Welcome to NJPP’s State of the State 2021: Rapid Reaction, your source for commentary and data analysis on Governor Murphy’s address. The transcript below was taken from NJPP’s Zoom room and has been lightly edited.

Lou (Louis Di Paolo, Communications Director): On Tuesday, Governor Phil Murphy delivered his third annual State of the State address — the first virtual address of its kind in New Jersey history. In his speech, the governor highlighted some major policies enacted during his first term, reflected on the COVID-19 pandemic, and laid out some priorities for 2021.

It should go without saying that this past year was an absolute dumpster fire. New Jersey was one of the first states hit by the COVID-19 pandemic, which has spread to more than half a million residents and taken the lives of nearly 20,000 of our friends, family members, and neighbors. In the absence of any meaningful federal response, Governor Murphy and state lawmakers were tasked with the difficult work of keeping everyone healthy by slowing the spread of the virus, as well as keeping the economy afloat.

Given that the pandemic recovery was a big theme in the governor’s speech, let’s start with that. What did you all think about Governor Murphy’s remarks and reflections on COVID-19 and the path forward?

Sheila (Sheila Reynertson, Senior Policy Analyst): Given the historical weight of the pandemic and its second wave, Governor Murphy absolutely hit the right tone in his address. He highlighted upfront the collective pain and trauma brought on by the pandemic, the inequitable impact on communities of color, and the need to put struggling families at the center of the recovery efforts. His commitment to the idea that “public health creates economic health” continues to drive the state’s recovery, which I believe is a great relief to New Jerseyans who have witnessed other states falter under dismissive leadership.

We have in place a plan to vaccinate every willing New Jersey adult resident.

As our statewide vaccination program continues to grow, we will begin to see the light on the horizon get a little brighter.

Learn more: https://t.co/wzXaqEnqSN#NJSOTS

— Governor Phil Murphy (@GovMurphy) January 12, 2021

The after-effects of the pandemic cannot be overstated, and Governor Murphy mentioned deliberate steps that have already been taken to get the state back on track. Things like the development of safe and affordable homes and robust and reliable public transportation, the expansion of high quality, affordable education, and child care support for essential workers. These are drivers of a robust recovery. And, thankfully, they received vital funding in the current annual budget — a policy decision that rejects austerity and protects New Jerseyans.

Lou: All great points, especially that last one about rejecting austerity. It’s a huge relief that the governor recognizes that you can’t cut your way out of an economic crisis like this one. But when we talk about a strong and fair recovery, we have to recognize that far too many families are being left behind. I’m thinking specifically about our immigrant communities here.

Vineeta (Vineeta Kapahi, Policy Analyst): That’s right. Many New Jersey residents have been left out of most forms of federal and state pandemic relief. Immigrants who file taxes using an ITIN number, for example, are ineligible for both the federal stimulus payments and unemployment insurance. While many states stepped up to provide much-needed relief to families who are excluded from many public programs, New Jersey lawmakers have yet to take action.

Lou: Thanks, Vineeta. As we’ve said many times, excluding these folks is not only cruel but bad economic policy.

As Sheila mentioned above, the governor made a strong point that there is no economic health without public health. I know you liked that line, too, Brittany. What did you think of the speech, especially as it relates to public health?

Brittany (Brittany Holom-Trundy, Senior Policy Analyst): I was happy to hear how this speech highlighted the interconnectedness of health, the economy, and social inequities. The Governor’s remarks made evident that the state has learned two important lessons during this crisis: first, that disparities have worsened the pandemic for our Black and Latinx communities in particular; and second, that there cannot be a healthy economy without healthy individuals and communities. And to thrive, everyone needs access to comprehensive health insurance, easy access to a full range of reproductive health services, worker protections, and child care support, to name a few things.

Vineeta: I was glad to hear Governor Murphy acknowledge the challenges that workers and their families have faced both during and before the pandemic. The state could also do more to protect workers’ safety and rights and to help families balance job and caregiving responsibilities by expanding access to paid leave, sick days, and job protections. Some recommendations are included in the report below:

Lou: Pivoting a bit. This was Marleina’s first State of the State address. What was your takeaway of the address?

Marleina (Marleina Ubel, Crotty Fellow): I thought it was great, if not a little eerie. The empty room was a stark reminder of the ongoing pandemic.

Sheila: Given the severity of the pandemic, obviously this was the only option. But perhaps it was the most appropriate. This isn’t the time for pomp and circumstance, you know?

Lou: I was surprised by how short the speech was. But I guess that’s what happens when the governor doesn’t have to wait for everyone in the audience to finish clapping after every other line.

Murphy's State of the State address today set the record for least applause lines.

— Matt Friedman (@MattFriedmanNJ) January 12, 2021

What was everyone’s favorite part of the speech?

Marleina: I liked that the governor addressed systemic racism and policing. The work that has been done on criminal justice reform over the last few years is an important step in the right direction. Next, I would like to see an end to the grant programs and civil forfeiture policies that incentivize the over-policing of marginalized communities.

Vineeta: I second that. Too many New Jersey residents face trauma and live in fear because of the criminal justice system. The state could also do more to prevent collaboration with ICE.

Sheila: I appreciated the governor’s thoughtful remarks on the economic damage done to women by not having a robust childcare support system in place. His words weren’t just an afterthought, which is how the childcare crisis has been treated for far too long. His acknowledgment that “we cannot afford to miss out on the contributions of half our population” matters. A lot.

Vineeta: To piggyback onto that, the governor also mentioned the Child and Dependent Care Tax Credit (CDCTC). While this is a good policy that helps some families cover the costs of care, New Jersey’s CDCTC is not refundable. As a result, many of the households with the lowest incomes cannot benefit from the credit. That needs to be fixed.

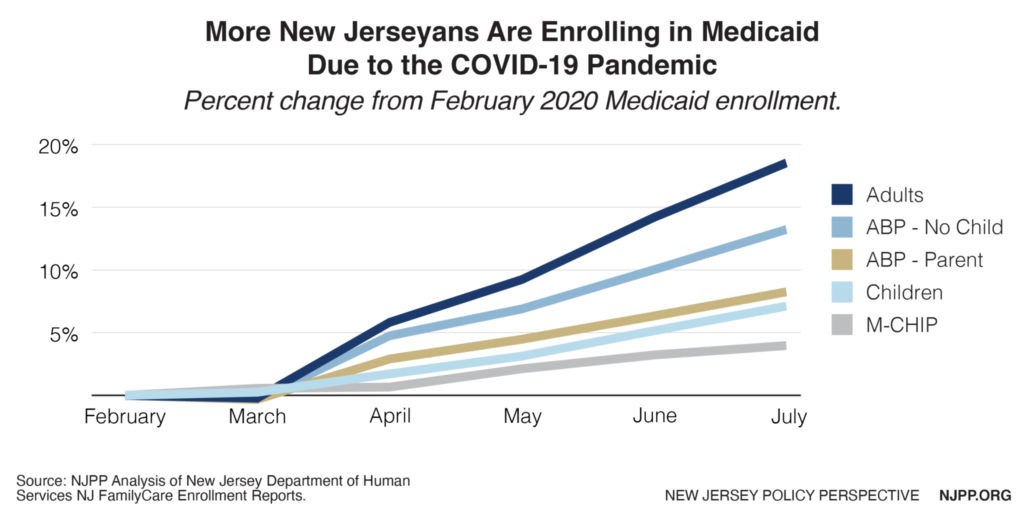

Brittany: I liked how he highlighted the many ways that New Jersey leads in health care, particularly with our new state exchange and the additional subsidies available to help improve affordability. With the loss of employer-based insurance threatening the health of so many people during the pandemic, finding a path to get all New Jerseyans insured is crucial for better protecting public health going forward.

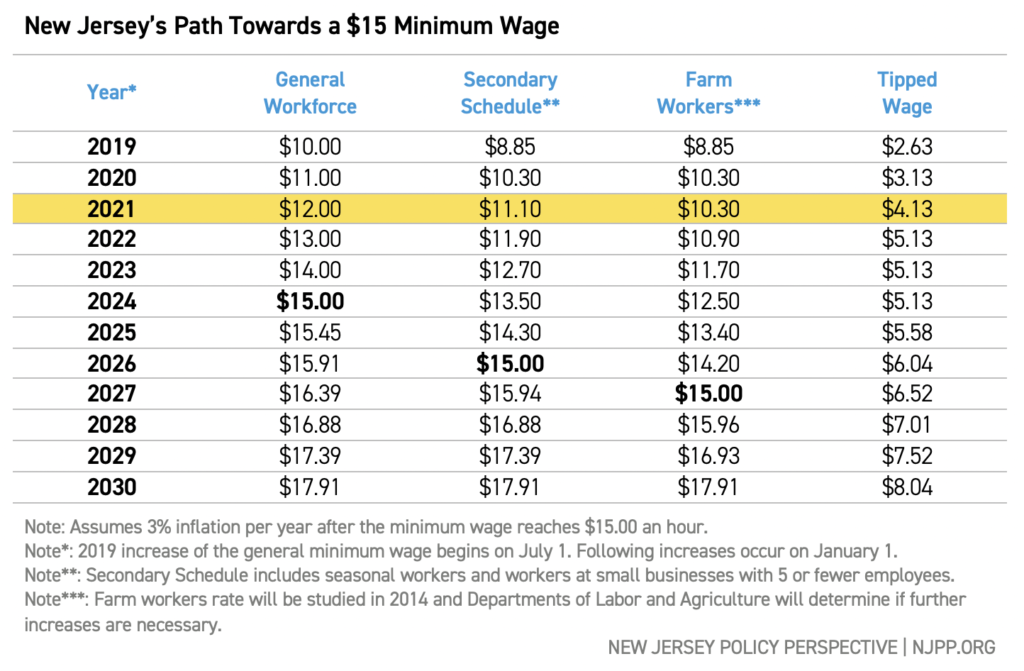

Lou: To answer my own question, I really enjoyed the beginning of the governor’s speech where he highlighted some of the bigger laws enacted during his first term. $15 minimum wage. Earned sick days. Expanded pre-k and free community college. This is how you build a strong foundation for a robust economic recovery.

Over the past three years, we’ve laid a foundation to support a stronger and fairer New Jersey that works for every family.

From raising the minimum wage to expanding paid family leave to ensuring tax fairness, our accomplishments have helped people across our state. #NJSOTS pic.twitter.com/C4bQfu1abJ

— Governor Phil Murphy (@GovMurphy) January 12, 2021

Since Brandon isn’t here, I’ll ask for him: Did the governor mention poverty during his address?

Marleina: He did not say the word “poverty,” but to his credit, he did speak at length about how many people were struggling before COVID, highlighting that economic insecurity is not a problem the pandemic created. He also proposed some solutions, including addressing New Jersey’s affordable housing crisis by building more units and expanding tax credits for those that need them.

Lou: Speaking of tax credits, the governor went to great lengths to highlight the newly enacted corporate tax break bill. Sheila, I’m sure you have some thoughts on this.

Sheila: The Governor was right to highlight the EDA grants or loans to 55,000 small businesses ravished by the pandemic. More New Jerseyans should be aware of these efforts. It makes an enormous difference to the owners, employees, local communities, and ultimately the state economy.

Having said that, tying this assistance to the newly enacted tax break legislation is a bit disingenuous. Yes, the new generation of corporate tax subsidies has a number of safeguards like worker protections and strong reporting requirements. And the new law does emphasize innovative industries, environmental cleanup, food deserts, and affordable housing. But the overall price tag of $14.4 billion is out of line with the rest of the country and sets the table for massive budget shortfalls in the not too distant future.

Lou: Yeah, giving tax breaks to corporations isn’t exactly my idea of small business relief, either. And let’s remember that this bill was rushed through the Legislature in less than a week. Can’t think of a better example for why we need serious ethics and transparency reforms in Trenton.

Sheila: This is long overdue, and not because the pandemic slowed down the initial efforts to address it. For the past several years, access to the lawmaking process has become tighter and, in some cases, impossible. All too often, lawmakers rush bills through committee, shut residents and advocates out of the process, and intentionally block popular legislation. This trend reached a pinnacle last year when the State Police forcefully removed Sue Altman from New Jersey Working Families from a public hearing — a spectacle that received unflattering national attention.

Given the events of last week at the US Capitol, public access to the legislative process could get even worse in the name of safety. We can’t let that happen. So I appreciated hearing the Governor say “the way to combat this contagion in our democracy is to further strengthen that democracy…give more power back to the people by expanding democracy.”

Lou: That’s for sure. Brandon and Michele Sierkerka did a great job making that point in this op-ed from earlier this week:

Fast-tracking bills before the public, press, advocates, and even lawmakers have time to read and understand the proposals generates unintended and costly consequences.

That's why we're joining @NJBIA in calling for more transparency in Trenton.https://t.co/pKKk8ocO0I

— New Jersey Policy Perspective (@NJPolicy) January 11, 2021

But let’s wrap this up. Anything else from the speech that’s worth mentioning? Let’s go rapid fire for this one.

Brittany: The vaccination efforts! They are underway, and fighting misinformation and getting everyone, particularly vulnerable New Jerseyans, vaccinated is really important at this time. I’m hoping people talk to trusted expert sources on this and visit the website that the Governor highlighted for more information and to pre-register. Let’s get vaccinated!

Sheila: Continued and meaningful efforts to drive down New Jersey’s horrendous racial disparity of maternal and infant mortality rates. It’s anti-Black racism in action — and it’s deadly.

Marleina: Ending mandatory minimums and getting the marijuana legislation done! It is time to end the drug war.

Lou: Wait, marijuana isn’t legal yet?

Marleina: Nobody knows! But in all seriousness, no.

Lou: Here’s hoping that’s signed into law by the time we’re back for our budget reaction…