Welcome to NJPP’s Budget Address FY2020: Rapid Reaction, your source for commentary and data analysis on Governor Murphy’s address. The transcript below was taken from a conversation in NJPP’s conference room — over half eggplant, half plain pizza — and has been lightly edited.

Lou (Louis Di Paolo, Communications Director): Earlier today Governor Murphy kicked off the start of “budget season” with the unveiling of his fiscal year 2020 budget proposal. In his address, the governor outlined his $38.6 billion spending plan and renewed investments in public education, NJ Transit, affordable homes, and much, much more. The proposal also makes the largest pension payment in state history.

The governor’s budget is grounded in big savings in public employee health care benefits and new revenue in the form of a true millionaires tax. As Sheila Reynertson states in NJPP’s response statement, this budget is a “fiscally sound vision that invests in New Jersey’s greatest assets while lifting up the most vulnerable families in the state.”

But that’s enough from me — let’s jump right into it. What did everyone think about Governor Murphy’s budget address? Let’s start with Ray since he has to leave us soon for a meeting.

Ray (Raymond Castro, Health Policy Director): I’m very impressed that Governor Murphy is so concerned with the most vulnerable people in New Jersey. However, it is also clear that much more needs to be done in a state with one of the highest costs of living in the US.

Lou: Definitely a fair assessment, but can you elaborate more on that? Two part question: what do you think this budget does especially well, and where does it come short?

Ray: It makes improvements in housing assistance, preschool funding and maternal health. However, we also need to expand NJ FamilyCare to all of the remaining 78,000 uninsured children in New Jersey and continue to partially restore the massive cutbacks in Temporary Assistance to Needy Families which helps about 25,000 poor children.

Lou: Those are important caveats and points I’m sure we’ll be flagging for legislators throughout the budget season. What are your thoughts, Sheila and Brandon?

[Ray has left the chat]

Sheila (Sheila Reynertson, Senior Policy Analyst): It is clear to me that fiscal responsibility and creating opportunities for those who are struggling to get by in the Garden State are top priorities in this year’s budget. From growing the state surplus to securing sustainable savings in public employee health care delivery to weaning the state off raiding of dedicated funds, this proposal is obviously laser focused on improving the fiscal health — and the credit ratings that come with it — of state government.

But equally, it is a proposal that takes seriously the role government can play in investing in all New Jersey families. Increased investments in education, college tuition aid and community college grants were expected, but it was thrilling to hear about state dollars being used to improve access to long-acting birth control and support efforts to reverse New Jersey’s dismal infant mortality rates among Black women.

Brandon (Brandon McKoy, President): Like Sheila, I’m very happy to see this budget include a significant surplus. This will make two straight years of NJ budgets having a surplus, something that hasn’t happened in a long while. It’s really important that as the budget goes through the legislature, the surplus is protected. Oftentimes legislators will look at such a large amount and try to skim some of it for other purposes, so we’re going to be working hard to keep this surplus intact because it will help our long-term fiscal standing.

Lou: Can we talk more about the budget surplus? It’s not exactly a sexy topic, so can one of you explain why this is so important for New Jersey’s fiscal health? Also, bummer Ray left for his meeting right before the pizza showed up.

Sheila: It’s great to see the governor budgeting a $1.1 billion surplus for this fiscal year. It gives the state a healthy cushion against unexpected budget gaps and a hedge against a potential national recession or another Superstorm. The governor asked the audience “to find the last time we had consecutive years of billion-dollar-plus surpluses.” The answer? 2009 – but it was quickly wiped out in reaction to the Great Recession. And despite a slow recovery, New Jersey has failed to replenish the surplus reserve fund. Instead the previous administration leaned on it to fill budget gaps year after year. By the end of Governor Christie’s term, New Jersey didn’t have enough reserves to last a single day compared to the US median of 20.5 days.

Rainy day funds are an important safeguard against economic downturns and natural disasters like Superstorm Sandy. Historically, NJ’s fund has been used to plug budget holes.

We commend @GovMurphy for building the state’s surplus in his FY2020 #NJBudget.

Source: @pewtrusts pic.twitter.com/KjV9UY227z

— New Jersey Policy Perspective (@NJPolicy) March 5, 2019

Brandon: I love surpluses, but can we talk about the millionaires tax already?

Lou: No, we can’t. Just kidding, of course we can.

Brandon:

Sheila: You should just copy and paste your twitter thread, Brandon. It’s not like anyone read it.

Brandon: Hey! Lots of people read my twitter thread. Here’s the proof!

But in all seriousness, the governor’s proposal to apply the millionaires tax to — wait for it — all millionaires is totally appropriate and really modest, especially when you take into account the high rate of economic and racial inequality that exists in New Jersey. For context, last year the state implemented a 10.75% tax rate for earnings over $5 million a year. Now it’s time to make sure all millionaires pay that tax rate. They’re all easily in the top 1% in New Jersey, and right now that group is taking home 19.7% of all income earned in the state, averaging an annual salary of $1.6 million. Meanwhile, those in the bottom 99% earn just $65,068 per year, on average.

Applying the millionaires tax to all millionaires would certainly help raise sustainable revenues that help us invest in our assets, but even more importantly it helps tackle the high level of economic inequality in the state. New Jersey ranks 9th worst for economic inequality nationally, so there’s definitely lots of space for improvement and we need to do more to address the issue.

Sheila: No way to top that. Except to say that using the new federal limit on the deductibility of state and local taxes (SALT cap) as an excuse NOT to increase income tax on earnings over $1 million ignores the facts.The truth is New Jersey’s highest-income households – those with annual incomes over $1 million – get a windfall from the new tax plan, even with the limit on SALT deductibility. That’s because for New Jersey’s wealthiest families, the average federal tax cuts from other changes in the law are notably larger than the average size of the impact from the loss of SALT deductibility (looking at you, massive CBT cut). There is no reason for legislative leaders to back off of long-held plans to make New Jersey’s income tax fairer and raise much-needed new revenue to invest in schools and property tax relief, especially after a decade of major tax cuts that disproportionately benefit the wealthiest.

Lou: For the folks at home who don’t follow New Jersey budgeting as closely as we do, can one of you briefly explain why having new sources of revenue is so important?

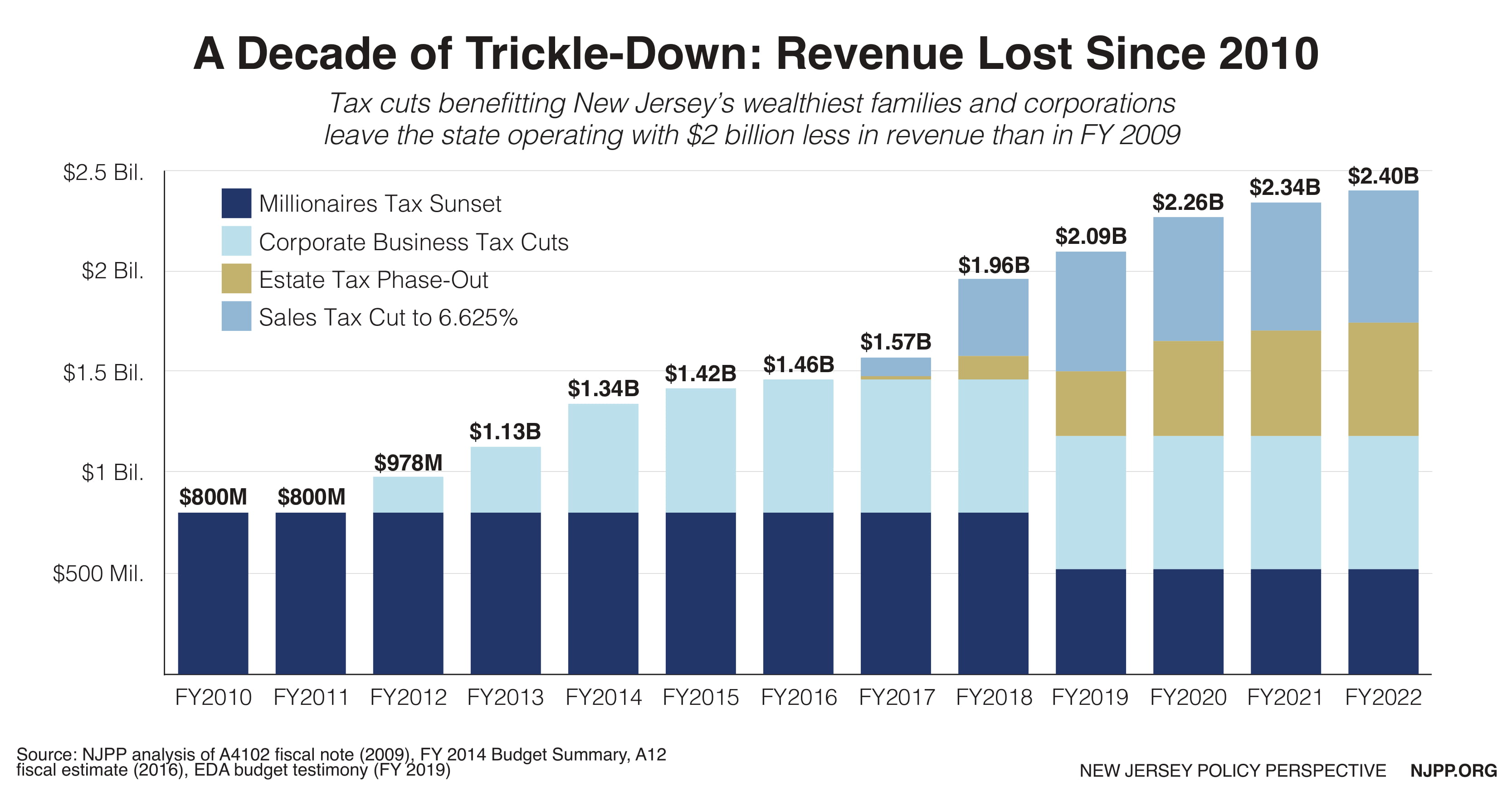

Sheila: The short answer is New Jersey has suffered from years of trickle-down economic policies. In just the last decade, New Jersey dolled out $13 billion in tax cuts for the wealthy and corporations on top of $11 billion in tax subsidies to corporations who promise to move into or expand in the state. That means less dollars for vital services. The state should be an active participant in helping the economy grow and flourish – something it can’t do if left to struggle with keeping the lights on or keeping up with rising costs. And that hurts everyone. See more on this history of disinvestment in my blog post from Monday.

Lou: But what about all the millionaires fleeing New Jersey to go to low tax states? I heard this trope in at least one of the televised responses to the governor’s address.

Sheila: Yeah, that’s not a thing.

And when I ask for concrete evidence on “tax flight” I generally get nothing or worse… *anecdotes*. Meanwhile, several comprehensive studies on whether tax policy affects relocation decisions draw the same conclusion: millionaire households overwhelmingly choose to live where they have family connections, work and business opportunities, and an established social network. State income tax rates have only a very limited impact on their residence decisions.

Brandon: It’s all about quality assets. That’s why we constantly advocate for the state to increase revenues — not just as a means to address income inequality, but also to invest in our unique and critical assets. Like Sheila says, people come to New Jersey to make their fortunes and wealthy people stay here because we have the assets and features that are central to them being successful. That’s why we need to do all we can to make sure that NJ Transit is fast and on time, that our public schools continue to be top notch, that our communities are attractive and affordable.

We already have a location that is the envy of the country, we’re smack dab in the middle of the most productive economic region in the world. Under the previous administration, transit, public education, and property tax relief were all cut significantly. We need to learn the lesson from those mistakes and secure a budget that enables those necessary investments to be made — this budget helps us get there in a big way.

Lou: All great points.

Sheila: Can you tell we talk about this a lot?

Lou: Not one bit. But you having Cristobol Young’s “The Myth of Millionaire Tax Flight” prominently displayed in your office bookshelf definitely gives it away.

Sheila: That picture is shockingly on brand.

Lou: It definitely is. But here’s my follow up question: if people decide to stay here based on the states assets, does the governor’s budget put enough funding behind them? I’m thinking of early and college education, housing, transit, etc. — you name it.

Sheila: Well, we know this budget builds on last year’s commitment to rebuild investments in K-12 education with an additional $200 million, $68 million more for pre-K expansion and NJ Transit with another $100 million. These are all smart moves. The proposal also restores $59 million for the Affordable Housing Trust Fund and gives the new free community college fund a $33.5 million bump. It was good to see pumps for both Tuition Aid Grants and the Educational Opportunity Fund too. These may seem like small potatoes in a $38.6 billion budget but one can’t underestimate how much of an impact they make in people’s economic future.

Lou: It seems like we generally like this budget, but where does it fall short? I know that it doesn’t go nearly as far as we’d like in terms of taxing wealthy — looking at you, estate tax — but what else is missing?

Brandon: Yea, so while we like the proposal to apply the top income tax rate of 10.75% to all millionaires, it’s fair to say that there should be separate brackets above (and even slightly below) $1 million. I’d suggest having those at $1 million pay 10.75%, then add another bracket at $2.5 million and another bracket at $5 million. This would help address income inequality even further and raise more revenue for investments. The millionaires tax proposal is good, but these changes would make it even better.

Sheila: We could even add brackets at $250,000 and $750,000. It’s insane that $75,000 in earnings is taxed at the same rate as $499,999. Really?

Lou: What about on the spending side? What could be better? And for this, let’s make it a rapid fire round: ready, set, go!

Sheila: There’s a small increase in funding for universal representation, which is a program that provides legal representation for undocumented New Jerseyans facing deportation. The bump is to $3.1 million this year, up from $2.1 million last year, but to fully fund the program would require about $18 million and we’d like to see that full investment made.

Brandon: There’s the Civic Information Consortium, an effort to improve local journalism that’s received a lot of praise from stakeholders across the country. The governor signed the legislation to make the consortium real into law last year, but the $5 million it needs to operate wasn’t appropriated. Making sure it gets that $5 million this year would be a big deal.

Lou: Anything else?

Sheila: The Child Care Tax Credit returns for a second year, but it remains a largely symbolic gesture due to the way it is designed. Right now the tax credit doesn’t really help those who need it the most – low-income families who pay little to no federal taxes. I am thrilled to have this tax credit on the books, I just wish it had more teeth.

Brandon: There’s an increase in the earned income tax credit (EITC) to 39% refundability this year, up from 37% last year. That’s really important and is going to help strengthen the EITC, but it would be even better if we expanded the eligibility of the EITC to more people. Right now you have to be over 25 years old to qualify for it, but there’s a bunch of people under the age of 25, both with and without children, who would benefit significantly from this credit. In fact, New Jersey’s own Congresswoman Bonnie Watson Coleman is proposing federal legislation that would reduce the age eligibility for EITC to 18 years old, something that California has done, so there’s already some precedent.

Lou: I said rapid fire… That’s a very long-winded answer.

Brandon: But EITC is important! It’s the best program we’ve ever had at combating poverty.

Lou: Fair point. I’ll let this one slide. Final thoughts? Anything we didn’t cover?

Sheila: I appreciated Governor Murphy calling out the awful Title X gag rule proposal on the federal level and positioning New Jersey as a champion of evidence-based reproductive health policy.

Brandon: The governor made quick mention of the need to get the state’s corporate tax subsidy programs under control. He’s made some good proposals for reform, including capping the amount of subsidies that can be awarded in a given year. This would really help us add some more stability and predictability to the state budget, and it would improve our standing with the ratings agencies. The legislature has shown that it’s not too interested in the governor’s proposals, but they would be wise to support them so here’s hoping that they make the right decision.

Lou: Thanks, team! This was fun.

Brandon: There’s 1 slice of pizza left … can I have it?

Lou: Of course, you’re the one who ordered it. Cowabunga, dudes!