Update, June 3: An amended version of this bill – without the provision on inverted corporations – cleared committee yesterday.

This written testimony, on A-328, will be delivered to members of the Assembly Commerce and Economic Development Committee today.

Members of the committee, thank you for the opportunity to submit this written testimony outlining New Jersey Policy Perspective’s strong support of the modest, common-sense reforms put forth in A-328.

This legislation brings four important fixes to New Jersey’s tax subsidy programs:

1. Restoring Financial Integrity to the ‘Net Benefits Test’

As you are aware, the Economic Opportunity Act of 2013 made sweeping changes to New Jersey’s tax subsidy programs. While some of those changes were positive, on the whole the legislation greatly expanded the size and scope of these offerings while eliminating several key financial protections for taxpayers and the State of New Jersey. A-328 represents a partial course correction, in that it eliminates some of the most egregious taxpayer risk.

It does so by restoring financial integrity to what’s known as the “net benefits test.” This is the formula the state uses to estimate the economic benefits of any proposed tax break, using the number of proposed jobs, their promised wages and other factors. When designed properly, this is a basic taxpayer protection that ensures the state isn’t losing money on an incentive deal. Problem is, in many cases under the EOA, the test offers little or no taxpayer protection.

Before 2013, to be approved for a tax break, a Grow New Jersey project had to deliver a benefit to the state of at least 110 percent – in other words, 10 percent more than the dollar value of the subsidy – over the same period (usually 15 years) that the company was committed to keeping the jobs in-state. If the corporation didn’t meet those promised obligations, it would receive less of a tax break, or none at all.

But now, a Grow New Jersey project in Camden need only deliver a 100 percent benefit – in other words, break even – over 35 years. And the corporation is obligated to deliver the proposed jobs and economic activity for, at most, only 15 years. After that, it can move, slash its workforce, cut pay across the board, or threaten to move in order to receive yet another tax break – and the state would have no recourse to claw back any of the tax credits that had already been claimed.

As a result, when taken together, the 17 Grow New Jersey projects approved for Camden so far actually come with a risk to the state of $273 million, according to the Economic Development Authority’s own numbers, which NJPP has obtained through the Open Public Records Act. That stands in stark contrast to the “net benefit” of $529 million that is officially on the books and created by this implausible and unrealistic economic estimating formula.

As a result, when taken together, the 17 Grow New Jersey projects approved for Camden so far actually come with a risk to the state of $273 million, according to the Economic Development Authority’s own numbers, which NJPP has obtained through the Open Public Records Act. That stands in stark contrast to the “net benefit” of $529 million that is officially on the books and created by this implausible and unrealistic economic estimating formula.

And Camden isn’t the only area where a corporation could receive an incredibly lopsided benefit. In the four other cities the state considers to be most distressed – Atlantic City, Passaic, Paterson and Trenton – a project’s benefits must equal 110 percent of the tax break but are estimated over 30 years, which still creates a significant imbalance between taxpayer and corporate interests.

A-328 corrects this imbalance by ensuring that the net benefits test corresponds to the number of years the corporation is committed by statute to stay in the state. This would be a big step towards good government and financial responsibility, and a return to the common-sense practices employed before extending tax breaks in the past.

2. Ensuring Fair Wages

A key positive provision of the Economic Opportunity Act of 2013 bill ensured that custodial, security and building maintenance workers on any project or development that received tax credits under Grow New Jersey or the ERG program be paid no less than the prevailing wage for that industry or sector.

Unfortunately, this was the only provision of the original legislation that the governor conditionally vetoed, and it never became a reality. As a result, the State of the New Jersey is at risk of subsidizing unlivable wages related to many of these projects. A-328 would add this provision back to the legislation, and ensure that workers involved in all aspects of these subsidized projects are paid fair wages.

3. Preventing Extra Rewards for Some Known Federal Tax Dodgers

This legislation would also bar any so-called “inverted” corporation from being able to receive state tax breaks. Inversions are when a larger U.S. corporation merges with a smaller foreign company to avoid U.S. taxes. This practice works wonders for corporate bottom lines but harmfully erodes the federal tax base and limits the government’s ability to invest in the public goods that grow the nation’s economy. Basically, company management stays put, taking advantage of America’s highly educated workforce, patent protections and transportation infrastructure – without helping to pay for it.

While this is largely a federal tax issue, and while recent U.S. Treasury rules may start to limit the flow of new inversions, here’s no reason New Jersey policymakers should reward corporations dodging federal taxes with additional tax breaks.

Barring them from doing so would prevent a double whammy for New Jersey: a company’s federal tax avoidance produces a lower state tax base, which is again reduced by generous tax breaks handed out by the Economic Development Authority. It would also revoke already granted incentives to companies if they choose to invert while receiving the state subsidy, and force those companies to return their incentive to New Jersey’s taxpayers.

While this policy change can’t change federal tax policy on inversions, it is a small but important step to protect New Jersey’s tax base and limit the state’s rewards for harmful corporate behavior.

4. Ensuring Comprehensive Review & Analysis

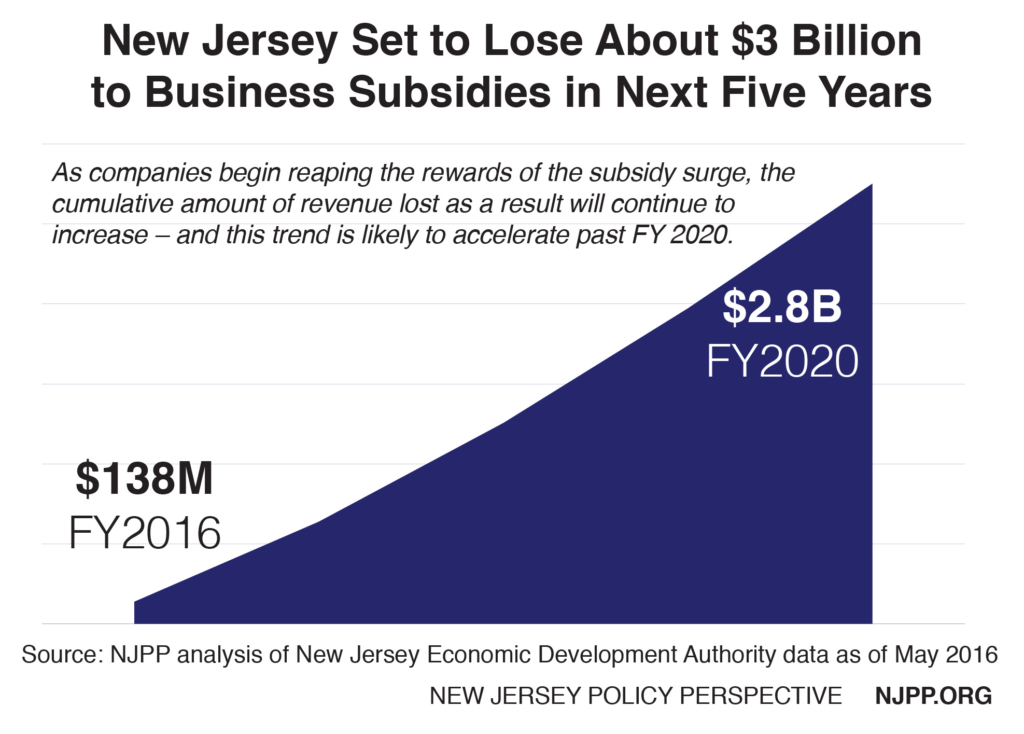

Last, but certainly not least, this legislation would ensure that the state provide essential information on the outcomes of these tax breaks – which total over $4 billion and growing in just two and a half years since the enactment of the Economic Opportunity Act – to enable a fair and comprehensive evaluation of these programs’ efficacy. While the EDA has taken some positive steps in this direction, including contracting with the Bloustein School at Rutgers University to analyze these subsidy programs, more certainly could be done. At the very least, A-328 would codify the requirement that such an analysis be done.

In conclusion, this legislation represents a smart, modest step towards more financial responsibility, better outcomes for all workers and greater taxpayer protection. We applaud it as a first step, but suggest that much more should be done, including restoring spending caps to Grow New Jersey, lessening the focus on shifting jobs within the state and disallowing corporations from selling these tax credits on secondary financial markets. NJPP is available and willing to partner with any legislator who’d like to discuss further reforms. Thank you.