Gov. Murphy took an important step toward righting New Jersey’s economic-development ship with today’s executive order calling for a robust, independent evaluation of the state’s use and abuse of corporate tax breaks. As we’ve often noted, better evaluation is a critical part of comprehensive comprehensive subsidy reforms that can usher in amore responsible approach to economic development in the Garden State.

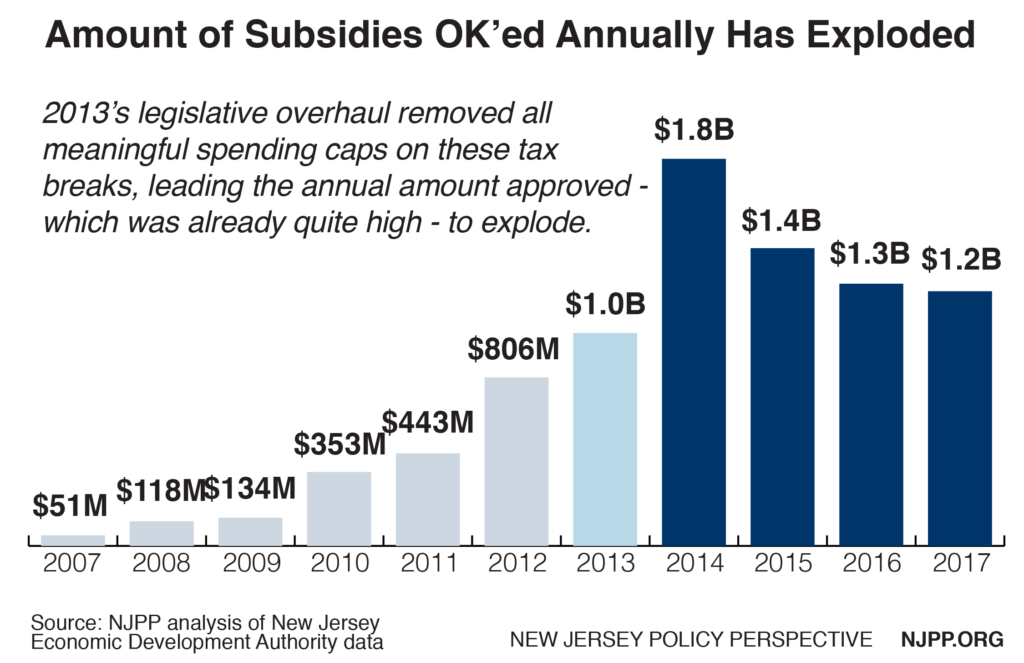

Since 2010 – and in particular since 2013 – New Jersey has seen an unprecedented surge in corporate tax subsidies, further cramping New Jersey’s ability to fund schools, transportation and other investments known to be greater drivers of job creation. The state has rapidly increased the amount of special tax breaks approved, more of these subsidies have been used to merely shift jobs around the state, and the breaks to individual corporations have become larger and larger even as the required investments from those corporations have gotten smaller and smaller.

A new direction is urgently needed, because the state can’t afford this subsidy largesse – both in terms of its direct, long-term drain on the state’s coffers and in terms of the opportunity costs created by having such a lopsided and flawed economic-development strategy.

New Jersey can’t afford to ink over $1 billion in subsidy deals every single year, or to continue approving 9-figure tax breaks to help profitable multinational corporations move their offices a few miles down the road with a new building fully paid for by the state’s taxpayers, or to continue expanding these programs without end.

New Jersey’s tax breaks must be smaller, smarter and more targeted to small, growing businesses located in places with access to public transit. We’re glad the governor is taking this essential first step to require rigorous evaluation so early in his tenure. And we look forward to working with him, his administration, members of the legislature and agency officials to retooling these subsidies and making New Jersey truly competitive in a 21st century economy.

NJPP’s reform agenda for corporate tax breaks

Better evaluation of the state’s corporate tax subsidies is one of ten key reforms proposed by NJPP in May 2017 – others include restoring spending caps on these programs, limiting the use of breaks for jobs already in the state, and restricting the ability of corporations to redeem more in tax credits than they owe in taxes. For the full report, click here: https://www.njpp.org/budget/its-time-for-new-jersey-to-rebalance-the-economic-development-scales

New Jersey’s subsidy surge, by the numbers (figures are through the EDA’s January 2018 meeting):

- 5: Number of years in a row (2013-2017) that New Jersey has approved more than $1 billion in tax subsidies

- 0: Number of times an annual report evaluating the efficacy and fiscal impact of these subsidies, mandated under a 2007 law, has been produced

- $8.4 billion: Total amount of tax breaks approved since January 2010 (a monthly rate of $87 million)

- $1.2 billion: Total amount of tax breaks approved during the entire previous decade (Jan. 2000-Dec. 2009) (a monthly rate of $10 million)

- $61,000: Taxpayer cost per subsidized job since January 2010 ($117,000 per “new” job)

- $16,000: Taxpayer cost per subsidized job in the 2000s ($22,000 per “new” job)