By Sheila Reynertson and Jon Whiten

To read a PDF version of this report, click here.

As Republican lawmakers in Congress move forward with their tax proposal, much attention has been paid to the fate of state and local tax deductions, which allow taxpayers who itemize deductions on their federal income taxes to deduct state and local property taxes, and either state and local income taxes or general sales taxes.

As Republican lawmakers in Congress move forward with their tax proposal, much attention has been paid to the fate of state and local tax deductions, which allow taxpayers who itemize deductions on their federal income taxes to deduct state and local property taxes, and either state and local income taxes or general sales taxes.

These deductions are widely used in high-cost, high-tax states like New Jersey. In all, 41 percent of Garden State households file using these deductions – the third highest share of all states, after Maryland and Connecticut. These households deduct a total of $32.2 billion in state and local taxes each year, the third highest dollar amount after California and New York.[1]

More than 1 in 4 New Jerseyans would face a tax hike by 2027 under the House tax plan in large part because of changes to these deductions. The House’s proposal is to end Americans’ ability to deduct state/local income or sales taxes paid, while capping the amount of property taxes one could deduct at $10,000. While the latter provision is being pitched as a “compromise” to win over reluctant lawmakers from New Jersey and other similar states, nationally just 1 in 13 households would see any benefit from this change.[2] The Senate proposal, meanwhile, completely eliminates all the state and local tax deductions.

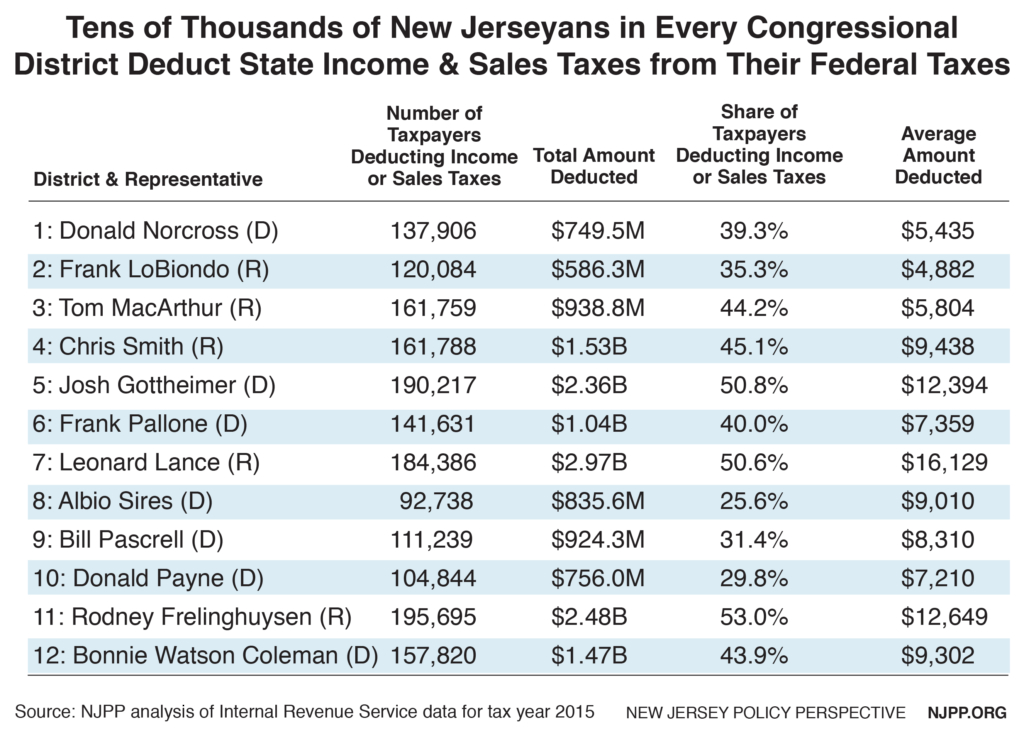

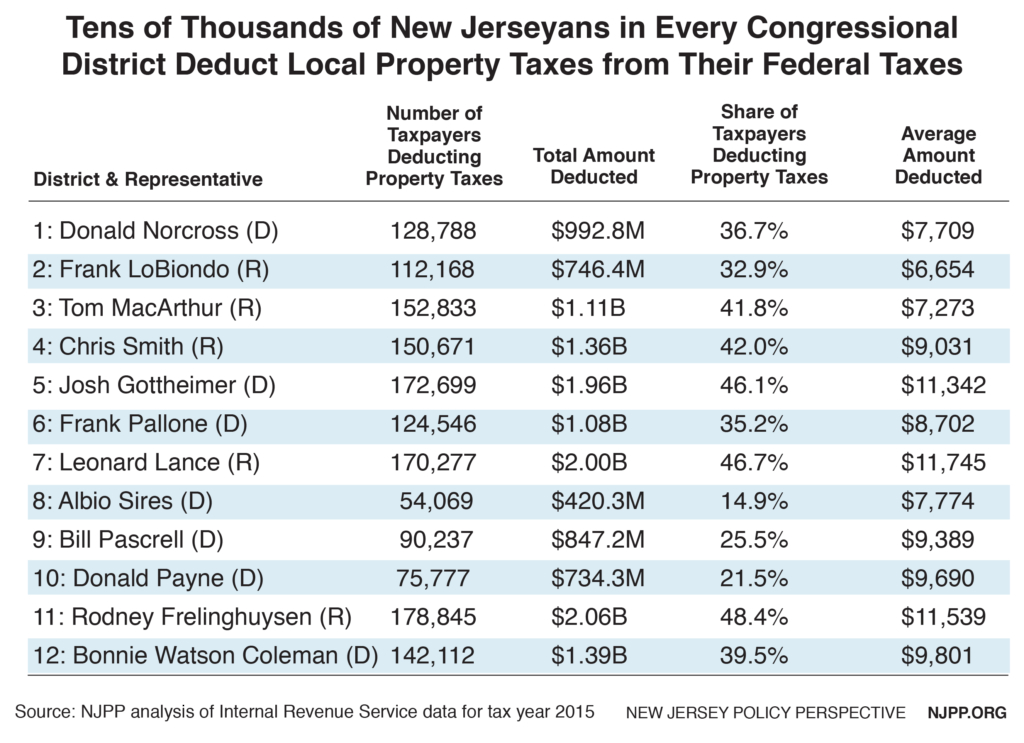

Altogether, these tax deductions are used by tens of thousands of New Jersey families across the income spectrum and in every Garden State Congressional District.[3]

And while Republican Congressional leaders point to a doubling of the standard deduction – the amount people deduct from their taxable incomes – as making up for the changes to these itemized deductions, that’s far from the case. That’s because even as the standard deduction would be doubled, personal exemptions would be eliminated and the tax rate for low-income earners would be increased from 10 percent to 12 percent. Even if the standard deduction were tripled, a significant portion of families that now itemize their deductions would still end up with tax increases.[4]

What’s more, the danger posed by the House tax proposal goes far beyond these changes to state and local deductions. In fact, the plan’s benefits are tilted to the wealthiest New Jerseyans, while the cost of the proposal would almost certainly lead to significant cuts to public services and investments on which all New Jerseyans – particularly low- and moderate-income families – rely.[5]

If the proposal moves forward in its current form, states would be squeezed on both ends: deep cuts to federal programs would reduce services for state residents, at the very same time the loss of key federal tax deductions would make it harder for states like New Jersey to raise enough revenue to provide a current baseline of services – much less make up for reduced support from the federal government.

And this problem is not alleviated by the so-called “compromise” in the House plan on the property tax deductions, because property taxes are not a major source of funding at the state level; they are levied by New Jersey’s local governments.

Millions of New Jerseyans Would Lose Ability to Deduct State Income or Sales Taxes

A total of 1.8 million New Jersey households deduct a cumulative $17 billion in state income or sales taxes from their federal taxes. At 40 percent of all taxpaying households, New Jersey ranks third highest in the nation, behind Maryland (45 percent) and Connecticut (41 percent). Of these 1,775,740 households, the overwhelming majority (1,525,000) take the income tax deduction; the remaining 250,740 take the sales tax deduction (taxpayers can’t take both).

The 11th Congressional District – represented by Rep. Rodney Frelinghuysen – has the highest number of households (195,695) and the highest share of households (53 percent) that deduct state income or sales taxes from their federal taxes. The 8th Congressional District – represented by Rep. Albio Sires – has the lowest number (92,738) and share (25.6 percent).

In terms of dollar amounts, the 7th Congressional District – represented by Rep. Leonard Lance – has the highest total amount deducted, at $2.97 billion each year and the highest average amount deducted, at $16,129 per year per family. The 2nd Congressional District – represented by Rep. Frank LoBiondo – has the lowest total amount ($586.3 million a year) and lowest average amount ($4,882 per year per family) deducted.

While a greater share of higher-income New Jerseyans deduct state income and sales taxes, the deduction is not exclusively taken by the state’s wealthiest families. In fact, 48 percent of all New Jersey households that deduct these taxes have annual incomes under $100,000 (19 percent under $50,000 and 29 percent between $50,000 and $100,000). An additional 34 percent have an annual income between $100,000 and $200,000, while 16 percent have annual incomes between $200,000 and $1 million. Just 1 percent of these households have annual incomes over $1 million.

Millions of New Jerseyans Would Lose Ability to Deduct Local Property Taxes

A total of 1.6 million New Jersey households deduct a cumulative $14.9 billion in local property taxes from their federal taxes. At 36 percent of all taxpaying households, New Jersey ranks third highest in the nation, behind Connecticut (37 percent) and Maryland (which at 36.4 percent just barely edges out the Garden State’s 35.7 percent). (Households can take the property tax deduction in addition to the income or sales tax deduction, so many of these 1.6 million taxpayers are from the same pool of the 1.8 million families taxing those deductions.)

Under the House proposal, an estimated 968,000 New Jersey households would no longer receive the property tax deduction, with the number of families taking the deduction falling by 60 percent next year, to just 658,000.[6] That’s because even though they’d still technically be able to take the property tax deduction, many would choose not to because the combination of itemized deductions (which would no longer include state income and sales taxes) would be smaller than the standard deduction. This would be a bad deal for many taxpayers even though the House bill makes the standard deduction more generous.

The 11th Congressional District – represented by Rep. Rodney Frelinghuysen – has the highest number of households (178,845) and the highest share of households (48.4 percent) that deduct local property taxes from their federal taxes. The 8th Congressional District – represented by Rep. Albio Sires – has the lowest number (54,069) and share (14.9 percent).

In terms of dollar amounts, the 11th Congressional District has the highest total amount deducted, at $2.06 billion a year, while the 7th Congressional District – represented by Rep. Leonard Lance – has the highest average amount deducted, at $11,745 per year per family. The 8th Congressional District has the lowest total amount deducted ($420.3 million a year), while the 2nd Congressional District – represented by Rep. Frank LoBiondo – has the lowest average amount deducted ($6,654 per year per family).

While the House tax proposal would currently maintain the property tax deduction up to $10,000, in higher-cost areas of New Jersey, property taxes can exceed $10,000 for many households that aren’t rich. New Jersey’s average residential property taxes are $8,549 a year, and 147 of New Jersey’s 565 municipalities (26 percent) have average residential property tax bills of over $10,000 a year.[7] Three Congressional Districts are home to average property tax deductions that exceed $10,000. And because the proposed $10,000 limit would not be adjusted for inflation or the growth in home values over time, it would hit more and more homeowners in the Garden State as the years went by.

While a greater share of higher-income New Jerseyans deduct local property taxes, the deduction is not exclusively taken by the state’s wealthiest families. In fact, 46 percent of New Jersey households that deduct these taxes have annual incomes under $100,000 (18 percent under $50,000 and 28 percent between $50,000 and $100,000). An additional 35 percent have an annual income between $100,000 and $200,000, while 17 percent have annual incomes between $200,000 and $1 million. Just 1 percent of these households have annual incomes over $1 million.

Endnotes

[1] All data on the use of these deductions in this Fast Facts are from a NJPP analysis of U.S. Internal Revenue Service Statistics of Income data from tax year 2015.

[2] Institute on Taxation and Economic Policy, House Plan Slashes SALT Deductions by 88%, Even with $10,000 Property Tax Deduction, November 2017.

[3] Using the 2015 IRS data referenced in Endnote 1, data by ZIP code were assigned to New Jersey’s 12 Congressional Districts. For ZIP codes in more than one Congressional District, the relevant IRS data were weighted using 2010 US Census population percentages, excluding ZIP codes with populations of less than 950.

[4] Government Finance Officers Association, Impact of Eliminating the State and Local Tax Deduction (Updated with 2015 IRS Data), 2017.

[5] New Jersey Policy Perspective, Fast Facts: New Jersey Third Hardest Hit State Under House Tax Proposal, November 2017.

[6] Institute on Taxation and Economic Policy, Flawed Data from House Leadership Attempts to Hide Tax Hikes Under Proposal, November 2017.

[7] NJPP analysis of New Jersey Department of Community Affairs, 2016 Property Tax Tables. Available at http://www.nj.gov/dca/divisions/dlgs/resources/property_tax.html