In 2022, New Jersey became the seventh state to enact a refundable state-level Child Tax Credit to help families meet the high costs of raising kids.[i] Under the new program, eligible families will receive up to $500 for every child under six years old as early as January 2023.[ii]

The success of the Child Tax Credit lies in its simplicity: It directs cash relief to families with kids who need it most. It is a straightforward, commonsense program with long-lasting benefits. When families can pay for basic expenses — like groceries, housing, and child care — and save for their children’s futures, it improves child wellbeing immediately and makes it more likely for children to reach their full potential later in life.

Recognizing the power of direct cash relief for families, the Legislature passed the Child Tax Credit with substantial bipartisan support in both houses.[iii] Indeed it was Republican lawmaker Aura Dunn who urged her colleagues on the Assembly floor to “go bold” and expand the tax credit when it was first created, saying that more children and families should qualify as bigger kids come with bigger costs.[iv]

To build on the success of the Child Tax Credit, state lawmakers can and should expand the program with a higher maximum credit and so more families qualify for financial support. This report lays out the logical next steps for the Child Tax Credit and would make New Jersey a more affordable place to start and raise a family.

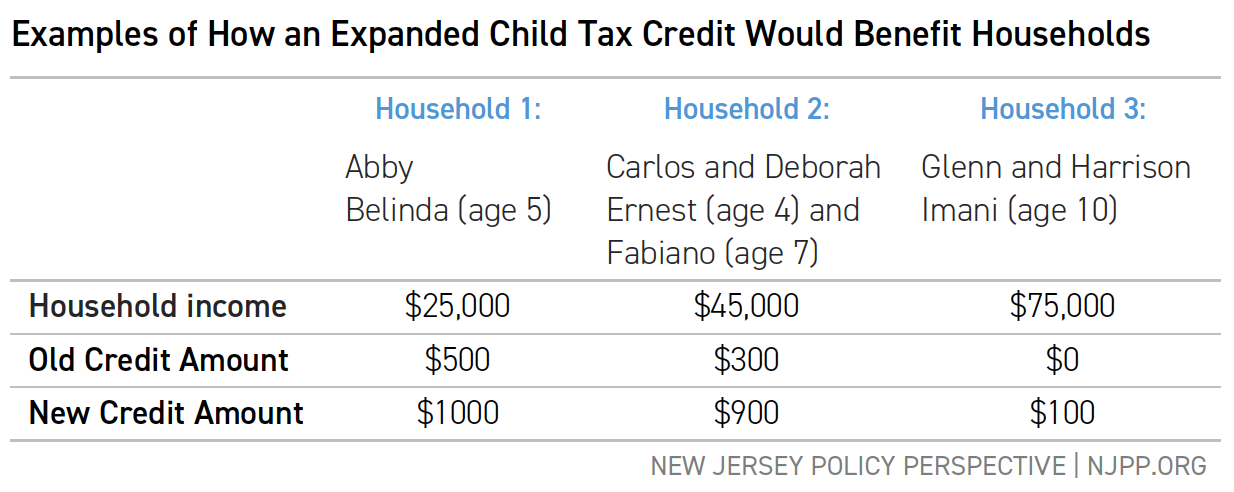

NJPP proposes a two-fold expansion to the existing law: expanding the Child Tax Credit to $1,000 for young kids under six years old, and opening eligibility to children ages 6-11.

This expansion targets two important limitations of the original credit:

- Its higher dollar amount reflects the needs of New Jersey families and the higher costs that they face with rising inflation.

- It recognizes that children have costs that do not end when they turn six and assists families whose children have aged out of the original credit.

The expanded credit would help 441,000 more families, including 713,000 children, across the state. On average, families receiving the credit would get $567.[v]

A History of Expanding Tax Credits Proven to Work

New Jersey created its Child Tax Credit just last session. Why expand it again so soon?

There’s certainly precedent. State lawmakers expanded New Jersey’s Earned Income Tax Credit (EITC) for working families in three straight years after it was created in 2000.[vi] In recent years, lawmakers have continued expanding the credit, reaching 40 percent of the federal credit amount in 2020.[vii]

Like the Earned Income Tax Credit, an expanded Child Tax Credit has a strong track record at the federal level for reducing child poverty and increasing household budgets for food, housing, and basic expenses.[viii] These programs also have a “multiplier effect” as the tax credits are often spent immediately and locally, stimulating the broader economy.[ix] But with the federal Child Tax Credit back to its pre-pandemic levels, families in New Jersey will see their benefits decline at a time when high costs cut deeply into working-class family budgets and financial security.[x]

In short, the Child Tax Credit is a highly effective anti-poverty and pro-family policy that should be expanded similar to other working families tax credits.

Measuring the Benefits of an Expanded Child Tax Credit

NJPP’s proposed expansion to the existing Child Tax Credit has two key components: a higher age limit so children up to 11 years old can be claimed, and a higher credit amount to better support families.

Increased Age Range

The age limit would be lifted from children under age 6 to children under age 12. Children do not stop having costs as time goes on.[xi] Expanding the age range will also cover a wider range of families and boost the credit amount for already-eligible families who also have children in the older age range.

Increased Credit Amount

The proposed credit would continue to honor the much-needed public investment in young children by providing a credit up to $1,000 for the current age range of children under age 6. A higher benefit for young children recognizes that young children are more likely to live in poverty than their older counterparts.[xii] For children ages 6-11, the maximum credit amount would be $500.

This expansion would reach roughly 441,000 families and provide benefits for 713,000 additional children. On average, a family receiving the credit would get $567, helping defray the daily costs of raising children.

These changes would provide meaningful relief to families who are experiencing the effects of high post-pandemic inflation, especially working-class and middle-class families, who reap the lion’s share of the benefits.

These higher dollar amounts also push the credit towards more poverty reduction. Recent estimates by the Institute on Tax and Economic Policy show that to achieve a 25% reduction in child poverty, maximum credit amounts would have to be upwards of $2,000, but a $1,000 maximum credit pushes the state in the right direction.[xiii]

Making New Jersey the Best Place to Raise a Family

The New Jersey Child Tax Credit is an effective, popular, and bipartisan program that gives working families the cash relief they need to make child-rearing more affordable. New Jersey should build on its successful program to expand the eligible age range and increase the benefit amount, especially for young children.

As Assemblywoman Dunn argued on the Assembly floor, it’s time for New Jersey lawmakers to go big and go bold when it comes to making the state the best place in the country to raise a family.

End Notes

[i] California, New York, Massachusetts, Colorado, New Mexico, and Vermont also have refundable state child tax credits. Other states have non-refundable or temporary credits. See Sophie Collier et al., State Child Tax Credits and Child Poverty: A 50-State Analysis (2022) at p. 9, https://itep.sfo2.digitaloceanspaces.com/Report-State-Child-Tax-Credits-and-Child-Poverty-A-50-State-Analysis-2022.pdf.

[ii] P.L. 2022, c. 115.

[iii] The final votes were 76-2 in the Assembly and 31-6 in the Senate. See New Jersey Legislature, Bill S2523 Sca (1R), Session 2022-2023, https://www.njleg.state.nj.us/bill-search/2022/S2523.

[iv] New Jersey Assembly GOP, Democrats reject Dunn’s “big and bold” child tax credit (June 30, 2022), https://www.youtube.com/watch?v=DtfMHBanHoM at 1:40.

[v] Analysis of New Jersey taxpayer data by Institute on Taxation and Economic Policy, on file with author.

[vi] New Jersey Division of Taxation, New in 2001 (2002), https://www.nj.gov/treasury/taxation/pdf/new2001.pdf at p. 1.

[vii] N.J. Stat. § 54A:4-7(2). The credit amount started at 10% in 2000, increasing to 15% in 2001, 18% in 2002, and 20% in 2003.

[viii] See Bradley L. Hardy, Center on Budget and Policy Priorities, Child Tax Credit Has a Critical Role in Helping Families Maintain Economic Stability (April 14, 2022). https://www.cbpp.org/research/federal-tax/child-tax-credit-has-a-critical-role-in-helping-families-maintain-economic

[ix] Natalie Holmes and Alan Berube, Brookings Institute, The Earned Income Tax Credit and Community Economic Benefits (November 20, 2015).

The Earned Income Tax Credit and Community Economic Stability

[x] See Chuck Marr et al., Center on Budget and Policy Priorities, Year-End Tax Policy Priority: Expand the Child Tax Credit for the 19 Million Children Who Receive Less Than the Full Credit (December 7, 2022), https://www.cbpp.org/research/federal-tax/year-end-tax-policy-priority-expand-the-child-tax-credit-for-the-19-million; Joshua Klick & Anya Stockburger, Bureau of Labor Statistics, Inflation Experiences for Lower and Higher Income Households (December 2022), https://www.bls.gov/spotlight/2022/inflation-experiences-for-lower-and-higher-income-households/home.htm.

[xi] See Mark Lino et al., U.S. Dep’t of Agriculture, Expenditures on Children by Families, 2015 (March 2017), https://fns-prod.azureedge.us/sites/default/files/resource-files/crc2015-march2017.pdf at 24, tbl. 1.

[xii] See Areeba Haider, The Basic Facts about Children in Poverty, January 12, 2021 at fig. 4, https://www.americanprogress.org/issues/poverty/reports/2021/01/12/494506/basic-facts-children-poverty/

[xiii] Institute on Taxation and Economic Policy, Columbia Center on Poverty and Social Policy, Child Tax Credit Options for Reducing Child Poverty: New Jersey (2022), https://itep.sfo2.digitaloceanspaces.com/Child-Tax-Credit-Options-New-Jersey-2022.pdf at p. 3