Next week Gov. Christie will release his proposed budget for the next fiscal year, kicking off a season of negotiations before a final document is signed by June 30. But the state budget is more than a laundry list of government spending. It is an official statement of what counts – and doesn’t – in meeting the needs of the people of New Jersey and, hopefully, in investing in the assets that are proven building blocks of a strong economy. There are hints of what priorities will be emphasized by the governor and the Democratic leadership, but many questions remain. Here are a few of the things we will be looking for in the governor’s 2017 budget.

Will New Jersey’s economy be able to offer a boost to next year’s budget?

Although job growth in 2015 was more encouraging than the previous few years, we’re not out of the woods – not even close. New Jersey’s recovery from the depths of the Great Recession continues at a much slower pace than neighboring states and the rest of the country, placing 42nd in job growth since December 2007. The state has recovered just 82% percent of jobs lost since then, far less than our neighbors in NY (286%) and PA (117%), and the US (152%).

Last year, New Jersey added 55,200 jobs. That’s better than recent years but to get back to pre-recession levels and keep up with population growth, we would need to add 120,000 jobs every year for the next three years. In the meantime, the state continues to struggle with the country’s 2nd highest rate of long-term unemployed and a chronic foreclosure crisis that puts a stranglehold on our economic recovery.

So how has this affected state revenue collections so far this year?

So far, so good. The first six months of this year’s budget has seen a growth rate of 3.9 percent, which exceeds the 3.4 percent rate that the Christie administration had projected. Eight of the 14 major revenues, including the income and sales taxes, are growing at rates above those needed to achieve year-end targets. The $11.8 billion collected through December exceeds projections by a modest $56.3 million, which is lower than the $180 million surplus at the 6-month mark last year, but much better than the giant shortfalls we had in the previous 3 years.

Meanwhile, corporation business tax collections through December 2015 are underperforming, at 14.6 percent below the same period last year. This tax will likely continue to erode in coming years as the bills for more of New Jersey’s lavish tax breaks come due.

All of that is to say, we are doing a little bit better, but it’s not a drastic improvement in revenues.

Will this small bit of good news help fund our most pressing obligations?

The short answer: No, not with the two elephants sitting in the budget-writing room. Between the broken Transportation Trust Fund and the failure to address underfunded pension payments, the overdue bills are just too massive to be covered by the modest bump in tax revenue. And never mind any step to honor universal promises to relieve property taxes.

Come June 30, the Transportation Trust Fund – the state’s sole source for modernizing and expanding highways, bridges and public transit – runs dry. Recent administrations have kept the Fund functioning by shifting money from the general budget, re-directing over $3 billion committed to the cancelled Hudson rail tunnel, and significantly increasing overall debt to the point that every dime of dedicated taxes is now going to pay debt service. If substantial new revenues are not identified soon, projects to upgrade the state’s roads, bridges and public transit will be cancelled July 1 and New Jersey could face the loss of more than $1.6 billion annually in matching federal dollars.

The bottom line is that new, big revenues must be enacted. A gas tax hike is the most obvious choice for a revenue source. Gov. Christie at first said “everything” was on the table, before later ruling out a gas tax hike while campaigning in New Hampshire. The question is whether his pledge to Republican primary voters will be honored at the expense of New Jersey’s greatest asset: its location. How he plans to fund transportation projects for the next five years may be spelled out in next week’s budget address.

The other massive obligation, of course, are the unfunded pension funds for teachers and state workers. Backed by state laws, Supreme Court rulings and legal opinions, the state ultimately will have to pay the bill and the cost goes up exponentially every year the state fails to act.

To stop the hemorrhaging, Senate President Sweeney has introduced legislation to put a constitutional amendment on the ballot to require the state to make pension payments on a regular schedule. The proposed amendment requires Gov. Christie to make 50 percent of the actuarially required pension payment in his final budget year — an increase in these year’s $1.3 billion payment to $2.4 billion payment. If the amendment is passed and the pension payment schedule followed, full funding of the pension fund could be reached in 2022. However, the amendment offers no source for the dramatically increased funding that it would require.

If not approved, Gov. Christie is on track to have under-funded the pension fund by a projected $23.7 billion by the time his term ends in January 2018 and the pension funds for public employees could go bankrupt as early as 2024. The teachers’ pension could run dry in 2027.

Despite this gruesome trajectory, Christie at his most recent appearance before the legislature blasted the constitutional amendment payment solution by asking which tax hike legislators were willing to pursue to fund the scheduled payments. The fiery speech meant to impress his national audience signaled that this year’s pension payment may be short-changed yet again.

And while efforts to rein in pension costs have gotten most of the attention this past year, the unfunded liability for retiree health care costs is actually much larger because nothing has been set aside to fund them. The state now faces $65 billion in unfunded health benefit liabilities for both current and retired employees, with the bill for retirees rising noticeably each year.

Will there be a push for more tax cuts?

Despite claims of tight revenues, Gov. Christie announced his intention to eliminate New Jersey’s estate tax entirely and immediately, an essential source of revenue that brings in about $300 million annually. He claims this tax on inherited wealth is an undue burden on the middle class. But truthfully, eliminating the tax would deliver the greatest benefit to only New Jersey’s most well-off households while seriously threatening resources needed for public colleges, safe communities and health care.

Not only are we facing another budget cycle without any guaranteed commitments toward major obligations, we are facing an entirely unnecessary revenue loss that reduces our chances of investing in the building blocks that matter in a state economy: transportation, public schools and colleges and opportunity for striving families. This tax cut would come on top of $2.3 billion in business tax cuts that are now fully phased in and costing New Jersey an estimated $660 million each year moving forward, and at least $3.6 billion that have been lost thanks to the de facto income tax cut the state’s wealthiest households received when the so-called “millionaires’ tax” expired in 2010.

One bright spot in this troubling storyline should be mentioned to help ease the pain. The Earned Income Tax Credit is stronger than ever providing a much-needed boost to the pocketbooks of over a half a million poor working New Jersey families. Last year’s increase to the state EITC to 30 percent (after a decrease to 20 percent in 2010) has also boosted the tax credit’s economic impact, generating approximately $120 million in new tax credits.

What programs are vulnerable to another year of cuts or flat-funding?

Since it’s bordering on the impossible that the economy will explode upward in the next six months to greatly affect the next budget, it is likely that programs like K-12 and higher education support and safety net programs will not receive funding that they are entitled to or that would ease the burden on New Jersey families.

Education

High-quality education does more to strengthen a state’s overall prosperity than any other economic asset. Yet, New Jersey’s investment in K-12 and higher education has decreased considerably over the past two decades and that trend is unlikely to be reversed.

Last year’s budget represented the seventh straight year the state failed to follow the school funding formula and provide districts with the aid to which they are legally entitled. The School Funding Reform Act (SFRA), which is considered a national model of state public school finance, has been cumulatively underfunded by over $7 billion. State Education Commissioner David Hespe recently acknowledged that state aid has stalled, but that the SFRA formula is likely to run at some level next year addressing the widest disparities among school districts. It remains to be seen if New Jersey’s high-quality pre-K program that targets at-risk 3 and 4 year olds across the state will be extended to more districts..

The situation is dire for college students as well. New Jersey is spending 22 percent less per student on higher education than they did in 2008, after adjusting for inflation. These cuts have driven up tuition and student fees over 14 percent since before the Recession, making it harder for New Jersey families to afford college and for the state to foster its well-educated workforce. With that the student debts borne by college graduates has steadily climbed. We will be looking closely at the budget to see whether this trend can begin to reverse course.

Cash Assistance for the Poor

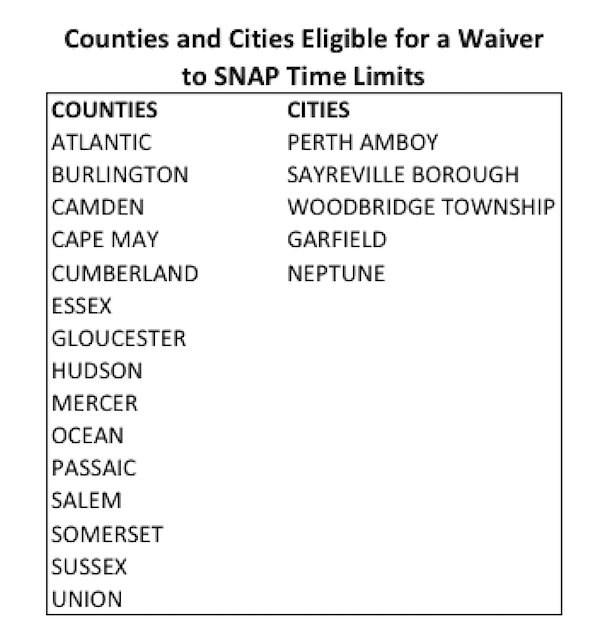

For the past few years, the state has decided not to extend the so-called “Heat and Eat” program, which made it easier for New Jerseyans to receive a higher level of SNAP benefits even if they had difficulty documenting their energy costs. A disproportionate number of these households include the elderly and disabled. Maintaining the Heat and Eat program should have been an easy decision for New Jersey given the federal funds that could probably have covered the modest increased cost for a benefit that is 100 percent federally funded. We will be looking to see if the necessary funding will be included in the budget to reverse course on this unnecessary burden to New Jerseyans struggling to get by.

Another program that could help alleviate poverty in the state would be to restore cuts in TANF (Temporary Assistance To Needy Families), also known as Work First New Jersey – a crucial anti-poverty program that helps the poorest of the poor. This benefit hasn’t been increased in New Jersey in 29 years. In order for children to live in a decent and healthy environment, the TANF benefit needs to be at least $2,636 – seven times higher than the current TANF benefit for a family of three. The erosion of TANF benefits is one of the main reasons why there are 140,000 children living in extreme poverty in New Jersey. Ignoring the urgent need to restore TANF benefit is not only an immoral act, it’s a poor investment. Child poverty costs New Jersey an estimated $13 billion each year – so we can either pay now to support these children, or pay much more when they are older.

Property Tax Relief

New Jersey’s property taxes, which fund schools, local services and county programs like parks, snow removal and libraries, continue to rise. The average bill in New Jersey is now $8,353 – up $200 from last year. That is a 2.4 percent increase – the second year in a row that the average property tax bill has defied the 2 percent cap implemented by Gov. Christie and the legislature in 2011. Income tax revenues already provide over $14 billion of relief to property owners in the form of school, municipal and county aid but it’s not enough to help relieve homeowner’s property taxes. Help from the general budget is likely not an option either given the tight state finances.

In fact, funds the state collects on behalf of municipal governments from taxes on utility company equipment – which are technically supposed to be distributed back to municipalities – have been diverted for years to help plug budget holes. More than $980 million is expected to be collected by the state from the energy taxes during the current fiscal year, about $192.3 million of which will be directed into the general fund, according the League of Municipalities. This money grab has been going on since 2010 despite legislative attempts to remedy it.

Recent legislation is again calling for the gradual restoration of $331 million in cuts to energy tax receipts and Consolidated Municipal Property Tax Relief Aid, but with one caveat: that the money be used exclusively for property tax relief. It remains to be seen how – or if – the Christie administration plans to offset rising tax rates that continue to burden New Jersey property owners.