To read a PDF version of this report, click here.

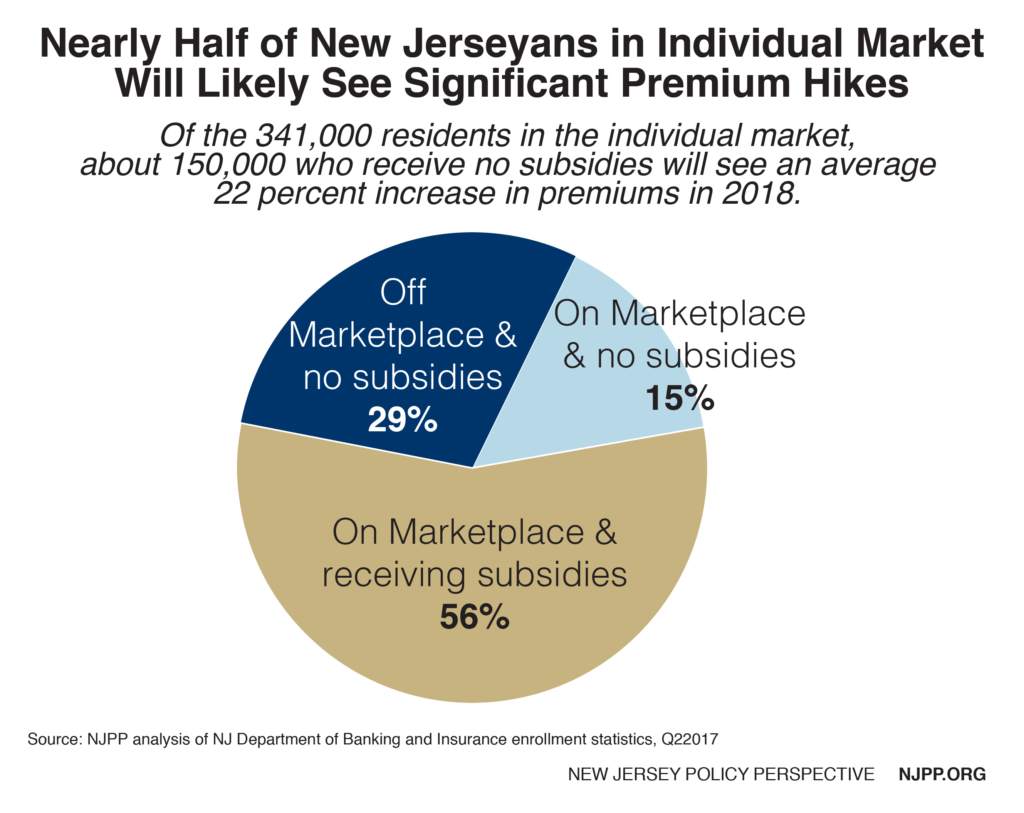

The Trump administration and Congressional Republicans’ sabotage of the Affordable Care Act’s health insurance Marketplace is driving up premiums and making insurance unaffordable for millions of Americans. In New Jersey, about 150,000 of the 341,000 people who buy insurance through the individual market will see an average 22 percent[1] – or $1,245 – increase in their premiums in 2018.

A typical four-person middle-class family will see their annual premium increase to about $23,000 for a mid-level plan next year – in addition to their deductible, copay and co-insurance – making it unaffordable for many families.[2] In all, these already-struggling New Jerseyans will face a total of $187 million in increased health care costs next year.[3]

One of the principal actions that President Trump and the Republicans in Congress took to undermine the Marketplace is defunding Cost Sharing Reduction payments, which will result in a loss of $166 million in federal funds to New Jersey insurers even though the insurers will still have to provide those subsidies to eligible consumers. Those subsidies are limited to a Marketplace customer who has an income below 250 percent of the federal poverty level ($51,000 for a family of three). In addition, Republicans in Congress have been unable or unwilling to pass legislation funding such payments.

The Trump administration has also issued conflicting statements on whether, or how well, the individual mandate will be enforced, and Republicans in the Senate propose to eliminate it entirely in the tax overhaul bill. The mandate is important because it results in healthier Americans obtaining insurance, which holds down the cost for everyone else insured in the Marketplace. Lastly, the Republicans in Congress have not extended the deadline for the Health Insurance Tax on insurers; without this tax revenue, $186 million in costs will be passed on to New Jersey Marketplace consumers.

New Jersey’s Middle Class Will See More Harm Than Peers in Other States

While most New Jerseyans in the individual market will be protected from these increases because they will still receive premium subsidies, almost half (44 percent) of the state’s residents in the individual market receive no subsidy, and therefore will have to subsidize their eligible neighbors plus bear the costs of their own increase.[4] This will be a much bigger problem in New Jersey than most states because it has one of the highest costs-of-living and average earnings in the nation. The resulting increase will likely leave many unsubsidized New Jerseyans uninsured.

These New Jerseyans do not receive subsidies because their incomes exceed four times the federal poverty level – or $81,700 for a family of three. While that income level may be a lot in lower-cost states, in New Jersey it is clearly middle-class and well below the median family income of $96,126.[5] This illustrates a deeper problem with using the federal poverty level to determine benefits, because this measurement does not consider dramatically different costs of living in states across the country.

Many of these New Jerseyans will have to drop their coverage entirely because it will be unaffordable, or they will pay their premium and not be able to afford other essentials like food and transportation. Another danger is that they will purchase plans that have a lower premium but higher cost sharing that they may not be able to afford when they need medical care.

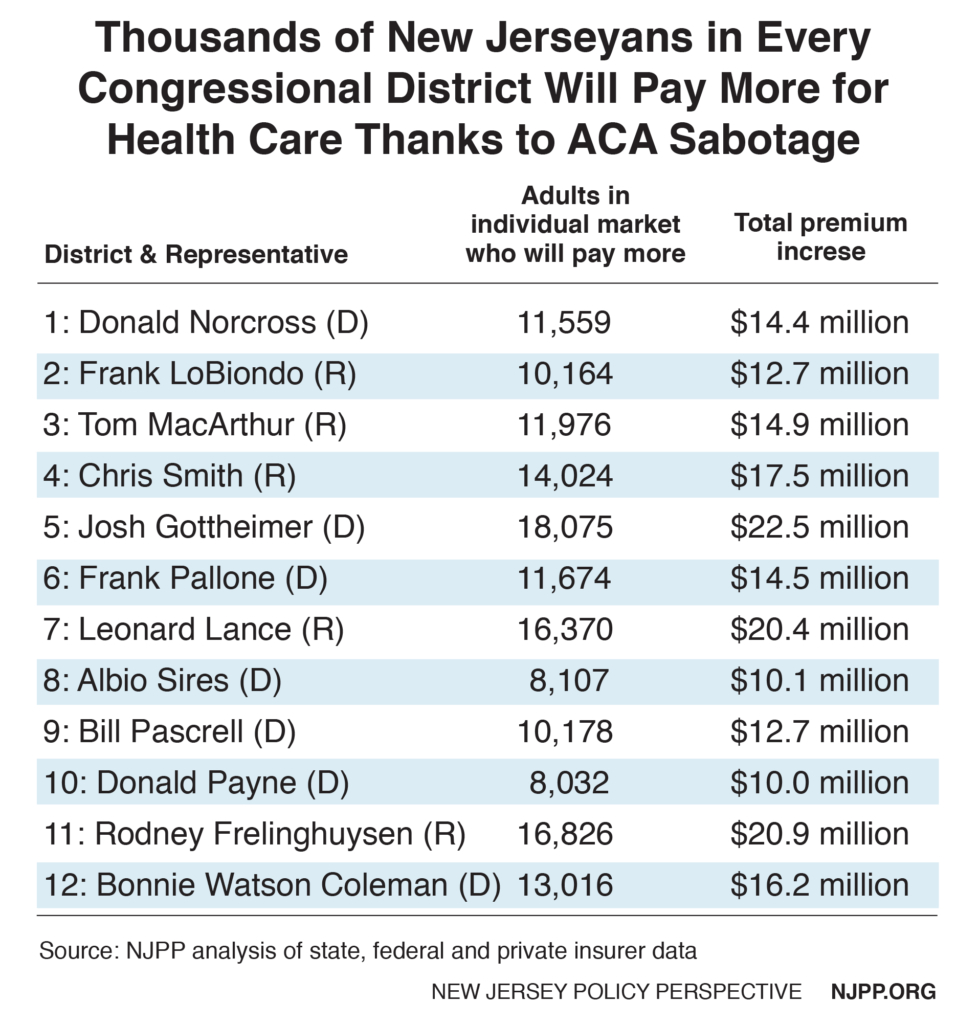

New Jerseyans across the state will face higher premiums, but people residing in Congressional Districts represented by Republicans are more at risk than people in Democratic districts. The share of all non-elderly adults who face these premium increases is about a third higher in districts represented by Republicans (3.2 percent) than in districts represented by Democrats (2.4 percent). The total number of New Jerseyans harmed by these premium increases is higher in Congressional Districts represented by Democrats because they represent more districts (7-5).

New Jerseyans With Employer-Based Insurance Could Also Be Harmed

While middle-class New Jerseyans in the individual market will see the most direct harm, the pain could very well spread to many other New Jerseyans who currently have coverage through their employer. While these residents once had the peace of mind knowing that if they lost their employer coverage they could always purchase affordable insurance on the individual market, the dramatic premium increases that are resulting from this sabotage change that equation. In fact, about 2.6 million New Jerseyans have incomes above four times the federal poverty level. If these residents were to lose insurance through their employer, they may not be able to afford the new higher premiums in the individual market.

Older New Jerseyans Will Be Hit the Hardest

All age groups are affected by these premium increases, but older New Jerseyans will be harmed the most. Half (50 percent) of New Jersey residents in the Marketplace are over age 45 and over a quarter (27 percent) are over 55.[6] While the percentage increase for older New Jerseyans is about the same as their younger peers, on average they pay much more for insurance – so this is actually a much higher dollar increase. For example, a 62-year-old New Jerseyan making $49,000 will have to pay the full cost of insurance that, on average, will increase by $12,400 to $14,500 a year. That dollar increase is almost twice the state average in the individual market.

In addition, the out-of-pocket limit rises to $7,350 next year, increasing the total potential costs for this older New Jerseyan to $21,850 – almost half (44 percent) of his or her income. To make matters worse, the House Republican tax bill eliminates the medical deduction, which would further reduce coverage for these New Jerseyans.

Many Low-Income New Jerseyans Are Also At Risk

Over 27,000 low- and moderate-income New Jerseyans could also be harmed by other actions – particularly cuts to outreach, enrollment assistance and education. This will likely have the greatest impact on the approximately 338,000 New Jerseyans who are uninsured and, in most cases, eligible for Medicaid or premium subsidies.[7]

For example, federal funding for outreach workers in states like New Jersey that chose not to establish a state exchange was reduced by an average of 41 percent.[8] New Jersey’s cut was the biggest in the Northeast, 61 percent. In addition, advertising was cut by 90 percent nationally.

An estimated 27,000 New Jerseyans will not obtain coverage in the Marketplace next year unless other resources are identified to replace the outreach efforts that have been lost.[9]

These cuts come at the worst possible time because there is much more confusion this year than in the past, thanks to the Trump administration and Congressional Republicans’ repeated efforts to repeal and replace the ACA this year and the shortest-ever open enrollment window (it runs for just 6 weeks this year from November 1 to December 15).

Endnotes

[1] Weighted average premium increases as reported by Horizon and AmeriHealth for 2018

[2] Assumes the children are ages 6 and 8 and the parents are 35 and 36. Plans were reviewed in healthcare.gov. The highest and lowest plans were selected and the mid-point was calculated.

[3] Percent premium increase was applied to average premium in the marketplace in 2017, as reported by The Assistant Secretary for Planning and Evaluation, U.S. Department of Health and Human Services.

[4] New Jersey Department of Banking and Insurance enrollment report, Q22017

[5] U.S. Census Bureau, American Community Survey, 2016

[6] Kaiser Family Foundation, 2017 Marketplace Selections by Age, November 2016- January 2017.

[7] Kaiser Family Foundation, Distribution of Eligibility for ACA Health Coverage Among the Remaining Uninsured as of 2016.

[8] Preliminary Navigator Grant Awards, 2017.

[9] New Jersey’s share of marketplace enrollment was applied towards national estimate by Get America Covered, Trump’s Ad Cuts Will Cost A Minimum Of 1.1 Million Obamacare Enrollments, October 2017.