Yesterday, the New Jersey Senate and Assembly unveiled their FY 2020 budget proposal. The spending plan totals $38.8 billion, $200 million more than Governor Murphy’s budget, but does not include enough new, sustainable sources of revenue like the millionaires tax to support those investments in the long-term. In response to the Legislature’s proposal, NJPP releases the following statement.

BRANDON McKOY, PRESIDENT, NEW JERSEY POLICY PERSPECTIVE:

“The budget proposed by the Legislature is an important, but incomplete, step in building an economy that works for all New Jerseyans. This proposal makes important investments in areas proven to lift working families like NJ Transit, property tax relief, health care, and public education. However, these new investments are not backed by sustainable sources of revenue, threatening their long-term viability and the well-being of New Jersey’s low-paid and middle-class families and children.

“This budget, like many before it, does not include the reliable revenue and savings necessary to meet the state’s long-term needs. By depending on rosy revenue projections and canceling a deposit in the state’s empty rainy day fund, the Legislature has doubled down on short-sighted fiscal practices and dismissed the warnings of budget experts and ratings agencies alike. New Jersey is woefully unprepared for the next economic downturn and the state’s window to build up a healthy rainy day fund is rapidly closing. This is a missed opportunity to bolster the state’s reserves and protect New Jersey families, workers, and businesses from the next recession.

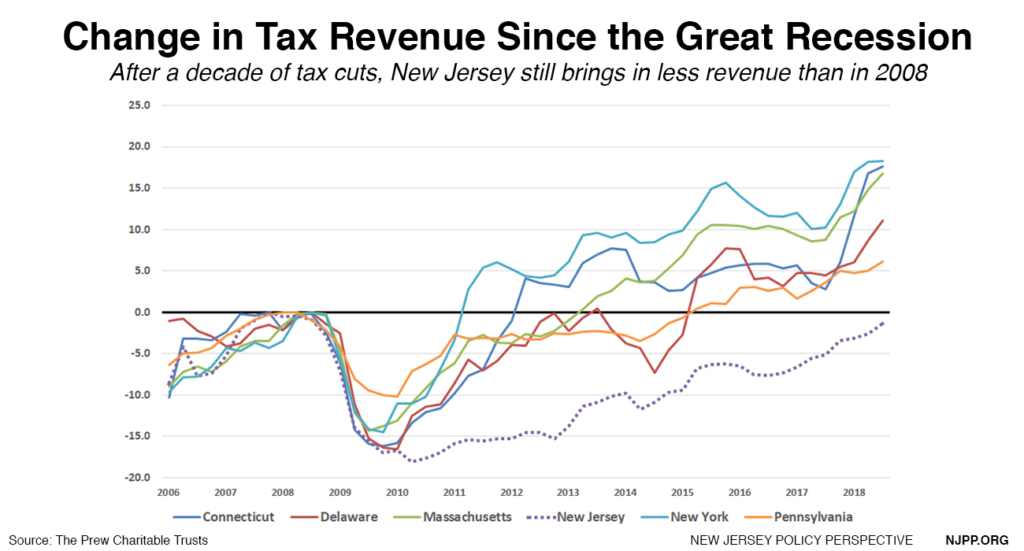

“Lawmakers should have learned by now that new investments must be paired with reliable sources of revenue. The fact remains that after eight years of tax cuts under the previous administration, New Jersey is a national outlier in that it still collects less revenue than it did prior to the Great Recession. Without restoring proper tax rates on wealthy residents, the state will continue to put its long term economic growth — and its chances of closing enormous economic and racial inequities — at risk.”

# # #