To read a PDF version of this report, click here.

Given the concern of some Republican Senators regarding the proposed cuts to Medicaid in the American Health Care Act (AHCA) as passed by the House of Representatives, many expected that the Senate proposal (the “Better Care Reconciliation Act of 2017”) would be much less harmful. But the reverse is actually true – and the potential consequences for New Jersey are devastating.

The Congressional Budget Office analysis of the Senate bill finds that it’s strikingly similar to the House-passed bill – which was clearly terrible for New Jersey[1] – with 22 million Americans losing coverage by 2026 and $772 billion in federal Medicaid cuts over 10 years.[2]

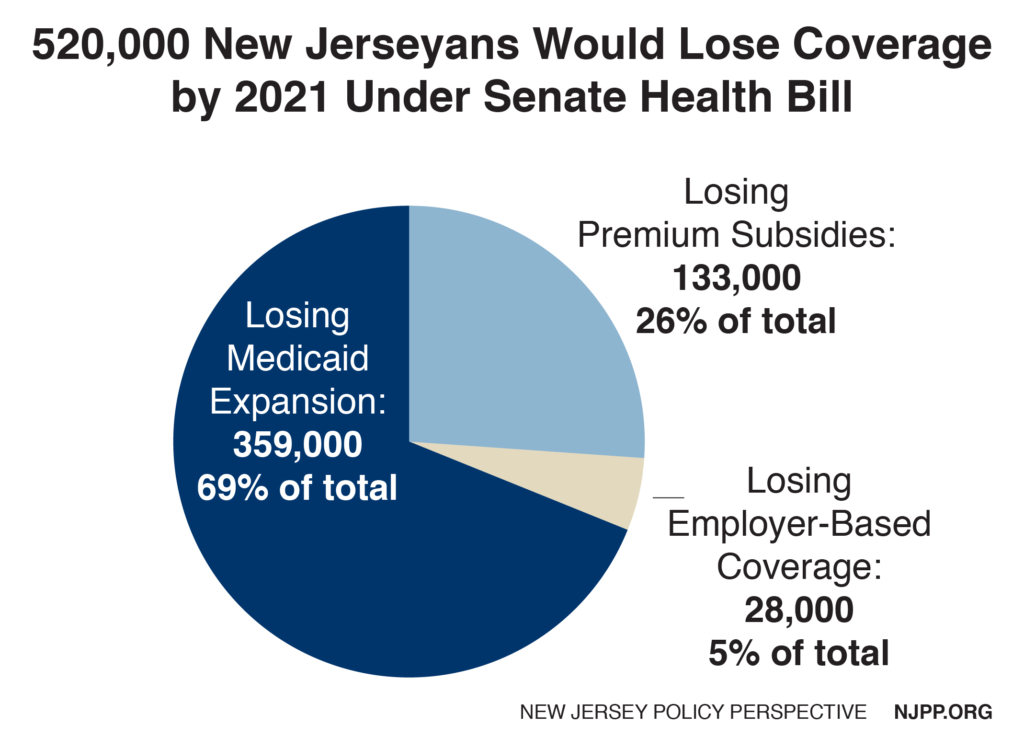

While the CBO estimates that national coverage losses would continue to increase until 2026, when they peak at 22 million, in New Jersey the peak would occur in 2021 because of the likely end of the Medicaid expansion. By 2021, an estimated 520,000 New Jerseyans would lose health coverage under the Senate proposal.

And when it comes to Medicaid cuts and New Jersey, there are some substantive differences between the Senate and House bills:

Everyone in the Medicaid Expansion Would Likely Become Immediately Ineligible

Under the House bill, everyone who was in the Medicaid expansion before 2020 would be eligible for the current 90 percent federal match indefinitely, as long as they remained in the expansion. For that reason, it was assumed that New Jersey would continue to assist them until they left. The end result would be that nearly all the 540,000 New Jerseyans in the expansion would lose coverage in the matter of a couple of years, as NJPP noted in a recent report.[3]

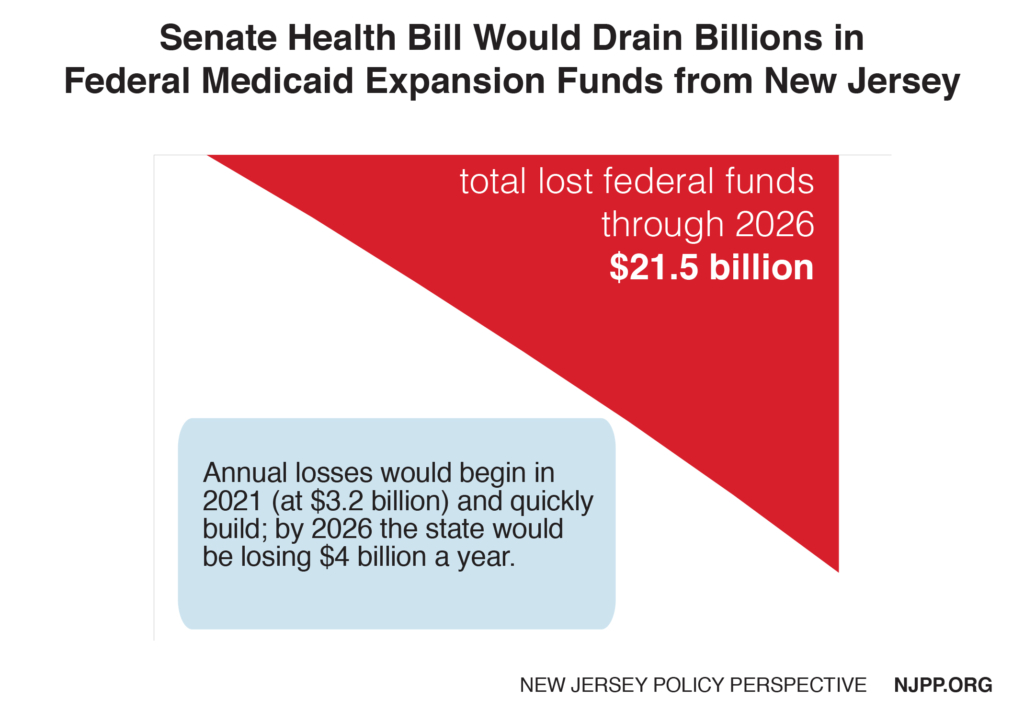

Under the Senate bill, however, the federal match is reduced starting in 2021, eventually dropping to the regular Medicaid match of 50 percent. This change would make the state more likely to terminate everyone in the expansion starting in 2021, resulting in a larger loss of federal funding loss – $22 billion in the Senate version versus $20.6 billion in the House bill – over seven years. By 2026, New Jersey would be losing about $4 billion annually, which would cause havoc in the health care system and the loss of thousands of jobs.

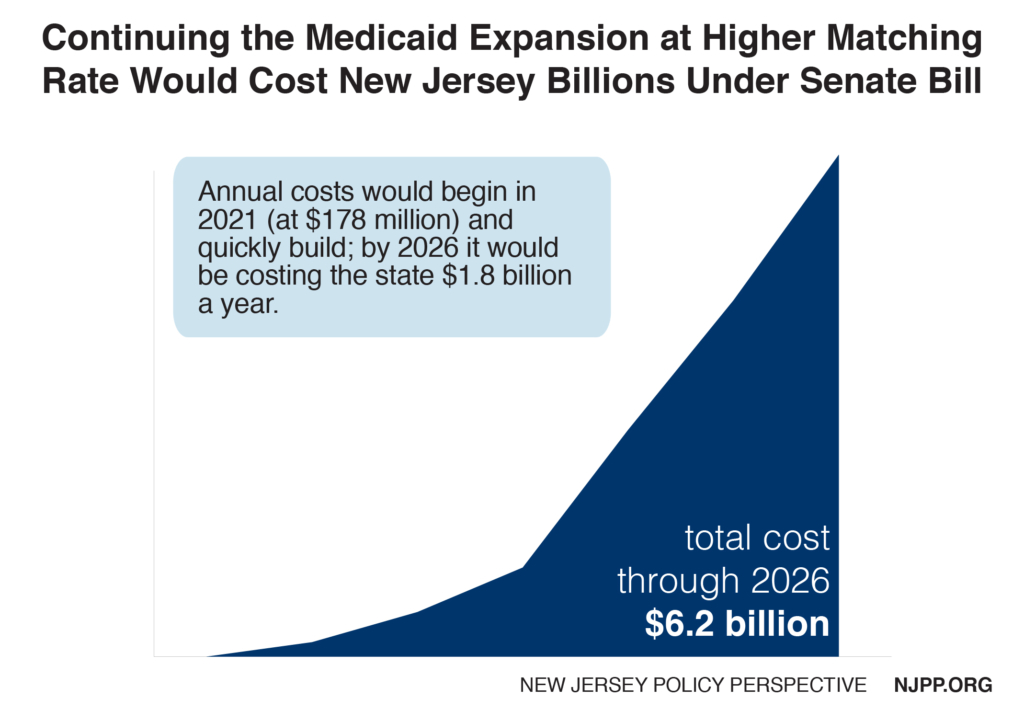

Maintaining the Medicaid Expansion Would Cost New Jersey Billions, Making it Essentially Impossible

Under the Senate bill, the state’s cost to replace lost federal funds would be relatively modest in the first year but would very quickly increase to nearly $2 billion dollars a year starting 2024, making the prospect of maintaining coverage for these more than half a million New Jerseyans very expensive – and highly unlikely.

What’s more, continuing the Medicaid expansion would be more difficult for New Jersey than most other states. It has one of the largest enrollments in the Medicaid expansion and the federal matching rate that would be available to New Jersey under the bill would be only 50 percent, the 42nd lowest rate in the nation. And New Jersey is already in a state of near bankruptcy, with many other urgent and significant funding needs.

Senate Bill Has Deeper Medicaid Cuts That Would Most Harm Seniors and People with Disabilities

New Jersey could lose about $60 billion in federal funds over 20 years under the Senate bill,[4] because it includes much deeper cuts to Medicaid through the per-capita funding caps.

Both bills adjust these caps upward each year based on the medical component of Consumer Price Index (CPI-M) for adults and children, and add one percentage point on top for seniors and people with disabilities. The problem with using the CPI-M is that its growth (3.7 percent) is likely to be significantly less than what is projected for actual Medicaid spending (4.4 percent), which is how the bill generates billions of dollars in federal savings and shifts those costs to states.

The Senate bill does the same – until 2025. Then it changes the caps’ annual adjustments to be tied to the CPI–U, which is expected to grow even less (2.4 percent) than CPI-M, leaving an even larger gap between the cap increases and actual spending on Medicaid. In other words, after 2025 states would only be reimbursed for about half their increased Medicaid spending for the foreseeable future.

Even worse, after 2025 this lower index would apply to all groups, including seniors and people with disabilities. They would be particularly vulnerable in New Jersey because they consist of nearly two-thirds (61 percent) all the state’s Medicaid expenditures.

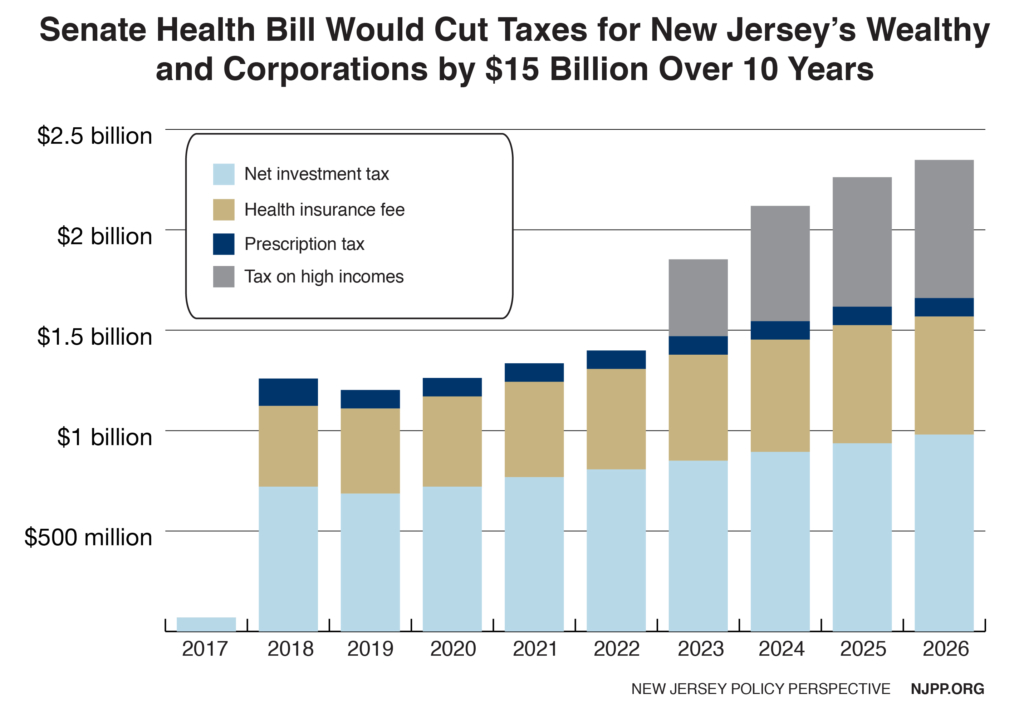

Cutting Health Care to Pay for Tax Cuts for the Wealthy is Robin Hood in Reverse

Incredibly, these Medicaid cuts that would imperil the health care of thousands of the most vulnerable people in the state are being proposed mainly to pay for massive tax cuts to the wealthy and corporations which amounts to about $15 billion in New Jersey over ten years.[5]

Due to the proposed tax cut for net investment and the additional tax cut for high earners, the top five percent of income tax filers would receive a $9.7 billion tax cut over ten years. These tax cuts are most concentrated at the very top, with the wealthiest 1 percent of New Jersey taxpayers receiving 73 percent of the tax cut. These taxpayers, with an average annual income of $2.9 million would receive an average tax cut of $23,000 a year.[6]

Endnotes

[1] New Jersey Policy Perspective, House-Passed Health Bill Would End Coverage for More Than Half a Million New Jerseyans, June 2017.

[2] Congressional Budget Office, Cost Estimate: H.R. 1628, June 2017.

[3] Ibid 1

[4] Based on NJPP extrapolation of the lower bound national estimate in AARP Public Policy Institute, The Senate Health Reform Bill Slashes Medicaid Severely, June 2017.

[5] The estimates for the insurance fee and the tax on prescription drugs are preliminary based on extrapolation of CBO national budget estimates. Further research is needed to determine how these taxes are implemented in New Jersey.

[6] Institute on Taxation and Economic Policy, Affordable Care Act Repeal Includes a $31 Billion Tax Cut for a Handful of the Wealthiest Taxpayers: 50-State Breakdown, March 2017.