Every New Jerseyan deserves to age with dignity, stability, and the ability to remain in their community — no matter their income or housing status. The state has a responsibility to ensure that people aged 65 and over on fixed incomes aren’t pushed out of their homes simply because they can’t afford their housing costs. At the same time, New Jersey must steward its public dollars wisely, prioritizing investments that advance equity and support those most in need.

Unfortunately, the much-discussed Stay NJ proposal to subsidize senior homeowners disproportionately benefits wealthy homeowners, fails to assist senior renters, and costs the state more than a billion dollars annually, with no new revenue source.[1]

This report offers a course correction for policymakers to preserve the intent of Stay NJ to keep senior residents in their homes by focusing resources on those who need help the most and improving the sustainability of the program. The report models the following proposed changes to the program:

- Lower income limits and maximum benefit amounts to focus the program on low- and moderate-income senior households.

- Double the existing senior renter tax credit for seniors from $700 to $1,400.

By refocusing the program on those most likely to experience housing insecurity and adjusting benefit levels for wealthier households, New Jersey can deliver targeted relief without exceeding its budget capacity. The state can also correct for the exclusion of senior renters from Stay NJ, who are much more likely to suffer from housing insecurity and high housing cost burdens than homeowners.[2]

Untangling NJ’s Property Tax Credits

New Jersey has multiple, often-overlapping, property tax benefit programs, but this report focuses on two:

- Affordable New Jersey Communities for Homeowners and Renters (ANCHOR) provides homeowners and renters with set property tax credits, ranging from $450 to $1,500, depending on age and an income cap of $150,000.

- Stay NJ is a new program that will provide homeowners aged 65 and above with a property tax credit worth 50 percent of their property tax bill up to $6,500, with an income cap of $500,000. Stay NJ is scheduled to begin paying out benefits in February 2026.[3]

For more information on these programs, see the New Jersey Division of Taxation website: https://www.nj.gov/treasury/taxation/relief.shtml.

|

Congress seems poised to provide significant tax breaks to the wealthiest in the country, which could substantially decrease revenue in New Jersey.[4] Meanwhile, many of the proposed federal budget cuts will harm our low-income neighbors in the state. For New Jersey to be a place where everyone can thrive, policymakers must make budget decisions that support households most in need and reduce spending on the already-wealthy, many of whom will likely benefit from the federal tax cuts.

Accordingly, New Jersey Policy Perspective recommends two targeted reforms to better align Stay NJ with the state’s fiscal and equity goals.

Proposal 1: Lower income limits and maximum benefit amounts, focusing on low- and moderate-income senior households

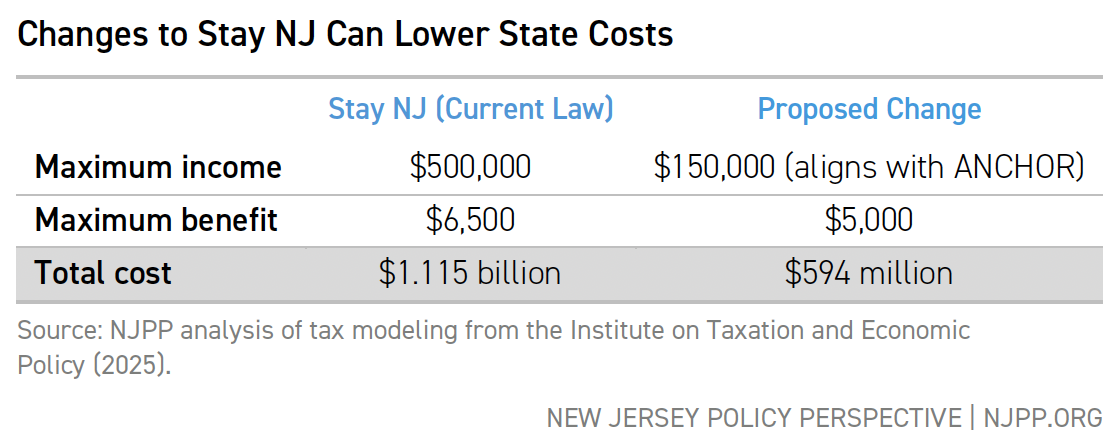

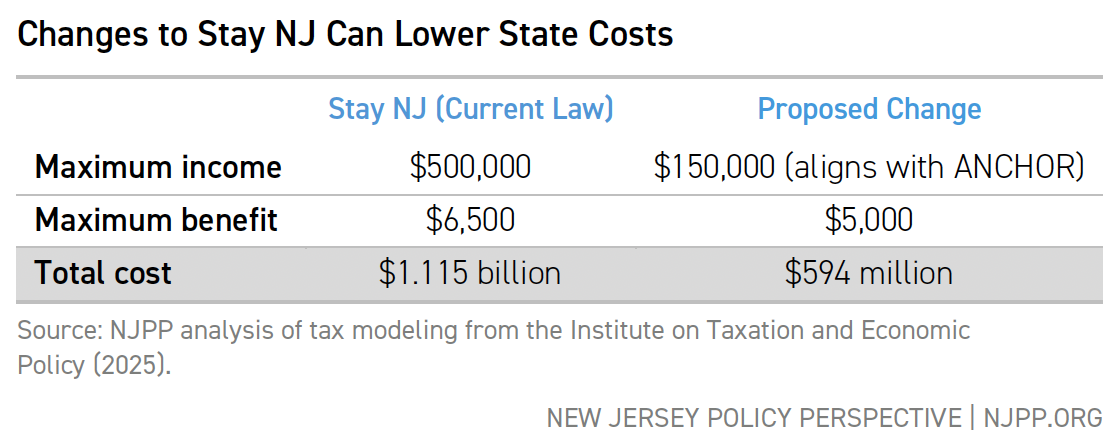

Two modest adjustments to the program’s design would substantially reduce its cost while ensuring that benefits reach low- and middle-income households:

- Reduce the maximum eligible income to $150,000 from $500,000, consistent with the ANCHOR property tax relief program.[5] This prevents the government from subsidizing the top 20 percent of household incomes with hundreds of millions of dollars.

- Lower the maximum benefit from $6,500 to $5,000.[6] This puts the benefit more in line with the state’s average property tax bill and prevents the state from subsidizing higher-value homes, which tend to have higher property tax bills.

These two changes would cut the cost of Stay NJ by $520 million, nearly half its

projected cost.[7]

Importantly, by focusing on reducing the subsidy for wealthier homeowners, this proposal achieves 70 percent of its cost savings by reducing state subsidies going to residents in the top 20 percent of incomes.

These reforms would preserve most of the benefits for moderate-income households while phasing out subsidies for higher-income homeowners. However, because benefits are based on a percentage of property tax amounts, which correlate with home values, benefits would still skew toward those with higher property wealth.[8]

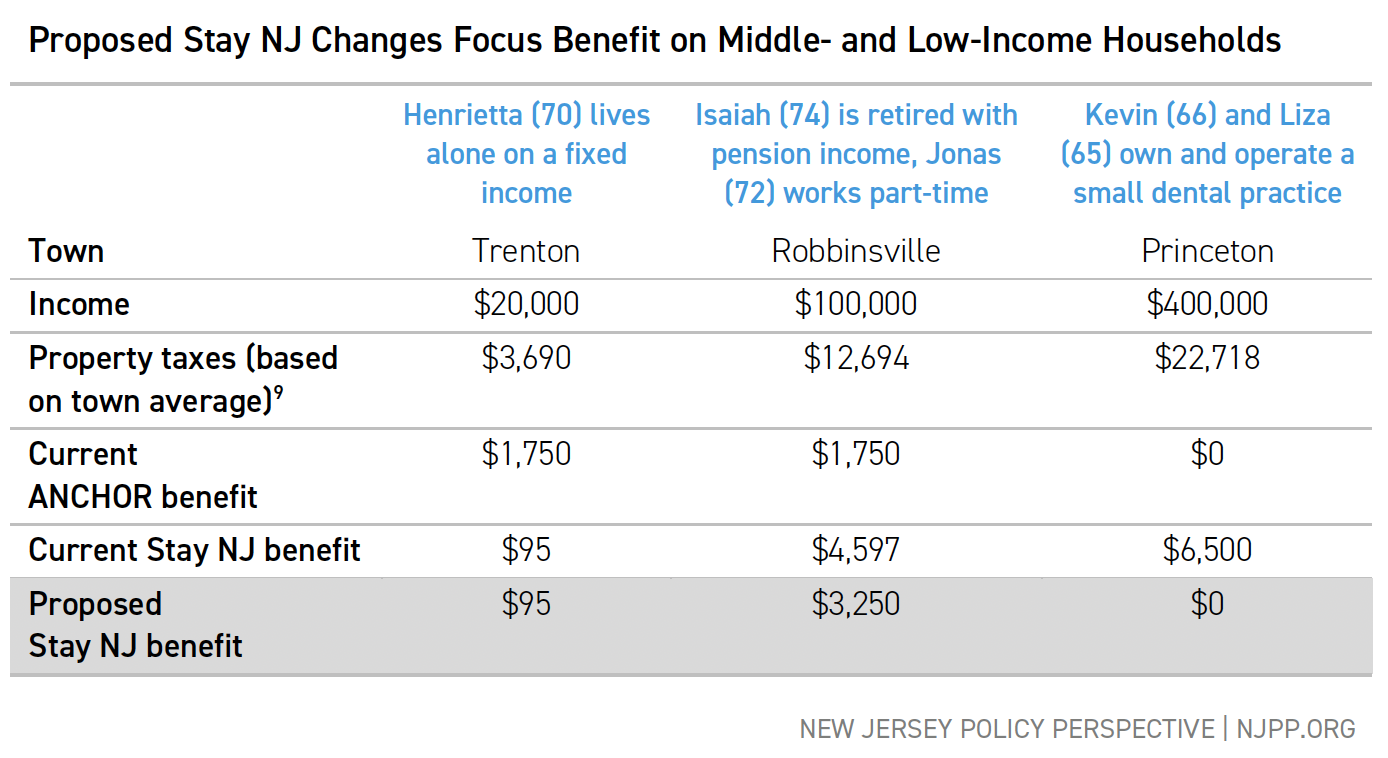

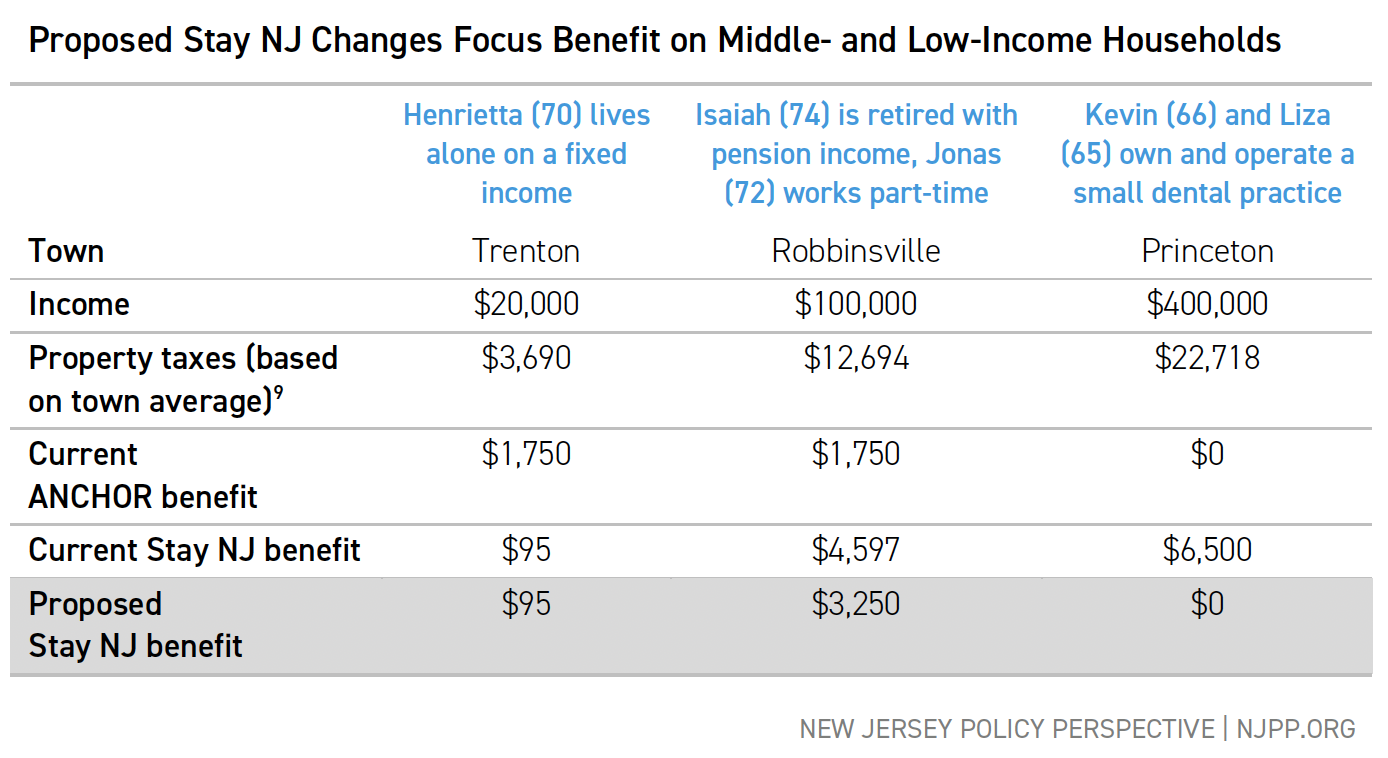

These examples illustrate how this proposal would affect different households.

Under the proposal, Henrietta, a low-income senior with modest property taxes, would see no change in her final tax bill. Isaiah and Jonas, with a higher income and above-average property taxes, would receive a reduced but still substantial benefit. Meanwhile, Kevin and Liza, who have a high income and substantial property wealth, would no longer qualify for a Stay NJ benefit.

Proposal 2: Double the ANCHOR renter benefit for seniors from $700 to $1,400

The current Stay NJ program only benefits people aged 65 and over who own their homes. This restriction of benefits to homeowners is not necessary. Other state property tax benefit programs do provide senior renters benefits: for example, renters aged 65 and older can receive enhanced ANCHOR benefits of $700, a modest increase from the $450 benefit available to renters under age 65.

Senior renters face serious housing insecurity challenges, putting them at higher risk of housing insecurity than senior homeowners. More than 1 in 4 seniors in New Jersey rent but would receive no new benefit from Stay NJ, including over half of Hispanic/Latinx and Black seniors.[10] Nationally, the poverty rate is twice as high for senior renters as for senior homeowners.[11] Renters also have significantly less wealth than their home-owning peers,[12] and nearly 1 in 4 senior renters in New Jersey report it is “very likely” they will lose their home to eviction.[13] However, because StayNJ excludes renters, who represent a substantial percentage of New Jersey’s senior population facing housing insecurity, the proposal fails to support the very people most at risk of losing their homes.

Despite this financial pressure and housing insecurity, Stay NJ limits renters to the $700 ANCHOR benefit, compared to the $6,500 maximum benefit available to homeowners.

At a cost of roughly one-tenth of the entire program ($149 million), doubling the ANCHOR benefit would provide targeted support to low- and moderate-income renters, with nearly 70 percent of the benefits going to households with an annual income of less than $62,000.

Conclusion: A Responsible Path Forward

With the state still facing a $1 billion structural deficit and a shrinking surplus,[14] state policymakers should exercise prudence regarding new spending programs. As New Jersey contends with the possibility of a recession and cuts in federal funding, it must ensure that state funding is directed toward residents who need it most — not to already-wealthy households.

These recommendations offer policymakers a way to refine Stay NJ without abandoning its core intent. While they don’t fix the program’s underlying design flaws, they make it more equitable and fiscally responsible by reducing costs and targeting relief to the seniors most at risk of losing their homes — especially renters, who currently receive the least support. In a challenging fiscal environment, this is a practical and balanced way to preserve the program’s goals.

End Notes

[1] Testimony of Peter Chen, Senior Policy Analyst, New Jersey Policy Perspective, Before Stay NJ Task Force, March 13, 2024, https://www.njpp.org/wp-content/uploads/2024/05/NJPP-StayNJ-Committee-Testimony-03-13-24.pdf

[2] Joint Center for Housing Studies of Harvard University, Housing America’s Older Adults 2023 (2023), p. 16, https://www.jchs.harvard.edu/sites/default/files/reports/files/Harvard_JCHS_Housing_Americas_Older_Adults_2023_Revised_040424.pdf

[3] N.J. Stat. Sec. 54:4-8.75e5.a.(1) (2025).

[4] Lilo H. Stainton, What GOP’s Medicaid Cuts Could Cost NJ, New Jersey Spotlight News, May 20, 2025, https://www.njspotlightnews.org/2025/05/nj-calculates-massive-cost-of-republican-led-medicaid-cuts/

[5] N.J. Stat. Sec. 54:4-8.75b2. For the ANCHOR eligibility threshold, see N.J. Stat. Sec. 54:4-8.61a.

[6] N.J. Stat. Sec. 54:4-8.75c.

[7] NJPP analysis of tax modeling from Institute on Taxation and Economic Policy, 2025.

[8] Testimony of Peter Chen, Senior Policy Analyst, New Jersey Policy Perspective, Before Stay NJ Task Force, March 13, 2024, https://www.njpp.org/wp-content/uploads/2024/05/NJPP-StayNJ-Committee-Testimony-03-13-24.pdf

[9] New Jersey Department of Community Affairs, 2024 Property Tax Information: Municipal Tax Summary (2025) https://www.nj.gov/dca/dlgs/resources/Property_Tax/24_data/24taxes.xls.

[10] U.S. Census Bureau, U.S. Department of Commerce. “Tenure by Age of Householder.” American Community Survey, ACS 1-Year Estimates Detailed Tables, Table B25007, 2023, https://data.census.gov/table/ACSDT1Y2023.B25007?q=age+tenure&g=040XX00US34. Accessed on May 15, 2025.

[11] Diane Elliott, More Than Shelter: How Housing Affordability Is Linked to Older Americans’ Health, Population Reference Bureau, April 9, 2024, https://www.prb.org/articles/more-than-shelter-how-housing-affordability-is-linked-to-older-americans-health/

[12] Jung Hyun Choi, Amalie Zinn, The Wealth Gap Between Homeowners and Renters Has Reached a Historic High, Urban Institute, April 29, 2024, https://www.urban.org/urban-wire/wealth-gap-between-homeowners-and-renters-has-reached-historic-high

[13] U.S. Census Bureau, Household Pulse Survey, Cycle 09, Housing Table 3b. Likelihood of Having to Leave this House in Next Two Months Due to Eviction, by Select Characteristics: New Jersey, Oct. 3, 2024, https://www2.census.gov/programs-surveys/demo/tables/hhp/2024/cycle09/housing3b_cycle09.xlsx.

[14] Nikita Biryukov, Budget experts tell lawmakers revenue projections are up, but there’s no windfall, New Jersey Monitor, May 14, 2025, https://newjerseymonitor.com/2025/05/14/budget-experts-tell-lawmakers-revenue-projections-are-up-but-theres-no-windfall/