New Jersey’s economy has changed in many ways since the 1990s, but the state’s premier social safety net program has remained largely the same. Designed to support families with little to no income, Temporary Assistance for Needy Families (TANF) has not kept up with the rising cost of living or the evolving needs of families with children.

The program maintains outdated administrative barriers that prevent many families from receiving assistance when they need it most.[i] For the families that do qualify, the monthly grant amount remains far too low to cover basic necessities or protect against the harms of deep poverty. By updating the state’s TANF program and raising benefit levels to reflect today’s economic realities, New Jersey can help families build a more stable future for themselves, their children, and their communities.

Supporting families as they navigate financial challenges has far-reaching benefits in both the short- and long-term. Beyond the immediate relief of helping families put food on the table and keep a roof over their heads, having a stable household income increases the likelihood of children succeeding in school, pursuing higher education, and finding good-paying jobs as adults.[ii]

A stronger, more effective safety net would also help address systemic economic disparities across the state. Due to the legacy of policies that prevented people from fully participating in the economy based on their race or gender, women, Black, and Hispanic/Latinx residents of New Jersey have disproportionately lower incomes and are the least likely to afford rising costs in housing, transportation, health care, and other essential needs.[iii]

To address rising costs, deep-seeded inequities, and ensure that TANF fulfills its intended purpose, New Jersey must raise the monthly grant amount to at least 50 percent of the federal poverty level. Additionally, grant amounts should be adjusted for inflation so the program remains an effective safety net in future years. These reforms would promote stronger families and more resilient communities where everyone has the resources they need and deserve.

TANF Grant Amounts Fall Short in Today’s Economy

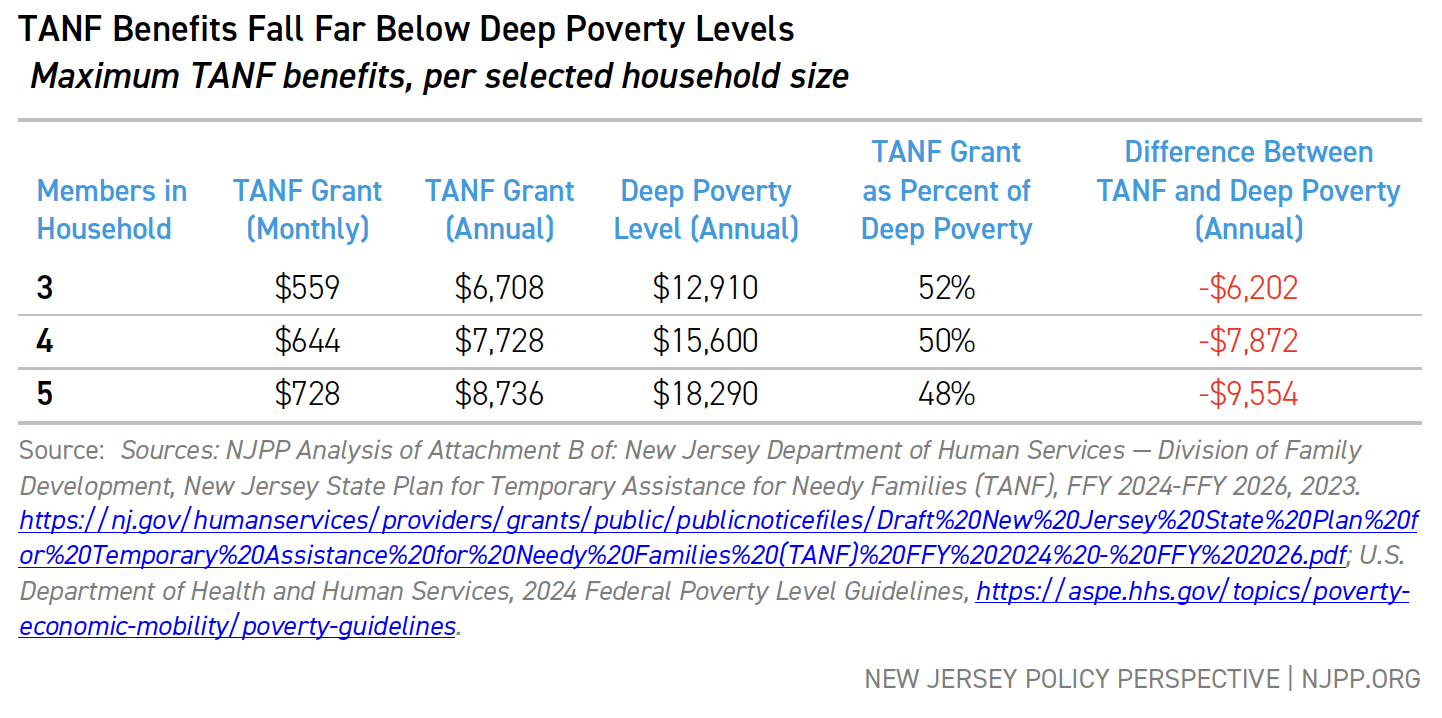

Targeted to families with the lowest incomes, New Jersey’s TANF program falls significantly short of meeting even the most basic needs, let alone enabling families to break the cycle of poverty and become self-sufficient. The current TANF grant only amounts to half of what the federal government considers “deep poverty,” which is 50 percent of the federal poverty level.[iv] Put another way, the current TANF grant in New Jersey is equal to only one-fourth of the federal government’s threshold for living in poverty. It’s worth noting that these are nationwide metrics that do not account for geographic differences in the cost of living, so this significantly undercounts the number of people living in poverty in states like New Jersey, where costs are higher.

For a family of three, the TANF monthly grant provides a maximum of $559 per month – only about $6,708 per year.[v] This is more than $6,000 below the deep poverty level.[vi] When accounting for the actual cost of living in New Jersey, a single parent with two children needs roughly $86,759 per year in order to meet their basic needs.[vii] Even excluding child care costs, a single parent with two children needs almost $63,000 per year, more than twice the federal poverty level for a family of three, to cover bills.[viii]

New Jersey’s low TANF amount has little purchasing power in today’s economy, especially compared to when the program was created. Since 1998, New Jersey’s TANF grant has lost approximately 30 percent of its value.[ix] As a result, the assistance that a family receives each month — which used to cover the average cost of groceries with enough left over to help pay other bills and living expenses like rent — now barely covers the average cost for the month’s groceries.

Without adjusting for inflation each year, families living in poverty receiving TANF cannot keep up with rising living costs to meet basic needs. Additionally, as this minimal support diminishes over time, the burden of the onerous and time-intensive application process makes it more likely that eligible families may never even apply.[x]

It’s Time to Provide Families with Enough Support to Build Their Futures

After nearly three decades, it’s time to finally update New Jersey’s TANF program so it’s a more effective safety net for families when they fall on hard times. While the program requires broader reforms to lower administrative barriers to access and eligibility, raising the grant amount is an easy and logical first step. The program’s current grant amounts are far too low, putting the health and well-being of low-income families at risk, and their ability to break the cycle of poverty out of their reach. The lack of financial assistance exacerbates housing insecurity, intensifies food insecurity, and limits access to essential health care services.[xi] Consequently, children growing up in poverty face greater challenges in school, hindering their prospects for a prosperous future and perpetuating intergenerational cycles of poverty.[xii]

In confronting the harms of deep poverty as costs continue to rise, policymakers must recognize the urgency of updating the state’s TANF program: Each day of delay for families can make a life-changing difference. By increasing the TANF grant amount, New Jersey can reaffirm its commitment to a stronger and fairer society where families have the resources necessary to overcome financial hardship and build a stable future.

End Notes

[i] While this report focuses on TANF monthly grant levels and how they are insufficient in helping families escape deep poverty, there are numerous administrative reforms needed to reduce barriers to assistance and eligibility. These include smoothing the off-ramps so that individuals do not face such steep cliffs for assistance, lowering administrative barriers to applications and documentation for the program, improving eligibility levels to better match today’s economic realities, and more. These reforms are further discussed in New Jersey Policy Perspective’s 2020 report, Promoting Equal Opportunities for Children Living in Poverty, https://www.njpp.org/publications/report/promoting-equal-opportunities-for-children-living-in-poverty/, as well as in testimony provided by New Jersey Policy Perspective to the New Jersey Legislature. These testimonies can be found on the NJPP website, such as: https://www.njpp.org/publications/testimony/its-time-for-new-jersey-to-fix-workfirst-nj-to-better-support-low-income-families/

[ii] Center on Budget and Policy Priorities, Economic Security Programs Help Low-Income Children Succeed Over Long Term, Many Studies Find, 2017. https://www.cbpp.org/research/poverty-and-inequality/economic-security-programs-help-low-income-children-succeed-over

[iii] Rutgers University – New Jersey State Policy Lab and the Center for Women and Work, Who Experienced the Greatest Financial Burden from Inflation in New Jersey? An Examination of Spending, Earnings, and Employment, 2023. https://policylab.rutgers.edu/report-release-who-experienced-the-greatest-financial-burden-from-inflation-in-nj/

[iv] UC Davis Center for Poverty & Inequality Research, What is “Deep Poverty”?, 2022. https://poverty.ucdavis.edu/faq/what-deep-poverty; Center on Budget and Policy Priorities Priorities, Chart Book: Temporary Assistance for Needy Families (TANF) at 26, 2022. https://www.cbpp.org/research/family-income-support/temporary-assistance-for-needy-families-tanf-at-26

[v] NJPP Analysis of data in Attachment B of: New Jersey Department of Human Services — Division of Family Development, New Jersey State Plan for Temporary Assistance for Needy Families (TANF), FFY 2021-FFY 2023, 2020. https://www.state.nj.us/humanservices/dfd/programs/workfirstnj/tanf_2021_23_st_plan.pdf

[vi] NJPP Analysis of Attachment B of: New Jersey Department of Human Services — Division of Family Development, New Jersey State Plan for Temporary Assistance for Needy Families (TANF), FFY 2024-FFY 2026, 2023. https://www.nj.gov/humanservices/providers/grants/public/publicnoticefiles/Draft%20New%20Jersey%20State%20Plan%20for%20Temporary%20Assistance%20for%20Needy%20Families%20(TANF)%20FFY%202024%20-%20FFY%202026.pdf; U.S. Department of Health and Human Services, 2023 Federal Poverty Level Guidelines, https://aspe.hhs.gov/topics/poverty-economic-mobility/poverty-guidelines

[vii] It is important to note that this assumes approximately the same costs for the goods and services in terms of their portion of the bills since the original report, as it is only updated to account for inflation. Note that the pandemic led to a significant increase in prices and, for some services and goods, a significant change that far outpaced that of inflation. This means that these true poverty level estimates are likely conservative estimates. Sources for calculation: NJPP Analysis of Legal Services of New Jersey, True Poverty: What It Takes to Avoid Poverty and Deprivation in the Garden State, 2021, pg. 23. https://proxy.lsnj.org/rcenter/GetPublicDocument/00b5ccde-9b51-48de-abe3-55dd767a685a; Legal Services of New Jersey, New Jersey True Poverty Tracker: A Poverty Benchmarks Report Series, 2022. https://proxy.lsnj.org/rcenter/GetPublicDocument/380358ae-ad82-43a2-8e35-cd243030dbbc.

[viii] NJPP Analysis of data from the Federal Poverty Levels (https://aspe.hhs.gov/topics/poverty-economic-mobility/poverty-guidelines) and Legal Services of New Jersey, True Poverty: What It Takes to Avoid Poverty and Deprivation in the Garden State, 2021, pg. 28. https://proxy.lsnj.org/rcenter/GetPublicDocument/00b5ccde-9b51-48de-abe3-55dd767a685a

[ix] NJPP Analysis of New Jersey state budgets and Department of Human Services report on grant amounts and inflation rates.

[x] Urban Institute, Few Families Receive the TANF Cash Assistance They’re Eligible For, 2023. https://www.urban.org/urban-wire/few-families-receive-tanf-cash-assistance-theyre-eligible

[xi] There are numerous studies and reports showing the connections between poverty and various outcomes, as well as how the effects of each issue are intertwined. See for example: Institute for Research on Poverty, Unaffordable America: Poverty, Housing, And Eviction, 2015. https://www.irp.wisc.edu/resource/unaffordable-america-poverty-housing-and-eviction/; Feeding America, Food Insecurity among Overall (all ages) Population in New Jersey, 2023. https://map.feedingamerica.org/county/2021/overall/new-jersey; Health Affairs, Health, Income, & Poverty: Where We Are & What Could Help, 2018. https://www.healthaffairs.org/do/10.1377/hpb20180817.901935/; Health Affairs, Economic Well-Being And Health: The Role Of Income Support Programs In Promoting Health And Advancing Health Equity, 2022. https://www.healthaffairs.org/doi/10.1377/hlthaff.2022.00846; New Jersey Hospital Association, New Jersey’s Most Vulnerable Communities: A Zip Code Analysis of Social Gaps and Their Impact on Health, 2019. https://www.njha.com/media/578105/CHART-NJ-Most-Vulnerable-Communities.pdf; Center for Budget and Policy Priorites, Chart Book: Housing and Health Problems Are Intertwined. So Are Their Solutions, 2022. https://www.cbpp.org/research/health/housing-and-health-problems-are-intertwined-so-are-their-solutions

[xii] For a summary of these effects, please see: The Center for Law and Social Policy, The Enduring Effects of Childhood Poverty, 2023. https://www.clasp.org/blog/the-enduring-effects-of-childhood-poverty/