 25 nonprofits in 15 communities across the state.[39] Continuing to fund these programs is essential to building upon a safer New Jersey for all and, as the need for a non-police response to crises becomes increasingly evident, the budget should include increased funding for more alternative response teams.

Toward Sustainable Funding for NJ Transit

New Jersey’s future prosperity depends on a safe and reliable transportation system that works for everyone. Over the past decade, however, New Jersey has shortchanged the public with inadequate investments in NJ Transit, resulting in delays, cancellations, and overcrowding. What’s more troubling is that transportation is mostly powered by fossil fuels, which are major contributors to air pollution and worsen the dangers posed by climate change.

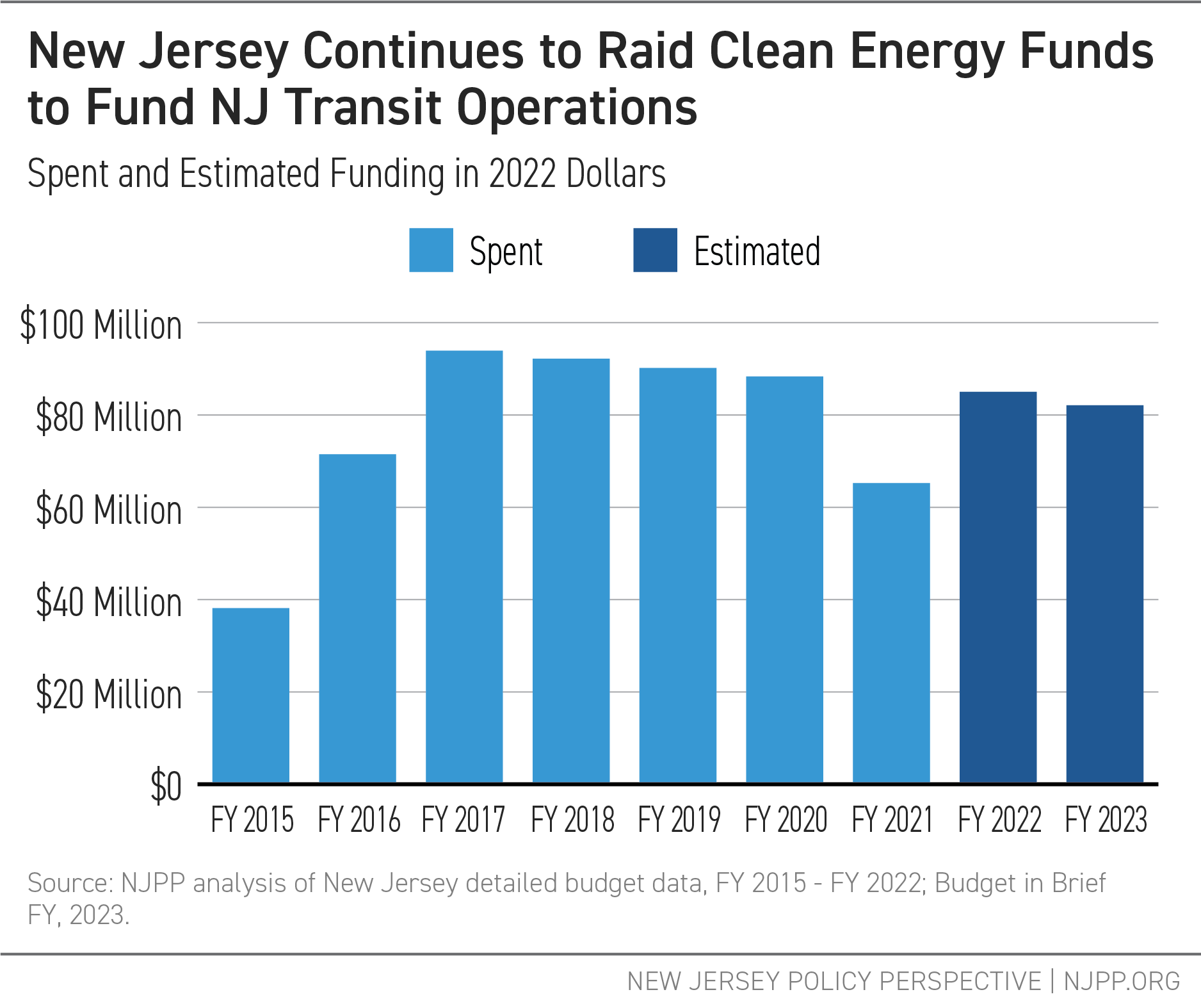

While the Governor proposes $2.76 billion for NJ Transit operations — a 21 percent increase since FY 2008 — with no fare hikes, this doesn’t tell the whole funding story.[40] The state continues to supplement funding for the transit authority by diverting $82.1 million from the Clean Energy Fund — resources meant to offer financial incentives, programs, and services to help save energy, money, and the environment, not fund public transit.

At the same time, the governor proposes using $721 million from the Turnpike Authority to supplement NJ Transit operations.[41] While this is a more reliable source for NJ Transit — and more appropriate than using revenue from the Clean Energy Fund — the state continues to use capital funds to fund operations, which is not sustainable in the long run. For instance, the $4.5 billion in capital needed to implement NJ Transit’s electric bus replacement program still has no identifiable funding source.[42]

The good news is that NJ Transit has been granted $1.6 billion in federal relief funds to support operations plus another $4.2 billion from the federal Infrastructure Investment and Jobs Act to improve public transit infrastructure.[43] This massive investment will enable NJ Transit to retain employees and maintain safe and reliable bus and rail services – without further diversions from other sources.

End Notes

[1] According to the most recent Household Pulse Survey data, for New Jersey families with kids under age 5, the majority of households had to have a parent stay home to care for children. U.S. Census Bureau, Household Pulse Survey: January 26 – February 7, 2022: Education

Table 1. New Jersey Childcare Arrangements in the Last 4 Weeks for Children Under 5 Years Old, February 2022. https://www.census.gov/data/tables/2022/demo/hhp/hhp42.html

[2] Board of Governors of the Federal Reserve System, FEDS Notes: Wealth Inequality and COVID-19: Evidence from the Distributional Financial Accounts, August 2021. https://www.federalreserve.gov/econres/notes/feds-notes/wealth-inequality-and-covid-19-evidence-from-the-distributional-financial-accounts-20210830.htm

[3] New Jersey Office of Legislative Services, January 2022 Revenue Snapshot. https://www.njleg.state.nj.us/publications/budget/ols-snapshots/FY22_January.pdf

[4] State of New Jersey, Governor’s FY2023 Budget in Brief, March 2022 at pg. 8 (hereinafter “Budget in Brief”). https://www.nj.gov/treasury/omb/publications/23bib/BIB.pdf

[5] New Jersey Governor’s Disaster Recovery Office, Financial Summary by Federal Act, December 2021. https://gdro.nj.gov/tp/en/financial-analysis/financial-summary

[6] Budget in Brief at pg. 18.

[7] Government Finance Review, Uncertainty, Risks, and Budgets in the Age of Coronavirus, June 2020 at pg. 27. https://gfoaorg.cdn.prismic.io/gfoaorg/33f669de-20be-4e13-8186-ec2cd632f3c4_GFR_04-2020-UncertaintyRisksBudgets.pdf

[8] Budget in Brief at pg. 73.

[9] New Jersey State Library, Legislative History for P.L. 2000, c. 80. https://repo.njstatelib.org/xmlui/bitstream/handle/10929.1/20234/L2000c80.pdf?sequence=1&isAllowed=y

[10] See New Jersey Department of the Treasury, Press Release: As Filing Season Kicks Off, Treasury Reminds Taxpayers that More Money is Available to More People Than Ever Before Under Expanded Earned Income Tax Credit Program, January 28, 2022. https://www.nj.gov/treasury/news/2022/01282022.shtml

[11] Budget in Brief at pg. 50.

[12] U.S. Census Bureau, American Community Survey 2019 5-Year Estimates, Table B19080: Household Income Quintile Upper Limits (indicating upper limit of 80th percentile at $166,319).

[13] NJPP analysis of Budget in Brief at pg. 12.

[14] New Jersey Department of Human Services, Current Program Statistics, December 2021, 2021. https://www.state.nj.us/humanservices/dfd/news/cps_dec21.pdf

[15] New Jersey Department of Human Services, New Jersey State Plan For Temporary Assistance for Needy Families (TANF), FFY 2021-FFY 2023, 2020, pg. 63, Attachment B. https://www.state.nj.us/humanservices/dfd/programs/workfirstnj/tanf_2021_23_st_plan.pdf

[16] Budget in Brief.

[17] New Jersey Policy Perspective, New Jersey’s Shrinking Pool of Teacher Candidates, May 2020. https://www.njpp.org/publications/report/new-jerseys-shrinking-pool-of-teacher-candidates/

[18] New Jersey Policy Perspective, New Jersey’s School Re-openings Are Racially Unequal, October 2020. https://www.njpp.org/publications/blog-category/new-jerseys-school-re-openings-are-racially-unequal/

[19] New Jersey Policy Perspective, School Funding in New Jersey: A Fair Future for All, November 2020. https://www.njpp.org/publications/report/school-funding-in-new-jersey-a-fair-future-for-all/

[20] New Jersey Policy Perspective, School Funding in New Jersey: Preparing Now for the 2020-21 School Year, August 2020. https://www.njpp.org/publications/report/school-funding-in-new-jersey-preparing-now-for-the-2020-21-school-year/

[21] New Jersey Policy Perspective, Separate and Unequal: Racial and Ethnic Segregation and the Case for School Funding Reparations in New Jersey, September 2021. https://www.njpp.org/publications/report/separate-and-unequal-racial-and-ethnic-segregation-and-the-case-for-school-funding-reparations-in-new-jersey/

[22] New Jersey Policy Perspective, New Jersey School Funding: The Higher the Goals, the Higher the Costs, February 2022. https://www.njpp.org/publications/report/new-jersey-school-funding-the-higher-the-goals-the-higher-the-costs/

[23] New Jersey Policy Perspective, New Jersey School Funding: The Higher the Goals, the Higher the Costs, February 2022. https://www.njpp.org/publications/report/new-jersey-school-funding-the-higher-the-goals-the-higher-the-costs/

[24] Budget in Brief at pg. 13.

[25] Budget in Brief at pg. 63 and 44.

[26] New Jersey State Assembly, A6072 – Increases number of hospitals eligible for highest amount of charity care subsidy payment; appropriates $30 million, 2021. https://legiscan.com/NJ/bill/A6072/2020; PoliticoPro, Middlesex Dems fast-track bill to boost charity care for St. Peter’s Hospital, 2021. https://subscriber.politicopro.com/article/2021/12/03/middlesex-dems-fast-track-bill-to-boost-charity-care-for-st-peters-hospital-9427950; NJPP Analysis of FY 2022 Detailed Governor’s Budget; Budget in Brief atpg. 32.

[27] New Jersey Policy Perspective, Shining a Light on New Jersey’s FY 2022 Budget, 2021. https://www.njpp.org/publications/report/shining-a-light-on-new-jerseys-fy-2022-budget/

[28] Office of Governor Phil Murphy, Governor Murphy Signs Legislative Package to Expand Harm Reduction Efforts, Further Commitment to End New Jersey’s Opioid Epidemic, 2022. https://www.nj.gov/governor/news/news/562022/20220118b.shtml

[29] NJPP Analysis of FY 2022 Detailed Governor’s Budget; Budget in Brief at pg. 30.

[30] Legiscan, S690 – Establishes Statewide universal newborn home nurse visitation program in

DCF, 2021. https://legiscan.com/NJ/bill/S690/2020; Budget in Brief at pg. 25, 62.

[31] NJ Spotlight News, Home visits boost health of newborns, mothers, July 2021. https://www.njspotlightnews.org/2021/07/new-nj-law-provides-home-based-wellness-checks-for-mothers-and-newborns/

[32] Budget in Brief at pg. 27-28.

[33] Budget in Brief at pg. 27 and 63.

[34] GetCoveredNJ, Get Financial Help, 2021. https://nj.gov/getcoverednj/financialhelp/gethelp/#premiumtaxcredit

[35] NJPP Analysis of GetCoveredNJ Final Snapshots, 2021 and 2022.

[36] NJPP Analysis of FY 2022 Detailed Governor’s Budget and Budget in Brief, pg. 28.

[37] Budget in Brief at pg. 41.

[38] Budget in Brief at pg. 41.

[39] Budget in Brief at pg. 41.

[40] Budget in Brief at pg. 33.

[41] Budget in Brief at pg. 33.

[42] NJ Transit. Capital Plan Project Sheets, Appendix B: Bus Fleet. pg 7. https://njtplans.com/downloads/capital-project-sheets/Bus%20Fleet%20-%20Project%20Sheets.pdf

[43] Senator Bob Menendez, “Menendez, Booker Announce $1.6B in ARP funding to support NJ Transit.” Press Release, January 12, 2022. https://www.menendez.senate.gov/newsroom/press/menendez-booker-announce-16b-in-arp-funding-to-support-nj-transit; Senators Cory Booker, Bob Menendez, “Bipartisan Infrastructure Investment and Jobs Act Delivers for NJ.” Press Release, August 13, 2021. https://www.booker.senate.gov/news/press/booker-menendez-bipartisan-infrastructure-investment-and-jobs-act-delivers-for-nj

[44] P.L. 2021, c. 308. Available at https://www.njleg.state.nj.us/Bills/2020/PL21/308_.HTM.

[45] Budget in Brief, at pg. 26.

[46] New York Times, Tracey Tully. “2,258 N.J. Prisoners Will Be Released in a Single Day,” November, 9 2020. https://www.nytimes.com/2020/11/04/nyregion/nj-prisoner-release-covid.html

[47] New York Times, Tracey Tully. “2,258 N.J. Prisoners Will Be Released in a Single Day,” November, 9 2020. https://www.nytimes.com/2020/11/04/nyregion/nj-prisoner-release-covid.html

[48] New Jersey Monitor, Sophie Nieto-Munoz. “Early release for hundreds of ex-offenders across N.J.” February 11, 2022. https://newjerseymonitor.com/2022/02/11/early-release-for-hundreds-of-ex-offenders-across-n-j/

[49] New Jersey Office of Management and Budget. Summary of Governor’s Budget Recommendations: State of New Jersey FY2023 Budget in Brief, Pg. 42. March 8, 2022. https://www.nj.gov/treasury/omb/publications/23bib/BIB.pdf

[50] According to the most recent Household Pulse Survey data, for New Jersey families with kids under age 5, the majority of households had to have a parent stay home to care for children. U.S. Census Bureau, Household Pulse Survey: January 26 – February 7, 2022: Education

Table 1. New Jersey Childcare Arrangements in the Last 4 Weeks for Children Under 5 Years Old, February 2022. https://www.census.gov/data/tables/2022/demo/hhp/hhp42.html

[51] Board of Governors of the Federal Reserve System, FEDS Notes: Wealth Inequality and COVID-19: Evidence from the Distributional Financial Accounts, August 2021. https://www.federalreserve.gov/econres/notes/feds-notes/wealth-inequality-and-covid-19-evidence-from-the-distributional-financial-accounts-20210830.htm