Friday Facts and Figures is a weekly newsletter with data points, analysis, and commentary on the biggest policy debates in New Jersey and beyond.

Sign up here.

66 Percent

Turns out increasing state funding for NJ Transit is not only good public policy but incredibly popular with residents across the state. According to a new poll by Rutgers-Eagleton, two out of three residents (66 percent) want lawmakers to increase state aid to NJ Transit, and nearly four out of five residents (78 percent) oppose service cuts. Without more state aid, NJ Transit faces a nearly $1 billion shortfall in two years. As of now, state lawmakers have no plans to increase funding for the transit agency, and Murphy administration officials have stated they will explore service cuts and fare hikes before considering more state aid. Keep in mind, NJ Transit is the largest transit agency of its kind in the country without a dedicated source of funding. [NJ.com / Larry Higgs]

3

There are three major red flags in the latest state budget that threaten New Jersey’s finances and the future of critical public services (including NJ Transit). A new report by the NJPP team finds that: the current budget spends $1.5 billion more than the state is collecting in tax revenue, new tax cuts and credits will erode revenue collections in future years, and major programs and services face looming shortfalls with federal pandemic aid about to expire. “This is unsustainable and will lead to serious shortfalls and hard decisions in the years to come,” said NJPP’s Peter Chen. [Patch / Eric Kiefer]

Misinformation

When it comes to clean energy policy, fossil fuel funded groups and right wing politicians are polluting the facts with misinformation, so let’s get it straight: No, no one is coming to take your gas stove. What’s really happening? The state wants to give residents financial incentives (read: money) to replace their gas stove with an electric one. That’s it. “There has been a lot of misinformation and, yes, fearmongering out there, and I want to put an end to it once and for all,” said Joseph Fiordaliso, President of the New Jersey Board of Public Utilities. [Gothamist / Nancy Solomon]

10

We just wrote last week about how sales tax holidays are costly gimmicks that don’t help families that need it the most. But for the second year in a row, New Jersey is offering a 10-day tax holiday on school supplies, resulting in an estimated $32.7 million revenue loss for the state — funds that could be used to provide meaningful and targeted relief to households with the lowest incomes. While the sales tax holiday may sound like it’ll help working families keep up with rising costs, it disproportionately benefits wealthier households with better flexibility to shift purchases. [NJ Spotlight News / John Reitmeyer]

ICYMI

There are a lot of friendly faces on this year’s Insider 100: Policymakers Power List — including NJPP President Nicole Rodriguez and NJPP Board Chair Marcia Marley! Big shout out to all of the advocates and policy experts recognized here. [Insider NJ]

Pets of NJPP

Meet Loki, Karlito Almeda’s adorable Siamese cat! Loki acts more like a dog than a cat, according to Karlito. Case in point: He hates seafood and would much prefer some chicken or steak. Meow … or is it woof?

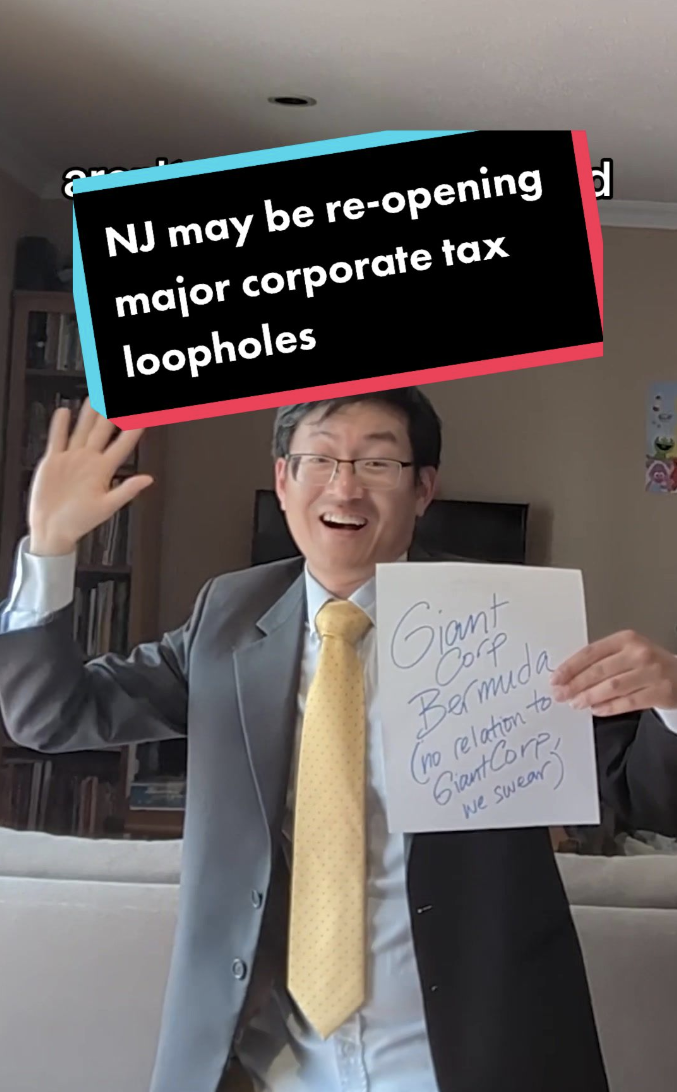

Check out our latest videos and follow us on TikTok.

Have a fact or figure for us? Tweet it to @NJPolicy.