Increasing New Jersey’s Earned Income Tax Credit (EITC) could boost the incomes of nearly 600,000 working families in the state who aren’t paid enough to get by, lift or keep many of these people out of poverty and give kids in these families a better shot at success later in life, as my colleague Brandon McKoy noted in legislative testimony earlier this week.

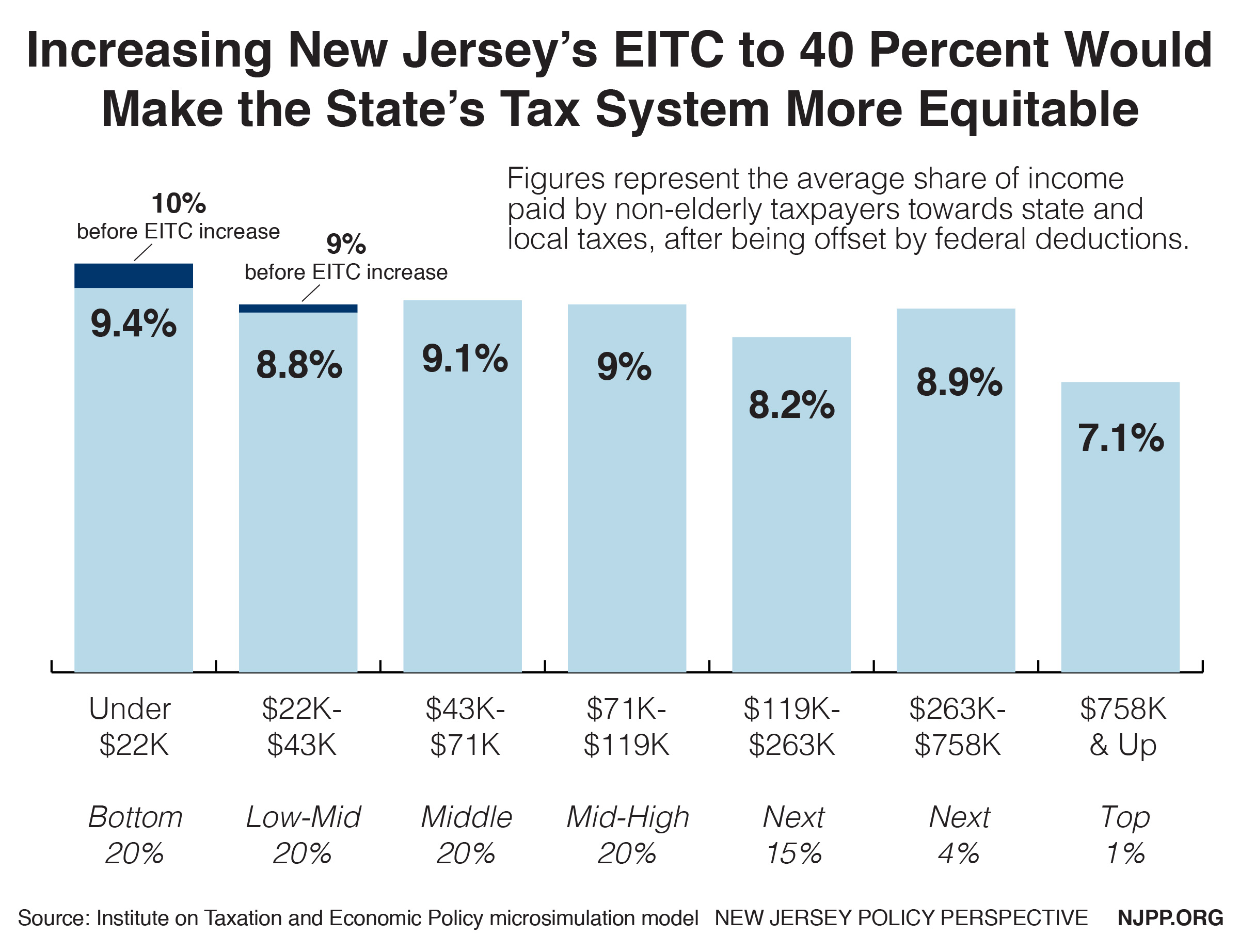

But increasing the state EITC to 40 percent would also help make New Jersey’s state and local tax structure more equitable by reducing the share of income the state’s residents contribute in taxes.

As it stands now, New Jersey taxpayers who make less than $22,000 a year – the bottom 20 percent – pay the highest share of their income towards state and local taxes. That’s because, even with a state income tax that is highly progressive and based on the ability to pay, other state and local taxes – namely property and sales taxes – are regressive and help tip the overall scales of the structure out of balance.

If policymakers increase the EITC to 40 percent, those poorest households would still pay the largest share of their incomes towards taxes, but not by nearly as much.