From the rubble of a chaotic legislative process rises a record-breaking state budget that funds the immediate needs of New Jersey’s pandemic recovery, invests in key public assets, and pays down billions of dollars of current and future debt. Buoyed by stronger-than-expected income and sales tax collections, the $46.4 billion spending bill is approximately 15 percent bigger than last year’s budget. A large portion of the unexpected surplus is directed toward long-standing obligations like the public employee pension system and debt service on borrowing — as it should. By almost every metric, this budget sets the foundation for a strong recovery and addresses fiscal issues that have plagued the state for decades. At the same time, the Fiscal Year (FY) 2022 budget misses a significant opportunity to enact bold, transformative changes that directly address centuries of racial and economic inequities that were exacerbated by the pandemic.

Almost everything that was first proposed by Governor Murphy back in February remains in the final budget, plus an additional $1.5 billion in appropriations. The state’s $10 billion surplus allowed lawmakers to strengthen programs that benefit low- and moderate-income residents, including early childhood intervention, pediatric behavioral health, wage increases for homeless shelter staff, reentry programs for individuals released from prison, summer youth programs, and services for domestic violence survivors. While things like Little League turf field renovations get outsized attention for their frivolous nature when juxtaposed against pandemic-induced challenges, these so-called “Christmas tree” items comprise less than a quarter of the last-minute additions to the budget, and many of these appropriations address critical local infrastructure needs.

And yet, the budget continues to leave far too many residents behind in the state’s pandemic recovery. Nearly half a million undocumented immigrants have been excluded from almost every form of state and federal relief for the past 15 months, and that trend continues with this budget bill — despite a multi-billion dollar surplus. The Fund for Excluded New Jerseyans, a modest cash assistance program, was established using $40 million in federal CARES Act dollars, but it will only reach a fraction of individuals and families excluded from federal relief programs.[i]

Fortunately, there are additional federal relief dollars to help the state invest in key areas that suffered during the pandemic and recession, including additional relief for excluded workers. The American Rescue Plan (ARP) passed by Congress provides a pandemic recovery roadmap with significant aid that can fund specific services like rental relief, food assistance, child care, and public education so that schools can safely reopen and help students recover from a difficult year. Additional federal aid is also available for a broader set of state-level purposes within the framework of a strong, inclusive, and equitable recovery. About a third of these flexible federal dollars ($1.86 billion) are included in the final state budget to help keep families safe in their rental homes, improve schools’ HVAC systems and offer disabled students an extra year of special education, enable hospitals to better serve low-income communities, and support child care facilities respond to growing demands.

Once the federal aid is gone, however, many of New Jersey’s structural deficiencies will remain. The school-aid formula that dictates state funding to K-12 school districts remains underfunded, and NJ Transit will again raid $360 million from its capital fund to pay for operating expenses due to chronic underfunding and no dedicated source of support. These bellwethers reveal an inconvenient reality: Despite the sheer size of this year’s budget, New Jersey is still struggling to meet its existing obligations fully.

Preparing for the future means taking a multi-year approach to the state’s obligations and assessing whether there are enough resources to meet them. Similarly, living up to our stated values of racial equity and economic justice will require a much more transparent and inclusive budget process. These changes would ensure more meaningful community engagement, help make sure already marginalized communities are not further left behind, and provide the necessary time for lawmakers to fully understand the budget before they vote on it.

Pension and Savings

Historic Pension Payment

Thanks to strong revenue collections, New Jersey is making its first full contribution to the public pension fund in 25 years. At $6.9 billion, the payment is over 40 percent larger than last year’s. This is not only the right thing to do for retirees and their families, it’s also smart budget policy, making the fund more secure and improving the state’s credit rating, which in turn lowers the cost of borrowing. New Jersey’s funded ratio — the value of plan assets in proportion to pension obligation — plummeted over the last three decades as the state decreased its contributions to the retirement system to cover budget shortfalls and avoid fair tax policies.

This year’s historic contribution is the third consecutive record payment into the retirement system. Though the state still has a long way to go in closing chronic shortfalls. At the end of FY 2020, New Jersey’s pension system held in its coffers just 58 percent of what was owed to retired state and local government workers.

Rainy Day Fund

New Jersey’s budget reserves were near-empty at the start of the pandemic and were quickly wiped out to make up for cratering revenue collections. The anemic state of the emergency fund was the result of lawmakers’ failure to replenish it in the wake of the Great Recession, instead relying on it to make ends meet without raising taxes. The Murphy administration deposited $421 million into the rainy day fund in FY 2019, representing the first payment into the fund in over a decade. Yet, despite the influx of extra revenue this year and the legislature intending to set aside $1.3 billion for such a purpose, the rainy day fund will remain empty leaving the state’s finances vulnerable to unexpected downturns and natural disasters once again. Investing in this reserve can make the difference between falling back on drastic budget cuts and advancing equity. Without this proven best practice, New Jersey will continue to fall short of building a state economy that works for everyone.

Debt Defeasance

The final budget also establishes the New Jersey Debt Defeasance and Prevention Fund, equal in size to the roughly $4 billion the state borrowed last fall through an emergency sale of general-obligation bonds. This fund will address $2.5 billion in current debt and set aside $1.2 billion for future infrastructure projects. Given how the fiscal emergency that sparked the borrowing never materialized, this debt fund acts as a compromise to ensure long-term debt repayment is a major priority.

Education

Strong public schools are necessary for setting kids up for success and maintaining a well-educated workforce. This requires steady investments in education, from pre-kindergarten through college. What will be particularly challenging for the upcoming school year is dealing with the disruption and loss from the COVID-19 pandemic. And school districts must figure out how much their students have missed and how to address it. While the FY 2022 budget provides a boost to the Department of Education (DOE), targeted investments will need to be made to ensure equitable recovery for all kids. Overall, DOE will receive $18.04 billion, a 55 percent increase over FY 2010 levels and a 27.2 percent increase over FY 2018 levels when Governor Murphy took office.

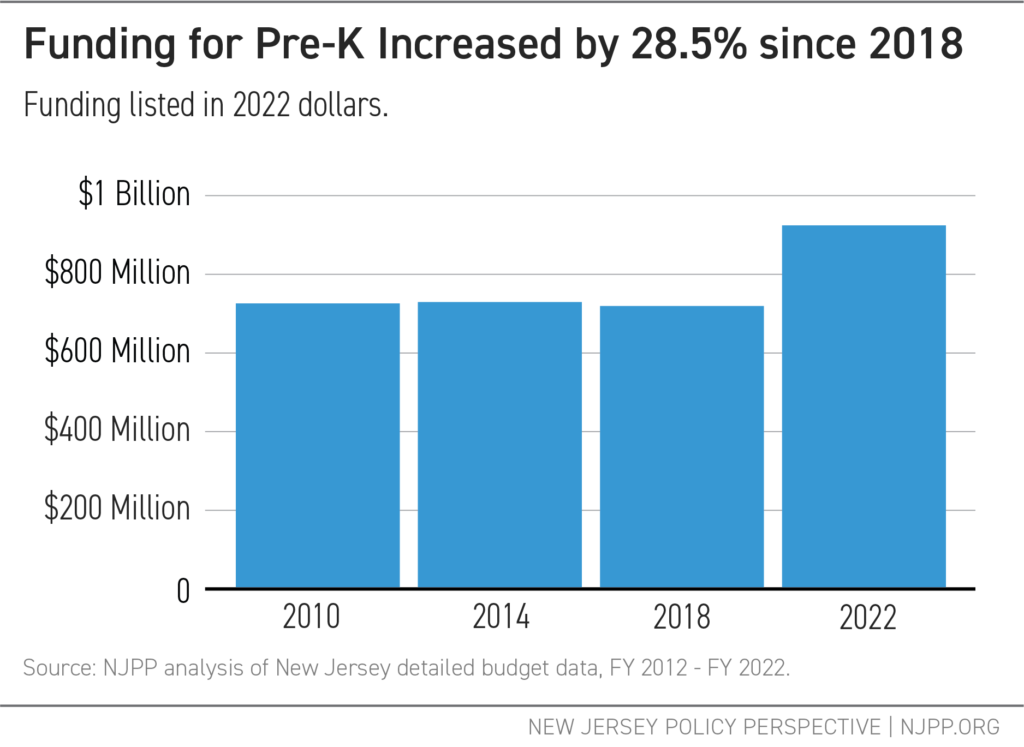

For public K-12 schools, the state provides nearly $9.3 billion for FY 2022, a $578 million increase over 2021 levels. However, some districts will lose funding due to recent changes made to the school funding formula and how it distributes aid. Notable increases for education include support for pre-K expansion and funding for kids with disabilities. For pre-K, the budget provides $924.2 million, a $50 million increase from last year, $26 million of which will go to new programs in 30 new districts ready to launch their pre-K programs. For students with disabilities, the budget provides $1.01 billion for Special Education Categorical Aid (SECA) and $400 million for Extraordinary Special Education (ESP).

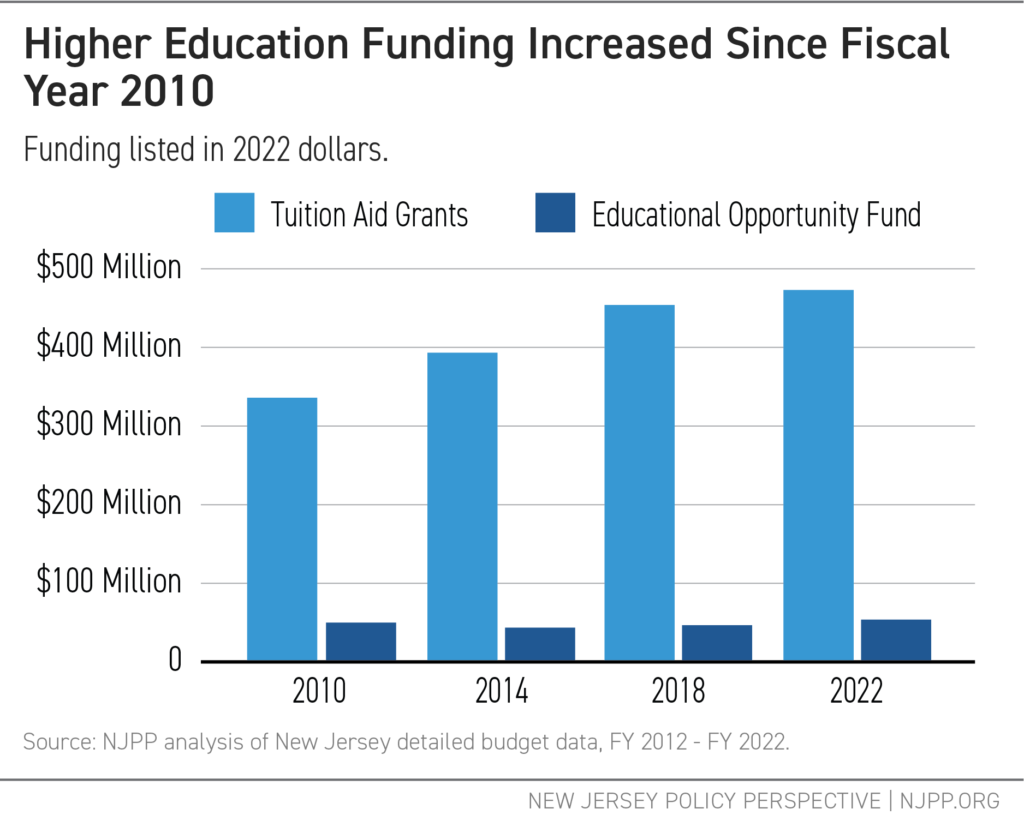

Higher Education

A majority of states have cut funding for higher education since the Great Recession, fueling a college affordability crisis across the nation, including here in New Jersey. Thankfully, the FY 2022 state budget increases support for students with the greatest financial needs. Specifically, the budget provides $472.9 million for Tuition Aid Grants (TAG) for full-time undergraduate students enrolled in an approved degree or certificate program. About one-third of the state’s undergraduates receive support through this program.[ii] The budget also provides $54.3 million for the Educational Opportunity Fund (EOF), which offers students financial assistance and support services like counseling and tutoring.

Additionally, the budget appropriates $5 million for the implementation of a new program, the Garden State Guarantee Initiative, which will help students with household incomes below $65,000 pay for tuition and fees for two years at any of New Jersey’s four-year public colleges or universities. The program will fill the gap left by the state’s free community college program, which already funds two years of tuition and fees at community colleges for low-income students.

Despite these investments in tuition assistance, tuition and fees are still slated to increase in the upcoming school year, with Rutgers University increasing tuition and fees by 2.6 percent for the 2021-2022 academic year.[iii]

Health

All New Jerseyans, regardless of race, gender, immigration status, income, or ability, deserve comprehensive and affordable health care. The FY 2022 budget reflects this growing recognition of health as a human right with big investments aimed at increasing access to care. This includes an additional $25 million toward subsidies on the state health insurance exchange (GetCovered NJ), which has proven successful at boosting health insurance enrollment. Taken together, the state’s health investments show lawmakers’ commitment to addressing the current health crisis, particularly among residents of color who have disproportionately suffered from the effects of COVID-19. Even so, the investments in this year’s budget must be maintained and expanded to build a stronger and healthier future for all New Jerseyans.

Cover All Kids

Even before the pandemic hit, more than 80,000 children in New Jersey lacked access to health insurance. This budget changes that. The new state budget invests $20 million toward providing health coverage to all kids by reducing many barriers keeping children uninsured. Specifically, the Cover All Kids initiative eliminates both premiums and enrollment waiting periods in the Children’s Health Insurance Program (CHIP) and expands outreach efforts to encourage families to enroll their children. It also establishes a new buy-in program for children ineligible for NJ FamilyCare due to immigration status or income limits, paving the way for universal coverage once the program goes into effect next fiscal year.[iv]

Charity Care and Medicaid Expansion

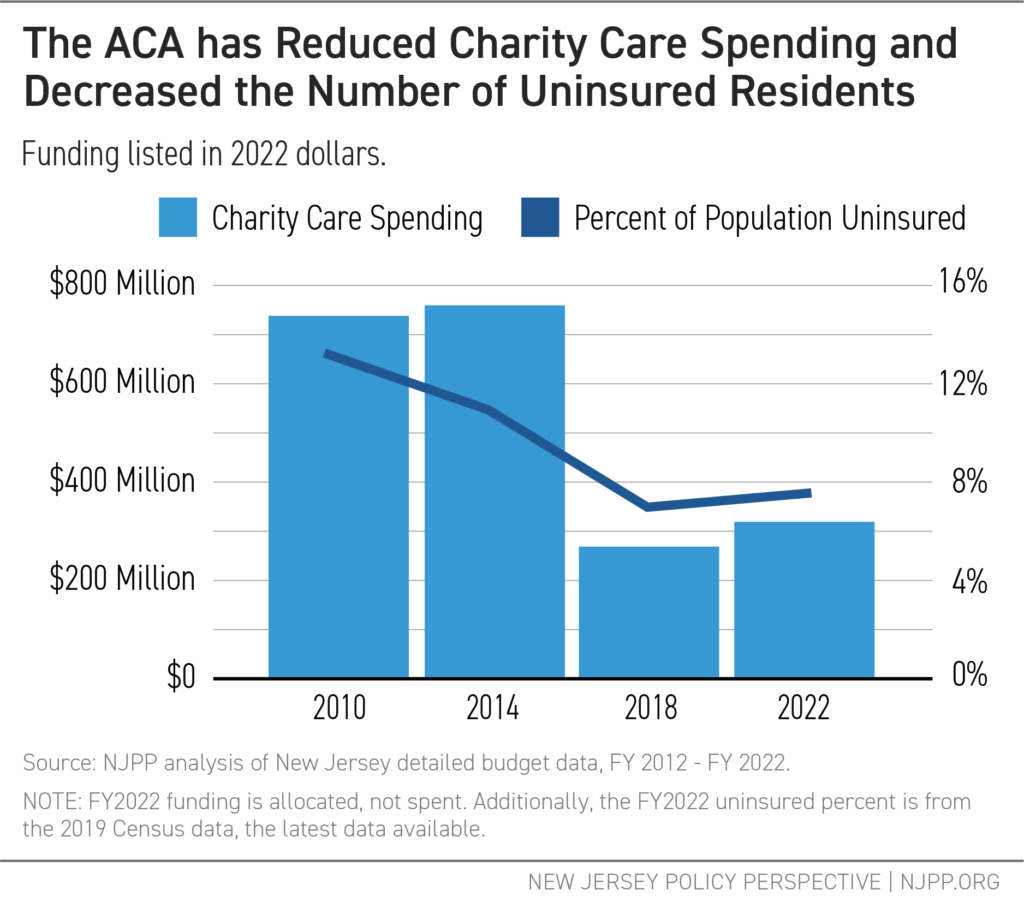

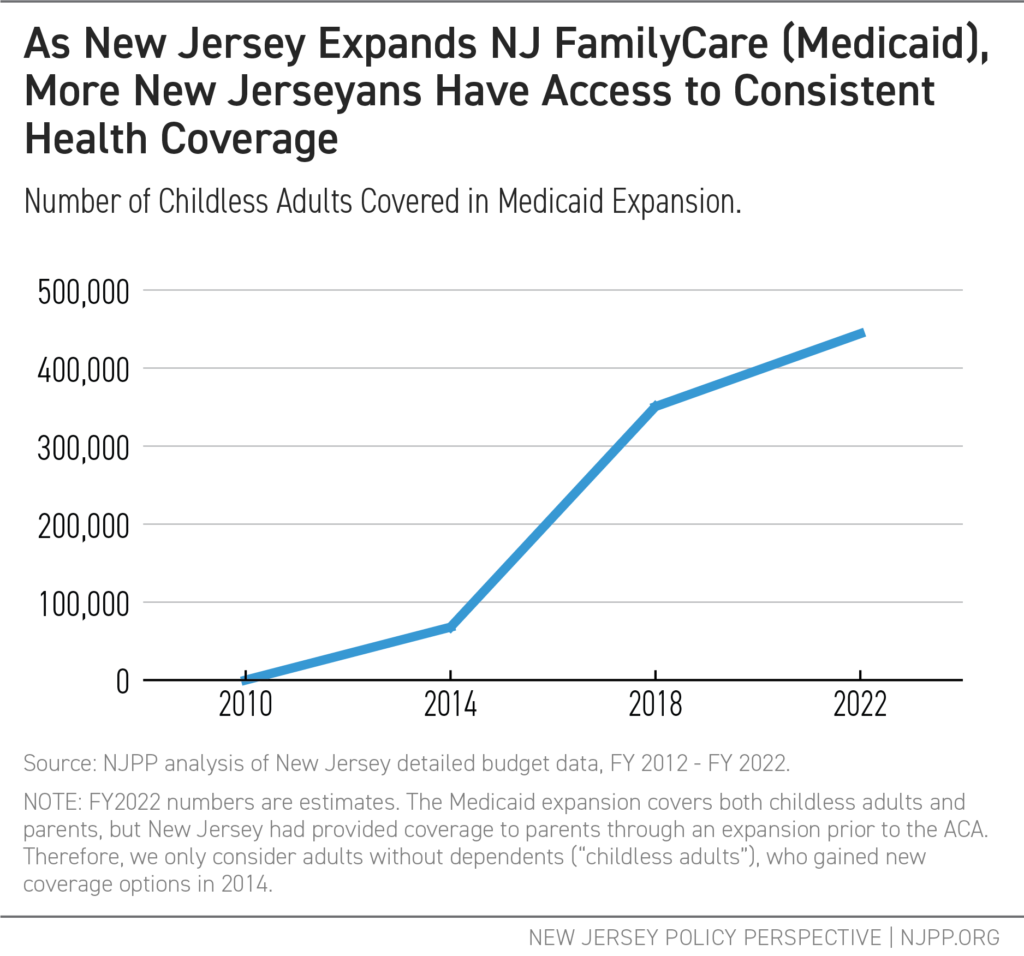

After New Jersey expanded Medicaid in 2014, state funding has shifted away from Charity Care — which covers some uncompensated care provided to uninsured patients at hospitals — and toward expanding coverage offered through the NJ FamilyCare (Medicaid) program. This expansion has reduced the number of uninsured individuals, stabilized uncompensated care payments, and helped address public health issues, including racial inequities. During the COVID-19 pandemic, these coverage options have been critical, especially for families of color.[v]

The benefits of this shift helped keep residents with low incomes insured during the COVID-19 pandemic. Investing in NJ FamilyCare is not only good for public health but also for the state’s finances: through the Affordable Care Act (ACA), the federal government provides greater matching funds to states for Medicaid expansion than it does for Charity Care.[vi] While the state still needs to better address the many effects of historical and current systemic racism on health, the ACA’s provisions have supported significant steps toward a healthier, more equitable future.

Graduate Medical Education

An ongoing shortage of doctors in New Jersey limited the state’s response to the pandemic. Without adequate funding for training new and more doctors of diverse backgrounds, the state will continue to struggle with cultural competency and meeting the needs of communities of color. The Graduate Medical Education (GME) program covers costs associated with training more doctors using a mix of federal and state funding.

Funding for GME is approximately three times higher than it was in FY 2010. However, funding has remained flat since FY 2019, which amounts to a cut when considering inflation. Of the total $242 million appropriated for GME, $218 million is distributed across all teaching hospitals, and an additional $24 million, known as Graduate Medical Education Supplemental, is distributed to the 14 hospitals that serve the highest proportion of Medicaid enrollees.[vii] Without more stable federal funds to supplement these investments, more state dollars are needed to expand New Jersey’s health care workforce.

Harm Reduction Services

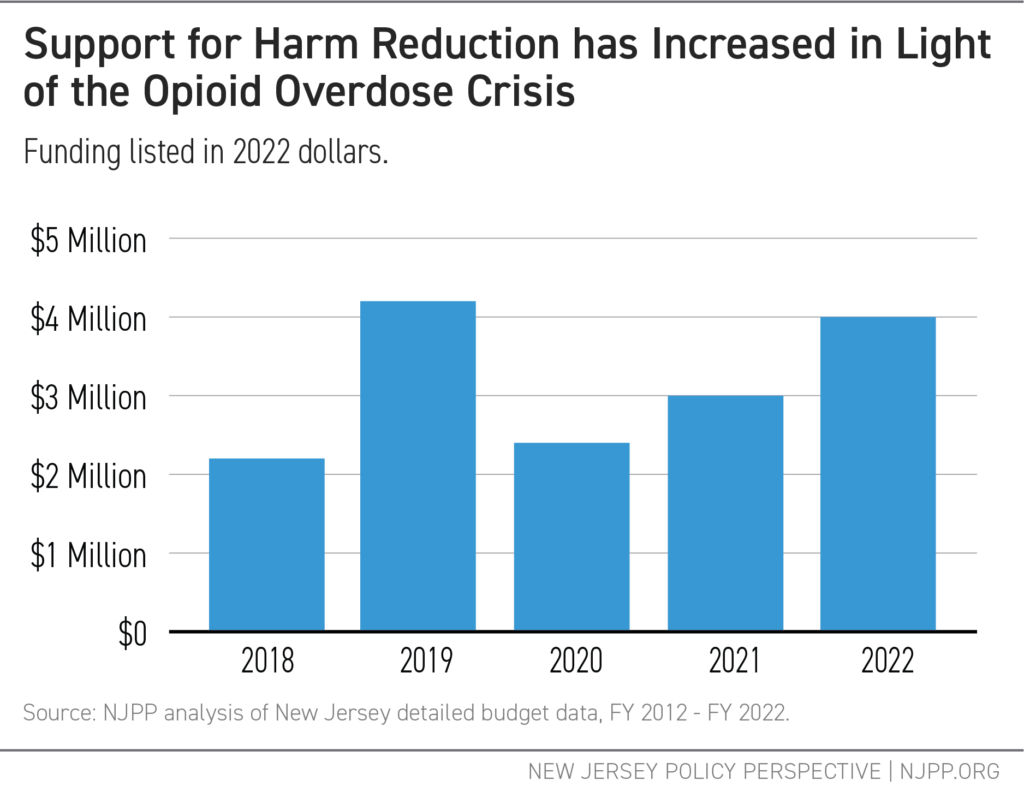

All New Jerseyans who use drugs deserve access to the care that best fits their needs. With the ongoing public health emergency of the opioid overdose crisis, the state should move away from punitive measures and provide individualized support for people who use drugs. In this vein, the state has provided additional funding to harm reduction initiatives over the past several years. This year the Syringe Access Program receives $4 million, almost double what it received in FY 2018.

Yet, every year the program fails to spend its budget fully due to a lack of local participation. For new harm reduction centers to open, local governments must pass an ordinance allowing the program to operate. This results in the unnecessary politicization of lifesaving public health services and limits the number of sites; as it stands, only seven harm reduction centers exist in the state, despite the need for far more. With a lack of action from municipal authorities, the program will continue failing to meet its full potential.

Reproductive Health Services

All New Jersey families have the right to determine the best health care plan for them to thrive. This includes having access to family planning and other reproductive health services. The budget builds on New Jersey’s long history of protecting reproductive rights by funding contraceptives and prenatal care for undocumented individuals, extending Medicaid coverage for postpartum care from 60 days to 365 days, and securing universal coverage for a home visit within two weeks of birth for all parents. The budget also establishes a $2 million pilot rental assistance program for pregnant individuals. These provisions build upon the administration’s goal to reverse New Jersey’s dismal maternal mortality rates among Black women. However, more must be done to make reproductive health services accessible and affordable. The Reproductive Freedom Act (S3030/A4848) would do just that, but it is currently stalled in the Legislature.

Housing

The current health and economic crises have deepened barriers to stable housing, particularly for people who do not own their homes, Black and Hispanic/Latinx residents, and people with low incomes.[viii] To provide support during the immediate housing crisis, $466 million in new dedicated federal funds is now available for rental assistance. New Jersey will augment that emergency rental assistance fund with an additional $500 million, using flexible federal dollars allocated in the ARP. About $326 million has also been allocated to New Jersey through the ARP to assist unemployed homeowners.[ix]

Both state and federal dollars are also being used to expand access to safe and affordable housing. In the state budget, lawmakers preserved the full funding of the Affordable Housing Trust Fund, which helps municipalities and developers finance the construction of new, affordable homes throughout the state. In years past, these funds have been repeatedly diverted to cover the costs of other programs, contributing to the current affordable housing shortage of more than 200,000 units.[x] The budget also includes substantial investments in reducing lead exposure in homes, including $10 million for lead paint remediation programs.

Immigrants’ Rights

Legal Representation

All New Jersey residents deserve access to due process. Many immigrants, however, are forced to navigate the immigration system without access to legal representation. As a result, many immigrants are separated from their families and communities or detained in inhumane conditions. This year’s budget includes funding for two programs that improve access to legal counsel for these immigrants. The budget will increase funding by one-third for legal assistance to individuals facing detention or deportation, up from $6.2 million in FY 2021 to $8.2 million. In addition, the FY 2022 budget includes a new program that will fund legal representation and case management for unaccompanied minors and other immigrant youth. By expanding access to legal representation, this budget should help keep more families together.

Pandemic Relief for Excluded Workers

The current health and economic crises have increased financial hardship, especially for undocumented workers who are disproportionately represented in service sector jobs which has been hardest hit by the pandemic. While most people have been able to rely on public programs like unemployment insurance to make ends meet, many New Jersey workers are ineligible for these programs. Several states have taken meaningful steps to address these gaps; however, New Jersey has not allocated state dollars to assist residents excluded from other forms of relief. In May 2021, Governor Murphy announced a $40 million fund to support excluded workers using federal aid from the CARES Act. However, this amount falls far short of the need.[xi] With a substantial surplus, lawmakers could have dedicated funding in the FY 2022 budget to ensure that all New Jerseyans are able to cover the cost of basic needs. Instead, lawmakers ignored the calls of excluded workers and missed a big opportunity to support a stronger and more inclusive recovery.

Corrections and Reentry

Prison Operation

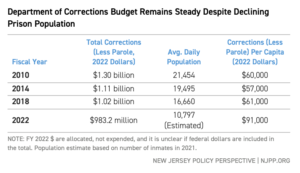

New Jersey has made significant progress towards incarcerating fewer residents over the last five years, largely due to bail reform. Yet the state continues to allocate large sums of money to prison operations under the New Jersey Department of Corrections (NJDOC). Since FY 2010, total state spending on corrections has remained steady at approximately $1 billion per year. On a per-capita basis, however, New Jersey will spend an estimated $91,000 per person incarcerated in FY 2022, up from $60,000 in FY 2010. With a prison population half of what it was in FY 2010, the state should assess whether this level of funding is still necessary — and whether opportunities exist to transfer these funds to other initiatives better-proven to increase public safety, like crisis intervention teams, mental health treatment, and harm reduction.

Parole and Reentry Services

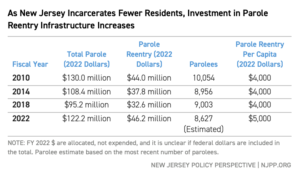

As New Jersey incarcerates fewer residents, the state will need robust and compassionate reentry services for those leaving prison. The budget takes important steps toward building this reentry infrastructure through an expansion of medication-assisted treatment (MAT) as well as the creation of county-level reentry coordinators.[xii] The parole reentry programs, however, are unnecessarily punitive. The majority of dollars are used for surveillance, and reentry services issued through the Department of Corrections to parolees are often involuntary.

The table below compares the investments in parole reentry programs through the Department of Corrections over the last decade.[xiii]

Reentry services are also funded through the Department of Community Affairs, which provides grants to nonprofit organizations and community-based reentry programs. Unlike the reentry services provided through the parole programs administered by NJDOC, these take a less punitive approach and are more accessible. For FY 2022, these reentry programs received just over $30 million, a boost of $7 million over what the governor proposed earlier this year.

Relief for Working Families

Unemployment Insurance

The COVID-19 pandemic has highlighted the critical challenges facing the unemployment insurance system. The state has received an unprecedented 2.2 million initial unemployment claims and paid out $29.9 billion in federal and state unemployment benefits since March 2020 using a 40-year old computer system.[xiv] Underlying many of the problems with processing claims is that the federal unemployment system is itself antiquated and does not reflect the realities of a modern economy, resulting in confusion and unnecessary delays.

To help improve and modernize the processing of unemployment insurance benefits, the budget doubles funding from $3.9 million in FY 2021 to $7.8 million and allocates $10 million in federal dollars for this purpose. Some legislators have called for an even larger allocation. In light of progress toward a comprehensive upgrade to the federal unemployment system in the near future, however, the New Jersey Department of Labor has indicated that the amount allocated is adequate for planned changes to the state system, including communication improvements and preparation for a full modernization.[xv]

Rebate Checks and Property Tax Relief

The 2022 budget provides $339.5 million for the Homestead Benefit Program, which gives credits directly against the property tax bills of eligible homeowners. That’s $80 million more than what was first proposed in the spring. The boost represents a course correction of sorts, putting an end to the use of outdated, and thus lower, property tax bills to calculate the benefit. This annual sleight of hand has shortchanged hundreds of thousands of homeowners since the Great Recession — a 15-year time period when property taxes increased by 40 percent.[xvi] This year, just over 364,000 senior homeowners and homeowners with disabilities with gross incomes up to $150,000 and over 124,000 homeowners with gross incomes up to $75,000 will finally receive the full Homestead credit.

This summer, New Jersey will also be sending out over $300 million worth of income tax rebate checks, worth up to $500, to about 764,000 working families as part of last year’s deal to reinstate the millionaires’ tax. Households with less than $150,000 in gross income can expect an average of $425, and single parents with gross income below $75,000 will receive an average check of $297.[xvii] The tax break is nonrefundable, meaning that families with little or no earnings will receive a smaller benefit or will be excluded entirely. In addition to the income tax rebates, the budget introduces tax deductions for college savings, tuition and loans, cuts taxes on retirement income, and property tax relief for peacetime veterans as approved by voters last fall.

Earned Income Tax Credit

The federal Earned Income Tax Credit (EITC), a proven tool for boosting the earnings of low-paid workers, is currently inaccessible to many New Jersey residents due to narrow eligibility requirements. This is because New Jersey’s state-level EITC mirrors the narrow eligibility criteria of the federal tax credit. For example, the federal EITC is available to workers who do not claim dependent children on their tax returns but only if they are between the ages of 25 and 64. Under the federal ARP, the eligible age range will be temporarily broadened to include workers ages 19 to 24 and those over 65. However, this expansion is only in effect through 2021. In the absence of a permanent federal expansion, states are taking action to expand their own EITCs.

In FY 2021, New Jersey deviated from the federal EITC’s eligibility for the first time by lowering the minimum age for workers without qualifying children from 24 to 21. In FY 2022, the EITC will be further expanded for these workers by reducing the minimum age to 18 and lifting the maximum age requirement. Unfortunately, many New Jersey residents, including workers who file taxes using an Individual Taxpayer Identification Number (ITIN), continue to be excluded from the EITC.

Child and Dependent Care Credit

New Jersey’s Child and Dependent Care Credit will also be expanded this year in two significant ways. This tax credit helps offset caregiving expenses for working families with children under 13 and other dependents — but families with the lowest incomes receive little or no benefit.[xviii] This year’s budget changes that by making the credit fully refundable. In addition, the income threshold will increase from $60,000 to $150,000. Together, these changes will double the number of families who benefit from the credit.

Safety Net

The FY 2022 budget includes some crucial improvements to social safety net programs, including an increase in the amount of child support payments that go to Work First New Jersey (WFNJ) /Temporary Assistance for Needy Families (TANF) households, funding for voluntary intensive case management, and less restrictive program requirements for cash assistance. However, these changes do not necessarily address the increased need for assistance across the state. Participation in social safety net programs has expanded significantly during the pandemic, particularly in the WFNJ General Assistance program and Supplemental Nutrition Assistance Program (SNAP), showing a need to bolster these safety nets for future crises. Yet the FY 2022 budget does not accurately reflect this growing need. Instead, it provides no new funding for SNAP administration and fails to improve TANF cash assistance levels, which are currently at 30 percent of the Federal Poverty Level ($559 per month for a single-parent family of three).[xix]

With cash assistance levels left flat-funded and improvements to the safety net funded through one-time budget resolutions rather than legislation, the state’s commitment to transformative investments supporting families with low incomes remains subject to the dynamics of the budget season each year.

Transportation

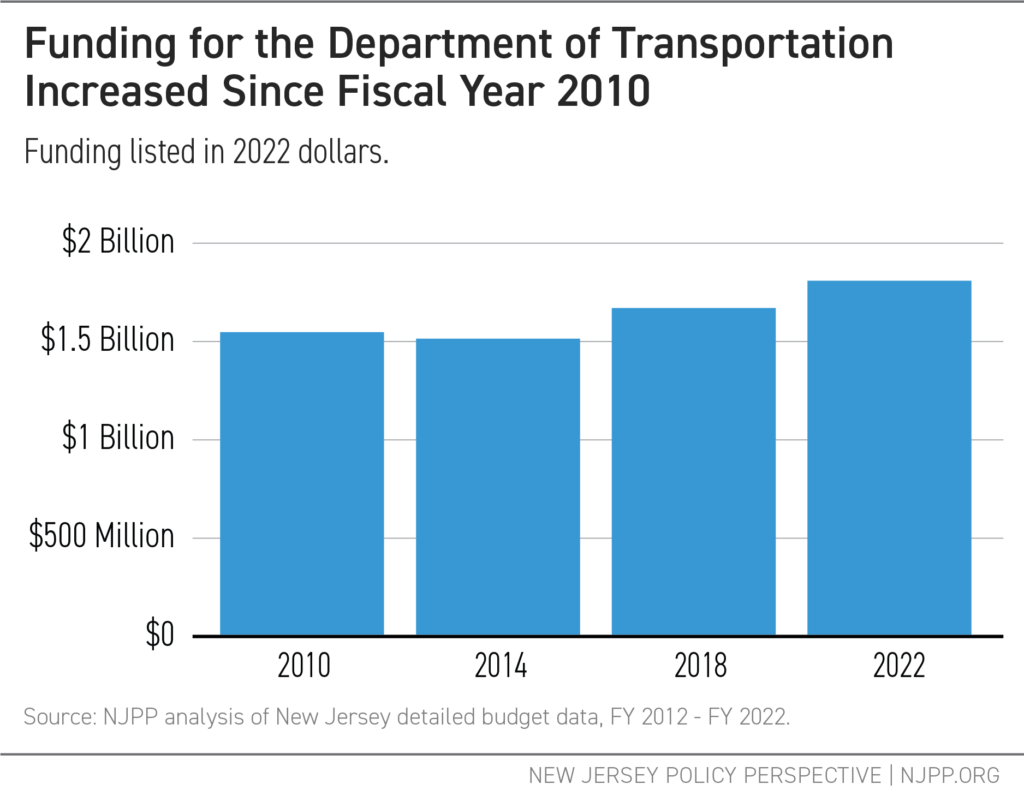

The state supports an array of transportation infrastructure, including roads, rail and bus systems, airports, and bike paths. Considerable funding for transportation comes from an array of revenue sources outside of the state budget, as well as a separate capital budget process funded through state bonds and targeted federal dollars. Nonetheless, the annual state budget process plays an important role in securing and maintaining New Jersey’s transportation infrastructure.

Overall, the budget provides $1.81 billion to the Department of Transportation, an 8.3 percent increase over FY 2018 levels.

NJ Transit

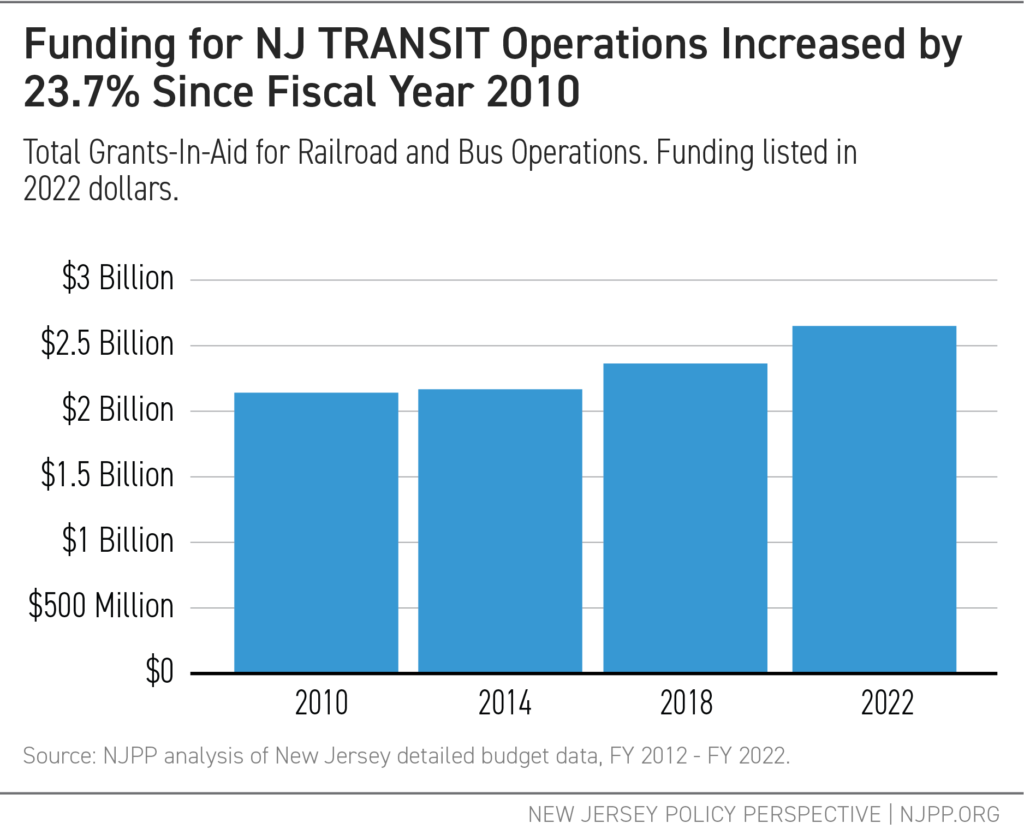

For NJ Transit operations specifically, the budget provides $2.65 billion for FY 2022, a 24 percent increase over FY 2010 levels. In addition, NJ Transit is slated to receive $2 billion in federal relief funds to help the agency recover from ridership loss due to the pandemic, and more than $5 million from the Federal Transit Administration (FTA) for the procurement of electric buses.

While the increase in transit funding is welcomed as the state begins to prioritize programs like bus electrification, it doesn’t tell the whole story. Ongoing diversions from NJ Transit’s capital improvement budget ($360 million) and the Clean Energy Fund ($82 million) continue at a time when NJ Transit has yet to secure funding for $5.8 billion worth of projects in its 5-year capital plan.[xx]

The ongoing diversion from the Clean Energy Program funds is especially egregious. That fund is meant to offer financial incentives, programs, and services to help save energy, money, and the environment. To limit these diversions, the state should dedicate funds from the state Turnpike Authority to NJ Transit’s operating budget, something the state transportation commissioner has already pledged to do. This would start with a $375 million transfer and gradually increase to $525 million per year.

Electric Buses and Vehicles

Even with a $10 billion surplus in this year’s budget, there remains no clear funding source for the $5.8 billion needed to implement NJ Transit’s electric bus replacement program.[xxi] Thus far, NJ Transit has only funded one electric bus pilot in Camden during the past three years. NJ Transit needs lead time to plan for the electric bus transition and outline the necessary capital dollars for both electric bus procurement and electrification charging technology.

Under the Board of Public Utilities, the budget provides a $5,000 rebate to help offset the costs of electric car purchases made by individuals in underserved communities, flat-funded from FY 2021 levels. However, households in lower-income communities with higher concentrations of people of color, like Jersey City and Newark, are less likely to own a car. These funds can be better spent on reducing and mitigating the higher rates of pollution from cars and trucks that plague these same communities. Investing in these efforts reduces the long-term health harms that disproportionately affect Black and Hispanic/Latinx residents.

End Notes

[i] NJ.com, ‘We are all in need of help.’ Undocumented immgrants seek $989M addition for N.J. excluded worker fund, June 2021. https://www.nj.com/coronavirus/2021/06/we-are-all-in-need-of-help-undocumented-immigrants-seek-989m-addition-for-nj-excluded-worker-fund.html

[ii] Higher Education Student Assistance Authority, The New Jersey Tuition Aid Grant, 2021. https://www.hesaa.org/Documents/TAG_program.pdf

[iii] Rutgers University News, Rutgers Board of Governors Approves 2.6 Percent Tuition and Fee Increase, June 2021. https://www.rutgers.edu/news/rutgers-board-governors-approves-26-percent-tuition-and-fee-increase

[iv] Office of Governor Phil Murphy, Governor Murphy Takes Action on Legislation, June 2021. https://nj.gov/governor/news/news/562021/approved/20210629a.shtml; New Jersey Department of Human Services, Response to OLS Budget Questions, 2021. https://www.njleg.state.nj.us/legislativepub/budget_2022/DHS_response_2022.pdf. Pg. 24-25.

[v] New Jersey Policy Perspective, Unprecedented and Unequal: Racial Inequities in the COVID-19 Pandemic, October 2020. https://www.njpp.org/publications/report/unprecedented-and-unequal-racial-inequities-in-the-covid-19-pandemic/; New Jersey Policy Perspective, Parents are Essential Too: Supporting Working Families During the Pandemic, December 2020. https://www.njpp.org/publications/report/parents-are-essential-too-supporting-working-families-during-the-pandemic/

[vi] Charity Care is generally split with half provided by the federal government and half provided by the state. This is done through a reimbursement process and with funding formulas determined by the state and federal governments. For simplicity, the funding shown in the table is the total spent or allocated (both state and federal funds). From 2014 to 2016, the federal government covered 100 percent of childless adults in the Medicaid expansion. This rate has decreased over time, as laid out in the ACA. In 2018, this federal matching rate was reduced to 94 percent. In 2022, the federal matching rate is 90 percent (meaning that the state pays 10 percent of enrollees’ coverage cost).

[vii] New Jersey Department of Health, Testimony of Judith Persichilli, Commissioner of Health, May 2021. https://www.njleg.state.nj.us/legislativepub/budget_2022/Persichelli_testimony_05112021.pdf. Pg. 13.

[viii] Eagleton Institute of Politics, Most New Jerseyans Say Housing Costs are a Serious Problem, Finding a Place to Rent is Difficult; Racial and Ethnic Disparities in Housing Access, June 2021. https://eagletonpoll.rutgers.edu/wp-content/uploads/2021/06/Rutgers-Eagleton-Poll-HCDNNJ-Housing-June-16-2021.pdf

[ix] U.S. Department of the Treasury, Homeowners Assistance Fund, April 2021. https://home.treasury.gov/system/files/136/HAF-state-territory-data-and-allocations.pdf

[x] National Low Income Housing Coalition, The Gap: A Shortage of Affordable Homes, March 2021. https://reports.nlihc.org/sites/default/files/gap/Gap-Report_2021.pdf

[xi] NJ.com, Governor Murphy Announces $275 Million in Relief for Small Businesses and Individuals Impacted by COVID-19 Public Health Crisis, May 2021. https://nj.gov/governor/news/news/562021/approved/20210507a.shtml

[xii] Provides one 30-day supply of prescription medications plus two refills and a 90 day supply of injectables upon release.

[xiii] Excludes parolees classified as sex offenders as they are often parolees for life (PSL) and thus are excluded from many reentry services. Given that some number of sex offenders are not PSL, it is likely that the Reentry Allocations/Expenditures per parolee are slightly smaller.

[xiv] NJ.com, Lawmakers wanted $50M to fix N.J. unemployment system, but budget calls for $17M, June 2021. https://www.nj.com/coronavirus/2021/06/lawmakers-wanted-50m-to-fix-nj-unemployment-system-but-budget-calls-for-17m.html

[xv] New Jersey General Assembly Budget Committee Hearing, April 21, 2021.

[xvi] NJ Spotlight News, Murphy plans to continue time-honored NJ tradition: Shortchanging recipients of Homestead tax relief, April 2021. https://www.njspotlight.com/2021/04/homestead-tax-relief-shortchange-baseline-frozen-2006-tax-returns/

[xvii] NJ.com, Murphy to sign biggest N.J. budget ever, and there’s plenty in it for you. What you’ll find, June 2021. https://www.nj.com/politics/2021/06/murphy-to-sign-biggest-nj-budget-ever-and-theres-plenty-in-it-for-you-what-youll-find.html

[xviii] New Jersey Department of Treasury, Division of Taxation, Child and Dependent Care Credit (P.L. 2018, c.45), June 2020. https://www.nj.gov/treasury/taxation/depcarecred.shtml

[xix] Center on Budget and Policy Priorities (Ali Safawi and Ife Floyd), TANF Benefits Still Too Low to Help Families, Especially Black Families, Avoid Increased Hardship, October 2020. https://www.cbpp.org/research/family-income-support/tanf-benefits-still-too-low-to-help-families-especially-black

[xx] NJ TRANSIT, Capital Plan Financial Summary (Unconstrained), June 2020. https://njtplans.com/downloads/capital-plan/NJ_Transit_Capital_Plan_Financial_Summary_(Unconstrained).pdf

[xxi] Politico Pro New Jersey, NJ Transit board approves $2.6B budget with no fare increase, October 2021. https://subscriber.politicopro.com/states/new-jersey/story/2020/10/22/nj-transit-board-approves-26b-budget-with-no-fare-increase-1329547