Last week Governor Murphy reiterated his support for a millionaire’s tax on New Jersey’s highest earners to help pay for some of New Jersey’s most pressing needs – property tax relief and reinvesting in K-12 education.

Senate President Stephen Sweeney, who posted a millionaire’s tax 5 times during Christie’s tenure and put it on the top of his list of legislative priorities as recently as November, now views a tax on New Jersey’s highest earners as only an “absolute last resort” and instead is pushing for a surcharge on large corporations to help fund education.

Despite some quibbling, it is refreshing to hear New Jersey most powerful politicians talking about cleaning up the state’s tax code and raising new revenues that the state desperately needs. But frankly, this should not be an “either/or” choice: New Jersey needs both. To really get the state back on track, profitable corporations and top earners in the state must pay their fair share.

Yet Assembly Speaker Craig Coughlin has taken a different tack altogether, stating that “our top priority should be to reduce spending, better manage our existing resources, and fully examine all revenues from existing programs before we raise taxes on anyone.”

But we’ve seen this movie before. And it didn’t have a happy ending for New Jersey’s economy or for its middle-class working families.

Governor Christie boasted of his deep cuts to what he liked to call “discretionary spending” – in other words, state investments in higher education, direct property tax relief and other middle-class priorities. As he presented his final budget, he said those investments were $2 billion less than in 2008, creating what he dubbed “a new baseline for government.”

That baseline – reinforced by tax cuts that drained critical dollars from New Jersey’s coffers – led the state to suffer 11 credit downgrades from three major credit-rating companies during the Christie administration. In other words, this “new baseline” didn’t match the state’s needs.

That baseline means that over 10,000 state government jobs – and over 100 public programs – have disappeared, dragging down the overall economy and making it harder for the public servants who remained to serve the public.

That baseline means deliberate disinvestment in New Jersey families. It means that the state’s public schools are underfunded; that more children can’t thrive in high-quality Pre-K classrooms; that parents and college students are taking on more debt as state support of higher education drops; that seniors, the disabled and low- and middle-income homeowners dependent on dwindling property tax relief are left out to dry; that commuters are paying 30 percent more for tickets on a public transit system that has become unreliable and, in some cases, downright dangerous.

Here’s the reality: New Jersey has already reduced spending – and reduced it beyond a sustainable level, reduced it to the point where it’s putting our future at risk. The trickle-down agenda of tax cuts and spending cuts has been the state’s chief economic policy for the past eight years. Legislative leaders owe it to those who have been paying for those cuts to embrace a better plan. First admit that there’s no more room to cut spending without even further harming families. Then make a commitment toward raising new revenue, and doing so in an equitable way.

Already, the tired and false claim that higher taxes will drive millionaires and successful businesses out of New Jersey has come roaring back. This time, though, legislators should consider what it is about New Jersey that helps foster a growing class of millionaires in the first place. It is undeniable that the public assets that make this great state hum – mass transit to major economic city centers, high quality education, an educated workforce – are key ingredients of prosperity. In fact, New Jersey now has the second most millionaires per capita in the country with just about 1 in 12 households having $1 million or more in investable assets. That’s up from third place a year ago.

Public assets cost money, and they work best when we all chip in and pay our fair share. That can only happen if New Jersey takes critical, bold steps to make its tax code fairer and its finances more stable with new revenues.

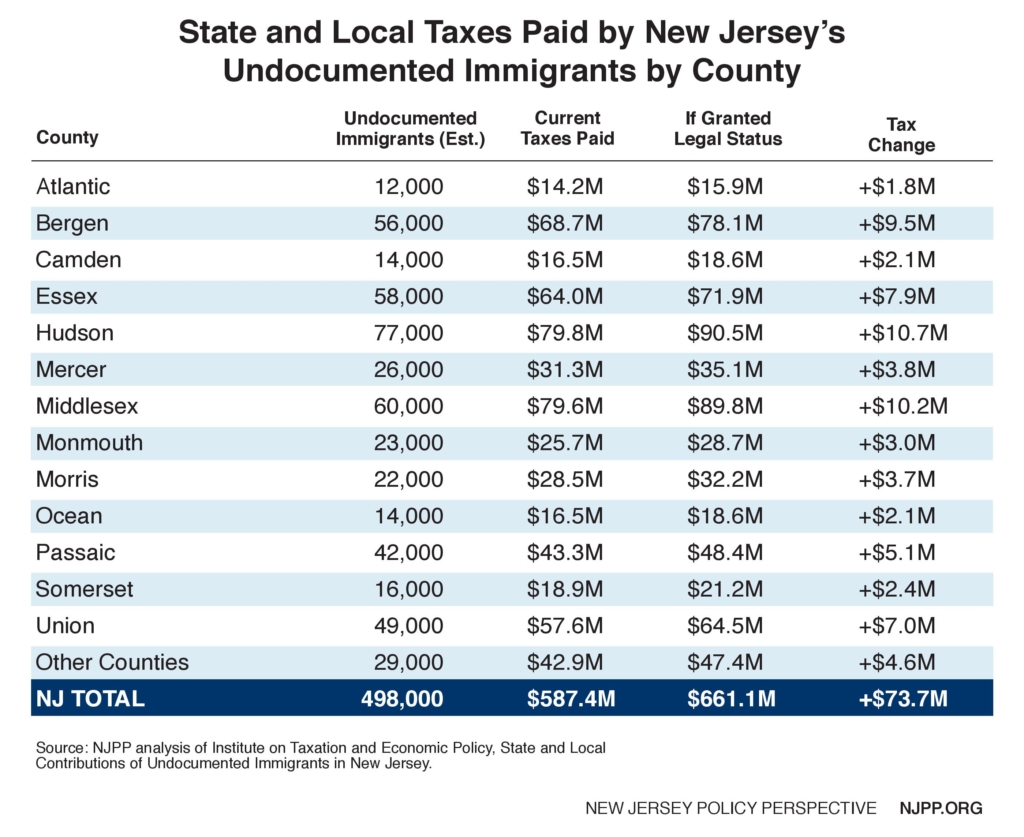

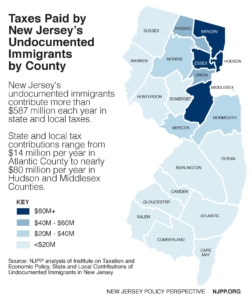

New Jersey’s undocumented immigrants pay about $587 million each year in state and local taxes, the sixth highest level of all states. And the more integrated these neighbors become in our society, the higher their tax contributions. For example, the same undocumented New Jerseyans would pay an additional $73 million – the eighth largest jump of all states – should they be covered by comprehensive immigration reform.

New Jersey’s undocumented immigrants pay about $587 million each year in state and local taxes, the sixth highest level of all states. And the more integrated these neighbors become in our society, the higher their tax contributions. For example, the same undocumented New Jerseyans would pay an additional $73 million – the eighth largest jump of all states – should they be covered by comprehensive immigration reform.