To read a PDF version of this report, click here.

As Republican lawmakers in Congress move forward with their tax proposal, much attention has been paid to the fate of state and local tax deductions, which allow taxpayers who itemize deductions on their federal income taxes to deduct state and local property taxes, and either state and local income taxes or general sales taxes.

Eliminating these deductions would make it harder for states like New Jersey to raise enough revenue to provide essential services and make public investments that benefit all residents. That’s because, with these deductions, higher-income filers are more willing to support state and local taxes – particularly ones, like New Jersey’s personal income tax, that are levied in a progressive manner.

What’s more, the GOP tax plan isn’t targeting these deductions in a vacuum. Instead, lawmakers are attempting to end this deduction to free up revenue for significant tax cuts for the wealthiest Americans. They are, in essence, targeting a tax feature that mostly benefits upper-income families in order to push through tax cuts that overwhelmingly benefit the extremely wealthy – swapping out a slightly regressive feature for an extremely regressive change to the tax code.[1]

These deductions are widely used in high-cost, high-tax states like New Jersey. In all, 41 percent of Garden States households file using these deductions – the third highest share of all states, after Maryland and Connecticut. These households deduct a total of $32.2 billion in state and local taxes each year, the third highest dollar amount after California and New York.[2]

The latest proposal reportedly on the table would scrap the income and sales tax deductions while preserving the property tax deduction. This would still leave many New Jerseyans high and dry, and the larger tax and budget scheme it’s part of would still have damaging long-term effects on New Jerseyans of all stripes – except the incredibly wealthy.[3]

40 percent of New Jersey households deduct income or sales taxes

A total of 1.8 million New Jersey households deduct a cumulative $17 billion in state income or sales taxes from their federal taxes. At 40 percent of all taxpaying households, New Jersey ranks third highest in the nation, behind Maryland (45 percent) and Connecticut (41 percent). Of these 1,775,740 households, the overwhelming majority (1,525,000) take the income tax deduction; the remaining 250,740 take the sales tax deduction (taxpayers can’t take both).

About half of New Jersey households taking income or sales tax deduction have five-figure incomes

While a greater share of higher-income New Jerseyans deduct state income and sales taxes, the deduction is not exclusively taken by the state’s wealthiest families. In fact, 48 percent of New Jersey households that deduct these taxes have annual incomes under $100,000 (19 percent under $50,000 and 29 percent between $50,000 and $100,000). An additional 34 percent have an annual income between $100,000 and $200,000, while 16 percent have annual incomes between $200,000 and $1 million. Just 1 percent of these households have annual incomes over $1 million.

While a greater share of higher-income New Jerseyans deduct state income and sales taxes, the deduction is not exclusively taken by the state’s wealthiest families. In fact, 48 percent of New Jersey households that deduct these taxes have annual incomes under $100,000 (19 percent under $50,000 and 29 percent between $50,000 and $100,000). An additional 34 percent have an annual income between $100,000 and $200,000, while 16 percent have annual incomes between $200,000 and $1 million. Just 1 percent of these households have annual incomes over $1 million.

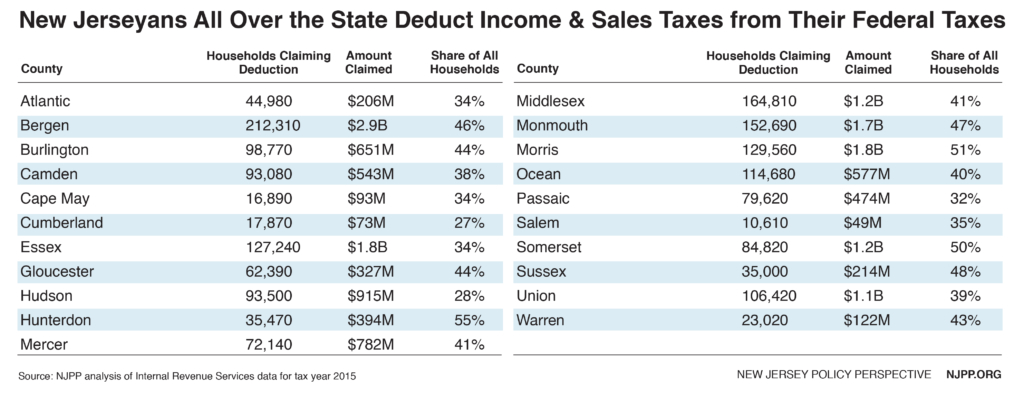

Tens of thousands of households in every county deduct income or sales taxes

The families who deduct state income or sales taxes from their federal taxes live all over New Jersey. Bergen County has the highest number of such households, at 212,000, while sparsely populated Salem County has the lowest, at 11,000. But the deduction is used by the highest share of households in Hunterdon County (55 percent of all tax filers), while it is used by the lowest share in Cumberland County (27 percent). In terms of dollar amount, Bergen County is home to the highest figure ($2.9 billion) while Salem County is lowest, at $49 million.

36 percent of New Jersey households deduct property taxes

A total of 1.6 million New Jersey households deduct a cumulative $14.9 billion in local property taxes from their federal taxes. At 36 percent of all taxpaying households, New Jersey ranks third highest in the nation, behind Connecticut (37 percent) and Maryland (which at 36.4 percent just barely edges out the Garden State’s 35.7 percent). (Households can take the property tax deduction in addition to the income or sales tax deduction, so many of these 1.6 million taxpayers are from the same pool of the 1.8 million families taxing those deductions.)

Nearly half of New Jersey households taking property tax deduction have five-figure incomes

While a greater share of higher-income New Jerseyans deduct local property taxes, the deduction is not exclusively taken by the state’s wealthiest families. In fact, 46 percent of New Jersey households that deduct these taxes have annual incomes under $100,000 (18 percent under $50,000 and 28 percent between $50,000 and $100,000). An additional 35 percent have an annual income between $100,000 and $200,000, while 17 percent have annual incomes between $200,000 and $1 million. Just 1 percent of these households have annual incomes over $1 million.

While a greater share of higher-income New Jerseyans deduct local property taxes, the deduction is not exclusively taken by the state’s wealthiest families. In fact, 46 percent of New Jersey households that deduct these taxes have annual incomes under $100,000 (18 percent under $50,000 and 28 percent between $50,000 and $100,000). An additional 35 percent have an annual income between $100,000 and $200,000, while 17 percent have annual incomes between $200,000 and $1 million. Just 1 percent of these households have annual incomes over $1 million.

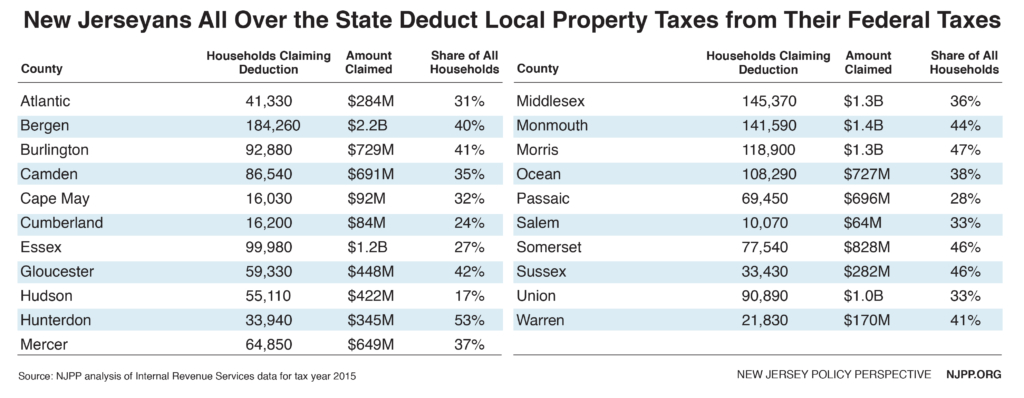

Tens of thousands of households in every county deduct property taxes

The families who deduct local property taxes from their federal taxes live all over New Jersey. Bergen County has the highest number of such households, at 184,000, while sparsely populated Salem County has the lowest, at 11,000. But the deduction is used by the highest share of households in Hunterdon County (53 percent of all tax filers), while it is used by the lowest share in Hudson County (17 percent). In terms of dollar amount, Bergen County is home to the highest figure ($2.2 billion) while Salem County is lowest, at $64 million.

Endnotes

[1] For more, see Center on Budget and Policy Priorities, Eliminating State and Local Tax Deduction to Pay for Tax Cuts for Wealthy a Bad Deal for Most Americans, October 2017.

[2] All data on the use of these deductions in this Fast Facts are from a NJPP analysis of U.S. Internal Revenue Service Statistics of Income data from tax year 2015.

[3] See Institute on Taxation and Economic Policy, Benefits of GOP-Trump Framework Tilted Toward the Richest Taxpayers in Each State, October 2017 (https://itep.org/trumpgopplan/) and Center on Budget and Policy Priorities, House GOP Tax Plan Likely to Contain Same Basic Flaws as Earlier Versions of the Plan, October 2017 (https://www.cbpp.org/research/federal-tax/house-gop-tax-plan-likely-to-contain-same-basic-flaws-as-earlier-versions-of)