To read a PDF version of the full report, click here.

The Earned Income Tax Credit (EITC) is a proven tool for addressing racial disparities in pay and supporting the economic security of low- and moderate-income adults and their families.[1] Claimed when people file income tax returns, this refundable credit increases households’ after-tax income. New Jersey, along with 28 other states,[2] offers a state version of the EITC. The New Jersey EITC supplements the federal program and is calculated as a percentage of the federal EITC.[3] By boosting the wages of low paid workers, the state and federal EITC programs help New Jerseyans better afford their basic needs, improve health and educational outcomes,[4] and strengthen state and local economies.[5]

The EITC’s narrow eligibility requirements exclude certain groups, including immigrants who file taxes without a Social Security Number.[6] As a result, many immigrants are ineligible for this important program, even if they pay taxes using an Individual Taxpayer Identification Number (ITIN). Extending eligibility for the state’s EITC to include ITIN holders would make the program more inclusive and increase its impact, allowing the credit’s benefits to reach more New Jersey families and communities. This simple change to the program’s eligibility would help more New Jerseyans make ends meet and infuse more money into the economy as the state recovers from the ongoing COVID-19 pandemic.

The Tax Code Can Better Address Racism and Anti-Immigrant Bias

A history of systemic racism in the United States has shaped policymaking and access to economic opportunity, resulting in massive inequities in the distribution of wealth.[7] Consequently, tax policy has disparate impacts across racial lines. The tax code can be a tool for addressing these disparities; however, many tax provisions instead reinforce or exacerbate inequities.[8]Income derived from work, for example, is taxed at a higher rate than income derived from capital gains, which disproportionately benefits wealthy households.[9] The EITC functions in the opposite manner, benefiting low- and moderate-income tax filers, who are disproportionately people of color.

While racial inequity has always been embedded in the U.S. tax code and immigration system, the Trump administration’s policies are exacerbating economic exclusion. The Tax Cut and Jobs Act of 2017, for example, made changes that widen racial and wealth disparities by giving disproportionate tax breaks to high wealth households,[10] including corporate, individual income, and estate tax rate reductions, as well as a new tax break for pass-through business income.[11] The law failed to provide comparable improvements for low- and moderate-income households and created new barriers for immigrants who do not have a Social Security Number (SSN). For example, the law reduced the Child Tax Credit,[12] which helps working families with children under 17 offset the cost of raising children, for families who file taxes with an ITIN.

To rectify these racial inequities in the tax code, lawmakers could choose to raise revenue in a progressive manner and make strategic investments that support households with the greatest need. New Jersey lawmakers could also improve equity in the state tax code by eliminating or reducing tax expenditures (exclusions, deductions, deferrals, and credits) that benefit wealthy households.[13] Strengthening programs that benefit low- and moderate-income households, such as New Jersey’s EITC, is another step that lawmakers can take to reduce racial and wealth disparities in the state tax code.

Federal EITC Eligibility Requirements Exclude ITIN Filers

In order to qualify for the federal EITC, a taxpayer, their spouse, and any qualifying children claimed as dependents must have a Social Security Number (SSN).[14] This undermines the reach of the EITC in New Jersey, as an estimated 225,000 residents live in households that file taxes using an ITIN,[15]which is a tax processing number used by tax filers who are not eligible for a SSN.[16] Tax filers who use an ITIN include undocumented immigrants, as well as a small number of other immigrants, such as certain students, professors, and researchers with non-immigrant visas; spouses and family members of people with certain employment visas; and some survivors of trafficking, domestic violence, or other serious crimes.[17][18] These immigrants not only pay income taxes, but they also pay sales taxes at the counter like all other New Jersey residents. In addition, ITIN filers pay property taxes, either directly as property owners or by supporting their landlord’s payments of property taxes as renters. In fact, undocumented immigrants in New Jersey contribute nearly $600 million in state and local taxes each year.[19]

Despite their important contributions as workers, business owners, taxpayers, and community members, ITIN holders are systematically excluded from many of the programs available to other New Jersey residents. In addition to the federal EITC, ITIN filers and their families have been excluded from many public benefits as well as stimulus payments under the Coronavirus Aid, Relief, and Economic Security (CARES) Act.[20]

Like most states, New Jersey’s EITC adopts the same eligibility criteria as the federal EITC, and thus excludes ITIN filers.[21] Legislation to address this barrier to the state EITC has been introduced in both the New Jersey Senate and General Assembly.[22] This policy would follow the lead of several other states that have taken steps to eliminate the discriminatory eligibility requirements in the EITC. Expansion of the EITC to include ITIN filers has already been enacted in California (for parents with at least one child under six years old) and in Colorado.[23] Similar eligibility expansions have also been proposed in New Mexico,[24] Oregon,[25] and Washington.[26] New Jersey can join these states in addressing an important barrier to the federal EITC by extending the state version of the credit to include ITIN filers.

Extending EITC Eligibility is a Step Toward a More Inclusive Tax Code

Because undocumented immigrants are disproportionately people of color,[27] removing the SSN requirement of the New Jersey EITC would improve racial equity in the tax code and promote the economic security and well-being of thousands of New Jersey’s immigrant households. Rather than further straining low- and moderate-income immigrants and their families, New Jersey can harness the existing ITIN and EITC systems to help those who need it.

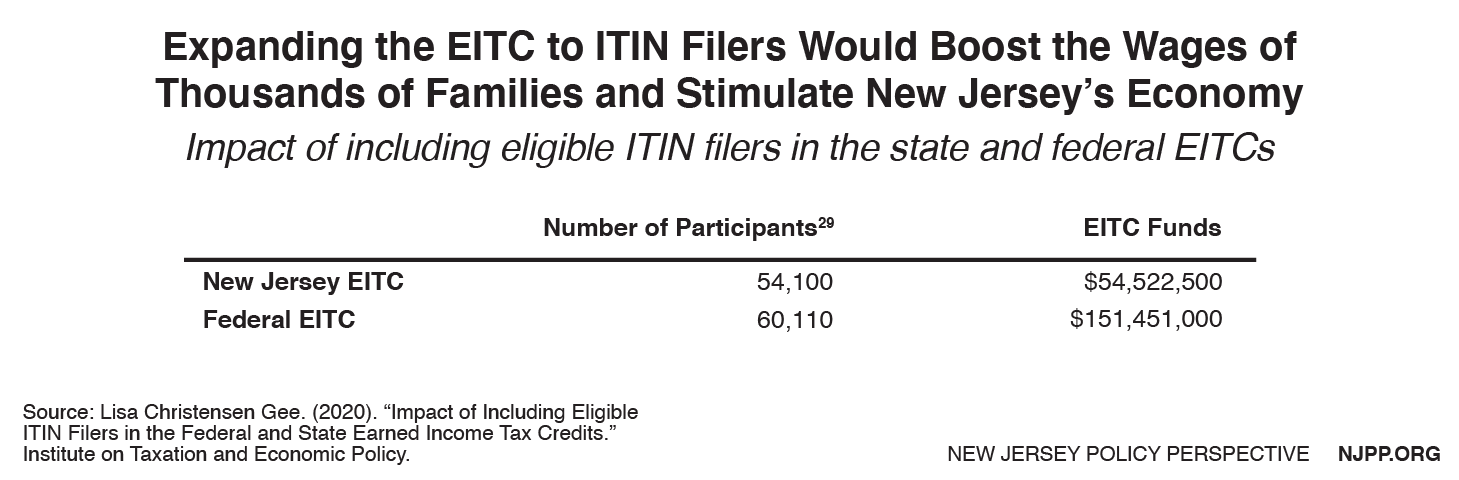

An estimated 77,650 ITIN returns filed in New Jersey meet all eligibility criteria for the EITC except for the SSN requirement. Assuming that participation rates are comparable to the EITC for New Jersey residents, eliminating the SSN requirement would result in an estimated 54,100 of these newly eligible ITIN holders receiving the EITC.[28]

Expanding the EITC program eligibility to include ITIN filers would add, on average, approximately $1,000 to these households’ earnings.[30] Beyond support for hardworking New Jerseyans and their families, making the state EITC more inclusive toward immigrants would provide a $55 million[31] boost to state and local economies, as newly eligible EITC claimants spend the credit at local business and increase economic activity. Some of these funds will even come back to the state in the form of sales tax and other government revenues[32].

In the absence of a federal EITC for ITIN filers, lawmakers should consider providing a credit comparable to what other low wage New Jerseyans receive. Going beyond the state EITC, if New Jersey matched the EITC amount that ITIN filers would receive if they were eligible for the federal credit, the state could add $151 million to state and local economies and allow families to cover more of their basic needs.[33] Providing ITIN filers with both the full federal and state credit amount that other New Jersey workers receive would provide more meaningful support for these households and add $206 million to state and local economies.[34]

Strengthening New Jersey Families and Economies

Excluding immigrants who file taxes using an ITIN from the EITC pushes households who are struggling to make ends meet further behind and hurts New Jersey’s state and local economies. There are approximately 140,000 households in New Jersey who file taxes using an ITIN, with over 225,000 people in these households, of which 85,560 (38 percent) are children.[35] Boosting the after-tax incomes of these low- and moderate- income households would have both short- and long-term benefits for the children in families and communities that receive the credit, as the EITC has been associated with improved health outcomes, educational achievements, and lifetime earning potential.[36]

As recipients of the EITC use the credit to meet short- and medium- term needs, such as utility bills, household supplies, and vehicle repairs, removing discriminatory barriers to the credit would increase economic activity and support businesses as they recover from the current crisis. Including ITIN holders in the EITC would not only promote equity by directly supporting households who need it – it would also strengthen the broader New Jersey economy.

End Notes

[1] Huang Chye-Ching and Roderick Taylor. 2019. “How the Federal Tax Code Can Better Advance Racial Equity.” Center on Budget and Policy Priorities. https://www.cbpp.org/research/federal-tax/how-the-federal-tax-code-can-better-advance-racial-equity

[2] Urban Institute. 2020. “State Earned Income Tax Credits” https://www.urban.org/policy-centers/cross-center-initiatives/state-and-local-finance-initiative/state-and-local-backgrounders/state-earned-income-tax-credits

[3] New Jersey Department of the Treasury. New Jersey Earned Income Tax Credit. https://www.state.nj.us/treasury/taxation/eitc/eitcinfo.shtml

[4] Marr, Chuck, Chye-Ching Huang, Arloc Sherman, and Brandon Debot. 2015. EITC and Child Tax Credit Promote Work, Reduce Poverty, and Support Children’s Development, Research Finds. Center on Budget and Policy Priorities. https://www.cbpp.org/research/federal-tax/eitc-and-child-tax-credit-promote-work-reduce-poverty-and-support-childrens?fa=view&id=3793

[5] Avalos, Antonio and Sean Alley. 2010. The economic impact of the Earned Income Tax Credit (EITC) in California. California Journal of Politics and Policy, 2(1): 1-25. https://doi.org/10.2202/1944-4370.1096

[6] Internal Revenue Service. Earned Income Tax Credit (EITC). https://www.irs.gov/credits-deductions/individuals/earned-income-tax-credit

[7] Huang Chye-Ching and Roderick Taylor. 2019. “How the Federal Tax Code Can Better Advance Racial Equity.” Center on Budget and Policy Priorities. https://www.cbpp.org/research/federal-tax/how-the-federal-tax-code-can-better-advance-racial-equity

[8] Tax Policy Center and the Urban Institute. 2020.. Racial Disparities and the Income Tax System. https://apps.urban.org/features/race-and-taxes/

[9] Huang Chye-Ching and Roderick Taylor. 2019. “How the Federal Tax Code Can Better Advance Racial Equity.” Center on Budget and Policy Priorities. https://www.cbpp.org/research/federal-tax/how-the-federal-tax-code-can-better-advance-racial-equity

[10] Institute for Taxation and Economic Policy. “TCJA By the Numbers, 2020” https://itep.org/tcja-2020/

[11] Huang Chye-Ching and Roderick Taylor. 2019. “How the Federal Tax Code Can Better Advance Racial Equity.” Center on Budget and Policy Priorities. https://www.cbpp.org/research/federal-tax/how-the-federal-tax-code-can-better-advance-racial-equity

[12] Ibid.

[13] Further information about these strategies for improving tax equity can be found in the following reports:

Reynertson, Sheila. 2020. “Road to Recovery: Reforming New Jersey’s Income Tax Code”. New Jersey Policy Perspective. https://www.njpp.org/budget/road-to-recovery-reforming-new-jerseys-income-tax-code

Reynertson, Sheila. 2020. “The COVID-19 Crisis Proves the Point: New Jersey Needs More Revenue to Support Workers, Families, and Businesses.” New Jersey Policy Perspective. https://www.njpp.org/budget/the-covid-19-crisis-proves-the-point-new-jersey-needs-more-revenue-to-support-workers-families-and-businesses

[14] Internal Revenue Service. “Do I Qualify for the EITC?” https://www.irs.gov/credits-deductions/individuals/earned-income-tax-credit/do-i-qualify-for-earned-income-tax-credit-eitc

[15] Institute for Taxation and Economic Policy. 2020. “Estimated Number of Adults & Children in ITIN Households based on IRS 2015 ITIN Market Segment SPEC Returns Database.” This analysis is unpublished, but can be made available upon request.

[16] Internal Revenue Service. “Individual Taxpayer Identification Number.” https://www.irs.gov/individuals/individual-taxpayer-identification-number

[17] National Immigration Law Center. “Individual Taxpayer Identification Number (ITIN).” Last Updated January 2017. https://www.nilc.org/issues/taxes/itinfaq/

[18] Internal Revenue Service. Taxpayer Identification Number. https://www.irs.gov/individuals/individual-taxpayer-identification-number

[19] Nava, Erika. 2018. “Undocumented Immigrants Pay Taxes: County Breakdown of Taxes Paid.” New Jersey Policy Perspective. https://www.njpp.org/blog/undocumented-immigrants-pay-taxes-county-breakdown-on-taxes-paid-in-2017

[20] Migration Policy Institute. 2020. “Mixed-Status Families Ineligible for CARES Act Federal Pandemic Stimulus Checks.” https://www.migrationpolicy.org/content/mixed-status-families-ineligible-pandemic-stimulus-checks.

[21] New Jersey Department of Treasury. “New Jersey Earned Income Tax Credit”. https://www.state.nj.us/treasury/taxation/eitc/eitcinfo.shtml

[22] New Jersey General Assembly. 2020. A4229. https://www.njleg.state.nj.us/2020/Bills/A4500/4229_I1.PDF

[23] Colorado General Assembly. 2020 Regular Session. HB20-1420. http://leg.colorado.gov/bills/hb20-1420

[24] New Mexico Legislature. 2020 Regular Session. HB 148. https://www.nmlegis.gov/Legislation/Legislation?Chamber=H&LegType=B&LegNo=148&year=20

[25] Oregon Legislative Assembly. House Bill 3028. https://s3.amazonaws.com/fn-document-service/file-by-sha384/7d2d89b1041b2e92228fee94ab8734aa2ac87fa89161ac7506b58be4377797166ba273f7ea0c6d70a8190388022bb0c2

[26] Washington House Committee on Finance. House Bill 2521. http://lawfilesext.leg.wa.gov/biennium/2019-20/Pdf/Bill%20Reports/House/2521%20HBR%20FIN%2020.pdf?q=20200216012900

[27] Center for Migration Studies. “State-Level Unauthorized Population and Eligible-to-Naturalize Estimates” http://data.cmsny.org/

[28] Gee, Lisa. (2020). “Impact of Including Eligible ITIN Filers in the Federal and State Earned Income Tax Credits.” Institute on Taxation and Economic Policy.

[29] Estimates of EITC eligible returns adjusted based on participation rates for the federal EITC, with a further 10% reduction to account for attrition between the state and federal EITC. The total number of ITIN tax returns that would be EITC eligible but for the SSN requirement is estimated to be 77,560.

[30] The EITC amount that households are eligible is calculated based on income and family size. The maximum NJ state credit amount for households without children is $206. The maximum NJ EITC amount for households with children ranges from $1,375 for families with one qualifying children, to $2557 for families with three or more qualifying children. More details about NJ EITC credit limits can be found here: https://www.state.nj.us/humanservices/dfd/programs/eitc/

[31] Institute for Taxation and Economic Policy. (2020). Estimated Number of Adults & Children in ITIN Households based on IRS 2015 ITIN Market Segment SPEC Returns Database.

[32] Avalos, A., and Alley, S. (2010). The economic impact of the Earned Income Tax Credit (EITC) in California. California Journal of Politics and Policy, 2(1): 1-25. https://doi.org/10.2202/1944-4370.1096

[33] Gee, Lisa. (2020). “Impact of Including Eligible ITIN Filers in the Federal and State Earned Income Tax Credits.” Institute on Taxation and Economic Policy.

[34] Ibid.

[35] Institute for Taxation and Economic Policy. 2020. Estimated Number of Adults & Children in ITIN Households based on IRS 2015 ITIN Market Segment SPEC Returns Database.

[36] Marr, Chuck, Chye-Ching Huang, Arloc Sherman, and Brandon Debot. 2015. EITC and Child Tax Credit Promote Work, Reduce Poverty, and Support Children’s Development, Research Finds. Center on Budget and Policy Priorities. https://www.cbpp.org/research/federal-tax/eitc-and-child-tax-credit-promote-work-reduce-poverty-and-support-childrens?fa=view&id=3793