Category: Blog

NJPP’s Ray Castro is Number 26 on ‘Power 50 Health Care’ List

New Jersey Policy Perspective Senior Policy Analyst Ray Castro yesterday was named the 26th most powerful health care figure in New Jersey. He – and Joel Cantor of Rutgers University, with whom he shares the spot – ranked far higher on the annual list published by NJ Biz than last year, when they came in at 48th.

“Their work may be more important now than ever, shedding light on the next upheaval in the health care industry as Congress works on replacing the ACA,” NJ Biz writes. “Castro has set himself apart from the crowd with his reports on the effects of out-of-network policy and the changes slated for Medicaid. He has become even more of a source for industry officials as ‘a data guy’ to lean on for insight.”

Hundreds Join NJPP for Progress 2017 Conference

Yesterday, hundreds of forward-looking, forward-moving New Jersey leaders joined New Jersey Policy Perspective for the Progress 2017 conference.

The event marked the kickoff to NJPP’s 20th anniversary celebrations, starting with special recognition for founder Jon Shure, and the release of NJPP’s anniversary video (produced by Riverview Studios):

Keynote speaker Heather McGhee, president of Demos, delivered a rousing keynote address. State and national thought leaders led breakout discussions on health care, immigration, economic development, revenue and how to make New Jersey work for working families. Three gubernatorial candidates presented their visions for New Jersey’s financial and economic future. And Gov. James J. Florio closed the day with his words of advice and courage for the incoming governor, and for all New Jerseyans, as together we tackle the tough challenges ahead. (Check out NJPP’s YouTube channel for clips of their speeches, and other highlights of the day).

NJPP gratefully acknowledges NJPP 20th Anniversary Sponsors. Please enjoy these highlight photos from an exciting day!

Despite ‘Exodus’ Rhetoric, New Jersey’s Still Adding Millionaires

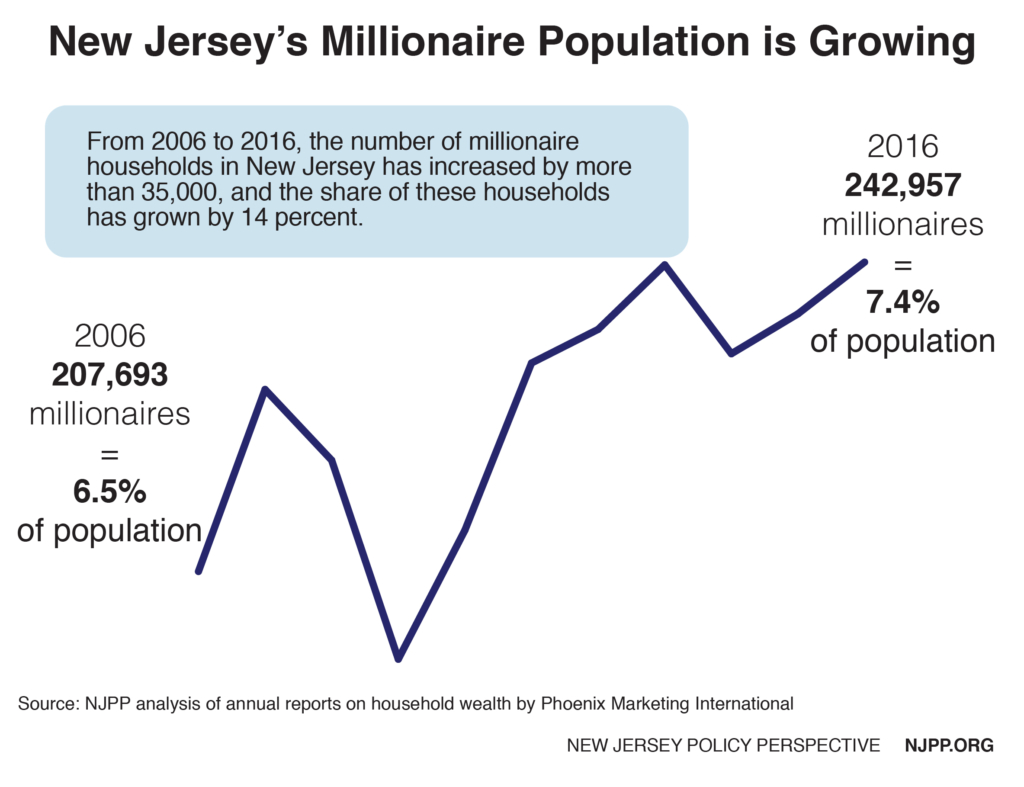

We hear it all the time: Hordes of wealthy New Jerseyans are packing up their Lexuses and heading to “friendlier” climates to avoid paying the Garden State’s relatively high income tax rates on the state’s most well-off families or its taxes on inherited wealth.

We hear it all the time: Hordes of wealthy New Jerseyans are packing up their Lexuses and heading to “friendlier” climates to avoid paying the Garden State’s relatively high income tax rates on the state’s most well-off families or its taxes on inherited wealth.

Yet time and time again, the facts clearly show this isn’t the case, and there is no such “exodus” of wealthy New Jerseyans.

The latest data point to confirm New Jersey’s ability to attract and retain well-off families comes from Phoenix Marketing International’s most recent annual Wealth & Affluent Monitor, which finds that the Garden State now has the third highest share of millionaires in the country, behind only Maryland and Connecticut.

New Jersey climbed to the Number Three spot in 2016 from Number Four in 2015, with the share of millionaires increasing to 7.4 percent from 7.2 percent and the number of millionaires rising to 242,957 from 237,064.

Since 2006, the number of millionaires in New Jersey has increased by more than 35,000 (or 17 percent) while the share of millionaires has risen by 14 percent.

New Jersey’s Immigrants are a Huge Economic Driver

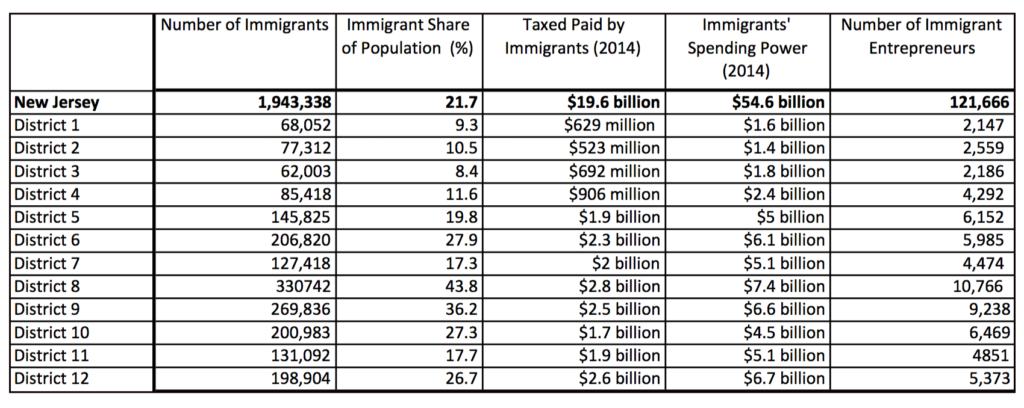

While undocumented immigrants in New Jersey now face greater threats from the federal government than they have in years, if not decades, new data at the state and Congressional District level released by the national organization New American Economy makes clear that the Garden State’s immigrants – both documented and undocumented – are an enormous economic benefit to this immigrant-rich state.

New Jersey benefits from its diverse immigrant population, with the third largest share of immigrants and half a million undocumented immigrants that contribute to the state’s economy.

New Jersey’s immigrants are contributing in major ways. We have more than 121,600 immigrant entrepreneurs who are generating billions of dollars in revenue and creating jobs for New Jerseyans everywhere. New Jersey is the only state where working-age undocumented immigrants start businesses at higher rates than legal permanent residents or naturalized citizens. In all, almost 270,500 workers in New Jersey are employed at an immigrant-owned business. And immigrants or their children founded 39 percent of the 19 “Fortune 500” companies based in New Jersey. These companies generate more than $133 billion in annual revenue and employ almost 600,000 people globally.

But New Jersey’s immigrants aren’t just contributing as entrepreneurs and job creators. They are also paying taxes – more than $13.1 billion in federal taxes and $6.5 billion in state and local taxes each year. And every year, New Jersey’s immigrants are also contributing to our entitlement programs – $2 billion to Medicare (of which $179.4 million is paid by undocumented New Jerseyans) and more than $7 billion to Social Security (of which $695.3 is paid by undocumented residents).

Other key findings::

- Households led by undocumented immigrants in 2014 earned $9.7 billion; $432.2 million was paid to state and local taxes and $731.8 million went to federal taxes, leaving these families with $8.5 billion in spending power that boosted the economy.

- New Jersey is home to more than 1 million eligible voters who are immigrants, representing 17 percent of the electorate.

- The average non-citizen in New Jersey earns $41,472 per year, earnings that could be boosted by 8 percent (an average of $3,318) if they naturalized.

- New Jersey had an estimated 33,711 undocumented entrepreneurs in 2014 with a total business income of $621.9 million.

Here is some key data on New Jersey’s immigrants, broken down by Congressional District:

2018 Budget Preview: The Legacy of the Christie Years

When Gov. Christie took office in 2010, he had his work cut out for him. New Jersey’s economy was in the depths of the Great Recession, throwing an already fragile state budget into deeper crisis. In his first budget address, he promised to fix the state’s budget crisis, revamp the public pension system and reduce overall state spending without using “gimmicks or band-aids.” But as we look toward the governor’s final budget of his eight-year tenure, it’s clear that New Jersey’s financial crisis persists.

A weak economic recovery, on top of big tax cuts and breaks that have helped lead to chronic revenue shortfalls, and ongoing battles over pension obligations, have led the state’s credit rating to be downgraded a record 10 times during Gov. Christie’s tenure. Despite a huge increase in corporate tax breaks, New Jersey has yet to recover jobs at a rate anywhere near those of neighboring states or the nation as whole. New Jersey has the eighth slowest post-Recession revenue growth rate of the states and only nine days of operating funds on reserve – the 5th lowest of the states – putting the state in serious jeopardy should another recession or disastrous storm sink the economy.

As he prepares to present his final state budget this month, the list of enormous and unresolved issues facing New Jersey’s finances – and its prosperity – is as varied as it is daunting.

After uneven reform efforts, New Jersey’s pension system for retired public employees is now the most underfunded in the country. Despite a jump in annual payment size, contributions are actually 40 percent of what is recommended by actuaries to keep up with the ballooning obligations. Add to this crisis the state’s losing battle to adequately fund health care benefits for public employees. The pay-as-you-go method coupled with rising health care costs continue to cripple the state budget. New Jersey has underfunded state-mandated school aid for the past seven years. Now Gov. Christie wants to gut the school funding formula to give residents in wealthier districts a property tax break.

Meanwhile, New Jerseyans continue to pay the nation’s highest property tax bills. This year the average homeowner paid $8,459 – 2.2 percent higher than last year’s rate despite a 2 percent cap implemented by Gov. Christie. The average residential property tax bill was $7,281 in 2009 representing a 16 percent increase. At the same time, the number of New Jerseyans living below the federal poverty line has grown by 13 percent from 2009 to 2015. Today one in four New Jerseyans live in true poverty. Over one in ten New Jersey households did not have enough money to purchase food at some point last year.

Who wins, who loses

During Gov. Christie’s tenure, corporations and wealthy households have prospered the most, while those in the middle and those struggling to get by in the face of rising costs of living were largely left behind. The name of the economic-development game has largely been to offer tax subsidies to encourage businesses to relocate or stay in New Jersey.

Over the past 6 years, New Jersey has approved over $7 billion in ineffective tax subsidies to corporations – on top of $3 billion worth of business tax cuts it’s doled out.. Touted as a job-creating stimulus, these tax breaks have done little to boost the economy. New Jersey would need to add 120,000 jobs each year for the next three years just to get back to pre-recession levels and employ a growing population. But this past year, just 21,4000 jobs were added representing the 7th slowest job growth among the states since the start of the recession.

Over three-fourths of total income gained between 2010 and 2013 went to the top 35 percent of households. New Jersey now has the 7th highest level of income inequality in the country. That trend is sure to worsen as New Jersey phases out the estate tax, one of the best tools for reducing inequality and building broadly shared prosperity.

Revenue growth still unsteady

New Jersey’s tax collections have grown this fiscal year but at a slower pace than anticipated. If the lower growth rate continues, revenue may fall considerably short of what Office of Legislative Services (OLS) says is needed for the remaining months of this fiscal year.

If the current growth rate of 2.3 percent were to remain steady, the state budget could be over $950 million short in revenue. According to the latest figures from the OLS, the growth rate would need to be more than twice that rate to meet current costs and recover from the enormous tax cuts signed into law last fall. This lower-than-expected trend has plagued New Jersey since the Great Recession.

Overall, New Jersey’s tax collections continue to struggle to bounce back to pre-Recession levels. State tax collections in the second quarter of 2016 were still 10.9 percent lower than its peak in the fourth quarter of 2007. In fact, New Jersey is surrounded on all sides by states whose tax collections have long since recovered and grown. New York’s tax revenue, for example, was 12.7 percent higher in Q2 2016 than at its peak in Q3 2008. Pennsylvania’s tax revenue was 3.2 percent higher in Q2 2016 than at its peak in Q1 2008.

Given that revenue shortfalls continue to undermine the state’s ability to meet its obligations, the next budget is likely to resemble those from the last several years with expected underfunding in key areas including pension payments, school aid, tuition assistance for higher education and general assistance to families in need. Add to this strapped budget the loss of $675 million as a package of tax breaks begin to be phased in. That loss will increase to $1.4 billion by 2021. Some $350 million will no longer be diverted from the general fund to pay TTF debts, but in the long run, the state’s ability to adequately fund key obligations will be severely compromised due to these cuts.

Pension payments

Pension payments during Gov. Christie’s tenure may have been larger than those made by his predecessors, but they have been only a fraction of what is needed to keep the pension system from piling up even more debt.

After skipping a $3.1 billion payment in fiscal year 2011, Christie contributed $484 million in 2012, $1 billion in 2013 and $696 million in 2014. He then made a $892 million payment in fiscal year 2015 – nowhere near the $2.25 billion sought by the legislature. And the 2016 state’s contribution of $1.3 billion was also well below the $3.1 billion payment included in the legislature’s budget. For the fiscal year ending this June 30, the state’s contribution of $1.86 billion to the pension fund, which mirrors the Legislature’s contribution, will occur near the end of the fiscal year.

Recently, Gov. Christie announced a $650 million increase in state contributions to the pension fund boosting the total pension contribution for the 2018 fiscal year to approximately $2.51 billion in keeping with the state’s 10-year pension payment formula.

Higher education

New Jersey students and families continue to have a hard time affording the high cost of a college education, thanks in large part to sharply declining state support for public colleges and universities.

New Jersey has cut funding for higher education by 23 percent since 2008 when adjusted for inflation, a decrease of more than $2,250 per student and a deeper cut than the national average, according to a new report from the Center on Budget and Policy Priorities (CBPP). This is the 13th largest percentage decline, and 12th largest dollar decline, of the 50 states.

While many states are starting to reverse course and increase funding for higher education, New Jersey is going in the opposite direction. In fact, it is one of just 11 states where per-student funding fell from 2015 to 2016.

As a result of these cuts, the average tuition at a public, four-year college in New Jersey has increased by 17 percent, or $1,903, during this period. On top of these tuition increases, colleges and universities across the state have increased student fees, cut staff and faculty positions and offered fewer courses to save money. All this means that a degree takes much longer to attain, adding years of cost and debt.

Together, this means that most New Jersey’s families – already struggling with slow income gains if not reductions – are often paying more and incurring higher levels of debt for a lower-quality education. These post-recession increases come on the heels of large increases in tuition and fees at New Jersey’s public, four-year colleges in the early 2000s.

Looking ahead

It took New Jersey decades to dig itself into this fiscal hole and no one governor is going to fix it, but without a doubt it has gotten steadily worse over the past eight years. But it didn’t have to be this way given the proven tools that could have been employed to dig our way out. Here are a few examples of big, bold tools that the next administration should consider to help move New Jersey toward a more stable and prosperous future.

One of the most responsible ways to create a path to financial sustainability is to ensure that corporations and the wealthy are paying their fair share in New Jersey. Closing tax loopholes is one way to do this. Expanding combined reporting in New Jersey would close corporate loopholes and help prevent multi-state corporations from artificially shifting profits out of state. This tax policy could raise up to $290 million in much-needed revenue each year to shore up underfunded investments like higher education and public transit.

New Jersey is currently experiencing income inequality the likes not seen since the Gilded Age. The top 5 percent of New Jersey’s households have average incomes more than 15 times greater than the bottom 20 percent. As income inequality continues to rise, New Jersey has an opportunity to reinstate tax rates and expand tax brackets on wealthy households that have far and away done better than families struggling to get by. By doing so, New Jersey could raise more than $1 billion more each year.

One of the most progressive and equitable taxes in New Jersey, the estate tax, was actually a growing source of revenue before it was eliminated last fall. Paid for by just 5 percent of New Jersey estates in any given year, this long-standing tax on inherited wealth is now being phased out, giving heirs an average tax break of $140,000 and costing New Jersey about $500 million a year – an amount that was projected to grow significantly each year despite the drumbeat myth that the wealthy were fleeing New Jersey in droves.

Bringing the estate tax back even with higher threshold could significantly steer New Jersey in the right direction again. For instance, reinstating the estate tax on estates worth $2 million or more, could recover three-quarters of the lost tax revenue while restoring responsible and fair taxation of inherited wealth. Moreover, New Jersey’s inheritance tax could be modified to ensure that wealthy heirs pay their fare share while ending the tax on modest inheritances of $500.

‘Relief’ Uneven for Families as Tax Cuts Start Going Into Effect

It’s been three months since New Jersey’s gas tax went up in order to pay for critical investments in roads, bridges and public transit. The increase was long overdue – fuel taxes hadn’t been raised since 1990 – but that didn’t make it easier politically. In an attempt to soften the blow for New Jersey drivers, several new tax cuts have gone into effect. However, the bulk of these breaks will benefit New Jersey’s wealthiest families. And these tax cuts aren’t free – they’ll cost the state about $1.4 billion each year, at a time when New Jersey is already unable to pay its bills.

Let’s start with the good news. Yes, there’s good news.

Included among the tax breaks is a 17 percent increase in New Jersey’s earned income tax credit, providing, on average, an extra $116 at tax time to nearly 600,000 working families striving to get by in high-cost New Jersey. This added tax relief for low-income families is very timely, given the state’s rising poverty rates and a minimum wage that chronically fails the adequacy test. In fact, this EITC increase alone should ensure that the state’s poorest families – those earning under $45,000 a year – don’t pay the largest chunks of their incomes to the new gas taxes.

Unfortunately, lawmakers weren’t content to craft good policy for the state’s poor working families and call it day. In search of a “broad-based tax cut” and to fix a mythical “outmigration” crisis, they also included gimmicky and unfair tax policies that have wealthy families clinking champagne glasses but leave the rest of us worried about our state’s capacity to create the kind of state we all want to live in.

The tax break to affect most New Jersey residents is the phase-in of a one-third percent drop in the state sales tax rate. This year’s tax cut means a savings of about 13 cents for every $100 spent. Next year it will be about a 40 cent savings. But to offset the expensive gas tax hike, one will need to spend $28,000 on taxable goods every year to match that hit at the gas pump. The more you buy, the more you’ll benefit from an unnoticeable sales tax cut. So families in the top 1 percent – with average annual incomes of $2.2 million – will see an average annual tax cut of $723, while those earning under $45,000 will get, on average, an annual tax cut of $46.50 – less than a buck a week.

And while it won’t really help most New Jersey families in any substantial way, the sales tax cut will sure cost the state a lot in lost revenue: over $600 million a year, to be precise. That is a direct hit to the state’s ability to adequately fund programs and services that benefit families and their communities.

The second-largest piece of the tax cut package is even more skewed to the state’s wealthiest families. Eliminating the estate tax will give around 4,000 inheritors of very large estates – the richest 5 percent of estates left behind, in fact – an average tax cut of about $140,000. These are the families who don’t have to worry about choosing between filling up the tank and buying food.

Proponents of killing the estate tax – which has been on the books for 80 years – claim that doing so will make wealthy families reconsider leaving New Jersey, but the data are clear: estate taxes do not drive wealthy retiree relocation decisions, and the existence of New Jersey’s estate tax has not been shrinking the state’s revenues or economy. In reality, the number of wealthy New Jerseyans has been steadily growing, as have estate tax revenues. Now New Jersey must go without this important revenue source and tool to fight inequality.

The gas tax increase, while not popular, will provide the state essential dollars to shore up the Transportation Trust Fund and get New Jersey’s roads, bridges and public transit back in shape. That’s an essential investment. But the trade-offs passed as part of the deal, in the end, will do more harm than good, providing a lavish tax break for those who need it the least and placing the state’s ability to pay for essential services, promised obligations and other critical investments in serious jeopardy. It’s a trade-off New Jersey simply can’t afford.

Join Us on March 10 for the ‘Progress 2017’ Conference

An incoming president in D.C. An outgoing governor in Trenton. An onslaught of state and federal policy proposals that threaten New Jersey’s residents and economic security.

It’s going to be a big year for New Jersey – and for New Jersey Policy Perspective, which marks its 20th anniversary this year.

Please join NJPP in marking this milestone year at a special day-long policy summit: Progress 2017: Paving the Way Toward Prosperity for All. Special guests and state and national experts will share their insider insight on the challenges ahead – and the strategies needed to restore sanity to New Jersey’s finances, mend the state’s tattered safety net, promote fair and effective economic development and respond to federal threats.

Featured speakers include Heather C. McGhee, President of Demos; U.S. Rep. Bonnie Watson Coleman; Nick Johnson and Judy Solomon of the Center on Budget and Policy Priorities; and many many more. A full agenda and links to registration and sponsorship can be found here.

Tipped Workers Need a Fair Wage, Not Tweaks to OT Rules

As the fight for a livable wage in New Jersey continues, workers who rely on tips have largely been left out of the debate by legislators in Trenton. While New Jersey’s minimum wage rose to $8.44 per hour in 2017, tipped workers are only guaranteed a cash wage of $2.13 per hour. In fact, the tipped minimum wage hasn’t gone up since 1989 – over 27 years. Officially, if these workers don’t make enough in tips to bring them to the minimum wage, their employers are supposed to make up the difference. Unfortunately, this doesn’t always happen for a variety of reasons, and as a result, tipped workers are some of the most vulnerable and lowest-earning employees in New Jersey.

In December, the New Jersey Department of Labor and Workforce Development announced proposed amendments to the way overtime pay is calculated for tipped workers. In short, instead of calculating an overtime rate based on actual pay for an actual worker, the new rule would calculate an overtime rate based on the state’s current minimum wage. While this could in theory lead to a boost in overtime wages for tipped workers who are having their wages stolen by their employers, the chances of low-road employers complying with overtime regulations is pretty slim. What the new rule will do, though, is lead to decreased overtime wages for tipped workers who currently earn more than the state minimum wage.

The stated rationale behind this decision is that the current method is unnecessarily complicated, creating confusion for employers, employees, and government compliance officers. In the announcement, the Department acknowledges that the likely impact for tipped workers will be to reduce their already-low earnings and limit their income potential, but it argues that simplifying the rules is more important than improving their wages. It’s a particularly tone-deaf and unacceptable action to take for a class of workers who have not seen a raise in 27 years.

This rule change is wrongheaded, not simply because it will negatively affect thousands of hard working New Jerseyans, but because it presents a false choice. While it may be true that the current rule for determining overtime pay is difficult and confusing, the proper way to deal with that problem without hurting the economic fortunes of tipped workers isn’t to suggest an amendment that creates more income inequality. It makes far more sense to do away with the tipped minimum wage altogether.

Even the President of the New Jersey Chamber of Commerce recognizes that the current minimum wage is inadequate in providing New Jerseyans with the means to afford their basic daily needs. For the Department of Labor and Workforce Development to propose a change that would further reduce the ability for tipped workers — who are already among the most economically insecure workers in the state — to earn a livable wage is unconscionable and irresponsible; particularly when there is a simple and sensible alternative.

For those who decry the amount of unnecessary government regulation, getting rid of the tipped minimum wage should be a easy policy to support. Doing away with it will simplify labor regulations, help reduce income inequality, and bolster New Jersey’s economy as more workers are able to inch closer to a livable wage. Alaska, California, Minnesota, Montana, Oregon, and Washington have all eliminated the tipped minimum wage without a significant negative impact to their economies or business communities. It’s time for New Jersey to catch up with reality and apply a single minimum wage across all sectors; there’s simply no reason for one class of workers to have a lower minimum wage than others. Doing so will benefit employers, employees, families, and the state as a whole.

A 35 Percent EITC is Good News for New Jersey Working Families

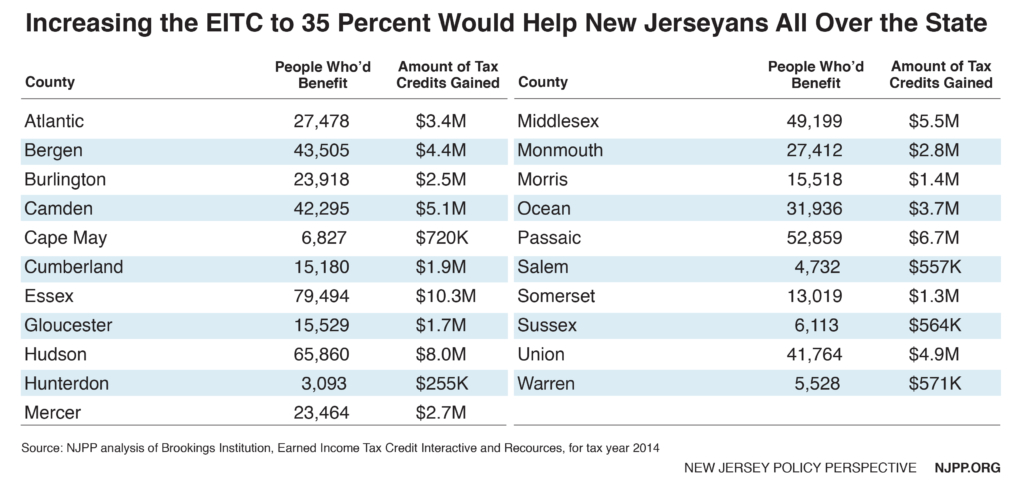

Increasing New Jersey’s Earned Income Tax Credit (EITC) will provide over half a million New Jersey working families with a much-needed bump in their take-home pay while giving the state’s economy a boost, according to a new report we released today.

As part of last year’s gas tax increase deal, the New Jersey EITC was increased to 35 percent of the federal credit, up from 30 percent of the federal credit. The change will help hundreds of thousands of New Jersey families this year during tax time, as the change applies to tax year 2016.

Working families across New Jersey will benefit from the governor and legislature’s decision to increase this important tax credit. Now Congress should take the next step in improving the EITC by expanding it for workers not raising children.

The report includes a county-by-county breakdown of the number of working families affected, and the increase in the EITC to those families, as well as other key information about this vital boost to this important tax credit.

Key findings:

Increasing the EITC to 35 percent will help nearly 600,000 New Jersey families whose members are working but not earning enough to get by in this high-cost state. These workers’ annual take-home pay will increase by an average of $116 (and by as much as $314), bringing the average total of state EITC dollars received to $811 a year

Boosting the EITC will help working people all over New Jersey. All but five of the state’s 21 counties have more than 10,000 households receiving the EITC, and more than half of them (12) have over 20,000 EITC households.

Increasing the EITC will help very poor families the most. Nine out of every ten New Jersey households that receive the EITC earn less than $30,000 a year. About three-quarters earn less than $20,000 and more than half – 61 percent – make less than $15,000.

Increasing the EITC will boost the economy. Increasing the state EITC to 35 percent will generate $69 million in new tax credits each year that will help boost local economies around the state, bringing millions of dollars of spending to almost every county.