New Jersey faces its second shutdown in as many years as legislators are at odds with Gov. Murphy's proposals to restore the sales tax to 7 percent and increase the state income tax on earnings over $1 million per year. Enacting a "millionaires tax" on New Jersey’s highest-earning individuals is a reliable, fair, and necessary measure in both addressing runaway income inequality and ensuring the state has ample resources to reinvest in critical public assets.

Key Findings

- Individuals earning more than $1 million per year make up 0.48 percent of tax filers in New Jersey.

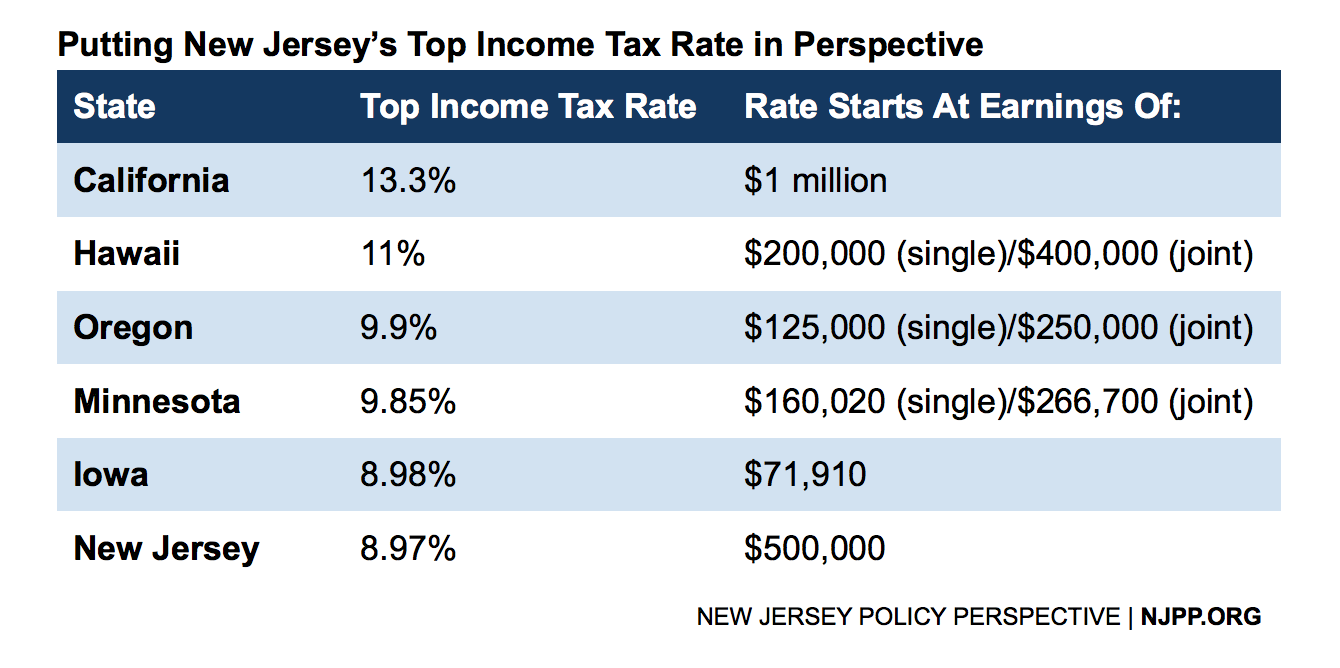

- Gov. Murphy's proposed 10.75 percent tax rate on earnings over $1 million per year would not be an outlier compared to the top income tax bracket in other states.

- A "millionaires tax" would help balance the regressive nature of New Jersey's tax code.

- New Jersey’s share of high-earners has more than doubled since the state started keeping detailed data on income in 2002.

- There are over 20,000 tax filers who earn more than $1 million per year, with a majority living in northern New Jersey (map and table below).

Putting New Jersey’s Tax Code in Perspective

Since 2010, New Jersey’s top income tax rate has remained at 8.97 percent as repeated attempts to increase the rate were vetoed by the governor. While tax reform efforts have stagnated, though, other states have moved forward in creating more equitable income tax structures. Today, New Jersey’s top income tax rate is no longer at the very top of the states; in fact, it is the sixth highest in the nation behind California, Iowa, Minnesota, and Oregon – many of which also levy higher rates on lower incomes than New Jersey.

Other states, like California and Minnesota, have changed course to rebalance their income tax code by asking top earners to pay more. In 2012, California voters decided to raise taxes on all residents, but mostly on the very wealthiest Californians, to help reinvest in public education.

Other states, like California and Minnesota, have changed course to rebalance their income tax code by asking top earners to pay more. In 2012, California voters decided to raise taxes on all residents, but mostly on the very wealthiest Californians, to help reinvest in public education.

Millionaire Tax Flight is a Myth

Claims that millionaires and small business owners spooked by higher income taxes will flee the state are commonplace, but that does not make them accurate. These anecdotal stories are unsupported by real-world statistics. In fact, the majority of rigorous studies on the subject have found a negligible correlation between state taxes and interstate moves.

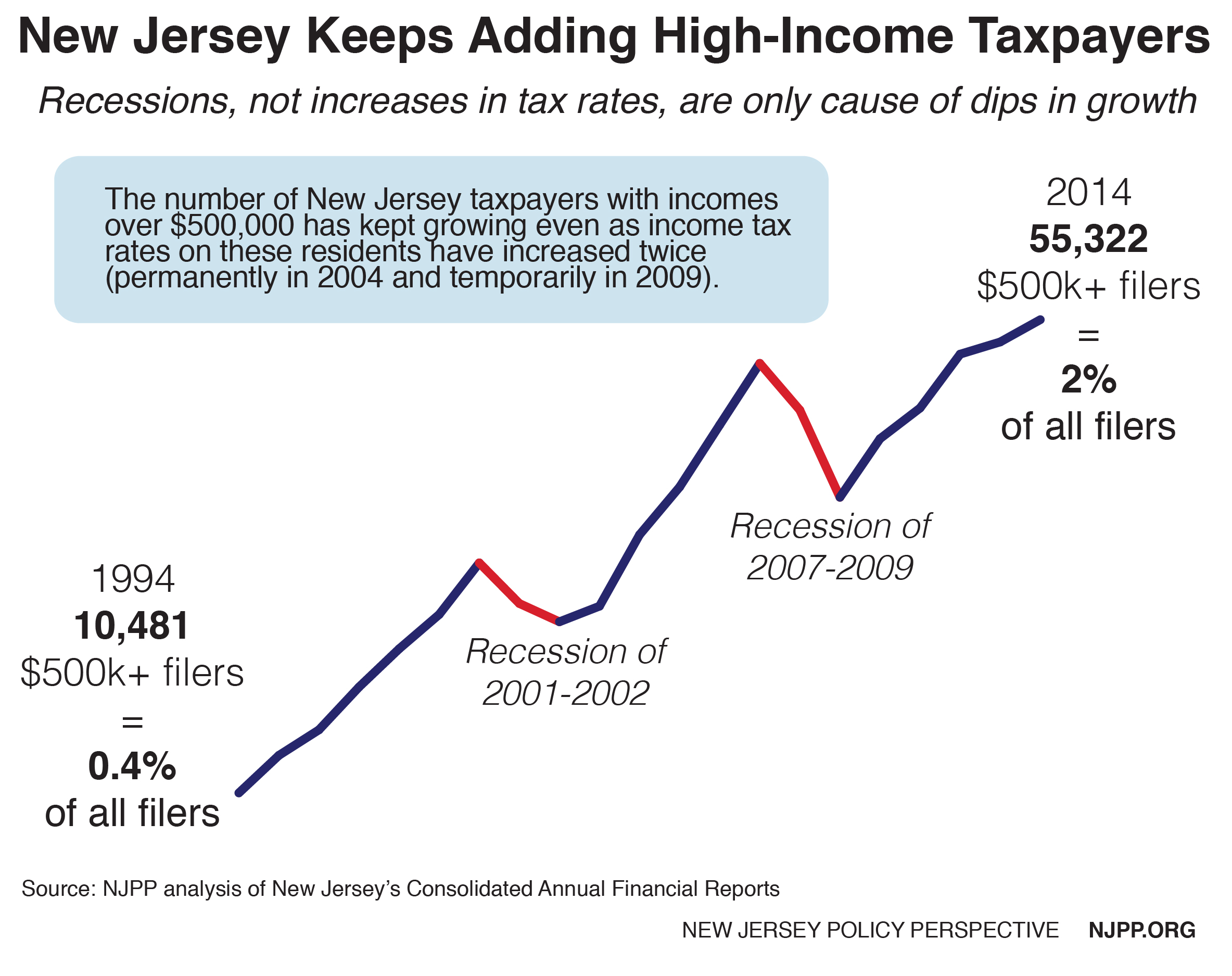

When income taxes were first raised on New Jersey’s highest earners back in 2004, one study found a slight uptick in the number of millionaires who left New Jersey. Their exit cost the state about $16 million between 2004 and 2007, but the state gained about $1 billion from those who remained. In other words, the revenue loss was less than 2 percent of the revenue gained. What’s more, the number of New Jersey tax filers with income over $500,000 rose by 82 percent between 2003 and 2007, nearly doubling from 28,178 (representing 1.1 percent of all filers) to 51,187 (1.3 percent of all filers). And that trend has continued after a sharp dip during the Great Recession of 2008 and 2009. Since hitting a recessionary low point in 2009, the number of New Jersey tax filers with income over $500,000 has rebounded by 44 percent, growing from 38,496 (or 1.3 percent of all tax filers) to 55,322 in 2014 (2 percent of all filers), even as New Jersey’s overall economic recovery has remained weak.

New Jersey's Statistics of Income report shows that between 2002 and 2015, the number of millionaires in New Jersey more than doubled from a little over 8,000 to more than 20,00. In fact, the report now has a line to detail the number of filers with more than $10 million in yearly income; that line didn't exist when the report was first published.

Mapping New Jersey's $1 Million+ Earners

Recently, NJPP took a look at state data to map out where tax filers who report an annual income of more than $1 million live throughout the state. An interactive map is below, followed by a sortable table of $1 million+ earners, by district.

New Jersey's $1 Million+ Earners, by District

The 27th legislative district has the most individuals – 2,515 – earning more than $1 million per year. The 35th legislative district has the least, with only 18 individuals earning more than $1 millions per year. Overall, these high-earners make up only 0.48 percent of tax filers in New Jersey.

Gov. Murphy’s Budget Would Make Tax Code More Progressive

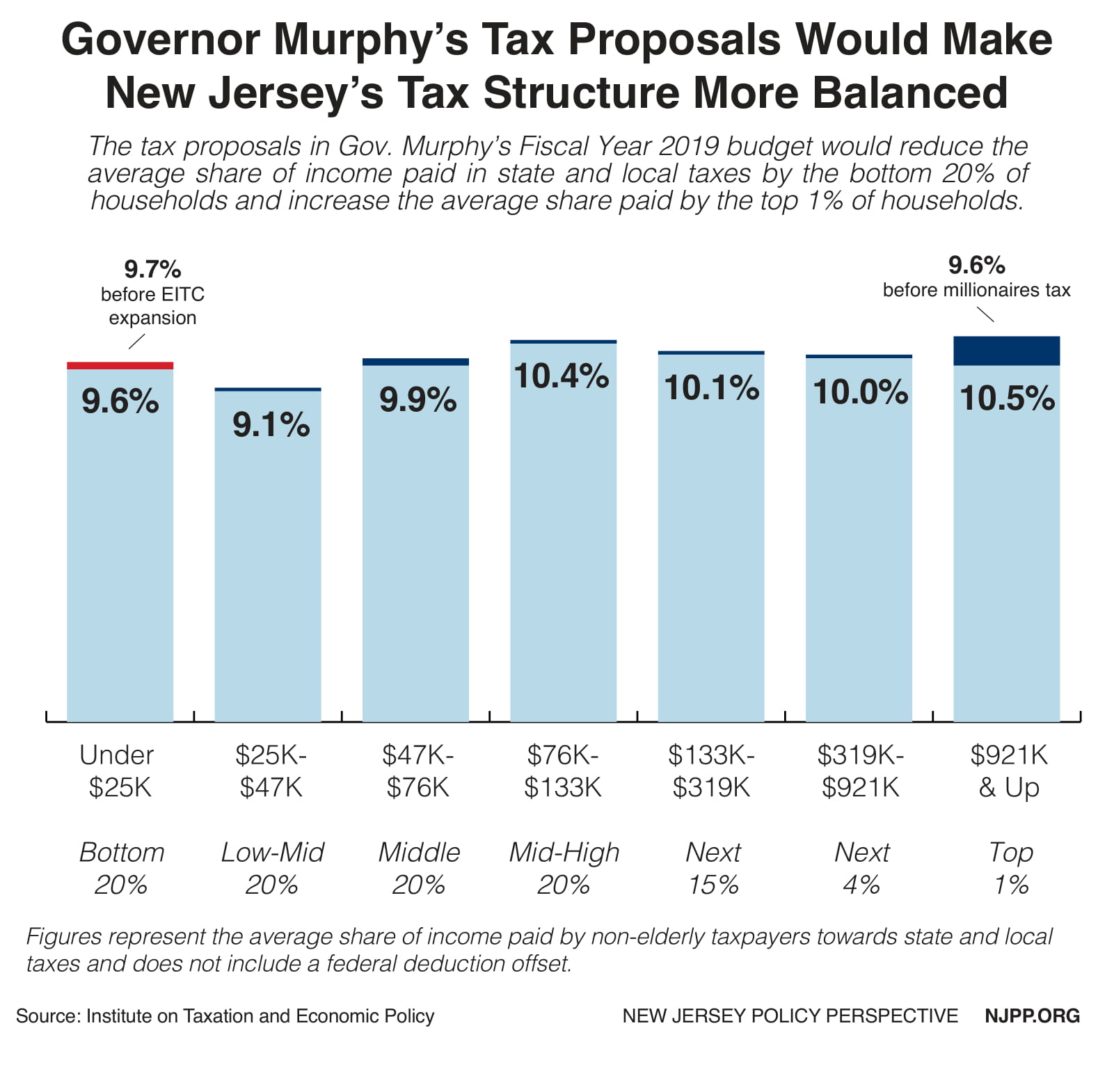

The tax changes proposed in Gov. Murphy’s first budget would bring more balance to New Jersey’s tax code by raising taxes on the wealthiest one percent while reducing them for the lowest-income New Jerseyans. The overall effect would be a tax code that more accurately reflects one’s ability to pay. Without raising the income tax on individuals earning more than $1 million per year, the state’s top one percent of earners would pay a lower percentage of their income in state and local taxes than most New Jerseyans.

As the level of income equality grows ever more dangerous throughout our state, it should be a priority of lawmakers to ensure that the state budget acknowledges this reality and asks those with the ability to provide more to do so and pay their fair share.

But What About the Federal Tax Changes?

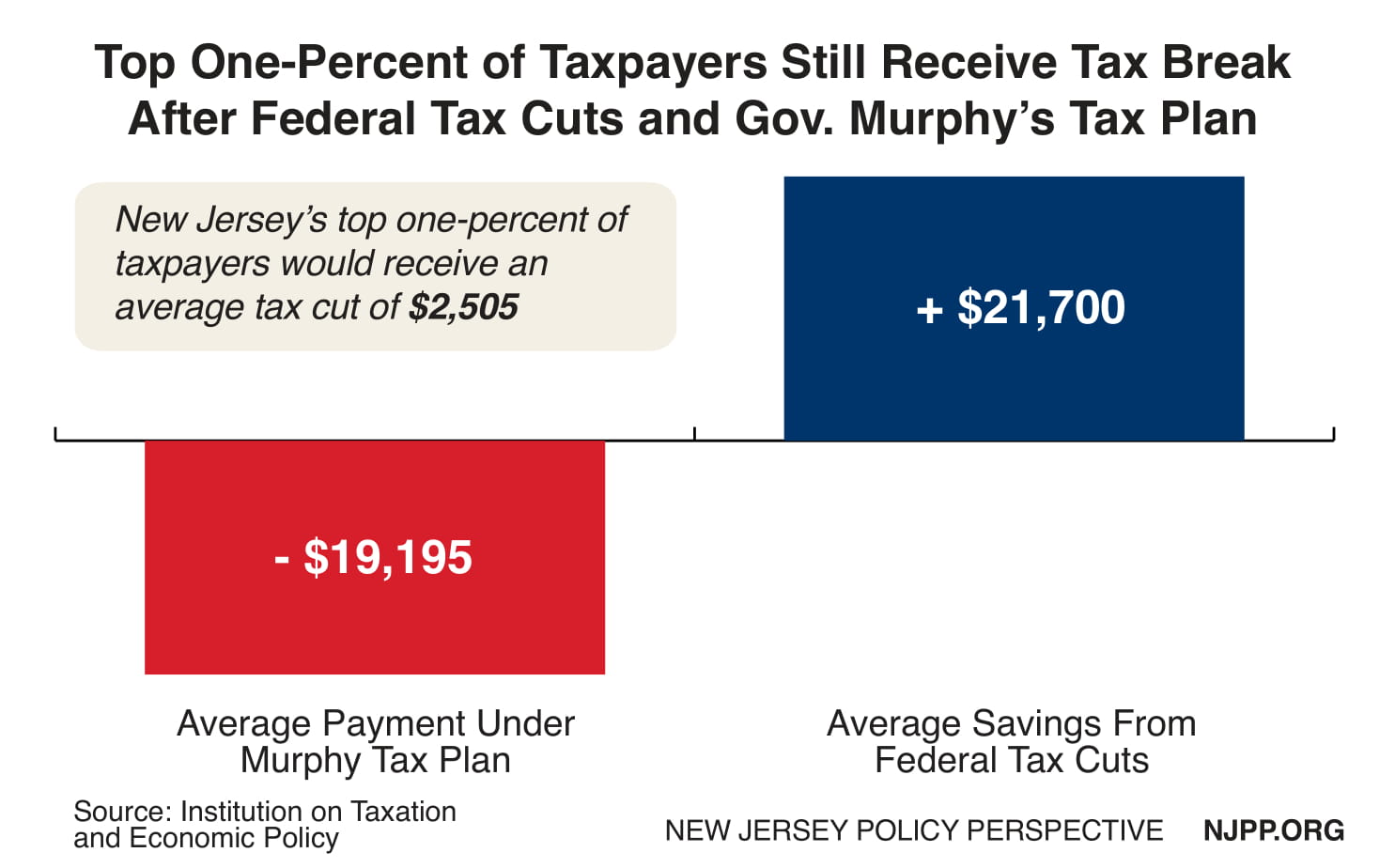

According to a side-by-side analysis of the Tax Cuts and Jobs Act and Gov. Murphy’s plan, the top one percent of taxpayers – those earning over $924,000 a year and with an average annual income of about $2.5 million – would still come out ahead. That’s because their average tax break from the federal tax law is slightly larger than their average tax increase at the state level.

Some of these wealthy households may experience a slight tax increase depending on their specific circumstances, but as a whole, the top one percent would not be burdened under Gov. Murphy’s tax plan. In fact, they would see little to no change to their overall tax bill, while New Jersey’s most important assets would see a much-needed boost in funding.