To read a PDF version of this report, click here.

Once the Senate tax proposal is fully phased in, New Jersey’s wealthiest 5 percent of taxpayers would receive an average $11,800 tax break each year while close to 1 in 4 Garden State taxpayers (22 percent) would pay an average of $2,330 more in a year in federal taxes.[1] (Unless otherwise noted, all data in this Fast Facts is on the impact in the year 2027, once the plan is fully phased in.)

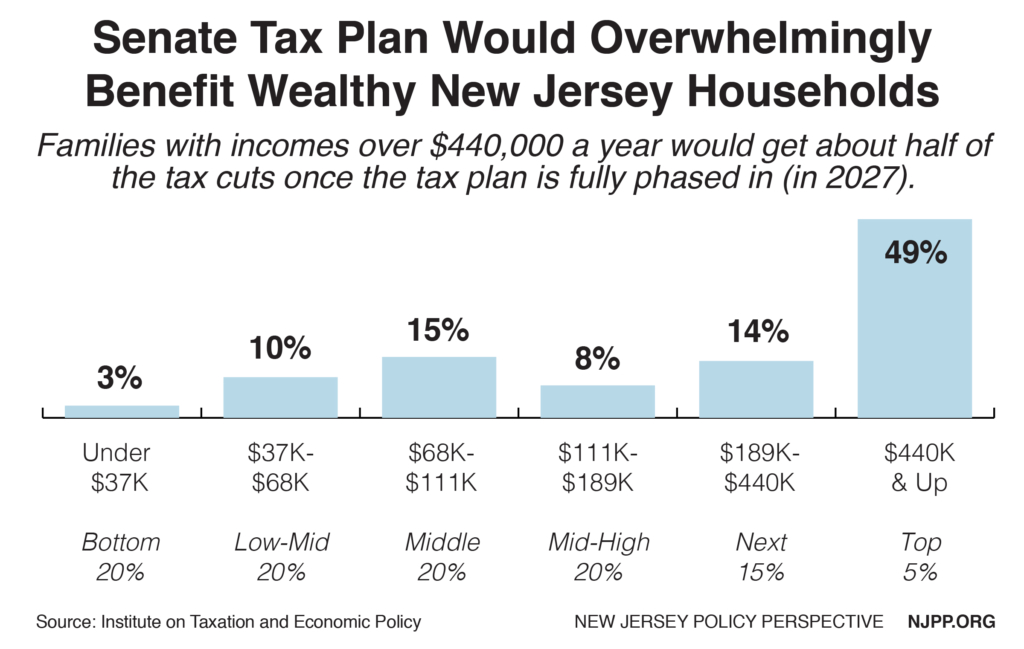

In all, the wealthiest 5 percent of New Jerseyans – those with annual incomes over $440,000 a year – would receive about half (49 percent) of the tax cut coming to the state by 2027, while the bottom 60 percent (everyone earning less than $111,000 a year) would get just 28 percent.

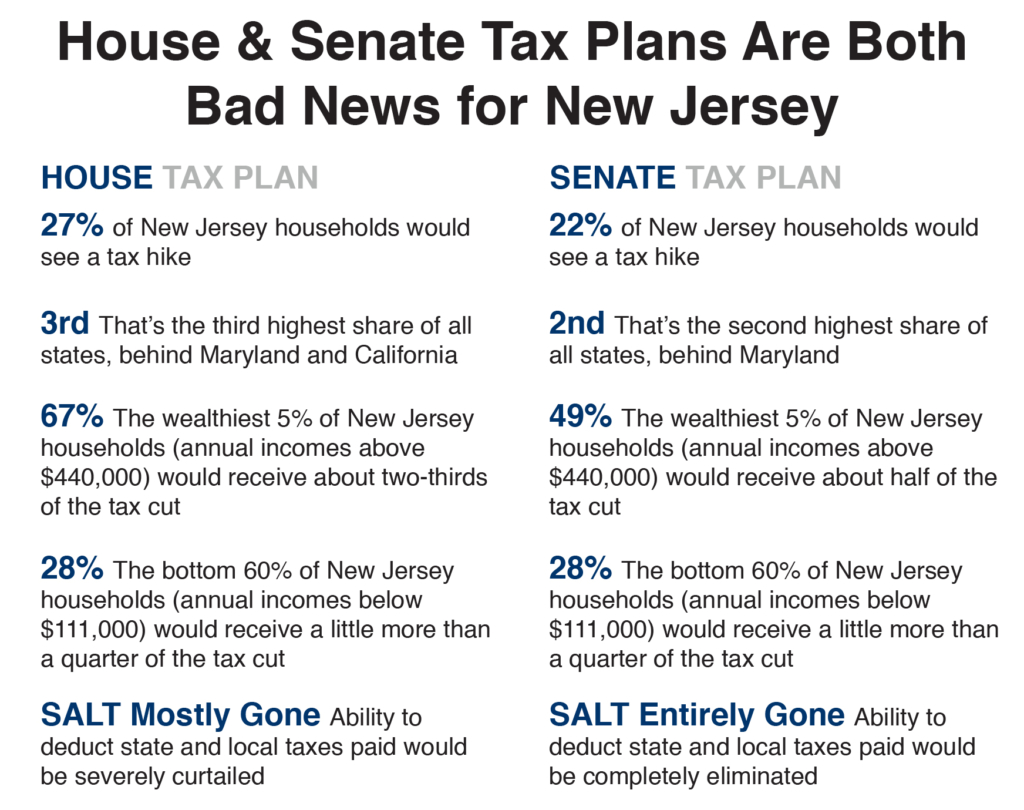

While the Senate plan is slightly less tilted to New Jersey’s top earners than the House plan, at its core it retains all the same flaws as the House plan:

- It increases federal deficits by more than $1.5 trillion over the coming decade

- Its tax cuts that are heavily skewed to the wealthiest families and large corporations

- It will lead to cuts to services and programs that working New Jerseyans count on

- It will make it harder for states to invest in schools, infrastructure, health care and more

- It punishes New Jersey more than nearly every other state

Nearly 1 in 4 New Jerseyans would face a tax hike by 2027 in large part because the Senate proposal would completely end Americans’ ability to deduct state and local income, sales and/or property taxes paid. (The House plan offered a partial elimination.) At 22 percent, New Jersey has the second highest share of taxpayers facing a tax hike behind only Maryland (27 percent). This is far higher than the total share of Americans – 13 percent – who face a tax hike.

A total of 1.8 million New Jersey households deduct a cumulative $17 billion in state income or sales taxes from their federal taxes, while 1.6 million New Jersey households deduct a cumulative $14.9 billion in local property taxes.[2] These deductions help tens of thousands of families in every single Congressional District.[3] New Jersey’s average residential property taxes are $8,549 a year, and 147 of New Jersey’s 565 municipalities (26 percent) have average residential property tax bills of over $10,000 a year.[4]

What’s more, this analysis of the “winners and losers” under the House proposal doesn’t take into account the impact of likely budget cuts that would be paired with these tax breaks. If the tax cuts were eventually paid for through the spending cuts on entitlements and federal programs promised in recent GOP budget proposals, it’s clear that any modest tax cut for low-income or middle-class New Jerseyans would be more than wiped out. (An analysis of the earlier tax framework that took program cuts into effect found the “vast majority of Americans” would lose – even if they took home small tax cuts.[5])

Endnotes

[1] Institute on Taxation and Economic Policy Microsimulation Tax Model, November 2017. Full dataset available at https://itep.org/senatetaxplan/

[2] New Jersey Policy Perspective, Fast Facts: Millions of New Jerseyans Deduct Billions in State & Local Taxes Each Year, November 2017.

[3] New Jersey Policy Perspective, State and Local Tax Deductions Benefit Tens of Thousands of New Jerseyans of All Incomes in Every Congressional District, November 2017.

[4] NJPP analysis of New Jersey Department of Community Affairs, 2016 Property Tax Tables. Available at http://www.nj.gov/dca/divisions/dlgs/resources/property_tax.html

[5] Center on Budget and Policy Priorities, Vast Majority of Americans Would Likely Lose From Senate GOP’s $1.5 Trillion in Tax Cuts, Once They’re Paid For, October 2017.