To read a PDF version of this report, click here.

Once it is fully phased in, the federal tax proposal released by conference committee on December 15 would raise taxes for the average middle-class and low-income New Jersey family while cutting taxes for wealthier families and for large corporations. At the same time, it would increase the number of New Jerseyans without health insurance by 340,000 by 2027 thanks to the repeal of the Affordable Care Act’s individual mandate,[1] and would tee up deep and devastating budget cuts that would harm working families across New Jersey.

While all income groups in New Jersey on average would see a tax reduction in 2019 under the final GOP plan, it’s important to look at the impact in the year 2027, since the bill includes both permanent provisions (the tax cuts for corporations and a tax hike on working families through a change to how inflation is measured) and temporary provisions that expire after 2025 (the rest of the bill that directly affect families and individuals). Unless otherwise noted, this fact sheet looks at the impact on New Jersey families in 2027.

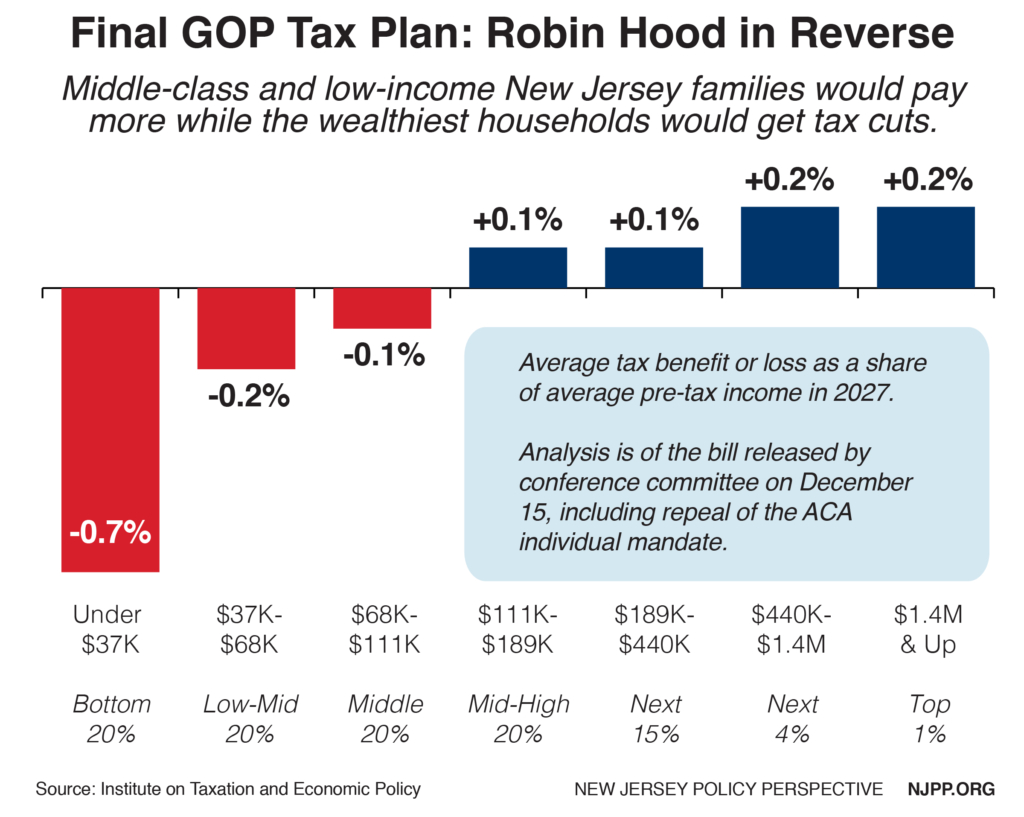

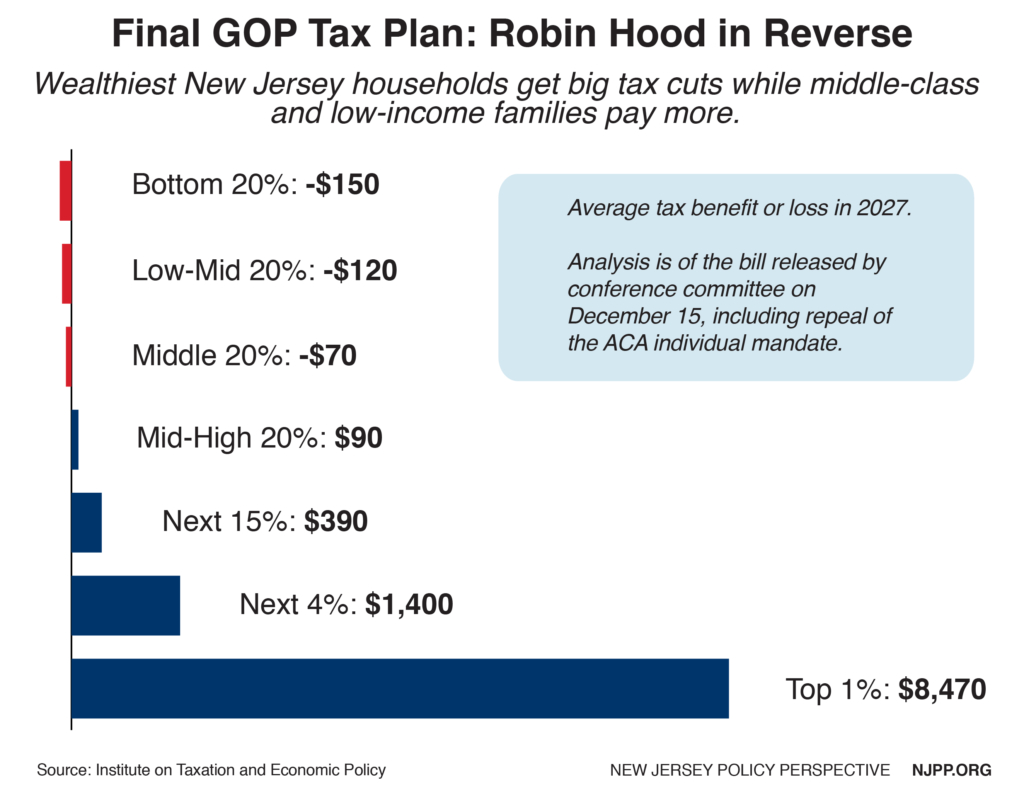

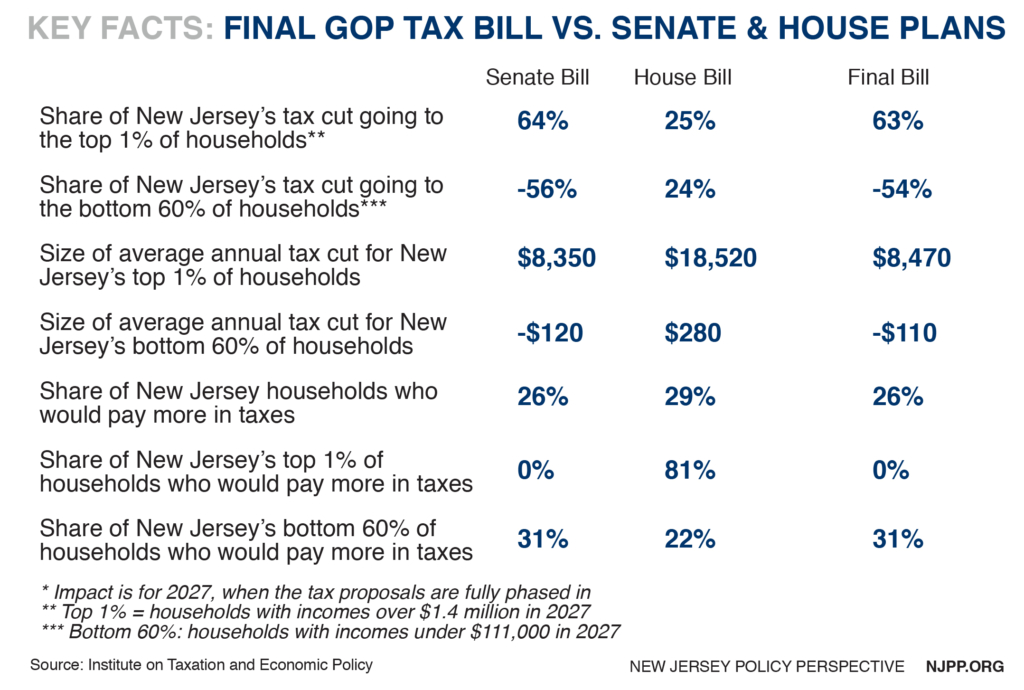

New Jersey households with incomes over $1.4 million (the top 1 percent) would receive an average $8,470 tax cut while the bulk of Garden State families (the bottom 60 percent, or those with incomes under $111,000) would see a tax hike averaging $110.[2] Taken all together, those families in the top 1 percent would receive 63 percent of the state’s share of the tax cut – $384.1 million in total – while the bottom 60 percent would, together, receive less than 0 percent of the tax cut, since they’d pay a total of $331 million more in taxes under the plan.

In all, about 1 in 4 New Jersey taxpayers (26 percent) would see a tax hike under the GOP bill,[3] a slightly lower share than the nation as a whole (27 percent) and the 22nd highest of the 50 states.

The plan is a clear example of Robin Hood in reverse, as it gives the largest average tax hikes to New Jersey’s poorest families while showering the state’s very wealthiest families with the biggest tax cuts. While just 1.6 percent of the state’s wealthiest 5 percent of families would see a tax hike, 31 percent of families in the bottom 60 percent would. That share of tax hikes for middle- and lower-income families is the 15th highest of the 50 states.

The final GOP bill is more similar to the Senate-passed bill than the House-passed bill, as you can see by looking at the impact of all three plans on New Jersey.

Corporate Tax Cuts Drive GOP Tax Plan’s Impact – and its Inequities

Big tax cuts for corporations – specifically a cut in the corporate income tax from 35 percent to 21 percent – are the centerpiece of the GOP tax plan. After all, they comprise most of the parts of the final plan that are permanent, while nearly all of the smaller tax cuts and changes for individuals and families are temporary. As a result, these breaks for corporations end up driving the overall impact of the GOP tax plan once fully phased in, as well as the plan’s inequity.

That’s because slashing the top corporate tax rate by nearly half will primarily benefit owners of corporate stocks, according to Congress’ own Joint Committee on Taxation.[4] In fact, despite President Trump’s insistence that average working families will get a “$4,000 pay raise” from this tax plan, just 25 percent of the long-term benefit of a corporate tax cut will go to workers.[5]

And of that already small share, an even smaller piece will go to middle-class or low-income workers, since fewer than half of all Americans own any stock, and overall shareholder wealth is – like most of the rest of the country’s wealth – extremely concentrated at the top (the top 10 percent of Americans own about 80 percent of the value of the total stock market, according to leading economist Ed Wolff).[6]

The bulk of the benefit from the corporate rate cut – three-quarters of it, in fact, – will go to shareholders, and a good chunk of that will flow to foreign investors, who own about 35 percent of stocks in American corporations.[7]

Tax Bill is Step One of a Damaging Two-Step Tax & Budget Agenda

Unfortunately, the pain for New Jersey’s working families does not end with the direct impact of this tax bill. In fact, the tax bill is step one of Congressional Republicans’ two-step tax and budget agenda that would rip the American social contract to shreds, undo decades of progress for working Americans and send the country hurtling even faster toward a new gilded age.[8]

Here’s how this two-step agenda works. First, enact costly tax cuts now that are heavily skewed toward wealthy households and profitable corporations. Next, use the cost of those tax cuts and their negative impact on the federal deficit as a rationale to cut public services, programs and investments on which all Americans – particularly low- and moderate-income residents – rely.[9]

We don’t need to wildly guess what will be on the chopping block when GOP lawmakers get to this second step. After all, they have already outlined deep and severe budget cuts in their long-range budget plans.

For New Jersey, these budget plans have included devastating cuts to programs that expand economic opportunity for all residents, including job training, education, and economic development programs in cities and rural communities. But the proposals’ cuts would fall hardest on Garden State residents struggling in today’s economy, with reductions to programs that provide income assistance to help families get back on their feet and help nearly 900,000 New Jerseyans afford groceries through SNAP, and additional cuts to Medicaid, which provides health care to about 1.8 million New Jerseyans – including 852,000 kids.[10]

Endnotes

[1] NJPP analysis based on Congressional Budget Office estimates using weighted average for employer-based, marketplace, and Medicaid expansion coverage.

[2] Institute on Taxation and Economic Policy (ITEP) Microsimulation Tax Model, December 2017. Model includes all major components of the tax bill, including personal income tax changes, changes to deductions, corporate tax changes and estate tax changes. Full dataset and methodology available at https://itep.org/finalgop-trumpbill/

[3] This report’s key findings on the distribution of the tax plan focus on average and total tax hikes or cuts by income group. This explains why, for example, the bottom 60 percent would, on average, and, in total, pay more in taxes, even while there are individual taxpayers inside that income group who would pay less – the tax cuts they receive are just overwhelmed by the tax hikes that others in the same income group would see.

[4] Joint Committee on Taxation (JCT), Modeling the Distribution of Taxes on Business Income, JCX-14-13, October 2013.

[5] ITEP and JCT both assume that in the short run, a corporate tax cut will benefit the owners of corporate stocks alone, but in the long run (usually assumed to be ten years after enactment) a quarter of the benefits will flow to workers.

[6] National Bureau of Economic Research, Household Wealth Trends in the United States, 1962-2013: What Happened over the Great Recession?, December 2014.

[7] Tax Policy Center, Slashing Corporate Taxes: Foreign Investors Are Surprise Winners, October 2017.

[8] Center on Budget and Policy Priorities, Budget Briefs: The Republican Two-Step Fiscal Agenda, November 2017.

[9] The Washington Post, GOP eyes post-tax-cut changes to welfare, Medicare and Social Security, December 2017.

[10] New Jersey Policy Perspective, House Budget Threatens New Jersey Families, July 2017.