While the three-day shutdown, the Horizon bill and “Beachgate” have dominated attention as this year’s budget season came to a dramatic close, there are several modest but important line-item vetoes Gov. Christie made to the final budget that fall on the most vulnerable in the state.

The governor agreed to most of the legislature’s changes to his spending plan, but aimed his red veto pen squarely at some of New Jersey’s most vulnerable residents. It’s a fitting final fiscal act from a governor who through eight budgets has prioritized tax cuts for the state’s wealthiest families and biggest businesses over helping struggling families climb the ladder into the middle class.

Among other things, Gov. Christie axed:

Food assistance for struggling families

The governor vetoed language that would’ve restored so-called “Heat and Eat” benefits that tie important federal nutritional benefits to state heating assistance. In 2014 when the federal government changed rules governing this program, most eligible states changed their rules as well to ensure the continuation of crucial benefits. New Jersey chose not to, and as a result an estimated 160,000 New Jersey households that include seniors, people with disabilities and children have had their Supplemental Nutrition Assistance Program (SNAP) benefits cut by an approximate average of $90 per month.

(Background: https://www.njpp.org/blog/op-ed-four-reasons-new-jersey-should-maintain-its-heat-and-eat-program)

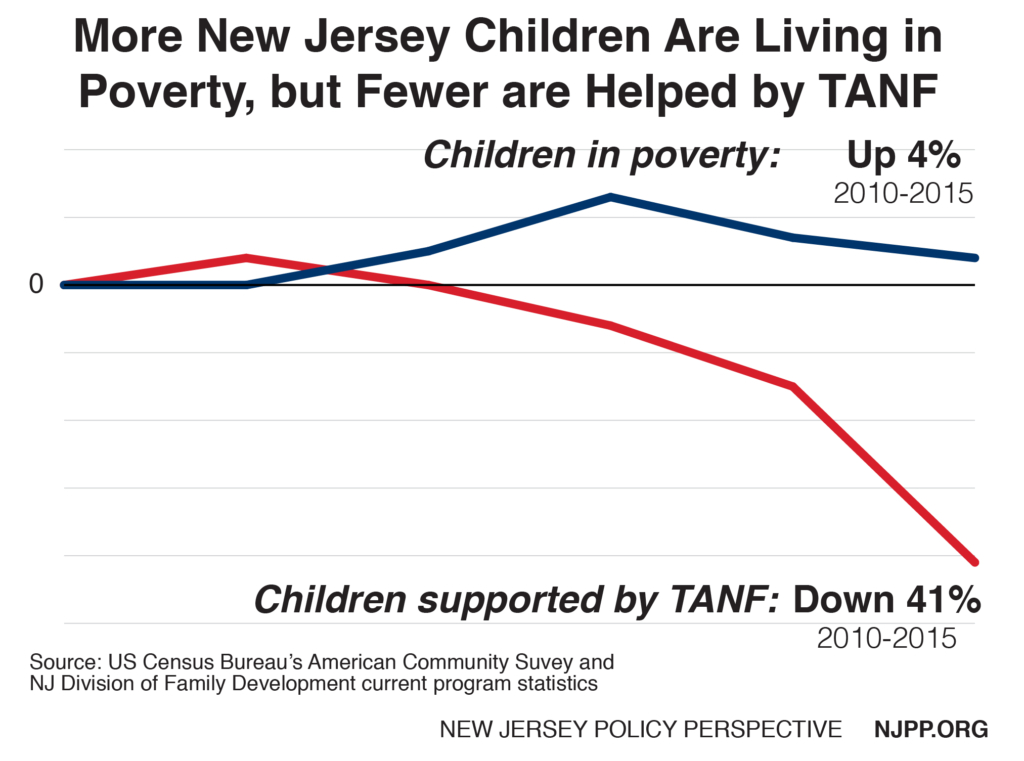

Basic assistance for some of New Jersey’s poorest kids

The governor vetoed language that would’ve repealed the so-called “family cap” for Work First NJ. This cap denies basic assistance to children who, through no fault of their own, are born while their mothers are on Work First NJ (also known as Temporary Assistance to Needy Families). This cap has denied essential assistance to over 20,000 babies since its inception and punishes kids for being born poor.

(Background: https://www.njpp.org/blog/repealing-tanfs-family-cap-makes-moral-and-economic-sense)

Paid leave processing & awareness improvements

The governor vetoed language that would’ve directed the state to spend $2 million from the paid family leave program’s fund to improve the timeliness of paid leave claims processing, and $1 million on education and community outreach.

(Background: https://www.njpp.org/reports/boosting-families-boosting-the-economy-how-to-improve-new-jerseys-paid-family-leave-program)