Tomorrow, Governor Murphy will kick-off what is affectionately known as “budget season” with his fiscal year 2020 budget address. It’s the time of year when we at NJPP fire up our spreadsheets, crunch numbers, and engage in a healthy debate about New Jersey’s path to a stronger state economy and more sustainable future.

But let’s be clear about one thing from the onset: Since 2010, New Jersey has had to make do with far less as a result of $13 billion in cumulative tax cuts — that primarily benefited the wealthy and large businesses — by the former governor with an eye on a presidential run and a misguided belief in trickle-down economic policies. Add to that the 2013 overhaul of New Jersey’s corporate tax subsidy program, which handed out an astonishing $11 billion worth of tax credits to corporations with little to no oversight.

Given New Jersey’s outsized spending obligations and lagging revenue, we expect Governor Murphy will make the case for building upon last year’s accomplishments by investing in valuable assets and fixing long-standing disparities in the tax code that exacerbate inequality. In fact, it has now been confirmed that an income tax increase on on earnings over $1 million will be a key component of the Governor’s budget.

And it should be. Pushing for a bold, progressive budget with new revenue sources and a commitment to New Jersey’s long-term wellbeing is absolutely justified. Here’s why.

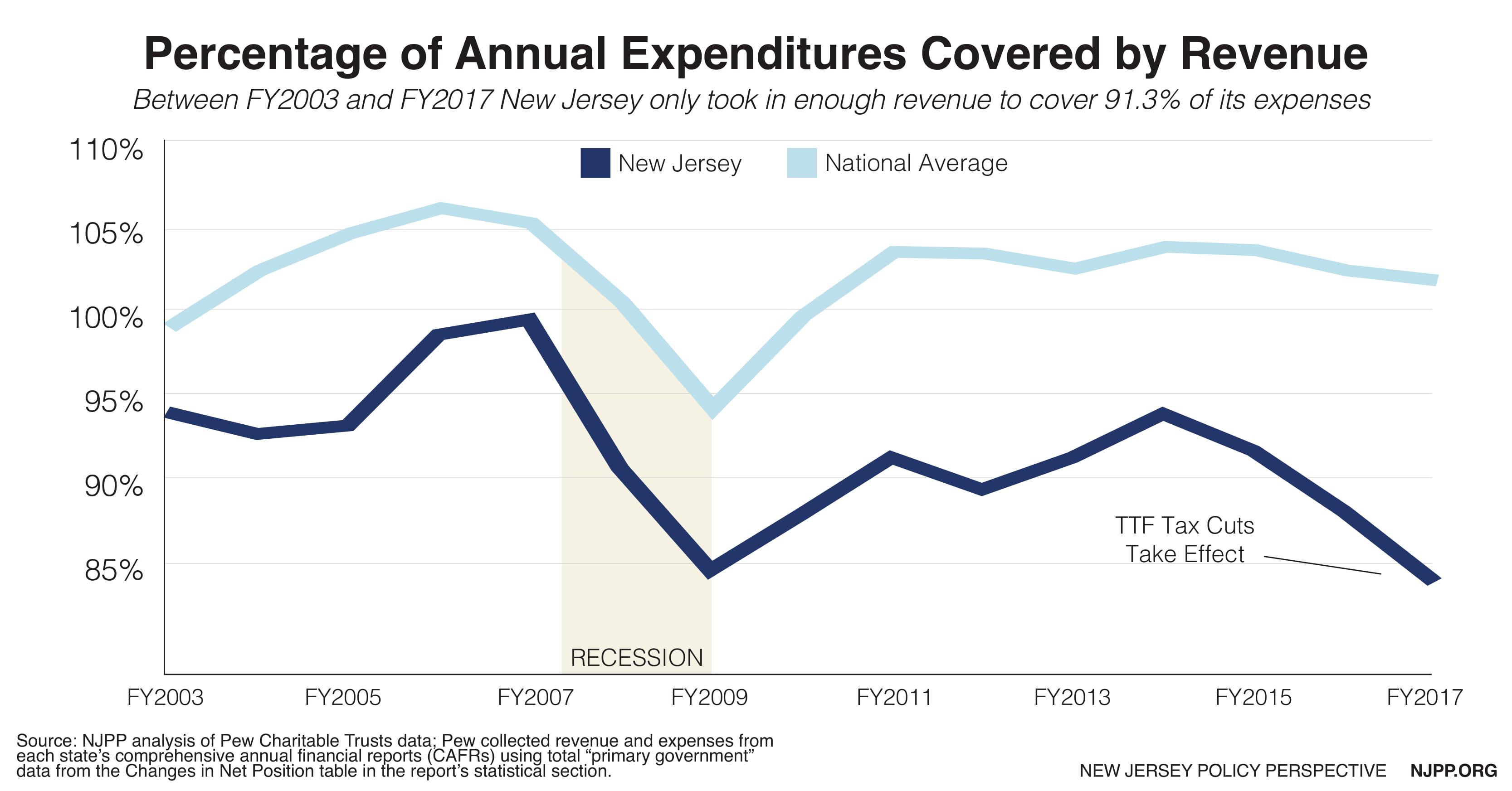

New Jersey has not been able to pay all its bills for 15 years straight because it doesn’t collect enough revenue to cover its expenses. In fact, the Garden State currently has the biggest gap between its revenue and expenses of any state in the country. This didn’t just happen by accident. For decades now, New Jersey has turned a blind eye to its financial woes. State leaders raided reserves, took on debt, and deferred payments on its obligations just to make ends meet for another year.

Credit rating agencies took notice and responded by repeatedly “dinging” New Jersey for its over-reliance gimmicky fixes and shameless money grabs of dedicated funds. Those lower credit ratings now make it more expensive to borrow funds for long-term projects.

The Great Recession and Superstorm Sandy certainly didn’t help matters much. And then another tragedy struck.

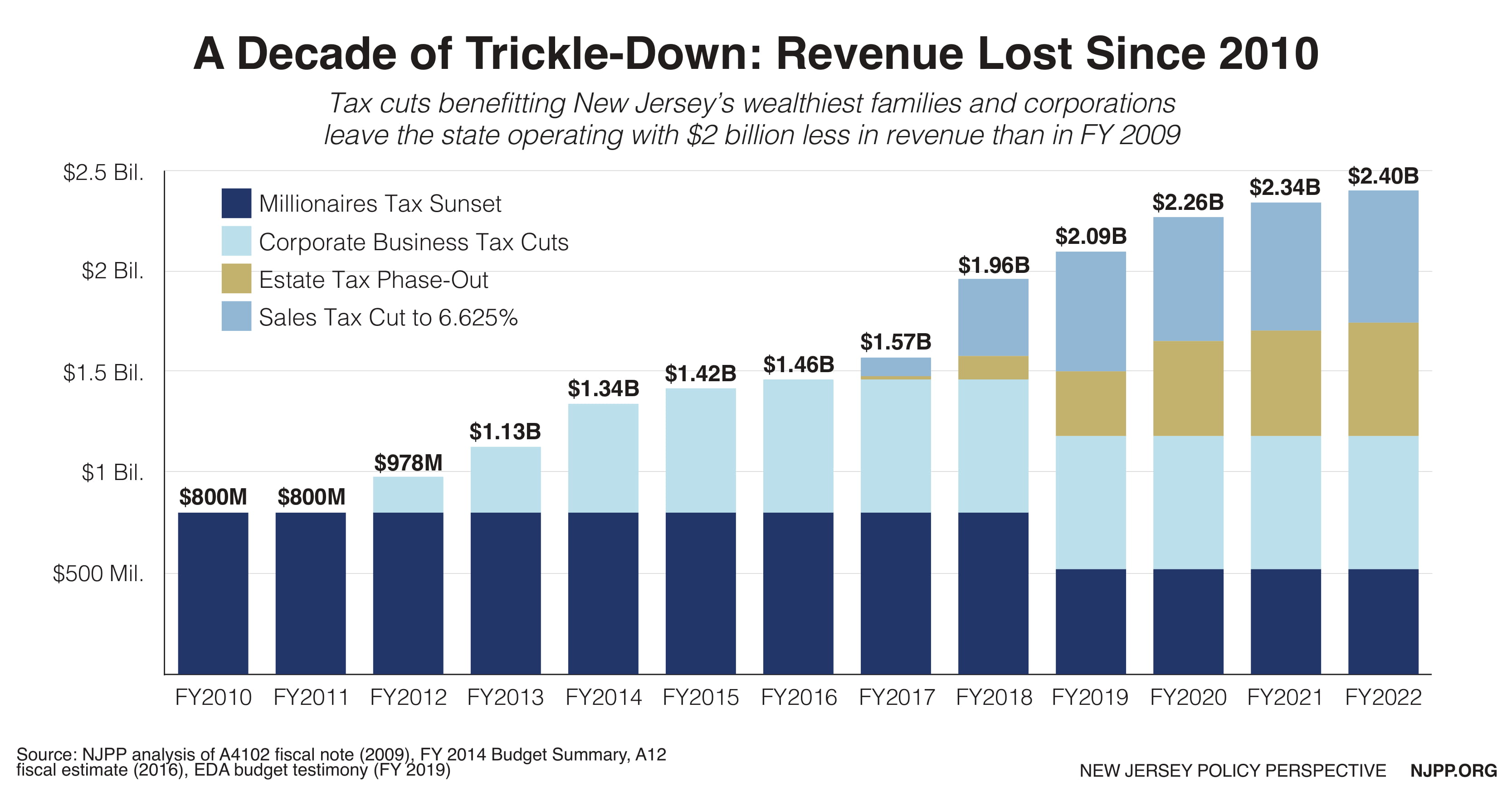

Just as New Jersey was beginning its laborious journey out of the recession, the wealthiest among us and large corporations were granted gifts that keep on giving — at the expense of the state’s ability to provide key services and invest in its assets. First, the wealthy were given a $800 million tax cut when the 2008 millionaire’s tax was allowed to sunset. Then, businesses were given $660 million in tax cuts.

Come 2016, a package of tax cuts that benefited the wealthy, and left crumbs for everyone else, was enacted as an unnecessary tradeoff for raising the gas tax. The deal to replenish the Transportation Trust Fund (TTF) eliminated New Jersey’s estate tax, allowing approximately 4,000 of New Jersey’s wealthiest families to collectively enjoy over $500 million in tax cuts. And the sales tax decrease, which disproportionately benefits New Jersey’s highest earners and spenders, translates to over $600 million less in the state’s general fund.

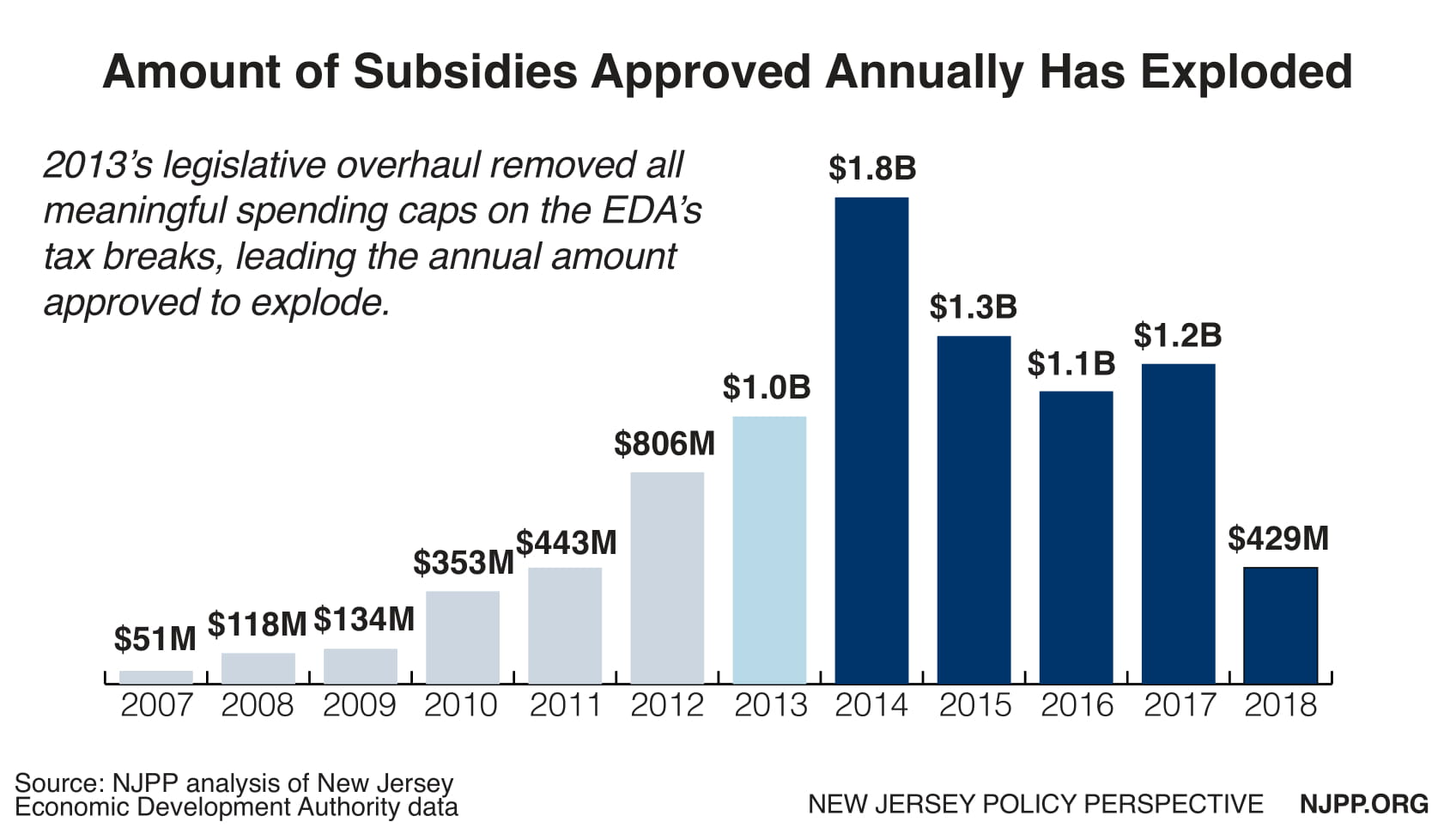

Worse, these cuts became fully phased in at precisely the same time that corporate tax subsidies began to balloon in cost. In essence, New Jersey has sacrificed revenue it is in no position to give away to begin with. When 2013 reforms stripped spending caps on the tax subsidy program, the cost per job (retained and new) drastically increased from $17,000 in the 2000s to $78,000 post-overhaul. If awarded corporations cash in their tax credits, the Treasury may come up short by $1 billion a year for the next three fiscal years, at least.

All told, the entire package of Christie-era tax cuts and subsidies for corporations deprives the state government of $3 billion in essential revenue in this upcoming budget season and well into the future.

And everyday New Jerseyans will pay the cost. It is our commutes to work, our roads, our children’s schools, and our pocketbooks that suffer. Governor Murphy has an opportunity to make the difficult and visionary choices that will lead us to a better financial future. This is the budget season to think big and bold — and protect New Jersey’s future.