To read a PDF version of this report, click here.

Once the tax cut proposal unveiled last week by Republicans in the House of Representatives[1] is fully phased in, New Jersey’s wealthiest 1 percent of taxpayers would receive an average $25,100 tax break each year while more than 1 in 4 Garden State taxpayers (27 percent) would pay an average of $2,200 more in a year in federal taxes.[2] (Unless otherwise noted, all data in this Fast Facts is on the impact in the year 2027, once the plan is fully phased in.)

The wealthiest New Jerseyans’ share of the state’s tax cuts would grow over time due to phase-ins of breaks that mostly benefit the rich and the eventual elimination or erosion in value of provisions that benefit low- and middle-income taxpayers. For example, after five years, the bill eliminates a $300 dependent credit that benefits low- and middle-income families while fully repealing the estate tax in year six for the few very large estates subject to the tax.

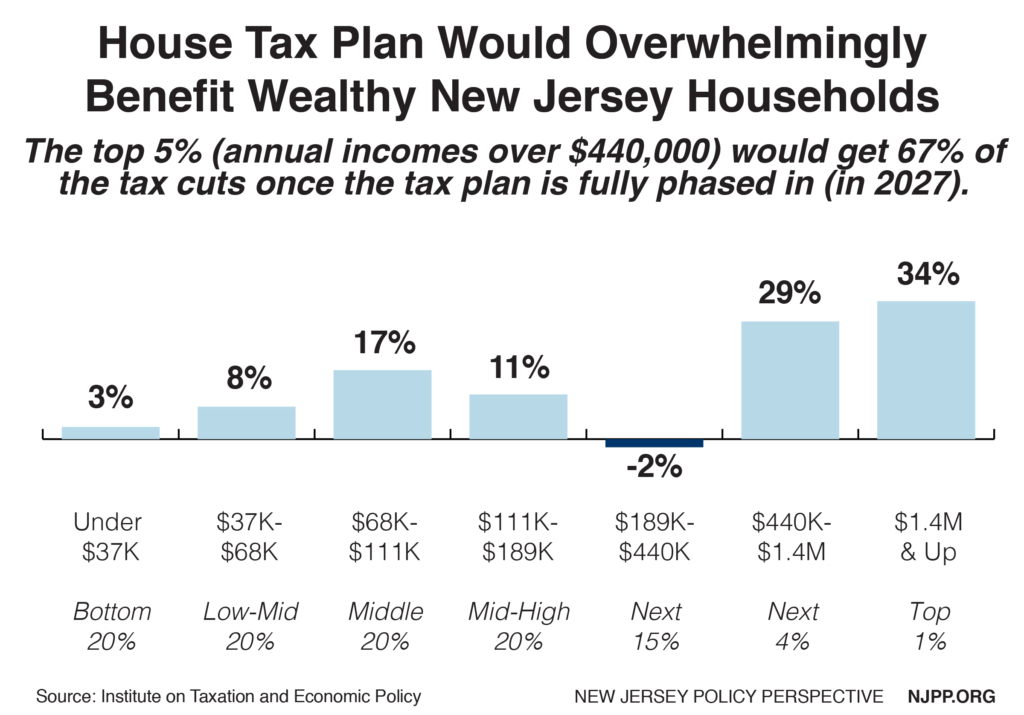

In all, the wealthiest 5 percent of New Jerseyans – those with annual incomes over $440,000 a year – would receive two-thirds (67 percent) of the tax cut coming to the state by 2027, while the bottom 60 percent (everyone earning less than $111,000 a year) would get just 28 percent.

More than 1 in 4 New Jerseyans would face a tax hike by 2027 in large part because the House proposal would end Americans’ ability to deduct state/local income or sales taxes paid while capping the amount of property taxes one could deduct at $10,000. While the latter provision is being pitched as a “compromise” to win over reluctant lawmakers from New Jersey and other similar states, nationally just 1 in 13 households would see any benefit from this change.[3]

A total of 1.8 million New Jersey households deduct a cumulative $17 billion in state income or sales taxes from their federal taxes, while 1.6 million New Jersey households deduct a cumulative $14.9 billion in local property taxes.[4] New Jersey’s average residential property taxes are $8,549 a year, and 147 of New Jersey’s 565 municipalities (26 percent) have average residential property tax bills of over $10,000 a year.[5]

What’s more, this analysis of the “winners and losers” under the House proposal doesn’t take into account the impact of likely budget cuts that would be paired with these tax breaks. After all, the tax proposal remains incredibly expensive – Congress’ Joint Committee on Taxation estimates it would cost $1.5 trillion over a decade.[6] If the $1.5 trillion in tax cuts were eventually paid for through the spending cuts on entitlements and federal programs promised in recent GOP budget proposals, it’s clear that any modest tax cut for low-income or middle-class New Jerseyans would be more than wiped out. (An analysis of the earlier tax framework that took program cuts into effect found the “vast majority of Americans” would lose – even if they took home small tax cuts.[7])

Endnotes

[1] H.R.1, The “Tax Cuts And Jobs Act,” https://waysandmeansforms.house.gov/uploadedfiles/bill_text.pdf

[2] Institute on Taxation and Economic Policy Microsimulation Tax Model, November 2017. Full dataset available at https://itep.org/housetaxplan/

[3] Institute on Taxation and Economic Policy, House Plan Slashes SALT Deductions by 88%, Even with $10,000 Property Tax Deduction, November 2017. https://itep.org/house-plan-slashes-salt-deductions-by-88-even-with-10000-property-tax-deduction/

[4] New Jersey Policy Perspective, Fast Facts: Millions of New Jerseyans Deduct Billions in State & Local Taxes Each Year, November 2017. https://www.njpp.org/budget/fast-facts-millions-of-new-jerseyans-deduct-billions-in-state-local-taxes-each-year

[5] NJPP analysis of New Jersey Department of Community Affairs, 2016 Property Tax Tables. Available at http://www.nj.gov/dca/divisions/dlgs/resources/property_tax.html

[6] The Joint Committee on Taxation, Distribution Effects Of The Chairman’s Amendment In The Nature Of A Substitute To H.R.1, The “Tax Cuts And Jobs Act,” November 2017. Available at https://www.jct.gov/publications.html

[7] Center on Budget and Policy Priorities, Vast Majority of Americans Would Likely Lose From Senate GOP’s $1.5 Trillion in Tax Cuts, Once They’re Paid For, October 2017. https://www.cbpp.org/research/federal-tax/vast-majority-of-americans-would-likely-lose-from-senate-gops-15-trillion-in