Critical investments in public assets won’t happen without more public income

To read a PDF version of this report, click here.

To begin rebuilding a strong state economy, New Jersey’s governor and legislators must stabilize the state’s finances and put the Garden State back on track to invest in its competitive assets, which have been largely neglected during a 25-year slide into financial peril. New investments require new revenue that should be tied to much-needed public services and essential investments.

This is the most pressing – and most contentious – of the many problems facing the state’s new governor and legislature. And it can’t be solved by more can kicking, the threat of more spending cuts or misreading the impact of President Trump’s tax revisions. A robust plan for new funding streams is required.

Crucial Public Investments Have Deteriorated

A quarter century of tax cutting, false promises and high-risk financial shenanigans have degraded New Jersey’s economic assets and imperiled its future. How bad has it gotten? Here’s a quick look.

School, municipal and county aid has been sharply reduced after adjusting for inflation, resulting in a steady increase in property taxes

The combination of reduced state aid, steady inflation and property tax caps have led to budget cuts, layoffs of public employees, tacked-on bills for sports and sewers, borrowing to cover annual costs and other financially imprudent – even dangerous – actions by towns, counties and school districts.

Direct property tax relief was slashed during the recession and has not been restored

In 2008, the state budget included $2.8 billion in direct funding to reduce property taxes for eligible aged, disabled or working-class New Jerseyans.[1] By 2012, this had been slashed by 57 percent to just over $1.2 billion, where it has pretty much remained for 7 years[2].

Residential property taxes continue to be the highest in the nation

What politician doesn’t promise “lower property taxes,” almost always without specifying how or what will lower them? Residential property taxes of more than $22.5 billion match the total collected by the state from income and sales taxes, $15 billion of which is dedicated to property tax relief.[3] If even a millionaire’s tax increase affecting only 20,000 of 4 million households is beyond consideration, there is no prospect of significantly reducing property taxes.

New Jersey has shifted the cost of public higher education to students and their families

New Jersey’s public colleges and universities have seen a steady decline of 24 percent since 2010 in state operating aid, when adjusted for inflation.[4] This helps explain the rapidly increasing costs of tuitions and fees at these institutions, and the accompanying growth in student debt. If state support for the operating costs of 4-year public colleges had just kept up with inflation in those costs beginning in 2010, instead of providing $703 million for operating costs for the 2016-17 academic year, the state would have put up just over $1 billion, a gap of 48 percent.[5] And during the same time, the number of students – full-time, part-time and graduate – grew by 10 percent.[6] At county colleges, operating support dropped 18 percent between 2009 and 2017.[7]

NJ Transit – once the national public transit model – is now the nation’s underperformer

State disinvestment in NJ Transit has led the agency to turn more frequently to riders, who now pay the nation’s highest fares for the 2nd worst on-time performance[8][9]. Location is New Jersey’s greatest asset, but if commuter trains to New York and Newark continue their downward slide, the prospects for attracting young families to towns like Ridgewood, Princeton, Summit, Red Bank, Bernardsville and Maplewood with their lively downtowns, excellent public schools and parks are badly diminished.

The state’s budget is unbalanced and its reserve fund is depleted

Next year’s budget begins with having to replace at least $700 million in one-time revenues in this year’s budget and a raid of at least $200 million on a very small reserve to fund Gov. Christie’s opioid treatment campaign. How small is that reserve? New Jersey currently has the third lowest level in the nation – at just 1.3 percent of spending, or enough to fund 4.6 days of operations. The median of the 50 states is 8 percent, enough to fund nearly a month (29.3 days) of operations. And the state’s more permanent “rainy day fund” has been at zero since 2009.[10]

Lawmakers have put New Jersey on the hook for billions in future tax breaks

As the Great Recession receded, New Jersey opted to run the table with a massive set of tax subsidies and little else. Eight years later, the state is in the bottom quintile of states when it comes to economic activity, new job creation and public and private investment. The 2013 Economic Opportunity Act needs to be sharply revised to minimize the harm that this reckless expansion of $5 billion in tax breaks will have over the next few decades and redirect public investments to tried-and-true methods of economic development.

The state is currently unable to fund promised public employee pensions

Since 1994, governors and legislators of both parties have hidden behind the complexity of actuarial calculations to promise pensions and health benefits that they did not bother to fund. New Jersey was the first state to confess to “fraudulent misrepresentation” to the Securities and Exchange Commission for increasing pension benefits by 9 percent financed by funds that didn’t exist. The total owed now exceeds $125 billion ($93 billion for pensions and $34 billion for retiree health benefits). This year alone, the state is $2.5 billion short of the required contribution.[11]

The Big Question: If New Jersey can’t finance the pensions it owes public employees or keep its commuter trains running or even discuss taxing a few thousand millionaires, how can it invest in New Jersey’s crucial assets like great public schools, the nation’s highest-quality preschool program, public colleges and universities or the nation’s 3rd largest public transit system?

Tax Reforms Can Bolster New Jersey’s Economic Future

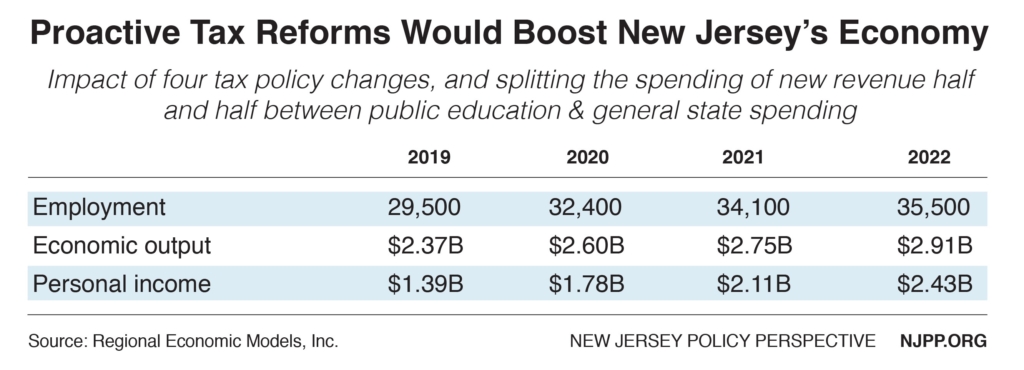

By cleaning up the state tax code, reversing some of the most ill-advised tax cuts of recent years and asking the state’s wealthiest households to pitch in a bit more, New Jersey could raise over $2.5 billion in new revenues that could be invested in the state’s long-neglected assets, putting the state back on the right track.

Like all investments, public investments take time – and dollars – to bear fruit. Policymakers must begin sowing the seeds for restoring New Jersey’s economic prospects and achieving widely shared prosperity now – and they must do so by raising new revenue to make these critical investments. They should start by restoring the tax cuts that Gov. Christie held hostage to signing the overdue financing of the Transportation Trust Fund in 2016.

Return the sales tax to 7 percent and modernize its application ($700 million+)

Most New Jerseyans haven’t been helped by the sales tax reduction by a third of a penny since 2016 (from 7 percent to 6.625 percent).[12] But the loss to the state of $600 million each year counts. For example, that’s near the amount that must be found next year to keep up with the 10-year schedule to fully fund pensions. Moreover, the economy has become more service than goods-oriented, yet the sales tax hasn’t kept up with the times. Expanding the sales tax to more services – such as accounting and interior design – would help modernize the sales tax without punishing low- and moderate-income families.[13]

Restore the estate tax at a threshold of $1 million ($400-600 million)

Under New Jersey’s recently-eliminated estate tax, only about 5 percent of the state’s 70,000 deaths each year triggered an estate tax payment. The new federal tax law doubles the floor on federal estate taxation to $24 million for a wife-husband estate, meaning that most of New Jersey’s wealthy families have nothing to worry about. Restoring the state estate tax with a threshold of $1 million would capture most of the dollars but very few of the estates that formerly were assessed. (In fact, it would recoup 93 percent of the tax revenue the state is now losing, capturing an estimated $5.6 billion over the next decade.[14]) On top of that, it would be sensible to increase the tax rate to capture some of the windfall the wealthiest heirs will get from the federal law.

Make the income tax more equitable by increasing rates on the wealthiest 5 percent of households ($1 billion+)

Increasing income tax rates on New Jersey’s wealthiest families households by creating 4 new income tax brackets and raising the top tax rate (on income over $2.5 million) to 11 percent would make the state’s tax code fairer. This tax increase – which is supported by 3 in 4 New Jersey voters – would be paid almost exclusively by New Jersey’s ultra-wealthy, with the top 1 percent – households with average annual incomes of $3 million – paying 85 percent of the new tax.[15] And even after this change, the wealthiest New Jerseyans would still be paying much less of their incomes on state and local taxes than the bottom 80 percent.

At the very least, policymakers should increase the income tax rate on earnings over $1 million, the so-called “millionaire’s tax” that would raise $600 million or more. The withdrawal of support by the Senate President puts even this modest revenue increase in peril, but does not dilute the fairness or value of it. The argument that its renewal would somehow lead to a loss of revenue defies simple arithmetic and common sense. The number of households with over $1 million in income filing taxes in New Jersey increased from 13,300 in 2005 to 20,600 by 2015, a 55 percent increase, which hardly represents the “exodus” so frequently asserted.[16] And the percentage of households reporting incomes of $500,000 and up increased five-fold in the years 1994 to 2014 (from .4 of 1% to 2%).

Close corporate tax loopholes used by multi-state corporations ($110m to $290m)

“Combined reporting” requires multi-state corporations to file a tax return that captures its business activities in all states in which they conduct business. This approach, which is now in force in 25 of the 45 states with a corporate business tax including such classic “red” states as Texas, Utah and Montana, prevents corporations from transferring profits to states without a business tax or ones with a very low tax rate. Most of New Jersey’s largest corporations are already honoring combined reporting requirements in other states without dire consequences.[17]

Consider recouping a piece of the windfall corporations will receive from the federal tax changes ($500m)

The recently enacted federal tax “reform” is friendliest to corporations, which have been granted a permanent and significant tax cut. It’s sensible for New Jersey to offset some of this windfall by modestly raising the corporate tax rate and investing the new revenue in public assets and services that can boost the state’s economy and help working families get ahead. An increase of 2.5 percent from the current rate of 9 percent would produce approximately $500 million in additional revenues without diluting strongly the federal tax windfall.

These are tax changes that need attention and deliberation if New Jersey is to return to a competitive economic position. Without raising these revenues to restore and expand public investments, New Jersey will continue to be in the bottom 20 percent of states for economic activity and job growth.

Next Tuesday, Gov. Murphy will present his first budget. If it does not call for significant new revenues, then New Jersey is fated to continue on its downward slide of a quarter century without the means to invest in the state’s neglected assets.

Endnotes

[1] New Jersey Office of Management and Budget, Fiscal 2009 Budget in Brief, February 2008. http://www.nj.gov/treasury/omb/publications/09bib/BIB.pdf

[2] New Jersey Office of Management and Budget, The Governor’s FY 2013 Budget Summary, February 2012. http://www.nj.gov/treasury/omb/publications/13bib/BIB.pdf

[3] New Jersey Department of Community Affairs, Property Tax Tables, 2017, http://www.state.nj.us/dca/divisions/dlgs/resources/property_docs/17_data/17taxes.xls

[4] Center on Budget and Policy Priorities, A Lost Decade in Higher Education Funding State Cuts Have Driven Up Tuition and Reduced Quality, August 2017. https://www.cbpp.org/research/a-lost-decade-in-higher-education-funding-state-cuts-have-driven-up-tuition-and-reduced

[5] NJPP analysis of Commonfund Higher Education Price Index, 2017 Update. Available at https://www.commonfund.org/commonfund-institute/higher-education-price-index-hepi/

[6] NJPP analysis of New Jersey Office of the Secretary of Higher Education enrollment statistics. Available at http://www.state.nj.us/highereducation/statistics/index.shtml#ENR

[7] Ibid 5

[8] The Star-Ledger, Boston’s stuck! Beantown rail fleet tops NJ Transit as least reliable, October 2017. http://www.nj.com/traffic/index.ssf/2017/10/nj_transit_trains_are_no_longer_the_least_reliable_in_us_but_its_close.html

[9] The Star-Ledger, Do N.J. rail commuters pay the highest fares in America?, May 2016. http://www.nj.com/traffic/index.ssf/2016/05/nj_rail_riders_still_pay_the_highest_fares_in_america_or_dont_they.html

[10] The Pew Charitable Trusts, State Rainy Day Funds Grow Even as Total Balances Lag, Updated January 2018. http://www.pewtrusts.org/en/multimedia/data-visualizations/2014/fiscal-50#ind5

[11] “State of New Jersey, Debt Report, Fiscal Year 2016, March 2017. http://www.nj.gov/treasury/public_finance/pdf/DebtReportFY2016.pdf

[12] New Jersey Policy Perspective, Poll: Most New Jerseyans Want Bold Solutions on State Taxes, November 2017. https://www.njpp.org/budget/poll-most-new-jerseyans-want-bold-solutions-on-taxes-public-investments

[13] New Jersey Policy Perspective, Modernizing New Jersey’s Sales Tax Will Level the Playing Field & Help the Economy Thrive, February 2018. https://www.njpp.org/budget/modernizing-new-jerseys-sales-tax-will-level-the-playing-field-help-the-economy-thrive

[14] New Jersey Policy Perspective, Fairly and Adequately Taxing Inherited Wealth Will Fight Inequality & Provide Essential Resources for All New Jerseyans, June 2017. https://www.njpp.org/budget/fairly-and-adequately-taxing-inherited-wealth-will-fight-inequality-provide-essential-resources-for-all-new-jerseyans

[15] New Jersey Policy Perspective, Reforming New Jersey’s Income Tax Would Help Build Shared Prosperity, September 2017. https://www.njpp.org/budget/reforming-new-jerseys-income-tax-would-help-build-shared-prosperity

[16] NJPP analysis of New Jersey Treasury Department Statistics on Income data, 2006 and 2017.

[17] New Jersey Policy Perspective, Nearly All of New Jersey’s Largest Employers Already Subject to ‘Combined Reporting’ in Other States, January 2016. https://www.njpp.org/budget/nearly-all-of-new-jerseys-largest-employers-already-subject-to-combined-reporting-in-other-states