To read a PDF version of the full report, click here.

For the past decade, New Jersey lawmakers fixated on big-ticket corporate tax subsidies as a key driver of economic development without any sound evidence that they worked. As a result, New Jersey is now a national outlier in both the size of its corporate subsidy awards and how little the state receives as a return on its investments. Thankfully, there has been a wealth of research and analysis in this area over the past several years that can help lawmakers better understand the true impact of these programs. The findings do not paint a pretty picture, an unfortunate reality that proponents of corporate tax subsidies must reckon with. As policy analyst Jason Brainerd told a special Senate committee in September, “There is no evidence the number of economic tax incentives bear any relation to the broader performance of a state’s economy.”[i]

At least 75 percent of the time, tax breaks for corporations do not affect a business’s decision on where to locate and expand.[ii] In other words, these tax breaks are often nothing more than a colossal giveaway with no additional benefit to a state’s economy. Even when subsidies do tip a location decision, they do not pay for themselves. Relocated workers raise costs to local public services offsetting at least 90 percent of any increased revenue.[iii] Nationally, only 10 to 30 percent of those new jobs go to state residents who are not already employed, doing little to boost overall employment rates and broadly shared local benefits.[iv]

Considering these damning findings, along with the fact that New Jersey’s fiscal situation is so poor that the state cannot afford such risky and poorly performing investments, the state would be far better off redirecting its economic development strategy away from corporate tax subsidies. Instead, New Jersey should focus on investments that are proven economic drivers, like public colleges, transportation infrastructure, development of affordable homes, and providing a stronger safety net for the growing numbers of working New Jersey families and children struggling to make ends meet.[v]

If the state is going to operate a corporate tax subsidy program as part of a broader economic development strategy, there are several critical and necessary reforms that must be implemented to mitigate further fraud, waste, and abuse of taxpayer dollars. The next generation of tax subsidy policies must be carefully designed to promote inclusive, local economic growth, target the right businesses in the right areas of the state with local hire and community input requirements, and have the safeguards necessary — namely hard caps on awards and robust assessment of programs — to ensure these investments provide a positive and significant return.

The next cycle of corporate tax subsidies must also break away from overly generous tax breaks to large corporations and instead focus on promising industries in areas of the state that have the greatest need for job opportunities. Economic development dollars saved can then be redirected back into public assets that benefit all New Jerseyans and have a more proven track record of economic growth.

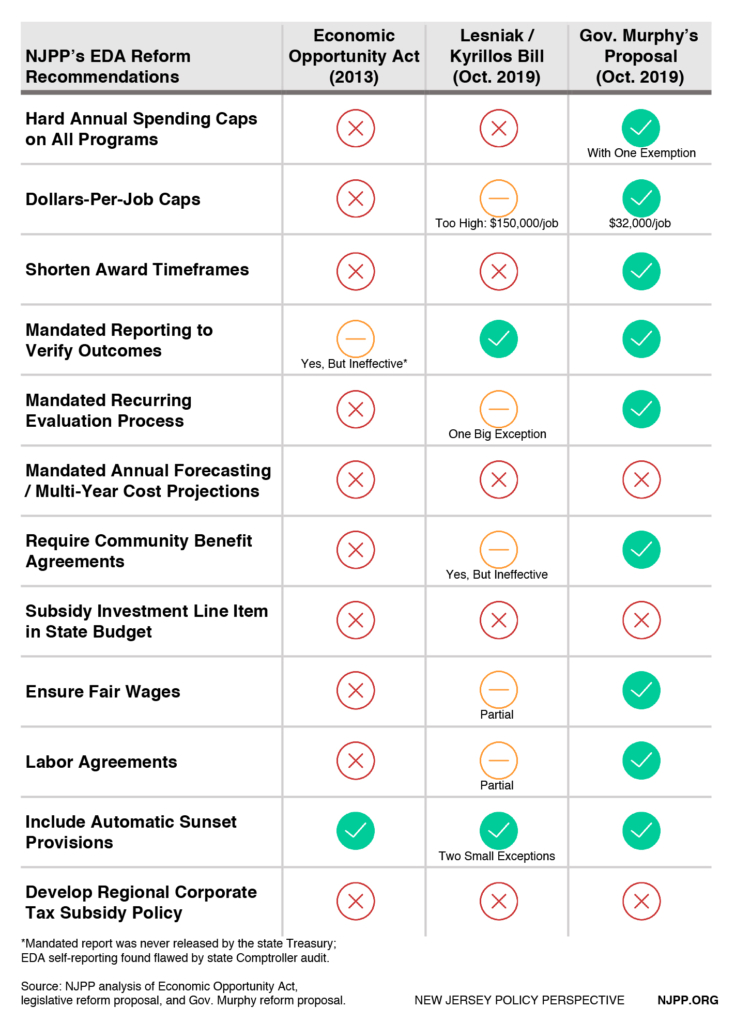

Governor Murphy and the legislature have released competing drafts of legislation to replace New Jersey’s now-expired corporate tax subsidy programs.[vi] The legislature enlisted former state Senators Ray Lesniak and Joe Kyrillos to craft their version of what the next generation of corporate tax subsidies should look like. The legislature’s version (hereinafter referred to as Senator Lesniak’s proposal), largely mirrors the previous iteration — the Economic Opportunity Act (EOA) — and does not address the need for good government policy in the wake of findings of fraud made by the Governor’s task force and investigative journalists. The Murphy administration’s proposal addresses some of the bigger flaws of the EOA and incorporates a few proposals found in the legislature’s bill.

Overall, both plans include important improvements like targeting industries that demonstrate real economic potential and addressing community-centered investment needs, like affordable housing and food deserts. Both offer sizable tax subsidies for redevelopment projects in economically distressed areas and for high-tech businesses like wind energy and research and development. Community benefit agreements also appear in both plans, opening the door for job training and apprenticeships, which experts say accomplish development goals in a more cost-effective manner. Nonetheless, both proposals tend to overemphasis mega-projects rather than the tried-and-true cultivation of small- and medium-sized businesses. This caveat balloons the potential overall price tag of both proposals, paving the way for more foregone revenue that could be better spent on other state investments.

What’s New in Both Proposals

In the latest iteration of Governor Murphy’s corporate tax subsidy reform proposal, he has adopted three new provisions from Senator Lesniak’s draft bill. One would offer tax credits to large-scale developments “anchored” by a nonprofit or government institution. To qualify for the tax break, the project would need to be either be located in an opportunity zone (more on that later) or designed to help a targeted industry — like biotechnology and advanced transportation and logistics — to take root. Another proposal would provide state grants to cover some rental costs of collaborative workspaces for start-up companies in technology or renewable energy sectors.[vii] Additionally, in an effort to take a more active role in addressing food deserts, Governor Murphy’s proposal establishes the designation of up to 75 areas that lack access to a grocery store to help pinpoint qualifying communities.

Senator Lesniak’s bill makes a significant push to address New Jersey’s affordable housing crisis by offering up to $100 million a year to community development or nonprofit housing organizations for developments in low- and moderate-income areas. The bill also expands the existing Film and Digital Media tax credit program, a favorite of Governor Murphy’s, by five years and removes the annual spending cap after the first year.[viii]

Overall, Senator Lesniak’s bill shies away from new reforms with one exception: any commercial developer who is more than two years behind in loan payments is automatically disqualified from applying for tax subsidies.[ix] This restriction, however, would not apply to the biggest recipients of tax subsidies: residential developers or any business looking to relocate or expand in New Jersey.

What’s the Same: The Good

Governor Murphy and Senator Lesniak align on several key reforms, a positive sign that nationally recognized best practices — and reforms promoted in previous NJPP reports — will be incorporated in the next iteration of corporate subsidy programs. Important measures found in both bills include:

- Preference to industries that show promise for economic growth[x]

- Bonus structure for workforce housing development (this is a requirement for newly-constructed housing)

- Mandated reporting to verify outcomes

- Sunset provision (except in Senator Lesniak’s food desert and historic preservation proposals)

- Bonus structure for labor agreements and fair wages (only Governor Murphy’s proposal covers all programs)

- Clawback formula whereby the state can recoup some tax subsidies if a corporation breaks a promise (though Governor Murphy’s formula is stronger and includes wage level protections)

- Smaller subsidies for jobs retained with no loopholes

- Creation of a state-run venture capital program

- Requirement of fair wages for construction and building service jobs

- Requirement of minimal environmental and sustainability standards that promote best practices

- Mandated disclosure of tax credit sales (excluding most programs in Senator Lesniak’s proposal)

What’s the Same: The Bad

Not all of the common measures are worthy of praise, however. Several important provisions in both bills do not reflect best practices of economic development and, left unchallenged, would repeat mistakes of the past.

Overly Generous Dollars-Per-Job Caps

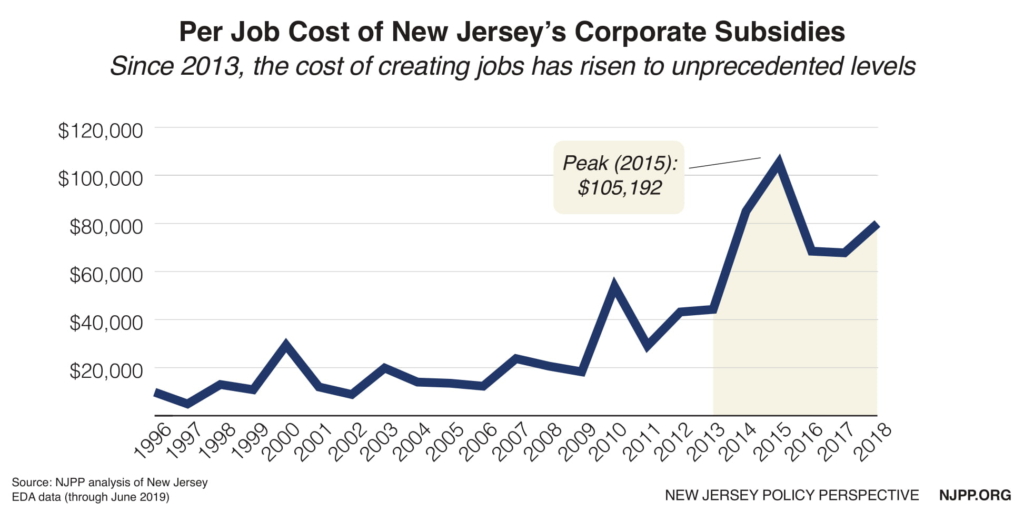

The removal of spending caps in the EOA enabled the per-job cost of tax subsidies to skyrocket to unprecedented levels. Throughout the 1990s and early 2000s, the per-job cost of subsidized jobs was approximately $20,000. After the passage of the EOA, this cost ballooned to over $100,000 per job created or retained.

Senator Lesniak’s proposal does little to get this cost under control. The dollars-per-job caps in his bill range from $70,000 to a whopping $150,000 for new or retained jobs for a “mega-project,”[xi] or a project in a specified New Jersey investment zone.[xii] This sort of giveaway blatantly ignores the excessive spike in corporate tax breaks over the last decade and deprives the state of revenue needed for other state investments. Governor Murphy’s job creation proposal has a cap of $32,000 per job, which is within the range of the national average but still relatively high compared to other states. Virginia, for example, successfully secured the Amazon HQ2 deal with tax breaks capped at $20,000 per job.

Over Reliance on the “Material Factor” Eligibility Criteria

Governor Murphy’s proposal requires corporations to verify they are in “good standing” with the state departments of environmental protection, labor, and treasury, and allows the Economic Development Authority (EDA) to commission a third party background check on tax subsidy applicants. These good governance reforms should help ensure tax breaks are not given to corporations with a history of polluting their communities, violating wage and hour laws, or evading state taxation. Both proposals require that the potential tax subsidy award be a “material factor” in a corporation’s decision to relocate to or expand in New Jersey. To satisfy this requirement, a corporation must submit evidence showing that if not for the tax credits it would leave New Jersey or choose to set up shop in another state.

According to national experts, however, there is no agreed-upon method to assess this factor properly, making the requirement meaningless, untestable, and as found by the Governor’s task force, highly susceptible to manipulation.[xiii] Nonetheless, Governor Murphy’s proposal doubles-down on this provision with a laundry list of required documentation certified as truthful under threat of perjury. This provision is more likely to bolster the real estate consulting industry than it is to guarantee the credibility of the applicant’s need for tax subsidies. It also provides coverage for elected officials who might otherwise come under fire for handing over tax money to corporations and developers.

Over Reliance on the Flawed “Net Benefit” Test

To protect taxpayers and ensure that tax subsidies are only awarded when the benefits clearly outweigh the costs, stricter standards must be applied to the statutory formula the EDA uses to estimate the economic benefits of any proposed tax break. The EDA’s “net benefit test” looks at the direct and indirect costs and benefits of a new business or redevelopment project. This model has gone through some internal improvements through regulation, but further legislative reform is needed to restore financial integrity and bring transparency to this test.

One noteworthy improvement to the net benefit test in both proposals was instigated by a recent finding that large tax breaks were awarded under the EOA to corporations that tipped the scales in their favor by counting exempted taxes as a benefit.[xiv] The Governor’s and Senator Lesniak’s proposals address this egregious provision by disqualifying “phantom taxes” like property tax abatements from being calculated into the net benefit test. However, Senator Lesniak’s proposal excludes the entire redevelopment program from this basic protection.

Both proposals require that the largest programs and megadeals go through a state-conducted fiscal impact analysis with the glaring exception of Governor Murphy’s job creation program, which allows a corporation to submit their own analysis with a requirement that the net positive benefit equals a predetermined percentage of the award. Given that even the EDA’s cost-benefit benefit analysis is hidden from public scrutiny, a debate about who is most qualified to analyze them or about the standards being used to estimate the efficiency of tax incentives is seemingly impossible. The result is that the public doesn’t know if the costs and benefits are calculated in a way that accurately captures the local economy and its unique needs. Does it estimate the employment benefits, particularly the proportion of new jobs likely to go to local, unemployed residents? What effect would the wage rate have on similar local jobs? Does the analysis look at wage gains across the income distribution and per capita income growth? Can the existing infrastructure accommodate the expected job growth and can the local government absorb the added costs that come with new residents? The model used for the net benefit test should be made publicly available and calculated exclusively by the EDA, not the corporations vying for tax breaks, to ensure the state is not losing money on any tax subsidy deals.

Bonus Tax Subsidies for Community Benefit Agreements

Communities are rarely at the table of a statewide economic development strategy. A community benefit agreement (CBA) can address this, but too often the corporation receiving the tax break dictates the terms, leaving out community voices and crucial benefits that would meet their needs. Providing bonuses for businesses that enter a CBA without meaningful parameters and oversight is a recipe for manipulation and token investments that don’t contribute to the economic growth of struggling areas of the state. In the aftermath of Governor Murphy’s task force findings and multiple pieces of investigative journalism, the next generation of job creation and redevelopment program must require a truly inclusive CBA to protect communities from predatory corporate interests.

Senator Lesniak’s bill offers bonus tax subsidies to applicants of the job creation program if it and a local county or town enter a CBA based on the support or operation of a so-called “One Stop Career Center.” Senator Lesniak defines this as a clearing house of either customized job training apprenticeship programs or development of infrastructure, affordable housing and public transit. But it also includes options like “greenspaces” or “other community amenities,” providing a giant loophole for corporations to do the bare minimum in exchange for a bonus tax credit of $5,000 per job. The proposal contains no protections to ensure the corporation’s compliance of the CBA, opening the door to abuse or fraud.

For the most part, Governor Murphy’s proposal gets this right by making a CBA a requirement in both the job creation and redevelopment programs. The agreement may include job training, employment, youth development, and free services to underserved community members. Prior to entering a CBA, the county or town would be required to hold at least one public hearing to give the affected community a chance to voice their needs. The resulting CBA must include the establishment of a community advisory committee to oversee implementation and compliance. Should the developer break the agreement, Governor Murphy’s proposal includes clawback provisions to protect the affected community and New Jersey taxpayers.

Given the level of fraud that was allowed to prosper under the previous economic development legislation, the EDA must be given a stronger role to ensure community voices are heard and that compliance with this type of agreement is enforced. “At least one” public hearing before the establishment of a CBA has all the characteristics of a token gesture. The process needs to encourage meaningful community engagement and input. In fact, recipients of tax subsidies should first be put on mandatory probation for year one, and if compliance of a CBA is not established, the EDA would have the authority to rescind and recapture the tax subsidies. Job training should be required as a main component of the CBA given its proven long-term economic impact, even if the subsidized jobs no longer exist. The CBA proposal should also require that the advisory committee accurately reflect the demographics of the community and prohibit any advisory committee members from having a financial interest in the project or deriving any form of income from the corporation receiving the tax credits.

Tax Subsidies for Businesses Located in a Qualified Opportunity Zone

Created by the 2017 federal tax law, the opportunity zone (OZ) provision allows investors to defer tax on capital gains by putting those gains into funds that invest in properties or businesses located in designated communities. After a certain number of years, investors get more tax breaks, including a permanent tax exemption on capital gains on their OZ investment. Governor Murphy’s proposal dips its toes into this new provision by offering bonus tax subsidies to developers or businesses that invest in an opportunity zone. Senator Lesniak’s plan fully endorses the concept in both the job creation program and a mega-project proposal.

If the OZ tax break is truly intended to improve the lives and opportunities of low-income residents of the zones, it should target investments that focus on that goal. Instead, it encourages investors to abuse the provision.[xv] That’s because the provision was enacted with nearly no government oversight and very few restrictions. This no-strings-attached policy has drawn predatory capital into neighborhoods most at-risk of displacement. Members of Congress including Senator Cory Booker, who helped create opportunity zones in the first place, have called for an investigation into the program by the federal Government Accountability Office.[xvi] New Jersey should not subsidize real estate projects already poised to get a hefty federal tax break without assurances that they will help — not push out — current low-income residents. The state should regard investors looking for more tax breaks in opportunity zones as the least in need of state assistance and redirect these tax credits to small-to-moderate-sized businesses. Better yet, drop “opportunity zones” from the proposal and replace it with recognized qualifiers, like investment zone or qualified incentive tract, to describe areas of the state in need of economic investment.

Massive Tax Subsidies for “Transformative” or “Community-Anchored” Projects

Both proposals allow for so-called mega-deals by setting aside $50 million to $100 million in tax breaks that do not count against annual spending caps. Mega-deals, as defined by Good Jobs First, provide at least $50 million in tax subsidies to either large-scale development projects or well-established corporations with a large workforce.[xvii]

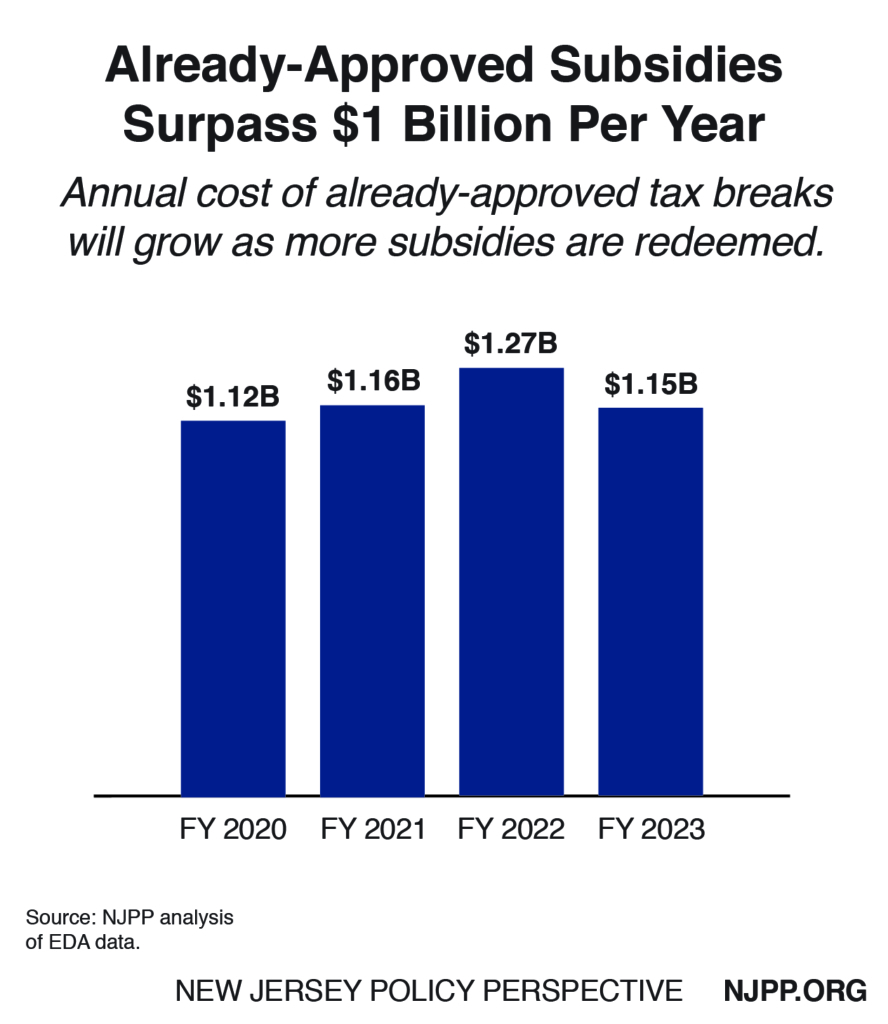

Over the past two decades, New Jersey has rewarded 30 mega-deals, more than half (16) of which received nine-figure awards, including Fortune 500 companies Prudential Financial, Subaru of America, and JPMorgan Chase Bank.[xviii] Given the mounting evidence that such large-scale tax subsidies do not pay for themselves, megadeals are a risky investment for New Jersey, a state struggling to pay its bills as the cost of already-approved tax subsidies explode.[xix]

These deals also help wealthy corporations avoid the competitive subsidy application process and parachute into a community without a thorough impact analysis. Similarly, opportunities for collaboration with research institutions, teaching hospitals, colleges or universities are plentiful and already market-driven. Let these assets speak for themselves without offering sweeteners like covering 100 percent of project costs or offering up to $250 million in tax subsidies.

Tax Credit Buyback Option

Both proposals would allow the Division of Taxation to buy back unused tax credits from businesses that don’t need them to lessen their tax bill — at a deep discount. Effectively, this allows businesses to convert tax credits into cash grants valued at 75 percent of the awarded credit. Such a provision should not be entertained without full transparency of all sellers and buyers.

What’s Missing

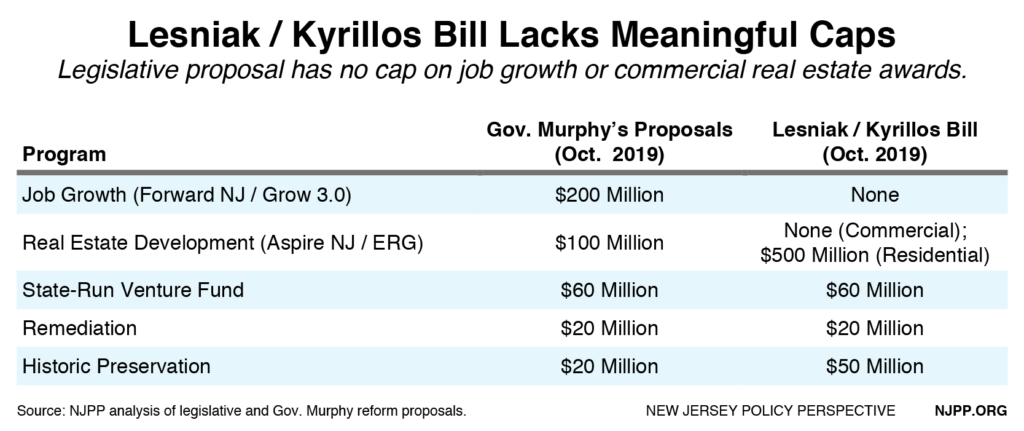

Hard Caps on Job Growth Programs and Commercial Redevelopment

New Jersey’s corporate tax subsidies have always included annual limitations on cost — until the passage of the Economic Opportunity Act of 2013. Bypassing such an important cost-control mechanism opened the door for enormous tax breaks for the next several years. As the state committed billions in lost tax revenue to already profitable corporations, the state simultaneously cut funding for public schools, NJ Transit, property tax relief, colleges and universities, and affordable housing — all proven drivers of widespread economic growth.

Senator Lesniak’s bill commits to annual spending caps for some programs but, most alarming, they are absent in the two largest programs: commercial real estate development and the job creation and retention program previously known as Grow NJ. This policy design contradicts extensive research that shows corporate tax breaks do not translate into more economic growth, and is based on the disproven notion that New Jersey must offer limitless tax incentives in order to compete with other states. Caps must be a central component of the next generation of corporate tax subsidies because they make New Jersey’s economic development policies less costly to the state budget and create more job opportunities for New Jersey residents.

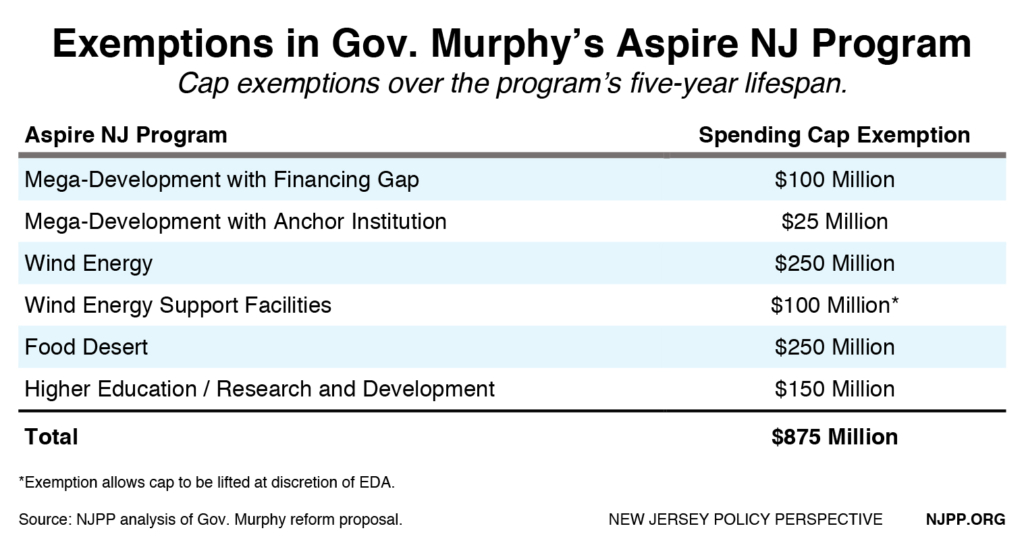

Governor Murphy’s bill features annual spending caps for every program. However, the redevelopment program allows for some flexibility, making it vulnerable to the political pressures of a proposed megadeal and, in the end, costly to New Jersey taxpayers. In fact, the proposal has over $800 million worth of exemptions over the lifespan of the legislation to support up to six potential large-scale development projects and removes caps altogether for a qualifying wind energy support facility. These projects may not all come into fruition, but their presence undermines the Murphy administration’s top priority of reining in subsidies and abiding by realistic expectations of what a state government can do to foster economic growth. The Governor’s recent support of lifting the annual cap of the Film and Digital Media tax credit program demonstrates this willingness to revise what should be a non-negotiable budget item.[xx]

Shorter Award Timeframes

Senator Lesniak’s proposal allows for subsidy awards to be paid out annually for 10 to 20 years, depending on the program. This measure ignores research that shows corporations generally don’t consider tax subsidies ten or more years out as valuable as those offered within a shorter timeline, like one to five years.[xxi] They also absolve current lawmakers from the future costs while giving them political credit for new jobs. Offering shorter timeframes means New Jersey can control the cost of subsidies and better predict when a business will redeem them. In contrast, the Murphy administration’s job creation and retention proposal includes this best practice by imposing a maximum timeframe of five years. Most of the other proposals in the Governor’s plan have one-year timeframes.

Recurring Evaluation by an Independent Entity

Lawmakers must fully commit to establishing a regular, independent evaluation process to effectively analyze the design, administration, and effectiveness of the state’s subsidy programs. Both proposals require a biennial, independently produced report with a detailed analysis of the tax subsidies’ effect on a business’ relocation decision, the return on investment for the award, the impact on the state’s economy, and other metrics based on national best practices. However, Senator Lesniak’s bill fails to require such a report for the job creation program, the same proposal that has no annual spending cap. This key reform should be a requirement for every program to ensure accountability and fiscal responsibility. But to ensure objectivity, a biennial performance audit should be produced by the state Comptroller or a public advocate rather than a subcontracted college or university given that academic institutions are eligible for and have benefited from these tax subsidies in the past, and that public universities depend on the legislature for state aid.

Other Important Reforms Missing in Both Proposals to Further Bolster Accountability

- Mandated annual forecasting/multi-year cost projection

The Treasury must release the Unified Economic Development Report (UEDR), an annual report that enumerates the direct costs and indirect loss of revenue from tax breaks with detailed information about larger tax subsidies and the types of jobs they created. The EDA should also be required to release an annual 15-year forecast of the cost of each program to better estimate long-term future revenue losses.

- Addition of hiring information in the UEDR

To better ensure local and representative hiring, the Treasury should analyze the match between a business’s labor needs and the labor force potential in the relevant geographic area.

- Requirement to put investment into state budget

Putting tax subsidies into the budget process as a line item would promote a better debate about the best ways to foster broad prosperity in New Jersey. This would take corporate subsidies out of the abstract and explicitly state what they are costing the state and its taxpayers.

- Requirement that application consultants register as lobbyists

Tax subsidies support a cottage industry of real estate consultants working on commission to help corporations navigate through the application process and get the biggest tax breaks possible. Requiring these consultants to register as lobbyists means the disclosure of their identity, compensation terms and other contractual details which takes away the monetary incentive.

- Regional corporate tax subsidy policy

Implementing a corporate tax subsidy ceasefire with neighboring states would end the costly practice of giving tax credits to companies within the same metro area and demonetize the blackmail tactics corporations deploy in exchange for tax subsidies.

Update: This report was updated on December 5, 2019 to clarify that the cap exemptions in Governor Murphy’s Aspire NJ proposal are for the 5-year life of the program, not annually.

End Notes

[i] Insider NJ, Bombshell Trenton Testimony: Smith to Brainerd: ‘Thank You for Blowing up the Hearing,’ September 2019.https://www.insidernj.com/bombshell-trenton-testimony-smith-brainerd-thank-blowing-hearing/

[ii] Prepared testimony of Dr. Timothy J. Bartik, Senior Economist, W.E. Upjohn Institute for Employment Research before New Jersey State Senate Select Committee on Economic Growth Strategies, September 2019. https://research.upjohn.org/presentations/60/

[iii] Ibid 2.

[iv] The Brookings Institution, Most business incentives don’t work. Here’s how to fix them, November 2019. https://www.brookings.edu/blog/the-avenue/2019/11/01/most-business-incentives-dont-work-heres-how-to-fix-them/

[v] United Way of Northern New Jersey, ALICE: A Study of Financial Hardship in New Jersey, 2018. https://www.unitedforalice.org/new-jersey

[vi] Politico New Jersey, Murphy, still apart from lawmakers, agrees to some tax incentive changes, October 2019. https://www.politico.com/states/new-jersey/story/2019/10/23/murphy-still-apart-from-lawmakers-agrees-to-some-tax-incentive-changes-1225939

[vii] Targeted industries listed in Senator Lesniak’s rental assistance proposal: advanced computing, advanced materials, biotechnology, electronic device technology, information technology, food technology, life sciences, medical device technology, health care technology, logistics technology, mobile communications technology, agricultural technology, and renewable energy industries.

[viii] Garden State Film and Digital Media Jobs Act (P.L. 2018, Chapter 56) https://www.nj.gov/state/njfilm/assets/pdf/garden-state-film-and-digital-media-jobs-act.pdf

[ix] Senate Bill No.1576: Prohibits awarding of economic development subsidy to business if payment of principal and interest on previously awarded loan or loan guarantee is greater than 24 months overdue. https://www.njleg.state.nj.us/2018/Bills/S2000/1576_I1.PDF

[x] Governor Murphy’s job creation proposal targets advanced transportation and logistics, advanced manufacturing, aviation, clean energy, life sciences, information and high technology, finance and insurance, and non-retail food and beverage businesses. Murphy’s mega-development proposals target wind energy, food deserts and R&D. Targeted industries listed in Senator Lesniak’s mega-project proposal: biotechnology, life sciences, pharmaceuticals, aeronautics, clean energy, advanced manufacturing, large-scale food and beverage production, advanced transportation and logistics, finance, financial technology, insurance, media, information technology, machine learning, and artificial intelligence.

[xi] “Mega” means a business other than a warehouse or distribution business at which the business intends to employ at least 1,000 new or retained full-time jobs and having a capital investment in excess of $100 million.

[xii] “Investment zone” means means a distressed, densely populated municipality or a government-restricted municipality.

[xiii] ROI-NJ, LeRoy: Lesniak’s advice on economic development belongs in museum, October 2019. http://www.roi-nj.com/2019/10/18/opinion/leroy-lesniaks-advice-on-economic-development-belongs-in-museum/

[xiv] Philadelphia Inquirer, New Jersey gave companies credit for millions in ‘phantom’ property taxes to qualify for incentives, October 2019. https://www.inquirer.com/business/nj-tax-incentives-phantom-property-taxes-camden-20191003.html

[xv] The New York Times, How a Trump tax break to help poor communities became a windfall for the rich, August 2019. https://www.nytimes.com/2019/08/31/business/tax-opportunity-zones.html

[xvi] ProPublica, Billionaires Keep Benefiting From a Tax Break to Help the Poor. Now, Congress Wants to Investigate, November 2019. https://www.propublica.org/article/billionaires-keep-benefiting-from-a-tax-break-to-help-the-poor-now-congress-wants-to-investigate

[xvii] Good Jobs First, Megadeals: The Largest Economic Development Subsidy Packages Ever Awarded by State and Local Governments in the United States, June 2013. http://www.goodjobsfirst.org/sites/default/files/docs/pdf/megadeals_report.pdf

[xviii] Good Jobs First’s Subsidy Tracker database, Megadeals list: New Jersey 1998-2017, August 2019. https://www.goodjobsfirst.org/megadeals

[xix] Ibid 17.

[xx] NJBIZ, Lawmakers move bill to expand state’s film tax credit program, November 2019. https://njbiz.com/lawmakers-move-bill-to-expand-states-film-tax-credit-program/

[xxi] CityLab, How Cities and States Can Stop the Incentive Madness, November 2019. https://www.citylab.com/equity/2019/11/business-tax-incentives-urban-economic-development-polices/601735/