Welcome to NJPP’s FY2020 Budget: Rapid Reaction, your source for commentary and data analysis on next year’s budget. The transcript below was taken from the Jersey Shore — just teasing, we were in NJPP’s conference room — and has been lightly edited.

Lou (Louis Di Paolo, Communications Director): On Sunday, Governor Murphy signed the Fiscal Year 2020 budget, marking an end to another lively “budget season.” Averting a shutdown, the governor ultimately signed the budget passed by the legislature a few weeks ago, meaning no millionaires tax, with some key changes. Specifically, Governor Murphy line-item vetoed $48.5 million in legislative priorities and put another $235 million of spending in a “lock box,” meaning the funds can only be appropriated once the revenue is guaranteed to be there. He also made a deposit into the state’s rainy day fund, which was empty for over a decade.

On the spending side, the state will make another record pension payment, boost funding for NJ Transit, and continue to ramp up funding for public K-12 schools. The budget funds other things, too, but we’ll get to that below. Overall, this is a responsible budget that invests in assets proven to build an economy that works for everyone.

But that’s enough from me — let’s jump right into it.

My first question is for Sheila, and it’s about the rainy day fund. What is it and why is it so important that the state finally deposited money in it?

Sheila (Sheila Reynertson, Senior Policy Analyst): A robust and well-designed rainy day fund can give New Jersey the flexibility it needs to weather the revenue impact of economic downturns or the next major climate change disaster. But for over a decade, New Jersey has had trouble maintaining this emergency fund. Before the Great Recession, the fund held $735 million, or roughly 2.2 percent of annual state spending, which was well below the national average. Then in 2009, the state withdrew the fund’s entire balance in response to the recession—and has made zero deposits since then.

New Jersey was one of only three states (KS, MT) with an estimated zero balance in their rainy day funds at the end of fiscal year 2017. That is a dangerous habit given the fact that all indicators point to another economic slowdown on the horizon. It’s also a habit that credit rating agencies consider a clear-cut symptom of the state’s continuing structural imbalance, insufficient revenue and poor budgetary planning.

New Jersey’s finalized 2020 budget finally turns the page on this risky chapter with the first rainy day fund deposit in 11 years. The $401 million will be kept in a separate fund that can only be accessed in response to economic changes to avoid unexpected drastic cuts to programs.

Lou: That’s great news. So how prepared is the state for the next economic downturn? Extra points if you can incorporate a gif into your answer.

Sheila: Still not that prepared. It’s a good start, but the state needs to continue making deposits like this one well into the future. National budget experts, namely the Center on Budget and Policy Priorities, recommend states build up their rainy day funds to at least 15 percent of their annual budget. This one-time deposit isn’t anywhere close to that.

Here’s a live look at New Jersey if a recession hits and this $401 million is all we have saved:

Lou: Extra points for Sheila! So while we’re not totally prepared for the next recession yet, this is a great start that should be commended. To reiterate one of your points, this is the first time in *over a decade* that New Jersey is taking steps to prepare for the next downturn. And if history has taught us anything, it’s that revenue shortfalls, and the subsequent cuts to public programs, disproportionately harm those struggling to make ends meet and communities of color.

Ray, can you elaborate on what next year’s budget does for these communities? Other than the rainy day fund, of course.

Ray (Raymond Castro, Health Policy Director): First, I am so impressed that the governor and the legislature agree that New Jersey must protect and lift up families struggling to make ends meet. There are many initiatives in this budget that help the working class, the very poor, children, seniors and people with disabilities. This is particularly needed given the enormous income and racial disparities in our state (and big shout out to our friends at the New Jersey Institute for Social Justice for reporting on the wealth gap).

New Jersey will not be able to compete in the 21st century until everyone has equal opportunity; we are only as strong as our weakest link. We all should all feel good about this budget because without these supports, far fewer New Jerseyans will ever make it to the middle class and NJ will not prosper as it should. The budget does not nearly meet all of the needs in the state, but there is no question that New Jersey is moving in the right direction.

Sheila: We’re definitely moving in the right direction! Anyone else listen to Gossip?

But before I get the song stuck in my head, Ray, can you name a few initiatives that received a boost in funding? The more specific the better.

Ray: There is an impressive list, but in terms of supporting working families, there was an increase in funding for preschool, a boost to the state Earned Income Tax Credit (which is now one of the highest levels in the nation at 39 percent), more funding for housing assistance, and a bump in aid for community colleges. There is also funding for nursing homes and child care centers to increase staff salaries to reflect the increase in the minimum wage. The budget also requires that the state come up with ways to increase enrollment in the state exchange that will become operational in 2020 and make insurance more affordable.

For the very poor, there was an increase in funding for Temporary Assistance to Needy Families, which will benefit 20,000 children who live in deep poverty. This increase was especially needed because the state has among the lowest grants for families in the country.

There was also an increase in charity care for hospitals that serve low-income New Jerseyans who cannot afford insurance. That will also help to maintain the financial solvency of these hospitals. Also, up to 125,000 SNAP (food stamp) beneficiaries will receive more in nutritional assistance thanks to a slight increase in funding for energy assistance, which qualities them for more in federally funded assistance. That will disproportionately benefit seniors and people with disabilities who have difficulty documenting their energy assistance needs.

Lou: I know this is year two for Governor Murphy, but I can’t help but think what a difference a new administration makes. After the state cut programs like these to the bone, it’s good to see New Jersey is once again investing in ordinary families instead of the wealthy and well-connected. Sheila, any other big appropriations you want to highlight?

Sheila: Absolutely. The biggest winners include NJ Transit, which received an additional $50 million, as requested in the Legislature’s budget. After years of having its operational budget shamelessly raided, more than $457 million has been allocated to the state-run public transit system for FY 2020. It is not nearly enough to fix the damage done during the previous decade, but it’s definitely a step in the right direction. Bumping up my op-ed on this from last year in case anyone’s interested.

The budget includes a record-breaking pension payment of $3.8 billion for public workers and a larger commitment toward property tax relief for senior citizens and the disabled. Finally, the Governor agreed to include an extra $50 million in state aid for costs associated with extraordinary special education as requested by the Legislature. These increases reflect New Jersey’s need to meet its obligations and provide assistance to communities struggling with property taxes.

One important increase that seems to be flying under the radar is the Governor’s decision to include the Legislature’s request to expand Medicaid coverage from 90 days to 180 days after the last day of pregnancy. As far as I can tell, New Jersey is the first state to do so. This appropriation is directly linked to the state’s renewed commitment to addressing its dismal racial disparities in maternal health. Reports from national and regional maternal mortality review committees have consistently indicated that the limited Medicaid coverage after the birth of a child is not enough to serve low-income people who disproportionately suffer from common maternal health complications like hypertension, diabetes and depression. Nearly one in five maternal deaths occur between six weeks and a year following childbirth. Of these deaths, 58 percent are considered preventable. Doubling the eligibility timeline to 6 months is an important component of improving maternal health outcomes in New Jersey and it should be widely celebrated and replicated in other states.

Ray: That’s definitely flying under the radar. Thanks for flagging it for us, Sheila.

Lou: This is why I enjoy having these conversations. I really appreciate you both (and the rest of our colleagues, of course) for digging through the budget line by line so other folks don’t have to.

For those working in the Trenton bubble, you’d think Governor Murphy and legislative leadership were miles apart with their budget priorities, but this list shows that’s not the case. They’re all committed to building New Jersey’s economy from the bottom up and the middle out. That definitely gets lost in a lot of budget reporting.

Before we get to their biggest disagreement (spoiler: it’s the millionaires tax), can we talk about the state health exchange? I know this wasn’t technically in the budget, but the bill had to be passed before lawmakers left for summer break so the state could meet an important federal deadline.

Ray, what can you tell us about the state health exchange? What does this mean for New Jersey’s health care landscape?

Ray: The establishment of the state exchange is enormously important for working families in New Jersey and to defeating the Trump administration’s sabotage of the Affordable Care Act. The legislature and the Murphy administration were in general agreement that such an exchange was greatly needed to be run by the state, but they differed in the details which got ironed out just in time.

By taking over the federal exchange, the state will be able to double the length of the open enrollment period, expand outreach, reduce premiums and decrease the number of residents who are uninsured. It can do all that without any increase in state funds. That is because the fees (about $50 million) that insurers in New Jersey send to the federal government to operate the exchange will instead stay here to fund the state exchange.

In addition, there are over 300,000 uninsured NJ residents who are not participating in the federal exchange, so even if a small percentage of them enroll in the state exchange, the state will see a major increase in premium subsidies which is totally funded by the federal government.

Lou: New Jersey is cementing its position as a national leader in health care policy. I’m not sure there’s another state that has better responded to the Trump administration’s sabotage of the Affordable Care Act. Again, this is a testament to what New Jersey can accomplish when the governor and legislative leaders unite behind a common goal.

But let’s pivot to the biggest point of contention in this year’s “budget season.” We all know that Governor Murphy wanted a millionaires tax in the budget, but legislators weren’t behind it. Instead, they took a page out of the Christie playbook and balanced their budget with rosy revenue projections.

The governor dealt with this in a novel way, putting $235 million in spending prioritized by legislators in a “lock box.” That way, the appropriations will only go out if the revenue exists. Seems like the fiscally prudent thing to do, while also creating some incentive to finally pass a millionaires tax in lame duck. Sheila, what are your thoughts?

Sheila: My first thought is, will you understand this lock box reference? Were you even born before the Bush-Gore election?

Lou: I do not get the reference. I was in third grade, by the way. Definitely not old enough to vote. But back to the question. Thoughts on the lock box?

Sheila: This was a well-played strategy. It gives the Legislature the green light on its funding priorities and allows the governor to use his executive power to hit the pause button until there is a better understanding of where the state economy is headed. It sends a strong message that relying on rosy projections has fallen out of favor and signals to credit rating agencies that the state will implement responsible budgeting practices with or without the cushion of new revenue. The question remains about which priorities are in this “lock box” and at what point will they be reevaluated for funding.

Ray: Agree on all fronts. I’m anxious to see what made it into the box.

Lou: Same here. But I mostly love that the state is moving away from gimmicks and rosy revenue projections. If the state wants to make new investments — which is should — it needs the revenue in place to pay for them. So, the millionaires tax didn’t make it into the budget, but it’s still super important. Do you think it happens in next year’s budget?

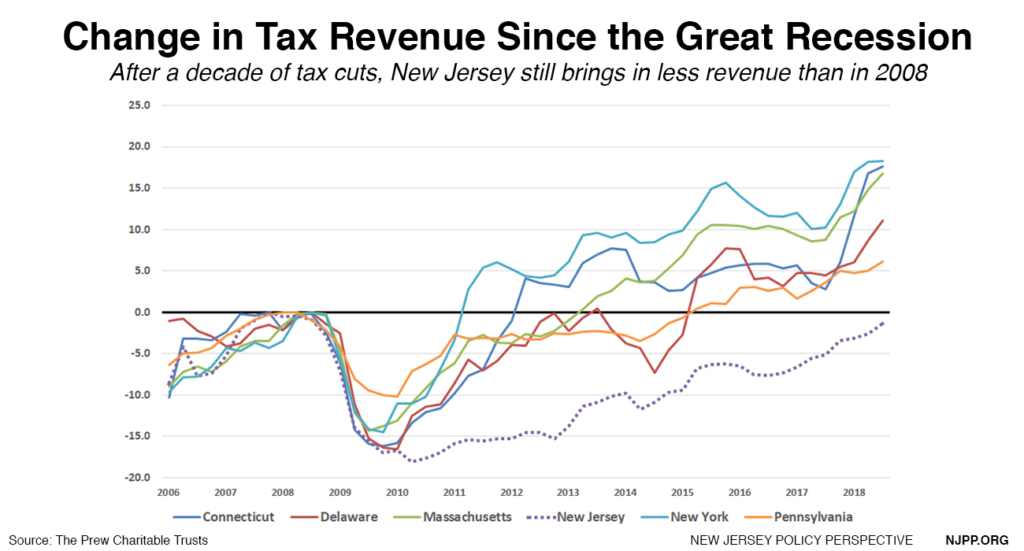

Sheila: Honestly, it could happen even sooner. That’s the beauty of the lock box; it creates an incentive for lawmakers to get serious about raising revenue, independent of the craziness of “budget season.” Remember, New Jersey is one of only a few states that still brings in *less* revenue than before the Great Recession. This is proof that New Jersey has a revenue problem, not a spending problem.

Given that the legislature passed a millionaires tax five times under the Christie administration, it is the most logical route toward creating new, sustainable revenue. Plus it remains extremely popular among voters of all political persuasions.

Lou: Well, Donald Trump isn’t a fan. I’m sure you saw his tweet congratulating lawmakers for not passing it?

I can’t imagine this pat on the back was welcomed by legislative leaders. Reaction?

Sheila: It was like Christmas in July!

But strategically, it would have been more helpful a month ago. Lol

Ray: Should I be on Twitter?

Lou: Yes.

Sheila: Yes.

Lou: So it’s settled. Ray, we’re making you a Twitter account! But we should be wrapping this up. Closing thoughts? Opportunities for next year? Plans for your Fourth of July weekend?

Ray: The opportunities for next year are unlimited. NJ has already been ranked number one in the nation in combating the Trump administration’s sabotage of the ACA. Next year, and in the year after, the state needs to focus on operating one of the best state exchanges in the nation with the goal of universal health care coverage. To do that, the state will need to be creative in how to reach the uninsured who are already eligible for federal assistance but are not participating. However, it must also make those New Jerseyans who are not eligible for federal assistance eligible. That includes middle-class families who have incomes that slightly exceed eligibility limits and those who are not eligible because of their immigration status.

That will require considerable state resources, but New Jersey can start with children as those costs will be offset by a decrease in state funding for charity care in hospitals and other savings down the road. Also, New Jersey needs to be much better at reducing total health care costs, which will also reduce state expenditures. It should start with lowering prescription drug costs, which have become unaffordable even for middle class families. The state also needs to start taxing entities in a way that discourages unhealthy behavior and use those revenues to provide comprehensive coverage for all New Jerseyans.

Lou: Fourth of July plans?

Ray: My wife and I are celebrating our anniversary! We got married on July 4th so we would also see fireworks on our anniversary.

Lou: That’s adorable. Congrats, Ray! Sheila?

Sheila:Tubing on the Delaware with 5 families!

Lou: You are both making me feel really lame for not having any plans — yet. But back to the budget. Final thoughts, Sheila?

Sheila: In the end, New Jersey passed a budget that funded its most important obligations and made strides toward investing in the true drivers of a state economy — all without relying on gimmicks and rosy revenue projections. It managed to cut about $1 billion in spending through collective bargaining, make a long overdue deposit into its rainy day fund and have a bit of a cushion in case revenues come in short.

What was strikingly different this budget season was the renewed public interest in Trenton politics after the release of the Comptroller’s audit of the Economic Development Authority and the subsequent task force investigation. The EDA story has it all: insider lobbying, potential fraud and misuse of taxpayer dollars. I think the budget process benefited from the unfolding EDA story as it put Trenton in a bigger spotlight than it’s used to. That’s a good thing, the more the public is engaged with the budget season the more likely the state’s priorities will reflect the values of the many, not just the few.

The law that governs the corporate tax subsidy programs expired at the end of June and the Governor has clearly stated he will not sign the Legislature’s bill to simply expand the law for another 7 months without major reforms. Stay tuned for that showdown!

[Brandon enters the chat]

Brandon (Brandon McKoy, President): Hey team! What did I miss?

Lou: The Knicks didn’t get Kevin Durant. Or Kyrie Irving.

Brandon:

[Brandon exits the chat]

Lou: Happy Fourth of July, New Jersey!