On Friday, I joined a tele-town hall on the Republican tax plan with Governor-Elect Murphy, Senators Menendez and Booker, and Congressman Pallone. Audio from the call, which was organized and hosted by New Jersey Working Families, can be heard here. Below are my prepared remarks.

There are a lot of ways to think about this Republican tax plan, and a lot of different slices to look at. I like to think of it this way: There are the pocketbook effects of the tax plan – these are the direct impacts on New Jersey families. And then there are the larger, existential threats to the American social contract that this tax bill represents and puts into motion.

On the first, the pocketbook effects, this plan is a raw deal for New Jersey’s middle class, its low-income families and its working class. We’ve been crunching the numbers with every new iteration of this bill, and while minor changes occur from version to version, the big picture remains the same: the wealthiest families and large corporations make out like bandits, and working families get stuck with the bill.

A few quick data points on the bill the Senate passed last weekend:

- New Jersey’s top 1 percent of households would receive an average $8,350 tax cut each year, while the bottom 60 percent of families see a tax hike averaging $120 a year.

- Those families in the top 1 percent would receive nearly two-thirds of the state’s total share of the tax cut.

- In all, we estimate that New Jerseyans would deduct nearly $27 billion less in state and local taxes under the Senate-passed bill than they do now.

As terrible as that all sounds, that is not even the worst part of this bill. In fact, this bill is the first step in a two-step “cut and cut” agenda that would rip the American social contract to shreds, undo decades of progress for working Americans and send the country hurtling even faster toward a new gilded age.

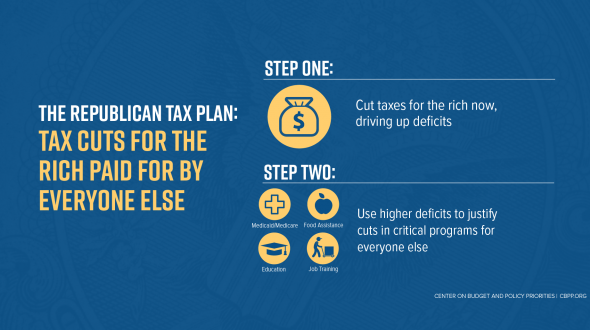

Here’s how this cut and cut agenda works: First come the tax cuts – they are tilted to the top, they are expensive and they blow up the deficit. That last point is key. Because the second step is to cut services, using the deficit pressure these tax cuts cause as the rationale. GOP leaders are already out there promising to slash the already-tattered safety net and rein in so-called “entitlements” – in other words, health care, retirement security and food assistance for millions and millions of Americans.

That’s why this tax battle is so critical. This is about so much more than preserving tax deductions that so many New Jerseyans use. It’s about so much more than beating back huge tax cuts for powerful interests who are the only ones thriving in today’s rigged economy. It’s about how we shape our society and our future. How we raise money, and what we choose to spend it on, are the truest reflections of our values as a country. We must do better than this. And we can do better than this – but only if we keep up the fight. Thanks to everyone here on this call for your commitment to doing just that.