The tumultuous passage of New Jersey’s 2018 budget may be over, but the horse-trading and the shutdown drama doesn’t hide the simple fact that New Jersey is in serious financial trouble. Big tax cuts and a lackluster economy continue to put a damper on the state’s ability to meet its needs – and save for unexpected ones. Last year New Jersey had to dip into its reserves just to pay its bills, ending the budget cycle with $80 million less in its nearly empty savings account. That doesn’t bode well as a long-term strategy, nor does it signal to credit agencies that the state is on solid footing.

As it stands now, New Jersey is slated to close out the current budget with just $493 million in savings on June 30, 2018. That represents approximately 1.4 percent of the state’s budget, or 5 days of government operation.

That’s about in line with what was recently projected by the credit-rating agency Moody’s, which estimated that the surplus will actually drop to 1.3 percent of operating revenues in the 2018 fiscal year. These reserves have remained at dangerously low levels in the state since they bottomed out at the end of the Great Recession. This pattern is a reflection of a state economy still struggling to bounce back; but it is also a reflection of poor governance grown accustomed to relying on these reserves to cover chronic budget shortfalls.

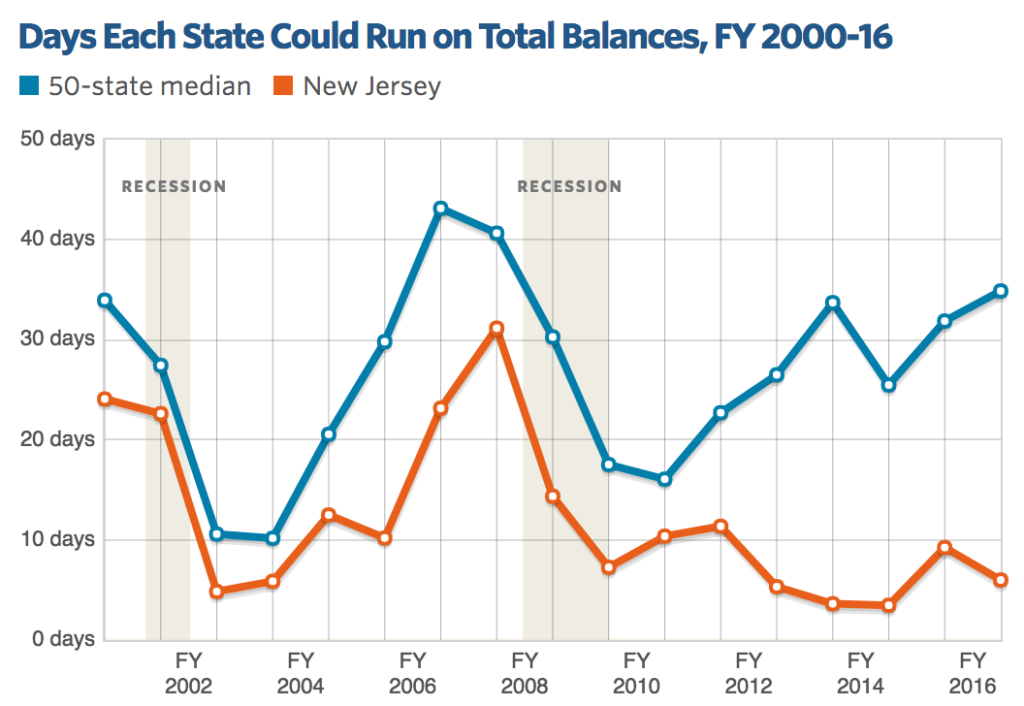

As of the end of June 2016, New Jersey had a total balance of just $551 million, or 1.6 percent of state spending. This was enough to operate the state for just six days. That ranked 5th lowest in the nation, and far behind the 50-state average of reserves that represented 9.6 percent of spending and kept the government running for 35 days, according to an analysis by the Pew Charitable Trusts.

This is a far cry from New Jersey’s reserves back in 2007 when the state had 31.2 days worth of general funds to operate on. That represented 8.5 percent of state spending at the time. Since 2009, New Jersey has put in on average less than 2 percent of annual spending into the surplus account (1.85 percent).

Rebuilding the reserves to this 2007 level would put New Jersey in line with today’s national median (34.9 days or 9.6 percent of spending). To ensure minimal disruption, this should be done over 5 years, putting 0.2 percent more – or an additional $100 million – into reserves each year, to slowly rebuild New Jersey’s financial cushion. The main point here is that New Jersey should be adding to the reserves each year, not subtracting from them. And, as we noted above, New Jersey’s reserves have only gotten smaller since this Pew analysis, shrinking by 12.5 percent between June 2016 and what is projected for June 2018.

A healthy surplus puts New Jersey in a much better position to weather a year of economic downturn or another super storm but it’s only viable as an option if the state’s finances are stabilized enough – and the state’s leadership is willing enough – to build it. Credit rating agencies are likely to take notice, too, leading to potential upgrades.

After a record 11 credit downgrades during Gov. Christie’s tenure, policies that can responsibly put our financial house back in order – which often come with credit rating boosts – are desperately needed and can help relieve some budget pressures. A state’s credit rating directly influences New Jersey’s cost of repaying bonds sold to investors to finance major capital projects like the construction and renovation of roads, schools and parks. The lower the rating, the more it costs taxpayers to pay off debts, siphoning away dollars the state needs to make ends meet.

Yes, New Jersey has a long list of other urgent needs that must take greater priority. But taking the initiative to also rebuild the reserves sends a message that New Jersey has its eye on the future by planning ahead for lean times. Ignoring this financial responsibility only puts New Jersey in greater trouble down the road. We just can’t afford to take that route.