Earlier this month, McKinsey & Company released a new report on how to “reseed” New Jersey’s economic growth moving forward. Among other things, it confirms that state policy governing tax subsidies for corporations has gone off the rails.

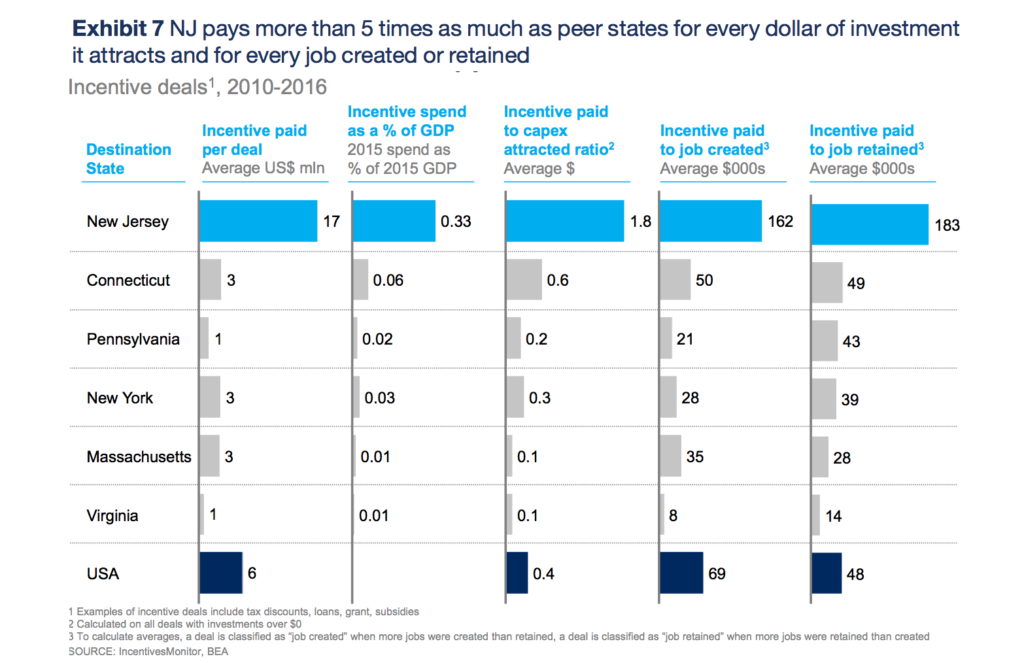

Taking a look at the chart above, it’s easy to see that New Jersey has become a big-time outlier when it comes to the extravagance of its tax break programs. The deals have gotten larger while corporations receive much richer subsidies for doing less than elsewhere: New Jersey’s average break per newly-created job is 2.3 times higher than across the country, and 20.3 times higher than it is in Virginia. Meanwhile, the average break per job kept in the state is 3.8 times higher in New Jersey than across the country, and 13.1 times higher than it is in Virginia.

While McKinsey’s findings track NJPP’s own analyses, the firm falls short when it comes to fully assessing why New Jersey has become such an outlier. It suggests that the state’s “returns on incentive deals are likely skewed by the large proportion that are done with older firms, which generate lower returns than investments in fast-growing young companies.” While this may not be incorrect, it is certainly incomplete.

In fact, New Jersey policymakers are to blame for the current situation and the out-of-control subsidy programs. Their almost exclusive economic response to the ravages of the Great Recession was to enact several new lucrative tax break programs. And then they doubled down on these subsidies in a major way with the “Economic Opportunity Act” of 2013, which lifted nearly all financial controls and ceilings, loosened job-creation and investment standards, and led to an explosion in subsidies awarded, costs per job and long-term reductions in budgetary revenues.

McKinsey does rightly note that New Jersey lacks consistent and rigorous oversight of its subsidy programs, and that more accountability would help improve the “investment returns” of these deals. Unfortunately, every attempt to improve in this area in recent years has been vetoed by the governor. What’s more, more reporting and transparency alone will not fix this problem. New Jersey needs to rein in the excesses, revise the programs and impose more financial control; for some concrete ways in which to do so, our May report is a good place to start.