A day before Governor Murphy delivers his annual budget address, workers, policy experts, and advocates from For The Many NJ gathered outside the State House to urge lawmakers to stop the corporate millionaires’ tax cut and maintain the Corporate Business Tax surcharge in next year’s budget.

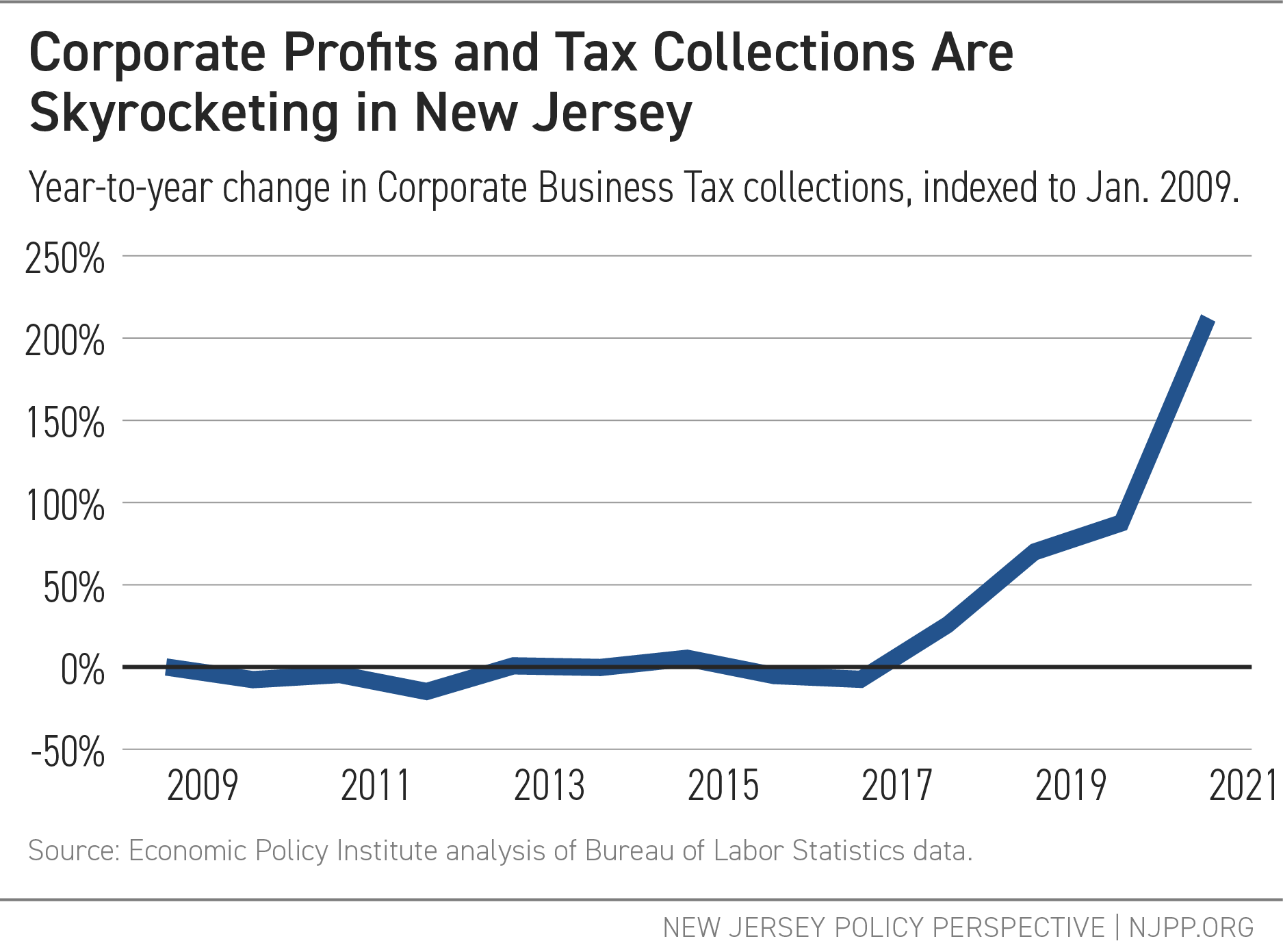

Eliminating the 2.5 percent surcharge, paid on every dollar of corporate profit over $1 million, would cost the state at least $650 million in revenue every year. The coalition warned that the tax cut would blow a big hole in the state’s budget and threaten investments in essential public services, programs, and infrastructure that residents and businesses alike rely on.

“Low and moderate-income families are struggling to make ends meet. Sunsetting the corporate business tax and undermining our current and future progress as a state would be a mistake,” said Antoinette Miles, Political Director of New Jersey Working Families and emcee of the press conference. “The only promise our state must fulfill in its budget is the promise of uplifting working families — not the largest multi-million dollar corporations.”

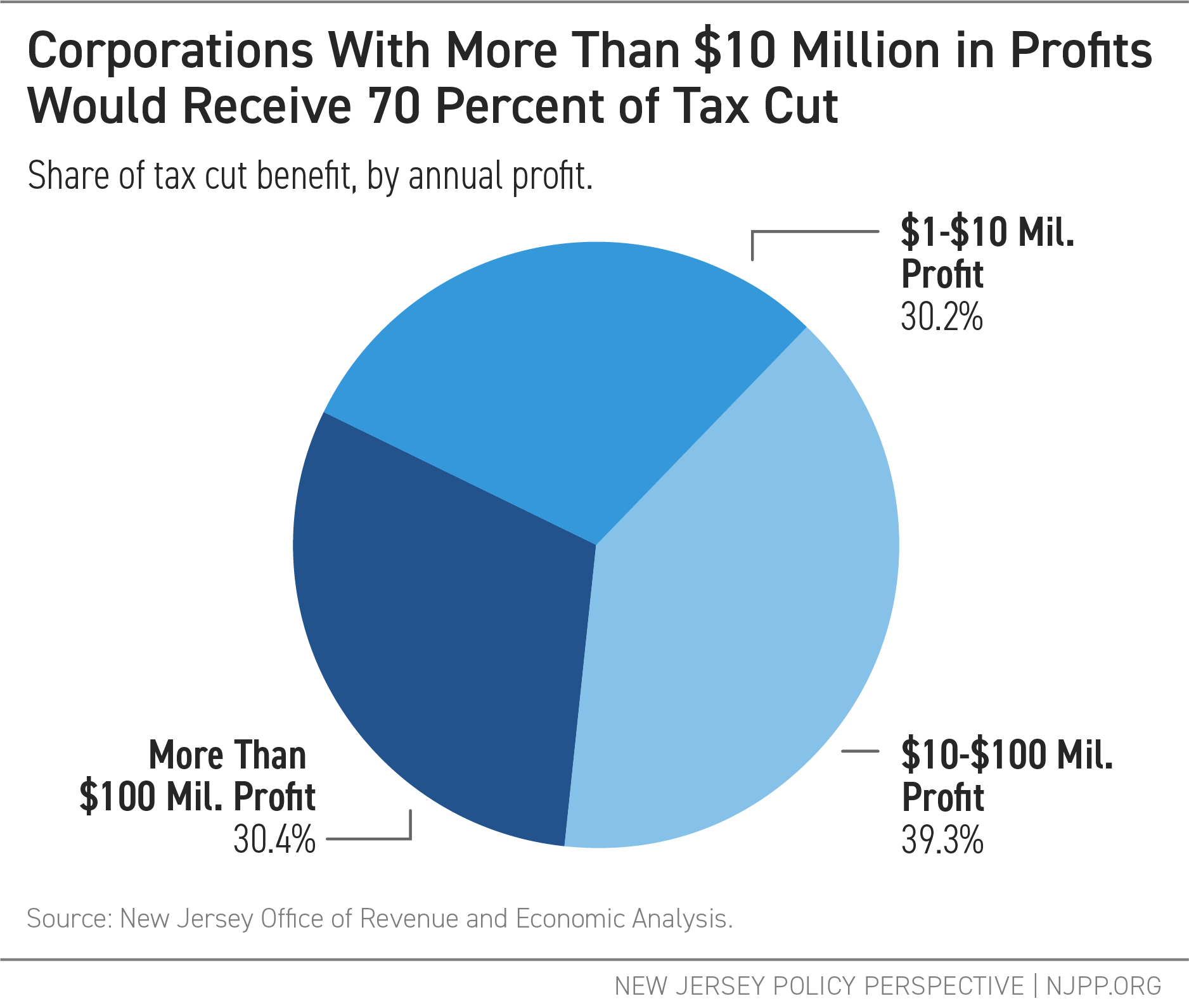

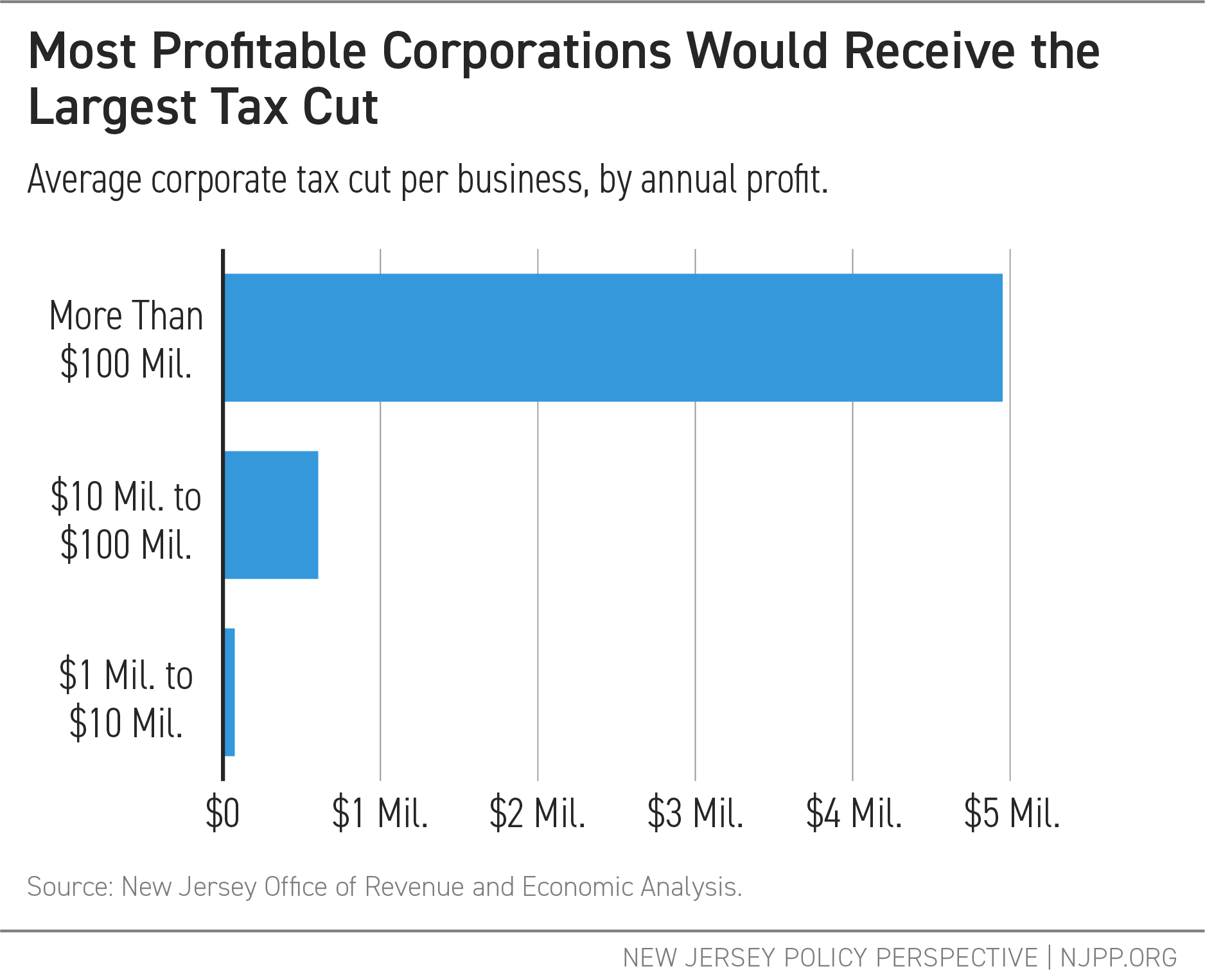

According to a report released last week by New Jersey Policy Perspective, only the top 2 percent of businesses operating in New Jersey pay the surcharge, including multi-national corporations not headquartered in the state like Amazon, Walmart, and Bank of America.

“This is a tax cut for some of the wealthiest corporations on the planet, not ‘Mom and Pop’ businesses,” said Sheila Reynertson, Senior Policy Analyst at New Jersey Policy Perspective. “When big corporations don’t pay what they owe, we all have to make up the difference, either in higher taxes or in cuts to vital public services like schools and transportation. We should know by now that corporate tax cuts never trickle down. This is a bad deal for New Jersey.”

Speakers from the coalition urged lawmakers to pass a budget that would benefit all residents, not just corporate shareholders.

“While working families struggle to pay for rent and food every month, multi-billion dollar corporations like Amazon are reporting record profits,” said Rodney Salas, leader and member of Make the Road NJ. “New Jersey cannot give bad actors like Amazon a tax break. Letting the (CBT) expire would mean that working people would have to subsidize billionaire corporations like Amazon that are making record profits. Working people do not want to subsidize corporations. It is time to invest in housing, schools & working families, not to give tax cuts to billionaire corporations like Amazon in the FY2024 budget.”

“We urge Governor Murphy and the NJ Legislature not to walk away from a successful policy that reversed the state’s fiscal damage and ensured the viability of important investments in low- and moderate-income New Jerseyans,” said Dena Mottola Jaborska, NJ Citizen Action Executive Director. “If our leaders reverse the CBT surcharge while we are simultaneously seeing a deep drop in federal funding, the state’s fiscal health will take a huge hit largely at the expense of our most vulnerable communities. All for a windfall for the state’s wealthiest corporations while jeopardizing funding for a host of programs that millions of residents need to achieve economic security. Progress for these communities requires sustained investment and commitment.”

“Cutting the corporate business tax surcharge is giving money to our wealthiest corporations, those in the top 2% of earnings,” said Francine Pfeffer, Associate Director of Government Relations at NJEA. “That’s $600 million the state doesn’t have to help schools pay for new ventilation systems, student transportation, or other needs.”

“Investments to protect New Jersey’s environment and public health have long been short-changed and allowing the millionaires tax for Corporations to expire on Dec 31st this year will be disastrous. Clean energy programs for the poor and mass transit capital projects are already defunded; climate programs are underfunded and delayed when they need to be expanded to meet the moment; and a cut to the corporate business tax will make matters worse resulting in a direct cut of $48 million to green and blue acres,” said Eric Benson, Clean Water Action, NJ Campaigns Director. “We are running out of time to make a meaningful impact on emissions before the worst impacts of the climate emergency become our NJ children’s future and we can’t afford to let New Jersey’s richest corporations, who have thrived in the last three years, off the hook.”

“Allowing the CBT surcharge to sunset would be yet another giveaway to the wealthiest corporations who already exploit tax avoidance loopholes to maximize short-term profits,” said Richard Lawton, Executive Director of the NJ Sustainable Business Council. “Since 98 percent of New Jersey businesses have revenues that make them exempt from the surcharge, eliminating it would only compound the unfair competitive advantage that large out-of-state companies already have over local businesses who do their part as responsible citizens to make New Jersey a great place to work and live.”

“The Christian church began our 40 day tradition of reflection, confession and renewal this past week on Ash Wednesday. We confessed that we are in bondage to sin and submit too readily to the idols and injustices of economic life. We often rely on wealth and material goods more than God, and close ourselves off from the needs of others. Too uncritically we accept assumptions, policies, and practices that do not serve the good of all,” said Rev. Sara Lilja, Executive Director of Lutherans Engaging in Advocacy Ministry NJ (LEAMNJ). “Today we call on all people of faith to question the decision of the Governor to let the Corporate Business Tax surcharge expire. Cutting the CBT puts vital funding for public services at risk — like investments in public infrastructure, health care, and public schools. Just as the federal government is pulling back on SNAP assistance for hard working families, or TANF benefits to those most in need, we as a state must continue to assist. If the pandemic taught us anything, it is that we rely on “essential workers” for our daily life, we must continue to support all New Jerseyans; and continue to fund programs that support families in the hight cost state.”

Keeping the Corporate Business Tax surcharge in place generates more than $600M per year and at a time when future federal windfalls are in doubt, making this revenue stream permanent is more essential than ever,” said Matthew Hersh, Director of Policy and Advocacy of the Housing and Community Development Network of New Jersey. “Corporate landlords are raising rents at unconscionable rates — between 20 and 40 percent statewide – while benefiting from huge tax breaks. NJ has long been a leader in many sectors, but when it comes to housing the approximately 200,000 neighbors in need of an affordable home, we continue to fall short. Working closely with the Murphy administration and our legislative allies, we have made great strides toward funding and allocating the Affordable Housing Trust Fund, creating the Affordable Housing Production Fund for towns with unmet Fair Share housing obligations, prioritizing first-time and first-generation homeownership and emergency rental assistance. But we cannot take our foot off the pedal now as we HouseNJ: the CBT is a key part of funding these priorities, and we cannot and should not reverse course.”

“It is unconscionable that New Jersey lawmakers would give tax cuts to the state’s largest corporations that make millions of dollars in profits every year instead of investing those funds in transformative policies that would narrow our massive racial wealth gap and create a more equitable New Jersey for everyone,” said Harbani Ahuja, Associate Counsel, Economic Justice, New Jersey Institute for Social Justice. “$600 million could go a long way in funding programs like Baby Bonds, to enable low-income and low-wealth Black and other children of color to build wealth and economic security.”

“Now is the time to address the future of New Jersey’s economy. The Corporate Business Tax has significantly supported investments and policies critical for maintaining the high quality of life New Jersey has to offer,” said Kelly Conklin, President of the Main Street Alliance Board. “As it stands, the CBT is New Jersey’s third largest source of revenue. To sunset the surcharge, of which only 2% of New Jersey businesses are taxed, will not help small businesses. Main Street businesses will have to pick up the revenue tab left by large multinational corporations, adding an undue burden to the struggles small businesses face year over year to make their margins, keep pace with inflation, retain their employees with competitive benefits and manage personal responsibilities. To sunset the CBT is to forfeit $664 million a year and force families in this state to spend an entire second income on child care. To sunset CBT is to give away $664 million to companies recording record profits while simultaneously laying off tens of thousands of employees. Without this funding public infrastructure like our roads, public spaces, schools and more will crumble. Corporations that qualify for the CBT have long avoided paying their fair share of taxes, placing the responsibility on small businesses and other vulnerable communities. Eliminating the Corporate Business Tax surcharge is not in the best interest of small businesses in New Jersey.”

Watch a livestream of the event here.

# # #

For The Many is a statewide coalition of more than 30 organizations working to expand funding for essential services and improve budget practices to meet current and future needs, especially for communities that have been historically left behind.