To read a PDF version of this release, click here.

To read reactions from policy leaders, click here.

For Immediate Release:

Contact: Louis Di Paolo, (201) 417-5049 (cell) or dipaolo@njpp.org

TRENTON, NJ (February 28, 2019) – The Board of Trustees of New Jersey Policy Perspective (NJPP), a Trenton-based public policy think tank, announced today that Brandon McKoy will serve as its next president. Founded in 1997, NJPP drives policy change to advance economic and social justice through evidence-based independent research, analysis, and advocacy. McKoy will become the fourth and youngest ever president of the organization.

“I am proud to announce that NJPP’s Executive Search Committee unanimously and enthusiastically endorsed Brandon McKoy as our next president,” said Marcia Marley, NJPP Trustee and chair of the board’s Executive Search Committee. “No other candidate matched his policy knowledge and deep passion for creating a stronger and more-inclusive economy. Brandon has the leadership capability and strategic vision necessary to guide NJPP’s work in shifting critical policy debates and analyzing the most pressing issues facing New Jersey’s lawmakers. The search committee is confident that the organization will flourish under Brandon’s leadership and we are thrilled to work with him.”

Brandon McKoy is currently NJPP’s Director of Government and Public Affairs, where he develops and implements the strategic direction of the organization’s policy agenda and outreach to legislative and administrative officials. Since joining NJPP in 2014, he has spearheaded analysis and research on labor and economic policy and expanded NJPP’s reach and influence in the halls of the State House, with the administration, and in the media.

“I could not be more excited to take control of NJPP and build on the organization’s successes in shaping public policy,” said incoming NJPP President Brandon McKoy. “This is a critical time for New Jersey, as we turn the page on almost a decade of trickle-down policies that prioritized the wealthy and well-connected. As President of NJPP, we will continue to speak truth to power, insert data and analysis into every debate, and promote policy solutions for the many — not a chosen few. I am honored to have this responsibility and look forward to working with our partners, board members, dedicated staff, and elected leaders in building a better New Jersey for all.”

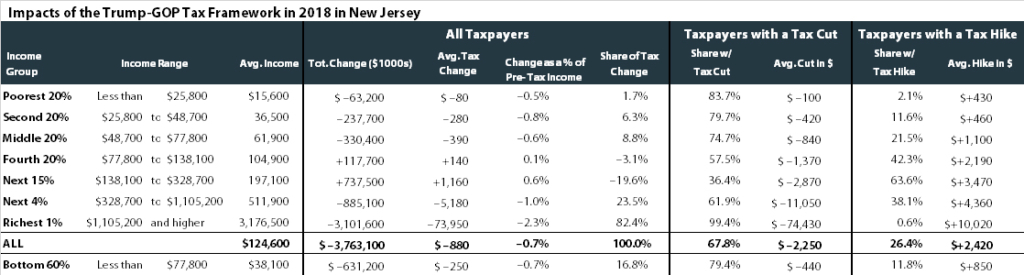

Over the last five years, Brandon McKoy has been a leading voice for policies that boost the economic security of New Jersey’s working families. His original research, analysis, and advocacy were critical in the fight for a $15 minimum wage, which passed the legislature and was signed by Governor Phil Murphy earlier this year, and the campaign for paid sick days, which was signed into law in 2018. McKoy has also researched and testified on issues related to state tax policy, higher-education funding, poverty alleviation programs, and marijuana legalization, including a landmark 2016 report on the potential tax revenue from a legal cannabis market.

“Brandon McKoy is a rising star in a rising generation of policy leaders,” said Jun Choi, chair of NJPP’s Board of Trustees. “His accomplishments speak for themselves: he was a central figure in the fight for a $15 minimum wage, one of the most impactful pieces of legislation in recent years for New Jersey’s working families; his reports on earned sick days provided the foundation for legislation signed into law by Governor Murphy; and his advocacy for a fairer tax code has resulted in critical relief for the state’s lowest paid workers. Brandon also brings important perspectives to the policy making process as a millennial and person of color in a state where decision makers are often older and whiter than the communities they represent. On behalf of the Board of Trustees, I am thrilled to announce Brandon McKoy as the next president of NJPP and am so excited to see what the future has in store with him at the helm.”

Brandon McKoy began his tenure with NJPP in 2014 as a Policy Analyst through the State Policy Fellowship program coordinated by the Center on Budget and Policy Priorities, one of the nation’s premier policy organizations. Prior to joining NJPP, he was a program associate at The Fund for New Jersey and began his career as an AmeriCorps VISTA member, working on housing and community development in Orange, NJ.

Beyond his policy work, McKoy is active in his local community, serving on the board of the I Am Trenton Community Foundation. He is also active in training and mentoring young progressive professionals, having served as the Deputy Director of New Leaders Council – New Jersey, where he is currently a member of the organization’s advisory board. McKoy is also a board member of Shelterforce, a community development and affordable housing publication.

Brandon McKoy is a lifelong New Jersey resident and proud product of the state’s public schools. After growing up in South Orange, he studied social psychology at The College of New Jersey and graduated with a Master of City and Regional Planning degree from the Edward J. Bloustein School of Planning and Public Policy at Rutgers University. McKoy currently lives in Trenton with his wife, Liz Mahn, and their dog, Scout.

Brandon McKoy will begin his tenure as president of NJPP on March 1, 2019.

# # #