Friday Facts and Figures is a weekly newsletter with data points, analysis, and commentary on the biggest policy debates in New Jersey and beyond.

Sign up here.

911

On Thursday, the Office of the Attorney General released body camera footage from the police killing of Najee Seabrooks, a violence intervention specialist in Paterson who called 911 for help while experiencing a mental health emergency. The chilling video clips show heavily armed officers negotiating with Najee, trying to lure him outside of the bathroom he locked himself in, with their guns drawn and pointed at him. Minutes after officers told Najee that they weren’t going to shoot him, they opened fire and shot him dead. In response to the footage, advocates and policy experts across the state have called for an overhaul of how mental health crises are handled — highlighting how this tragedy is a symptom of a bigger, systemic policy failure. “What outcome should we expect when someone in crisis is met with police armed for war with their guns drawn?” said NJPP President Nicole Rodriguez. “Our system failed Najee, just as it continues to fail our Black and brown neighbors who put their lives in jeopardy when they call 911 for help.” [WHYY / Tennyson Donyea]

1,700

In an op-ed published Wednesday, Zellie Thomas of Black Lives Matter Paterson called on state lawmakers to divert mental health crisis calls away from police and toward trained mental health professionals. The evidence that the police killing of Najee isn’t an isolated incident? Since 2016, more than 1,700 people were killed by police while experiencing a mental health emergency, according to a Washington Post database. In successful alternative response programs across the country — including the Paterson Healing Collective that Najee was a member of — trained professionals and EMTs provide immediate assistance to people experiencing mental health crises and other non-emergency situations, significantly reducing the number of arrests and hospitalizations. By removing police from mental health crisis responses, New Jersey can save lives and connect people to the care and support they need. [NJ Monitor / Zellie Thomas]

Fees

There is one area where New Jersey is leading the way in criminal justice reform: Eliminating public defender fees. Governor Murphy’s new budget proposal includes funding for the Office of the Public Defender that would eliminate public defender fees and make sure the constitutional right to legal counsel is no longer behind a paywall. Currently, New Jersey residents can be charged thousands of dollars for a public defender — even if they establish they cannot afford an attorney — which can influence how they navigate the legal system. Fully funding public defenders comes at a minuscule cost (less than one one-hundredth of 1 percent of the state budget, to be exact!) while going a long way toward advancing equity in and out of the justice system. [Center on Budget and Policy Priorities / Mike Mitchell]

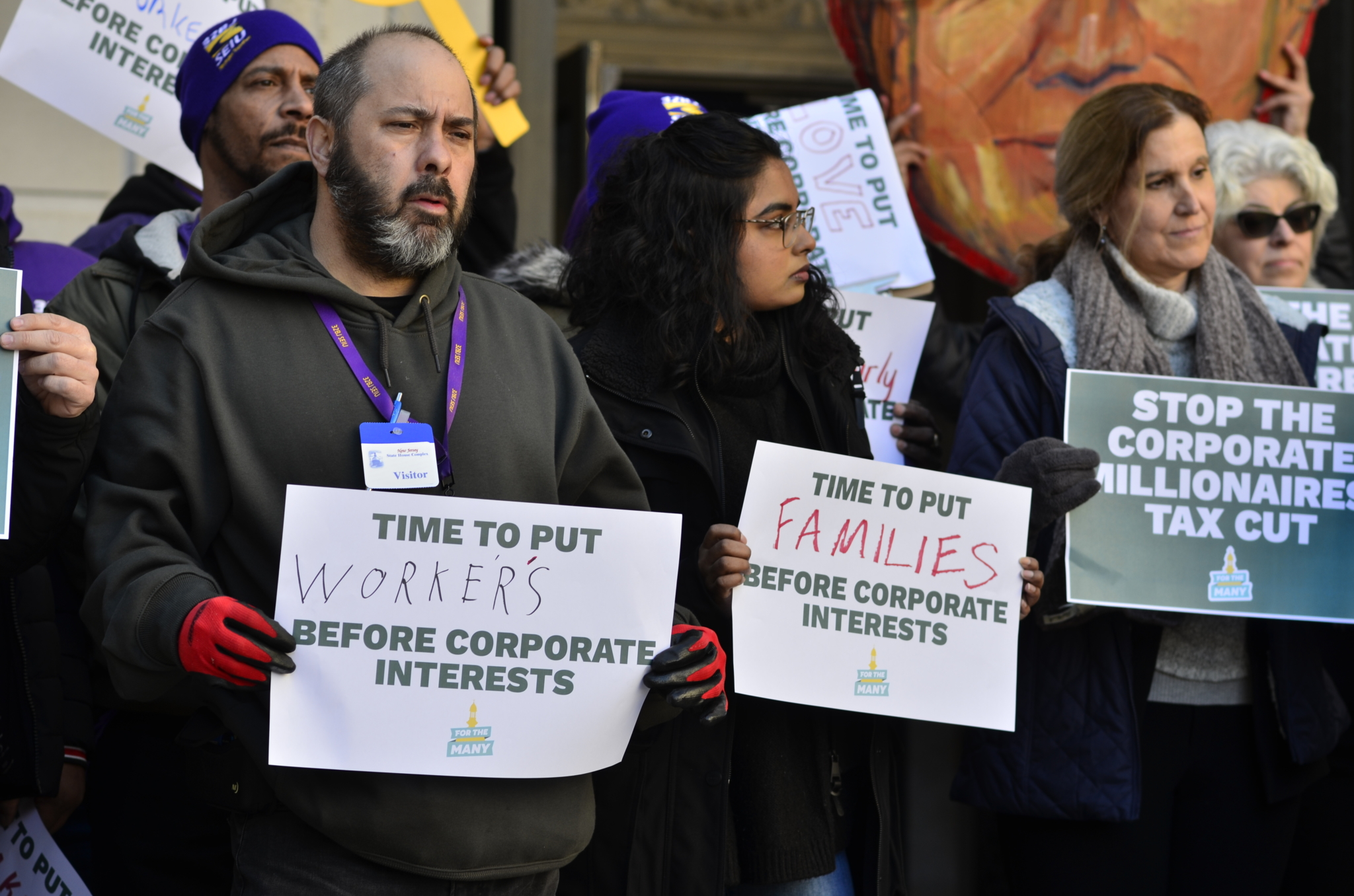

11.4 Percent

Grocery prices rose by 11.4 percent last year, the highest yearly percent change since 1974, according to new data from the U.S. Department of Agriculture. Companies are publicly blaming rising prices on inflation, wages, and supply chain issues — but their balance sheets say otherwise. “Corporate profits have hit their highest level ever, and corporate profit margins — how much they’re making on each unit that they’re selling — have hit the highest level in 70 years,” said Chris Becker, Senior Economist at the Groundwork Collaborative. It’s worth noting that these mega-corporations raking in record profits by price-gouging consumers are the same ones that would benefit from the $1 billion corporate tax cut in Governor Murphy’s proposed budget. [Vox / Whizy Kim]

Temporary

Most states, including New Jersey, collected way more tax revenue than expected over the last two years, but new fiscal data shows that this surge in revenue is likely temporary. Even so, lawmakers in many states, including New Jersey, are proposing large tax cuts that they may not be able to afford. If tax collections dip over the next year, states may have to use their reserves — if they have any — or cut public services and programs to balance their budgets. This is all the more reason for New Jersey to keep its Corporate Business Tax surcharge, and for lawmakers to build up a healthy surplus in next year’s budget. [Tax Policy Center / Lucy Dadayan]

ICYMI

Earlier today, the ACLU of New Jersey raised concerns with the Office of the Attorney General’s statement describing the body cam footage of Najee Seabrooks: “Using words like ‘lunge’ to describe Mr. Seabrooks’ last movements undermine the purpose of the [independent prosecutor] law by swaying the narrative, undercut the role of grand juries, and diminish the public confidence in the independence of the process,” said ACLU-NJ Legal Director Jeanne LoCicero. [ACLU of New Jersey]

Pets of NJPP

Meet Julie Borst’s 8-month-old Retriever-Hound mix, Rosie! She’s got lots of puppy curiosity and loves her new “big brother” Max. She’s still learning to walk on a leash and slowly adjusting to life in the suburbs after being fostered on a farm. She’s super sweet and loves a good belly rub and a cuddle. Woof!

Have a fact or figure for us? Tweet it to @NJPolicy.