To read a PDF version of this report, click here.

New Jersey’s ongoing efforts to protect the Affordable Care Act (ACA) are starting to pay off: all middle class New Jerseyans who purchase their insurance in the individual market will pay far less than they otherwise would have next year and for the foreseeable future. These major savings will be available to New Jerseyans who exceed the income cut-off for federal subsidies, which is $48,560 a year for an individual and $100,400 for a family of four. Time is of the essence as consumers can maximize saving by selecting a plan before the open enrollment period ends on December 15.

This relief could not occur at a better time since these same New Jerseyans were hit with a whopping 19 percent increase in their premiums this year as the Republican-led Congress and Trump administration worked tirelessly to undermine the individual market.[1] That made insurance unaffordable for many New Jerseyans and was one of the major reasons why the number of residents in the individual market decreased by about 40,000 in 2018.[2]

Thanks to the following actions taken by the state to reverse the federal ACA sabotage, consumers will be able to achieve major savings starting next year:

- Establishing a reinsurance program that will reimburse insurers for individuals with unusually high medical costs, which will be mainly supported with federal funds.

- Maintaining the federal individual mandate for New Jerseyans who can afford insurance.

- Encouraging insurers to offer lower-cost Silver (mid-level) plans.

- Launching a state outreach campaign, Get Covered New Jersey, that will result in healthier New Jerseyans obtaining insurance, and therefore a further reduction in premiums and the state’s uninsurance rate.

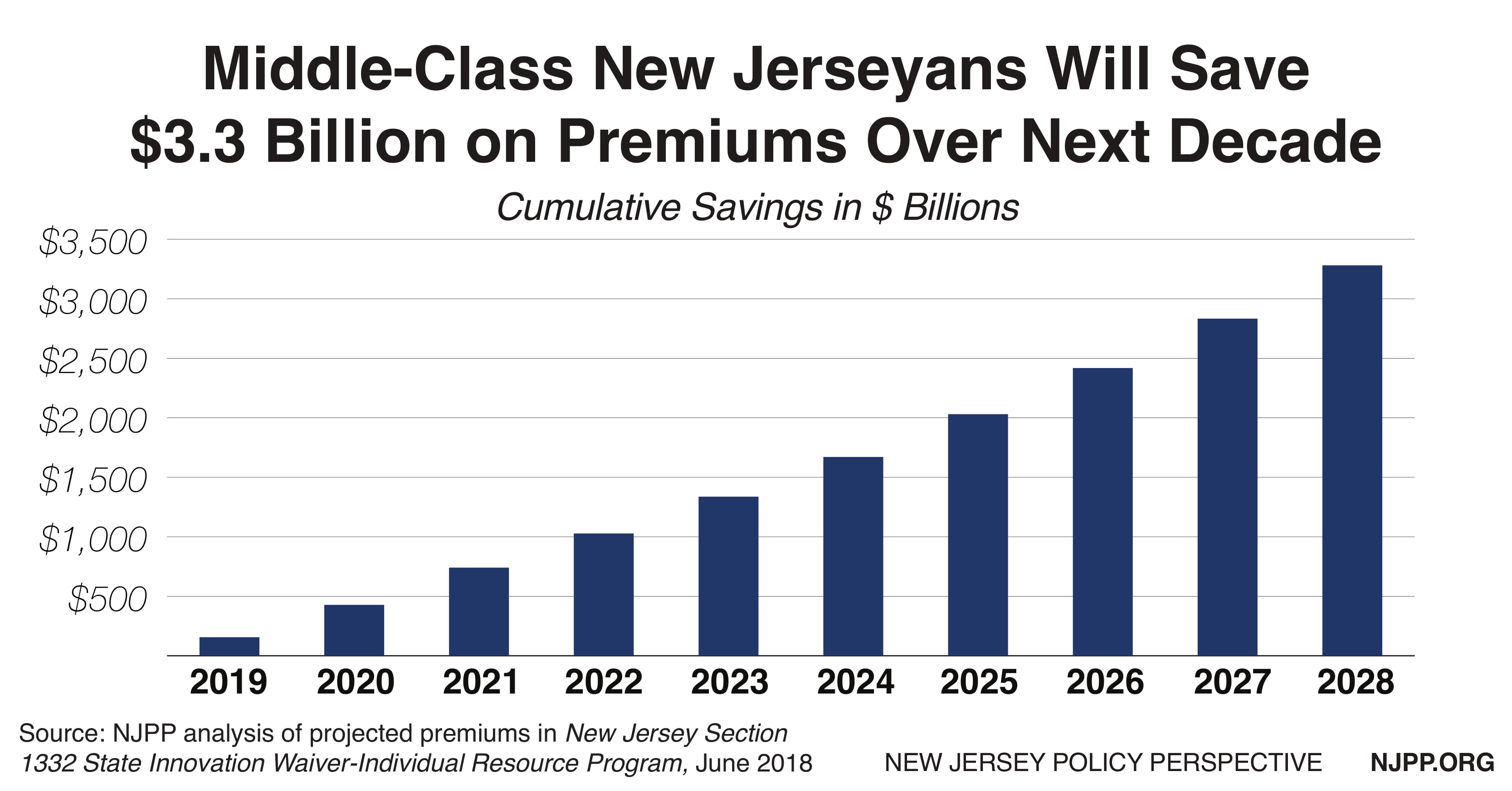

Middle-Class New Jerseyans Will Pay $3.3 Billion Less in Premiums Over Ten Years

The New Jersey Department of Banking and Insurance (DOBI) estimates that the new reinsurance program will guarantee that premiums will be 15.1 percent less than they would have been otherwise. Maintaining the federal individual mandate will further reduce premiums by 6.8 percent, for a total reduction of 21.9 percent.[3] In 2019, the average consumer will pay a premium of $5,700 instead of $7,300,[4] a savings of $1,600 which will total at least $23,000 over 10 years (adjusting for inflation).[5]

All 140,000 middle class New Jerseyans in the current market will save a total of $3.2 billion over 10 years compared to what they would have paid.[6] This estimate is conservative as it does not consider an increase in the number of additional individuals who will obtain insurance because of the lower cost nor the savings that will be achieved from the other initiatives outlined in this report.

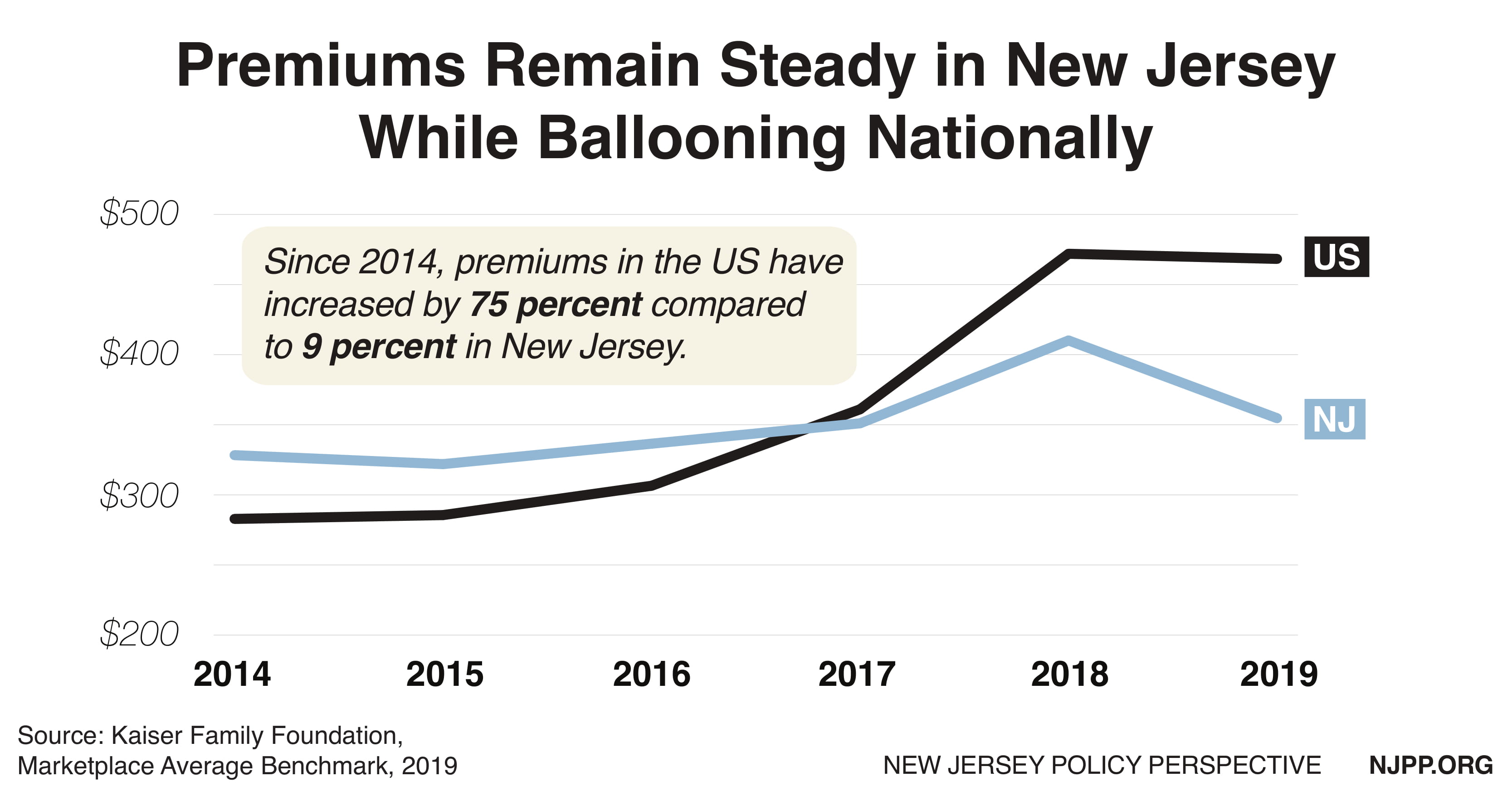

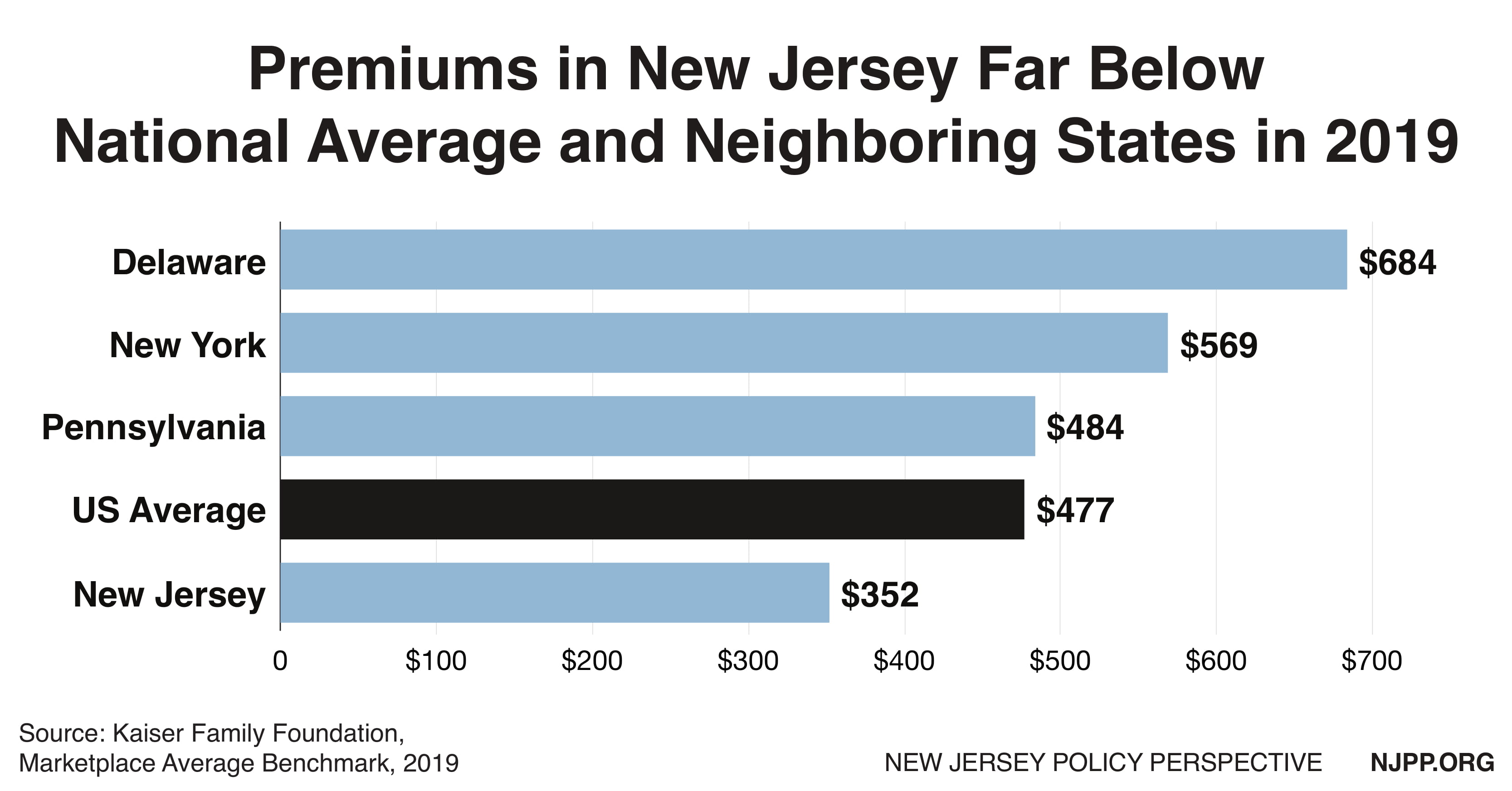

New Jersey Premiums Will Rank Fourth Lowest in the Nation

Remarkably, premiums for the Silver plan[7] (which is the most popular) will drop from 9th highest in 2014 to 47thin the nation in 2019. The main reason is the growth in premiums in New Jersey is the second lowest in the nation. New Jersey’s increase (9 percent) was eight times lower than the average for all states in the Marketplace (75 percent). Adjusting for inflation, there was essentially no increase in New Jersey. This is in stark contrast to premiums for employer-based insurance in New Jersey, which was fifth highest nationally in 2013 and increased to fourth highest in 2017.[8]

Whereas in 2014 premiums in New Jersey were 18 percent higher than the national average, next year they will be 26 percent lower. New Jersey’s average premium next year will be far less than its neighboring states: Delaware (94 percent less), Pennsylvania (38 percent less) and New York (61 percent less).

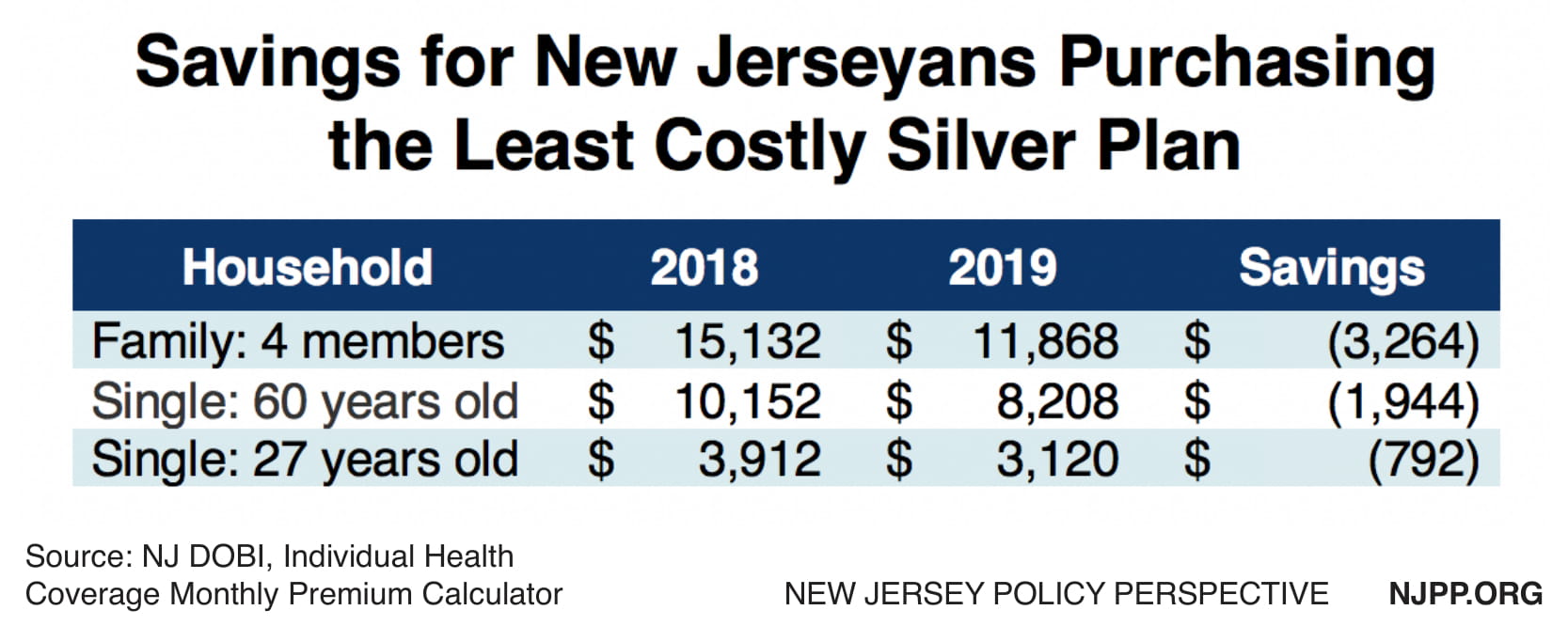

New Reduced Silver Plans Could Mean Even More Major Savings

For the 2019 plan year, DOBI encouraged carriers to offer less expensive Silver plans which could prove to be a game changer for consumers. This year, Silver plans were kept artificially high because insurers had to factor in President Trump’s decision not to fund cost sharing reduction payments even though insurers were still required to maintain the reduction for policyholders. This did not affect consumers who received federal premium subsidies because those subsidies were increased to compensate for the higher premiums. However, consumers who were not eligible for premium subsidies had to pay for the full increase this year. That will not be the case for next year, which will result in several lower cost options. Seven new Silver plans have been added, two of which have the lowest Silver premiums.[9] Overall, the total number of plans off the Marketplace increased to 32 in 2019 from 28 in 2018 mainly due to the increase in Silver plans.

This will mean that the base rate for the lowest premium Silver plan will be reduced to $240 in 2019 from $312 in 2018, a 23 percent reduction.[10] For households that currently have the lowest Silver plans and want to switch plans to continue to have the lowest plans, the savings could be major. A family[11], 27-year-old single adult and 60-year-old single adult could see annual savings of $3,264, $792, and $1,944 respectively.[12] In addition, consumers who have higher cost Silver plans, or have Gold plans, may want to reconsider these new less expensive Silver plans next year even though the cost-sharing likely would be higher.

However, the two lowest cost plans, and three other higher cost Silver plans, will only be available to individuals who purchase insurance off the Marketplace.These plans will not even be listed in the Marketplace. These off the Marketplace options may be found at GetCovered.NJ.gov and purchased directly through carriers.

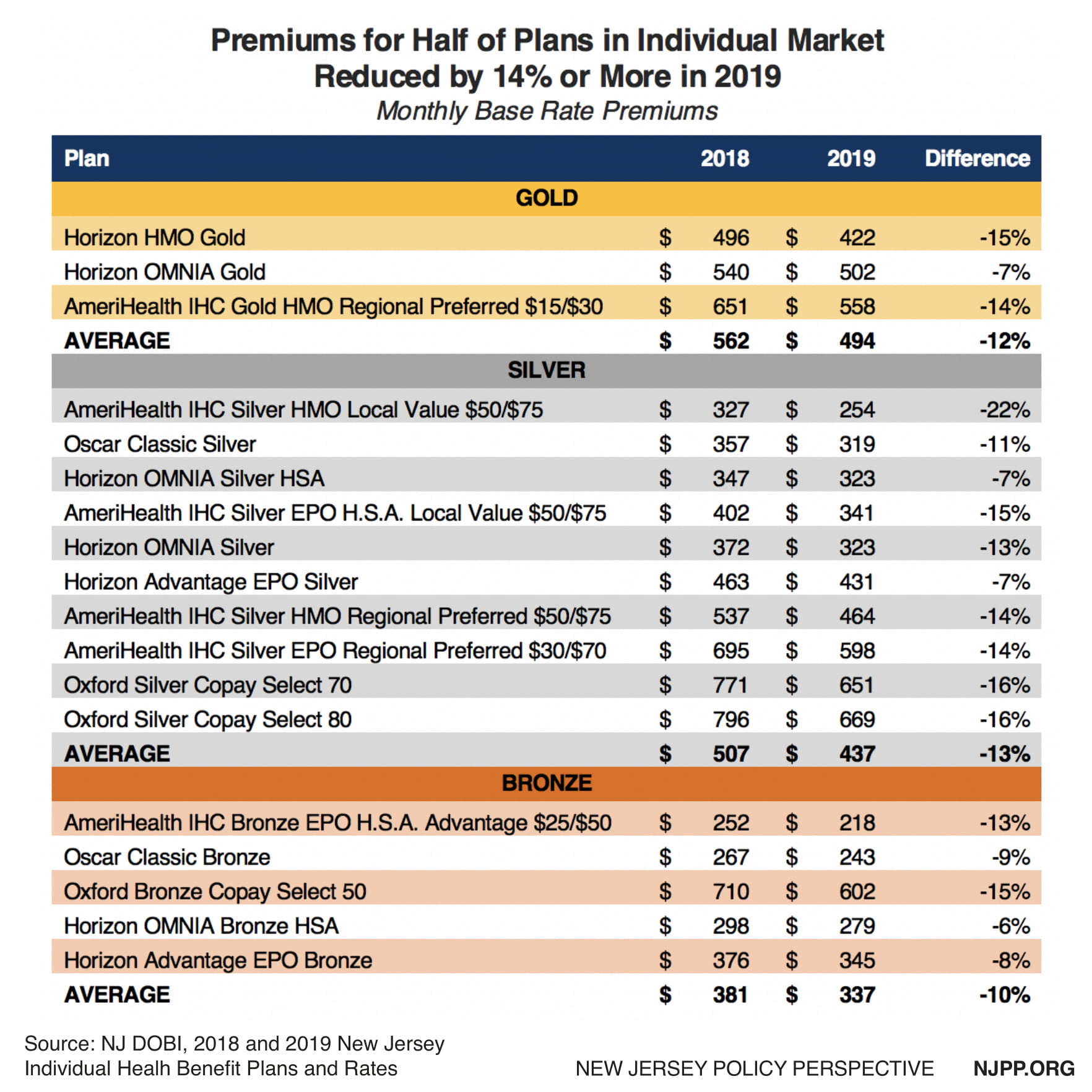

Premiums Reduced by 14 Percent or More in Half of Plans in Individual Market

DOBI estimates a 9.3 percent[13] average weighted reduction next year for all plans compared to this year. Of course, there will be some plans that exceed this average and those that fall below it. The table below shows the premium reduction in all current plans, which ranges between six and 22 percent, and that half of the plans exceed 14% or more.[14] Bronze plans had the least reduction (10 percent) and the Gold and Silver were similar (12 and 13 percent respectively). The good news is that premiums in the individual market for all middle class New Jerseyans should decrease this year unless their household situation changed. However, as is always the case, consumers should shop around for the best deal possible including new plans that are not listed below.

Endnotes

[1] KFF, Marketplace Average Benchmark Premiums, 2014-2019, https://www.kff.org/health-reform/state-indicator/marketplace-average-benchmark-premiums/?currentTimeframe=0&sortModel=%7B%22colId%22:%22Location%22,%22sort%22:%22asc%22%7D

[2] NJ DOBI, Total Lives Comparison, 2018 and 2019, https://www.state.nj.us/dobi/division_insurance/ihcseh/enroll/2018_1q_ihc_coveredcomparison.pdf

[3] Gov. Murphy’s Office, Governor Murphy Announces Impact of New Jersey’s Actions to Stabilize the Health Insurance Market, 2018. https://www.nj.gov/governor/news/news/562018/approved/20180907a.shtml

[4] The 21.9 percent premium reduction was applied to the projected baseline premium for 2019 in New Jersey Section 1332 State Innovation Waiver-Individual Reinsurance Program, Oliver Wyman, June 27, 2018

[5] Estimate is conservative because as individuals age their premiums go up which was not considered in the analysis.

[6] Same Section 1332 source as above but premium reduction was applied to each of the ten years.

[7] Based on second lowest benchmark Silver plan for a 40-year-old person, https://www.kff.org/health-reform/state-indicator/marketplace-average-benchmark-premiums/?currentTimeframe=0&sortModel=%7B%22colId%22:%22Location%22,%22sort%22:%22asc%22%7D

[8] KFF, Average AnnualSingle Premium per Enrolled Employee For Employer-Based Health Insurance, 2017https://www.kff.org/other/state-indicator/single-coverage/?currentTimeframe=0&sortModel=%7B%22colId%22:%22Employee%20Contribution%22,%22sort%22:%22desc%22%7D

[9] NJ DOBI, 2019 and 2018 New Jersey Individual Health Benefits Plans and Rates, https://www.state.nj.us/dobi/division_insurance/ihcseh/ihcrates_2018.pdfand https://www.state.nj.us/dobi/division_insurance/ihcseh/ihcrates_2019.pdf

[10] Ibid.

[11] Assumes both parents are age 35, one child at 3 and one at 15.

[12] NJ DOBI, IHC Premium Calculator, https://www.state.nj.us/dobi/division_insurance/ihcseh/IHC_Calculator_2018/IHC.HTM

[13] Gov. Murphy’s Office, Ibid

[14] Not weighted.