Below are prepared remarks to be delivered in front of a joint meeting of the Senate Health, Human Services & Senior Citizens and Assembly Human Services Committees today.

Thank you for the opportunity to testify on the governor’s proposed reorganization plan to transfer mental health and addiction functions from the Department of Human Services to the Department of Health. This is not a minor administrative issue; rather it represents one of the most radical changes ever in the organization of state departments in a century and deserves much more study than the allotted 60 days allow. While we appreciate the governor’s admission that there is a stunning lack of coordination and integration of services within his administration, this plan does not sufficiently support the conclusion that the solution is to put all of these services in one department.

We are also very concerned that even though these problems have been going on for many years, the governor chose to wait until the very end of his administration to rush through these changes, all of which would have to be carried out by the next governor. Gubernatorial transitions are already complicated enough; adding a significant change like this – which could have life or death consequences for New Jersey residents – would make it even more so.

To some extent, this issue is déjà vu all over again. It was only six years ago that the state formally transferred addiction services from the DOH to the DHS to “provide increased efficiency, coordination and integration of the State’s addiction prevention and treatment functions.” Rather than continue to bounce state services back and forth between departments, we need to recognize that there may be other factors that are much more important in improving the efficiency and effectiveness of these services.

One of the main reasons that the DHS was created in 1919 was too oversee psychiatric care. Ever since then, psychiatric hospitals and community mental health services have always been within the department. What we know from this extensive experience is that managing inpatient and community mental health services is very complex, and if it is not done properly it can have disastrous consequences for the consumer’s mental health, including death.

We are also concerned that the state could lose federal Medicaid funding if these services are transferred to the DOH, since Medicaid is administered by DHS. The state has been particularly successful in funding more of these services thanks to the Medicaid expansion, which increased the number of New Jerseyans enrolled in Medicaid by about a half million residents. Also, the department is in the middle of a major transition to fee-for-service funding for mental health and drug addiction services to also maximize Medicaid funds. There have been major problems in administering this transition, which need to be remedied before other major structural changes are implemented.

The governor says there needs to be more integration between mental health and physical health. We strongly agree, but the DHS is the largest provider of physical health in the state through Medicaid so why transfer behavioral health services to the DOH? It would appear that problem could more easily rectified by only relocating all licensing to the DOH rather than transferring all services to the department.

We are also extremely concerned that adding such a major new function to the DOH will divert it from its core mission as a regulatory and planning agency which oversees health in New Jersey. We believe that function is critical and will be especially needed in the future given the many changes that are going on in the health sector, such as consolidation of hospitals, the increase in for-profit hospitals, the growth in tiered network and value-based health services and the need for more accountability throughout the health care system to improve care and reduce costs. We are concerned that these critical functions will be reduced, rather than strengthened, as a result of adding an entirely new function to the DOH. Also, how can the department fairly evaluate the extent to which the state is meeting its health goals if the department itself becomes a major provider of health services?

We also disagree with the governor’s suggestion that since the DHS has a lot of staff and the Department of Health does not, there should be more of a balance. It should be pointed out that while the department does have about 11,000 staff now, that’s about half what it used to have when the department also included children services and corrections. In addition, most research in organizational theory shows that the size of an organization has very little to do with it its efficiency and effectiveness.

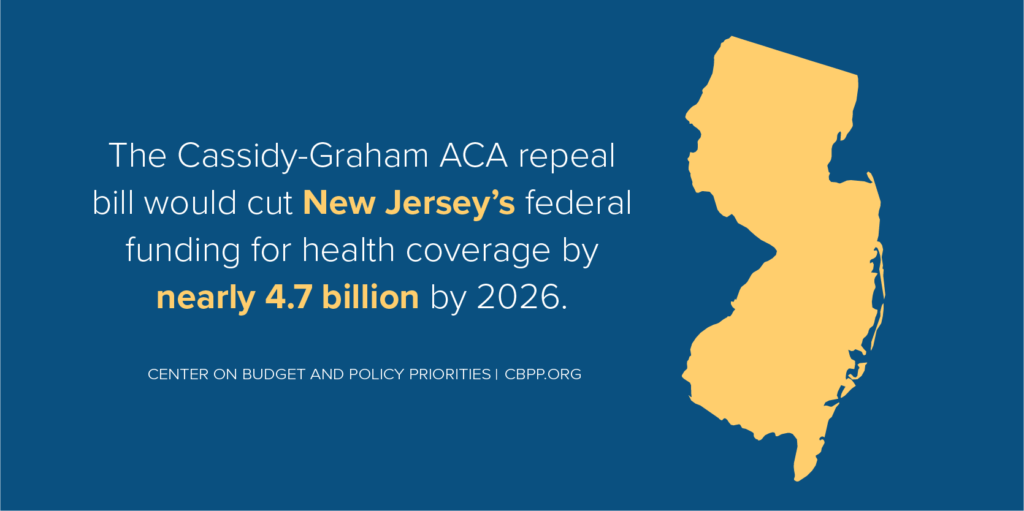

Lastly, such a major change in state government should not be made in the face of such uncertainty at the federal level. As we all know, there is a major effort to greatly reduce the amount of federal support the states receive to fund health care. The focus currently is on repealing the Affordable Care Act, but it’s also clear that Congress is very interested in many other health care cutbacks, including about $2 trillion in cuts to health funding over 10 years in the House’s proposed budget. Until we know what those changes are going to be, it would be premature to make major organizational changes in state government. For example, it appears quite likely that there’ll be a major reduction in federal funds to hospitals, in which case the DOH will have more than its hands full.

In conclusion, we believe the governor’s plan could create many more problems than it solves -if it solves any. On the other hand, we recognize that there may be some merit to transferring these services that we have not identified.

We therefore urge that you vote to oppose the governor’s plan and direct him to provide a thorough study, with public hearings and stakeholder input, of the advantages and disadvantages of transferring these services to the DOH from the DHS, taking into account what the mission of the departments should be in the future given the many changes that will likely be made in Washington and the health field in general, and recommending any organizational and statutory changes that may be needed.

We also recommend that the report evaluate the extent to which the governor’s office has the authority to better coordinate these services in lieu of transferring them from one department to another in anticipation that the next governor will decide to take more of a leadership role in managing state services, promoting transparency and encouraging public input.