Good morning. I am Peter Chen and am a Senior Policy Analyst at New Jersey Policy Perspective (NJPP). New Jersey Policy Perspective (NJPP) is a nonpartisan think tank that drives policy change to advance economic, social, and racial justice through evidence-based, independent research, analysis, and strategic communication.

NJPP opposes A5587 and encourages the committee to vote against its passage.

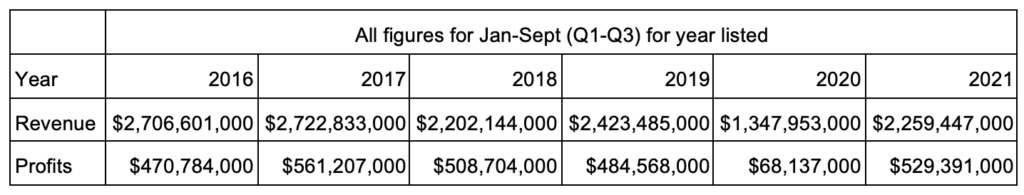

Atlantic City casinos have had a banner bounceback year in 2021. Profits for the first three quarters of 2021 of $529 million have topped each of the previous 5 years except 2017. This explosive growth has been buoyed by sports gambling, with a record-setting $557 million in revenue for sports wagering alone, a 150 percent increase from the first nine months of 2020.

TABLE: Atlantic City casino profits well in line with historical data

Source: Division of Gaming Enforcement Statistical Summaries, Third Quarter 2016-2021, available at https://www.njoag.gov/about/divisions-and-offices/division-of-gaming-enforcement-home/financial-and-statistical-information/quarterly-press-releases-and-statistical-summaries/

The closures and subsequent shock to the hotel and entertainment industries were devastating to the balance sheets of casinos in 2020. But it’s notable that even in the depths of the pandemic, the casinos nonetheless maintained a profitable year, followed by the 2021 bounceback.

Given the successful rebound of Atlantic City casinos, it is unnecessary to adjust the payment-in-lieu-of-tax (PILOT) payments to further reduce their financial liabilities. Wealthy corporations need to pay their fair share. PILOT payments for 2021 were already reduced due to the financial conditions of casinos in 2020. The formula adopted by lawmakers in 2016 takes into account the possibility of adverse financial conditions. It’s unclear why new changes are needed to reduce the amount casinos pay, beyond what current law provides.

And with the expansion of sports betting as a larger fraction of casino revenue, there’s no justification for removing these revenues from PILOT calculations. The casinos’ healthy profit margins suggest that whatever extra third-party expenses these betting operations require are more than offset by the revenues generated by them.

Again, NJPP urges the committee to vote No on moving the bill out of committee today. Thank you for this opportunity to testify today.