Friday Facts and Figures is a weekly newsletter with data points, analysis, and commentary on the biggest policy debates in New Jersey and beyond.

Sign up here.

$500,000

Earlier this week, Governor Murphy and legislative leaders reached a compromise on the StayNJ senior tax cut proposal, adding an income cap of $500,000, lowering the max benefit to $6,500, and adding a $250 benefit for renters. These changes will prevent millionaire households from getting a tax cut (sorry, Bruce Springsteen), but the proposal still overwhelmingly benefits the state’s wealthiest households. Because benefits are tied to property taxes paid, seniors with the highest valued homes — and therefore the most wealth and highest incomes — will get the biggest tax cuts, while renters will receive a small fraction of the benefit. Keep your eyes peeled for an NJPP analysis of the new proposal early next week, and in the meantime, read Peter Chen’s thoughts on the bill in The New York Times by clicking the link. [The New York Times / Tracey Tully]

Bunk

So, how are lawmakers defending a tax cut that will overwhelmingly benefit the wealthiest households? Some are pointing to a survey by United Van Lines as proof that seniors are fleeing the state — even though this survey isn’t worth the paper it’s printed on. We were thinking about writing something breaking down why United Van Lines isn’t a reliable source, but Jen Miller beat us to it. In a new op-ed, Jen explains how this survey is from one company’s customer data, and its findings run counter to what the Census says about New Jersey’s population. “The problem with the survey is it’s bunk.” [NJ Monitor / Jen Miller]

78 Percent

An overwhelming majority of New Jersey residents — 78 percent — oppose NJ Transit service cuts and fare hikes, according to a new Rutgers-Eagleton poll. Instead, residents want the state to increase funding for NJ Transit to cover its growing budget shortfall, which is expected to reach $1 billion in a few years. So, how did we get here? State lawmakers have chronically underfunded NJ Transit by hundreds of millions of dollars and have consistently raided its capital projects fund to cover operating costs, and it’s one of the only transit agencies of its size without its own dedicated source of funding. Instead of increasing funding for NJ Transit in the budget, lawmakers are prioritizing a $1 billion corporate tax cut and a big tax break for the state’s wealthiest homeowners. [NJ.com / Larry Higgs]

$4 Million

New Jersey is one step closer to eliminating public defender fees thanks to a new bill sponsored by Senator Nellie Pou (D-Paterson). After an NJPP report uncovered the high cost of “free” representation, public defenders and advocates for criminal justice reform have urged state lawmakers to follow the lead of neighboring states by eliminating fees for residents who cannot afford an attorney. Governor Murphy already included $4 million in his budget proposal to cover the costs, and this new legislation would void liens for outstanding fees and throw away any warrants issued for unpaid public defender fees. “It’s a drop in the bucket,” said NJPP’s Marleina Ubel on the cost of eliminating these fees. [NJ Monitor / Nikita Biryukov]

$11.6 Billion

A new editorial in The Star-Ledger urges state lawmakers to oppose increased penalties for fentanyl, saying the proposal would reignite the War on Drugs and result in more overdose deaths and longer prison sentences for residents struggling with their drug use. The editorial cites NJPP research showing the state spent $11.6 billion over the last decade enforcing the drug war with no return on investment, and that the only way forward is to take a public health approach to drug policy: “If our Legislature wants to do something useful, it should go back and read a 2019 report from the New Jersey Policy Perspective that showed how our state spends 8.5 times more on enforcement than it does on addiction services.” [The Star-Ledger / Editorial Board]

ICYMI

Essential workers, union members, and advocates rallied in Trenton this week to oppose corporate tax cuts in the new state budget. “This is about making sure the budget reflects what every day New Jerseyans need to survive, not about giving billions of dollars to big corporations like Amazon and Wells Fargo,” said NJPP’s Peter Chen. Click the link to watch the coverage on News 12. [News 12 / Matt Trapani]

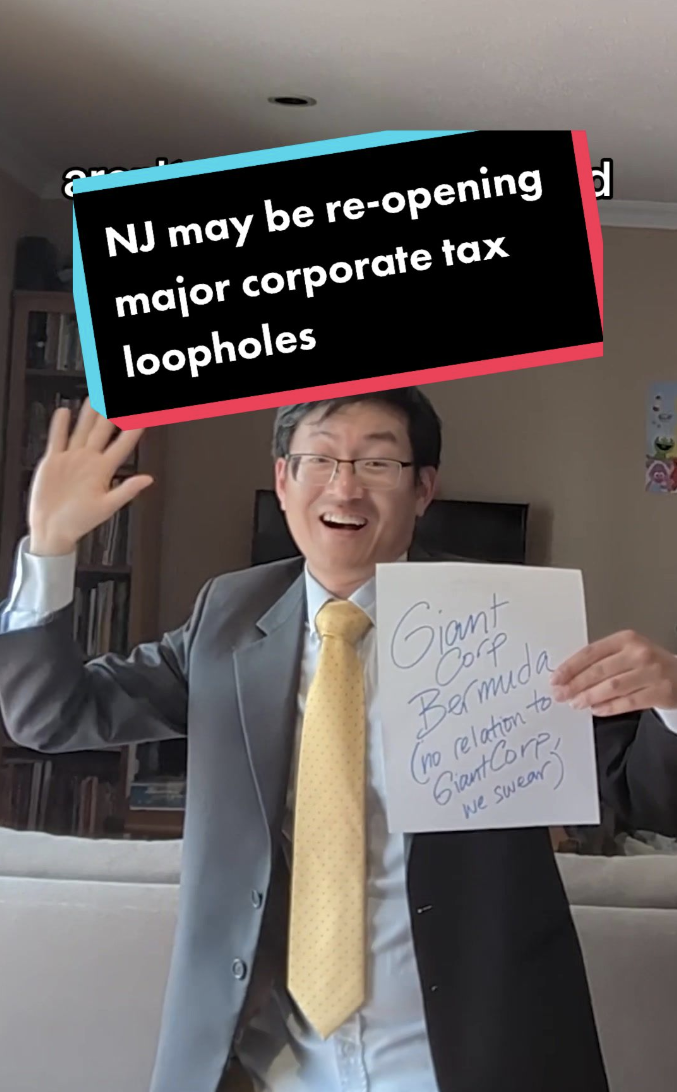

TikToks of NJPP

As if the $1 billion corporate tax cut wasn’t bad enough, lawmakers are also looking to overhaul New Jersey’s corporate tax code and re-open some major loopholes. In a new Tiktok, Peter acts out how corporations exploit these loopholes to hide their profits in tax havens abroad. [NJPP]

Check out our latest videos and follow us on TikTok.

Have a fact or figure for us? Tweet it to @NJPolicy.